Investor | Writer | Detective | USN Veteran | Sinner saved by grace

I tweet about investing in the stock market.

3 subscribers

How to get URL link on X (Twitter) App

Fisher says there are 3 reasons for investors to sell a stock and 3 reasons not to sell.

Fisher says there are 3 reasons for investors to sell a stock and 3 reasons not to sell.

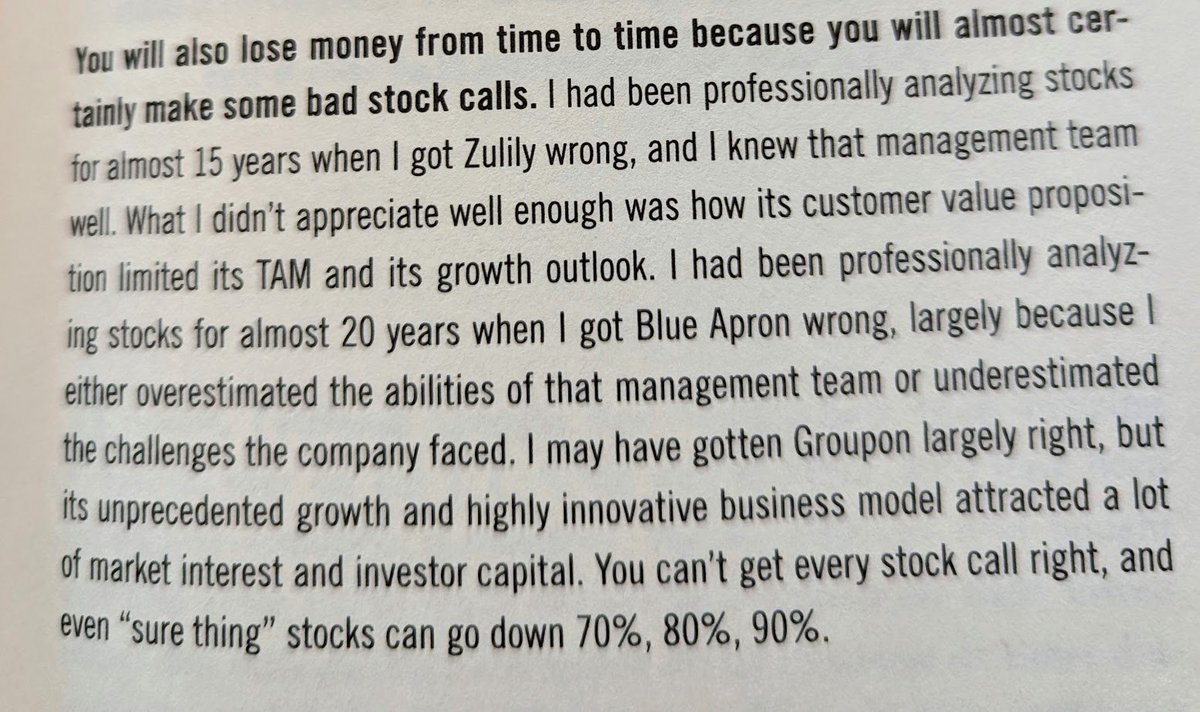

Lesson 1: There will be blood when you pick bad stocks

Lesson 1: There will be blood when you pick bad stocks

I'm currently reading through Mahaney's book for the second time since getting it last year. I whole-heartedly recommend the book.

I'm currently reading through Mahaney's book for the second time since getting it last year. I whole-heartedly recommend the book.

Fisher says there are 3 reasons for investors to sell a stock and 3 reasons not to sell.

Fisher says there are 3 reasons for investors to sell a stock and 3 reasons not to sell.

Luther Turner opened his first store just before the Great Depression. Even though he had a 3rd grade education and could barely read, Luther's store was still successful, mostly by acknowledging he wasn't smart and could learn something from everyone.

Luther Turner opened his first store just before the Great Depression. Even though he had a 3rd grade education and could barely read, Luther's store was still successful, mostly by acknowledging he wasn't smart and could learn something from everyone.

Being a South Florida native, I don't think Wayne Huizenga gets the credit he deserves.

Being a South Florida native, I don't think Wayne Huizenga gets the credit he deserves.

Point #1: Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years.

Point #1: Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years.

Davis didn't start investing until later in life, in his late 30s. Before investing, he was an economic advisor to NY Governor Thomas Dewey and a freelance writer.

Davis didn't start investing until later in life, in his late 30s. Before investing, he was an economic advisor to NY Governor Thomas Dewey and a freelance writer.

2/ In 1995, the newly dubbed world wide web was exploding, w/ more than 100K web pages by the end of year. But there was no easy way to find something on the web or sort these pages.

2/ In 1995, the newly dubbed world wide web was exploding, w/ more than 100K web pages by the end of year. But there was no easy way to find something on the web or sort these pages.

https://twitter.com/Matt_Cochrane7/status/1564270398098784259DG Fresh, the company's initiative to reduce product cost on its frozen and refrigerated items and drive sales in the refrigerated category, is now live across 19k stores.

2/ Focus on buying companies with competitive advantages.

2/ Focus on buying companies with competitive advantages.

2/ This quarter, $ADBE did complete the acquisition of Frame.io, a leading cloud-based video collaboration platform. Just another feature that makes its bundle a little stickier and keeps customers from looking at the competition in a remote work world.

2/ This quarter, $ADBE did complete the acquisition of Frame.io, a leading cloud-based video collaboration platform. Just another feature that makes its bundle a little stickier and keeps customers from looking at the competition in a remote work world.

When investors talk about China, they keep mentioning business risks. I agree, at these valuations, you're taking on very little business risk!

When investors talk about China, they keep mentioning business risks. I agree, at these valuations, you're taking on very little business risk!

And $SQ is looking to acquire Afterpay! 👀

And $SQ is looking to acquire Afterpay! 👀

2/ $MSFT is a $2T company growing revenue +21%, net income +47%, operating income margin of 41%. That's incredible.

2/ $MSFT is a $2T company growing revenue +21%, net income +47%, operating income margin of 41%. That's incredible.