Professor of Economics @Harvard. Inequality, taxation, innovation & how people understand economic policies. Theory+data. https://t.co/naCOmtlUCe

5 subscribers

How to get URL link on X (Twitter) App

What is zero-sum thinking? It’s the belief that gains for one individual or group tend to come at the cost of others. It’s the belief in a “limited good”: if you get a bigger slice of the pie, it means that I must get a smaller one. 2/23

What is zero-sum thinking? It’s the belief that gains for one individual or group tend to come at the cost of others. It’s the belief in a “limited good”: if you get a bigger slice of the pie, it means that I must get a smaller one. 2/23

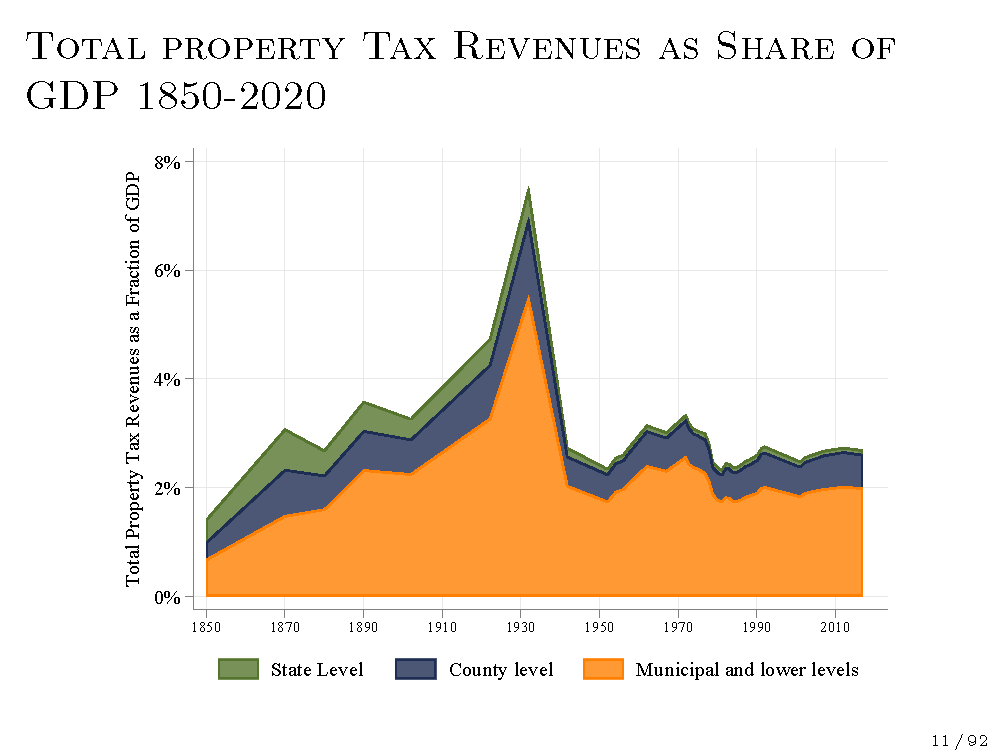

2/24: A summary of this history, based on invaluable work by economic historians, is in our new paper with @landais_camille & @sachajdray here: . #EconTwitter https://t.co/JmTaRBki0Zscholar.harvard.edu/stantcheva/fil…

2/24: A summary of this history, based on invaluable work by economic historians, is in our new paper with @landais_camille & @sachajdray here: . #EconTwitter https://t.co/JmTaRBki0Zscholar.harvard.edu/stantcheva/fil…

2/19: The study tackles two key questions: what do people know about the impacts of trade? And, how do they weigh trade-offs when forming their views on trade policy? We conducted large-scale surveys and experiments in the US at the Social Economics Lab socialeconomicslab.org

2/19: The study tackles two key questions: what do people know about the impacts of trade? And, how do they weigh trade-offs when forming their views on trade policy? We conducted large-scale surveys and experiments in the US at the Social Economics Lab socialeconomicslab.org

Surveys are an essential approach for eliciting otherwise invisible factors such as perceptions, knowledge & beliefs, attitudes & reasoning. These factors are critical determinants of social, economic & political outcomes.

Surveys are an essential approach for eliciting otherwise invisible factors such as perceptions, knowledge & beliefs, attitudes & reasoning. These factors are critical determinants of social, economic & political outcomes.

Citizens are *very concerned* about climate change and supportive of taking action ⬇️. Yet, governments have set strong climate goals but struggle to implement them. This large-scale international survey sheds light on what matters for increased support 2/N

Citizens are *very concerned* about climate change and supportive of taking action ⬇️. Yet, governments have set strong climate goals but struggle to implement them. This large-scale international survey sheds light on what matters for increased support 2/N

Surveys are a key tool for understanding people's views on public policies as they reveal otherwise invisible things such as attitudes, perceptions, reasoning, and beliefs. Our usual methods of using preferences revealed through behaviors face challenges on these issues 2/N

Surveys are a key tool for understanding people's views on public policies as they reveal otherwise invisible things such as attitudes, perceptions, reasoning, and beliefs. Our usual methods of using preferences revealed through behaviors face challenges on these issues 2/N

What are ‘good jobs’? It's hard to give a unique definition, but typically people say that good jobs provide a middle-class living standard, sufficiently high wages & benefits, good levels of personal autonomy, adequate economic security & stability & career ladders [2/N]

What are ‘good jobs’? It's hard to give a unique definition, but typically people say that good jobs provide a middle-class living standard, sufficiently high wages & benefits, good levels of personal autonomy, adequate economic security & stability & career ladders [2/N]

It is hard to find data and provide empirical evidence on the long-term effects of taxes on innovation. Here we bridge this gap: our new data contains the universe of all inventors & personal & corporate tax data at the state level for the US from 1920 to 2000 [2/17]

It is hard to find data and provide empirical evidence on the long-term effects of taxes on innovation. Here we bridge this gap: our new data contains the universe of all inventors & personal & corporate tax data at the state level for the US from 1920 to 2000 [2/17]

[2/] Adrien & Thomas conducted a survey on a representative sample of 3000 French people to understand their attitudes towards a carbon tax with cash transfers. Although a carbon tax alone is regressive, redistributing its revenues equally to each adult can make it progressive.

[2/] Adrien & Thomas conducted a survey on a representative sample of 3000 French people to understand their attitudes towards a carbon tax with cash transfers. Although a carbon tax alone is regressive, redistributing its revenues equally to each adult can make it progressive.

[2/15] We exploit large-scale, longitudinal, and representative surveys for 12 countries from March to December 2020 (n=54 000), and we complement the analysis with experimental data.

[2/15] We exploit large-scale, longitudinal, and representative surveys for 12 countries from March to December 2020 (n=54 000), and we complement the analysis with experimental data.

[2/20] We focus on large samples of non-Hispanic Black & white respondents across the US. Importantly, we survey both adults and teenagers aged 13 to 17. Black respondents are oversampled & represent half of the sample.

[2/20] We focus on large samples of non-Hispanic Black & white respondents across the US. Importantly, we survey both adults and teenagers aged 13 to 17. Black respondents are oversampled & represent half of the sample.

[2/N] We leverage a unique data combination, linking survey data to detailed administrative data for a large sample of prime-age people in Denmark.

[2/N] We leverage a unique data combination, linking survey data to detailed administrative data for a large sample of prime-age people in Denmark.

[2/14] Joint with my wonderful colleagues and co-authors Marcella Alsan, Joyce Kim, Luca Braghieri, Sarah Eichmeyer @LMU_Muenchen and David Y. Yang @Kennedy_School @HarvardEcon @InequalityHKS

[2/14] Joint with my wonderful colleagues and co-authors Marcella Alsan, Joyce Kim, Luca Braghieri, Sarah Eichmeyer @LMU_Muenchen and David Y. Yang @Kennedy_School @HarvardEcon @InequalityHKS

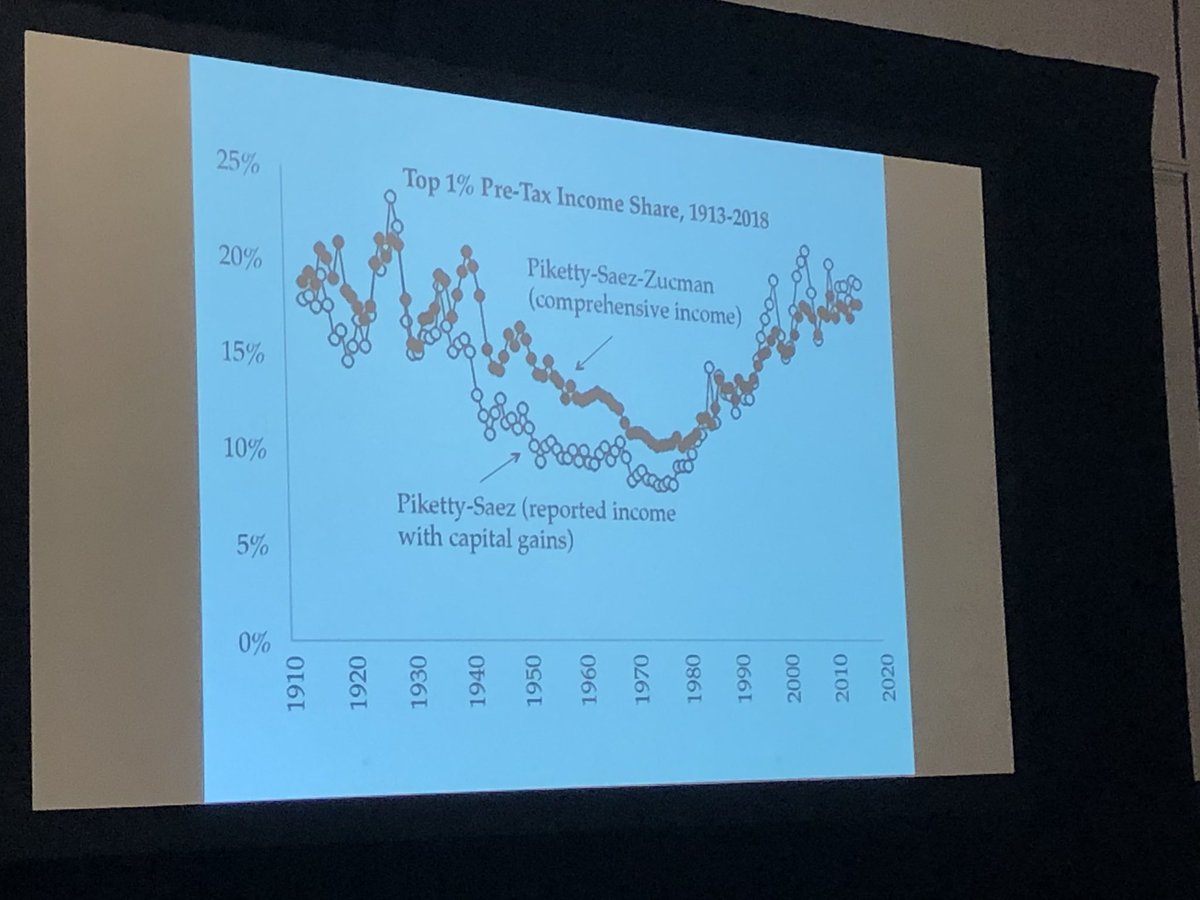

Older series done by @PikettyLeMonde and Saez only captured fiscal income— but that’s not all income going to people. Distributional national accounts improve the series by attributing all national income (including non taxed income) to different groups

Older series done by @PikettyLeMonde and Saez only captured fiscal income— but that’s not all income going to people. Distributional national accounts improve the series by attributing all national income (including non taxed income) to different groups