👨💻 Non-traditional Actuary @ActuariaConsult

🔥 Simplifying Personal Finance

👷♂️ Building @ProtectMeWell

🎯 FI by 2025. Sharing learning along the way

How to get URL link on X (Twitter) App

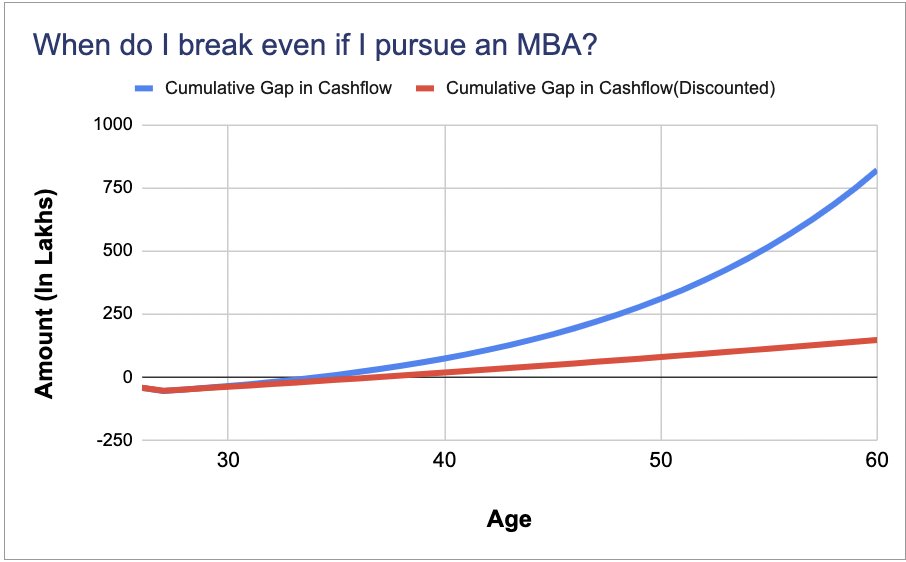

Before we dive in, what does 'missing the context' mean? Here are a couple of examples:

Before we dive in, what does 'missing the context' mean? Here are a couple of examples:

Some background before we dive in

Some background before we dive in

So what do we cover in this thread?

So what do we cover in this thread?

To clarify, the example may not be representative and might not be closer to reality.

To clarify, the example may not be representative and might not be closer to reality.

Let's first define Financial Freedom.

Let's first define Financial Freedom.

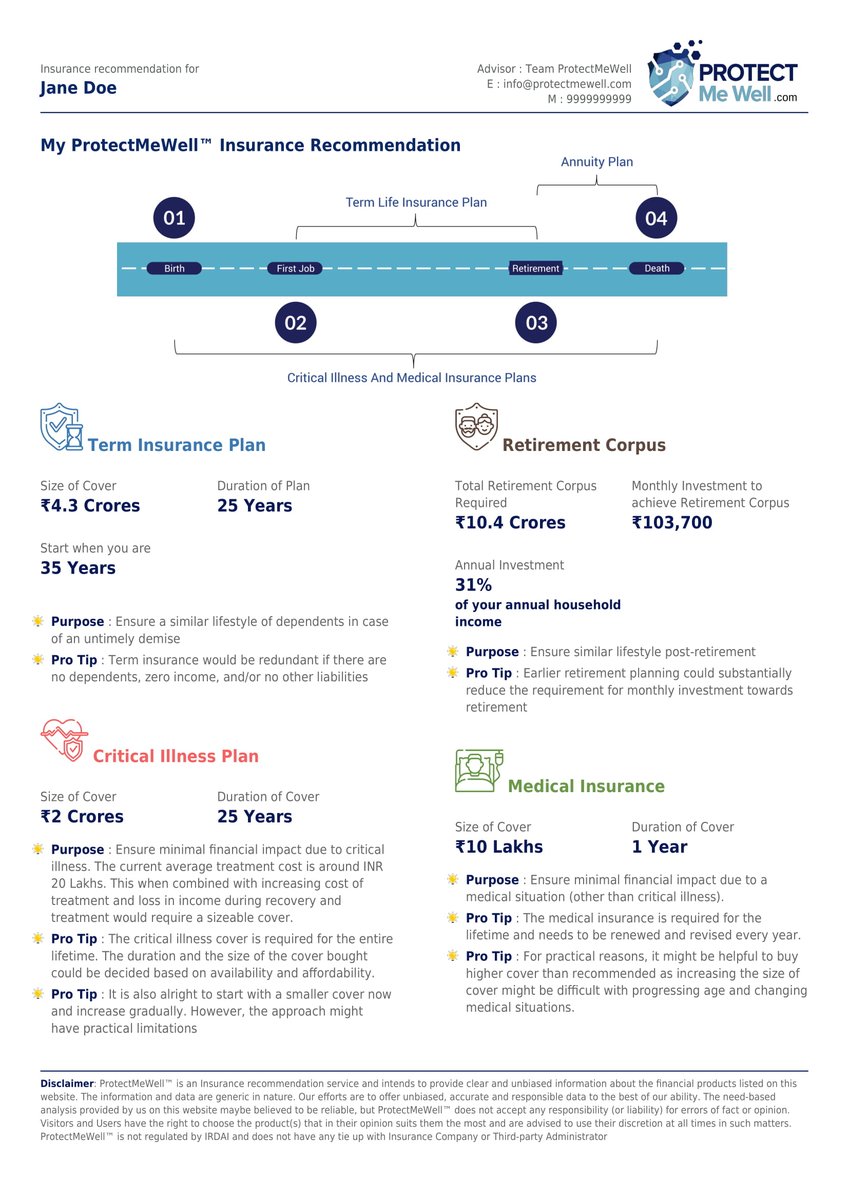

If investment returns are an accelerator in the journey of financial independence, risk management instruments (largely insurance) are brakes. Brakes ensure that journey is not derailed and give you the confidence to drive faster🏎

If investment returns are an accelerator in the journey of financial independence, risk management instruments (largely insurance) are brakes. Brakes ensure that journey is not derailed and give you the confidence to drive faster🏎