750 years of amateur Trading from my Dodge Caravan

mom/momma/mommy

4 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/SoccerMomTrades/status/1401322243561607173

As you can see from quoted tweet, I was bullish in the low 30k range between May to June because we had such a notable dump that it turned sentiment very bearish with sellers piling on late and shooting for aggressive sub 30k targets, even HODLers didn't wanna DCA till lower..

As you can see from quoted tweet, I was bullish in the low 30k range between May to June because we had such a notable dump that it turned sentiment very bearish with sellers piling on late and shooting for aggressive sub 30k targets, even HODLers didn't wanna DCA till lower..

https://twitter.com/SoccerMomTrades/status/1389376055509725184

Watch that 8 pm EST daily candle closing print right now -1 std dev of 20bb $btc

Watch that 8 pm EST daily candle closing print right now -1 std dev of 20bb $btc

https://twitter.com/SoccerMomTrades/status/1379884807287672838

This is also first loss of +2 std dev line on this entire move above it ... Big air pocket till +1 std dev line

This is also first loss of +2 std dev line on this entire move above it ... Big air pocket till +1 std dev line

https://twitter.com/SoccerMomTrades/status/1379820267539738624

The BBW (Bollinger Bandwidth) squeeze resolved upward but with very little momentum and already waning....a move back under the 50 hour MA (pink) could send us into a nice long liquidation

The BBW (Bollinger Bandwidth) squeeze resolved upward but with very little momentum and already waning....a move back under the 50 hour MA (pink) could send us into a nice long liquidationhttps://twitter.com/SoccerMomTrades/status/1379884807287672838?s=20

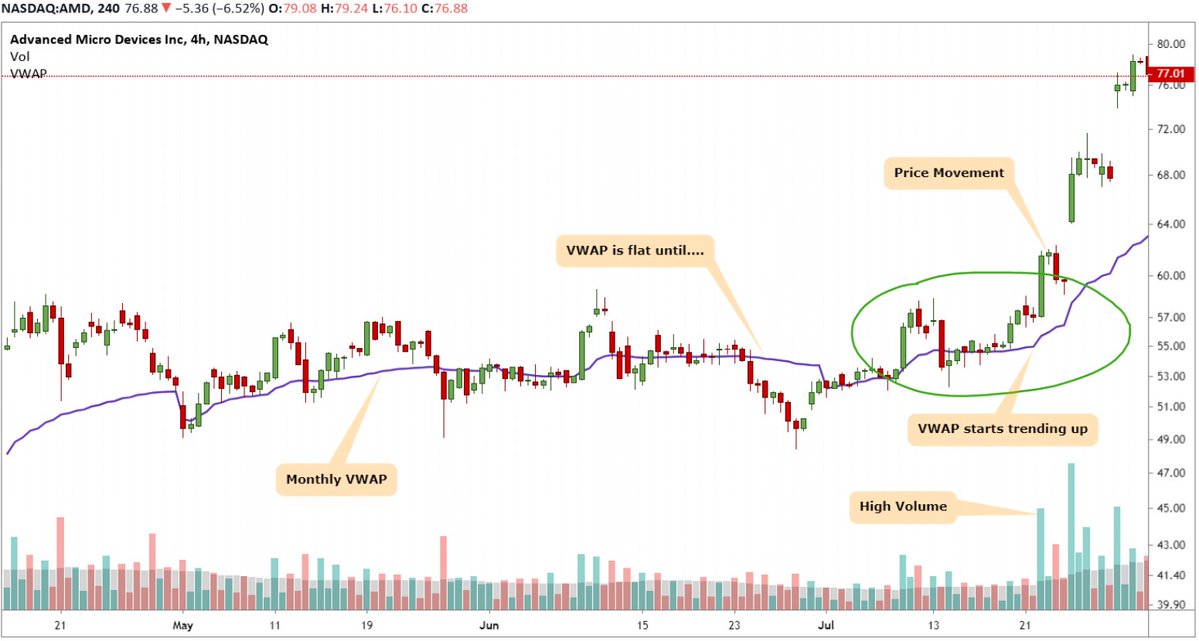

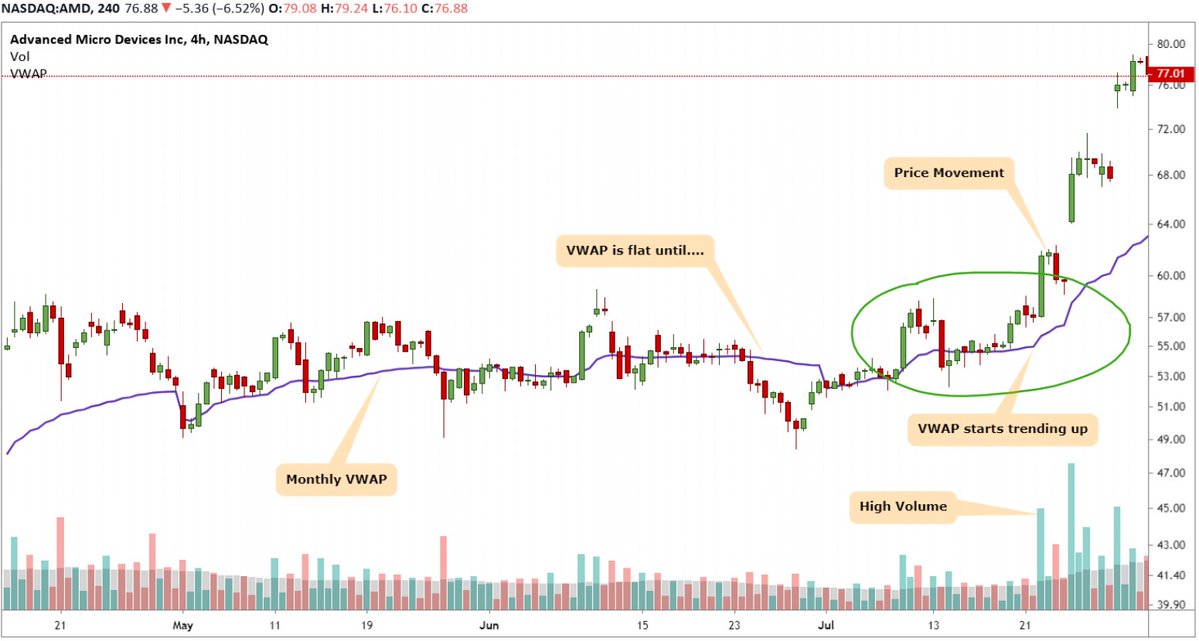

Let's say you really believe in $AMD in April and want to have a decent exposure for an eventual breakout. You don't know exactly how this happens. So you allocate 1/2 of the money for this position to a core of 1000 shares and the other half to the funnel method techniques

Let's say you really believe in $AMD in April and want to have a decent exposure for an eventual breakout. You don't know exactly how this happens. So you allocate 1/2 of the money for this position to a core of 1000 shares and the other half to the funnel method techniques

This is the best non-mathematical way to look at the VWAP:

This is the best non-mathematical way to look at the VWAP: