Senior Advisor, @FDICgov. Former director at the Yale Program on Financial Stability. Still an academic at parties.

How to get URL link on X (Twitter) App

2/ Articles, books, & academic literature often simply postulate that the Fed creates SPVs to get around the legal limits of Section 13(3), which—according to this misconception—don't allow the Fed to purchase assets. But that really doesn't track with SPVs' more nuanced history:

2/ Articles, books, & academic literature often simply postulate that the Fed creates SPVs to get around the legal limits of Section 13(3), which—according to this misconception—don't allow the Fed to purchase assets. But that really doesn't track with SPVs' more nuanced history:

https://twitter.com/NewYorkFed/status/1671159597401509893

2/ Prior to this, the best explanation we had from Fed officials was Powell saying that because this was a "special" facility, the Fed should use its "special" authority.

2/ Prior to this, the best explanation we had from Fed officials was Powell saying that because this was a "special" facility, the Fed should use its "special" authority.https://twitter.com/DavidBeckworth/status/1638616514596053000?s=20

2/ Of course, profit is not the goal of financial stability interventions.

2/ Of course, profit is not the goal of financial stability interventions.

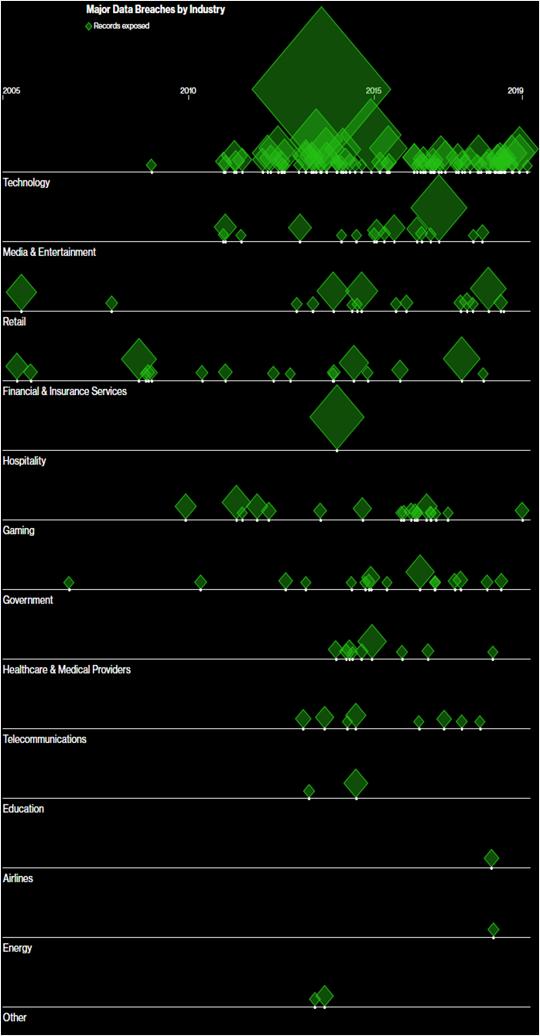

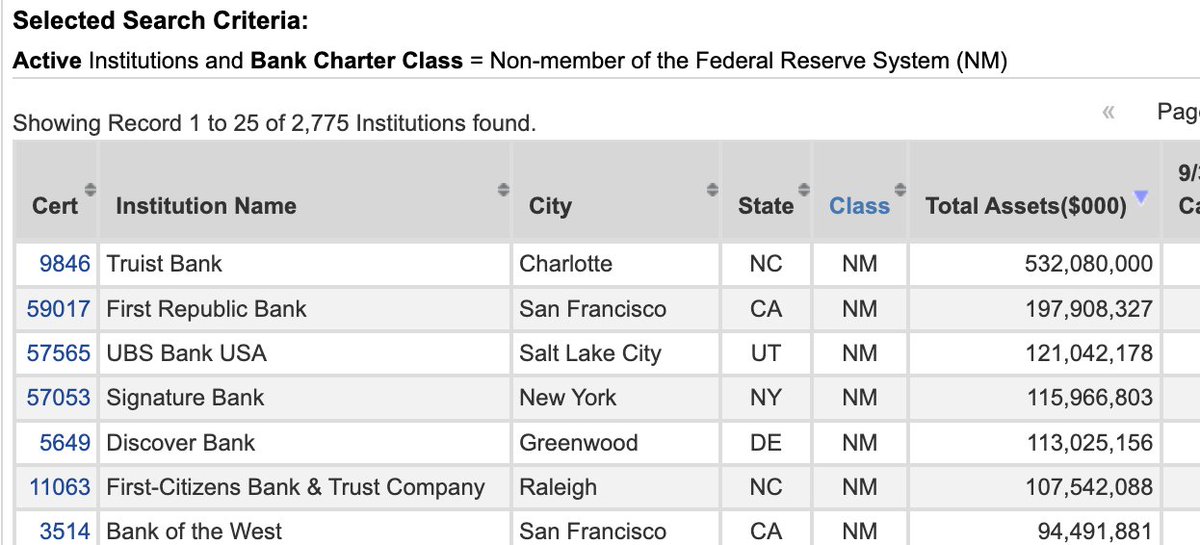

SVB, First Republic, Silvergate, Signature (yes, NY-based, but run on for catering to the very tech-y, West Coast-y crypto industry), PacWest, Western Alliance, etc.

SVB, First Republic, Silvergate, Signature (yes, NY-based, but run on for catering to the very tech-y, West Coast-y crypto industry), PacWest, Western Alliance, etc.

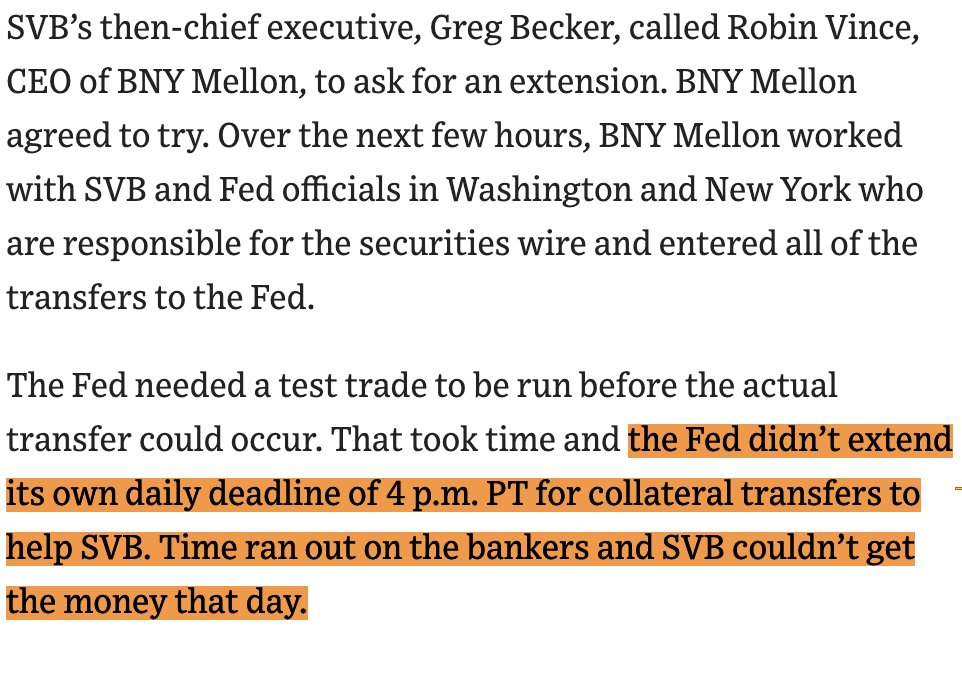

2/ Similarly, the WSJ's play-by-play of SVB's last days notes that the Fed did not extend its wire deadline on Thursday March 9, limiting SVB's access to the discount window that night.

2/ Similarly, the WSJ's play-by-play of SVB's last days notes that the Fed did not extend its wire deadline on Thursday March 9, limiting SVB's access to the discount window that night.

https://twitter.com/federalreserve/status/1635043886409326594

15 years & 1 day ago, the Fed announced its first 13(3) program of the GFC, and didn't mention the authority for fear of ... fear.

15 years & 1 day ago, the Fed announced its first 13(3) program of the GFC, and didn't mention the authority for fear of ... fear.

https://twitter.com/federalreserve/status/16350438864093265942.1) This should serve as a wakeup call to the Fed that it's consistently been overconfident in the emergency efficacy of a discount window and Standing Repo Facility (SRF) that lend at fair/market value.

https://twitter.com/StevenKelly49/status/1443047721380810756Here's the status of the Fed's CARES Act facilities. As shown, only the corporate bond facilities have yet returned all the Treasury funding. They did so after selling all holdings. The other facilities need not do the same or change their stated risk profile to return funds.