Econ professor @imperialcollege. Londoner, made in 🇮🇹. Flute über alles 🎵

How to get URL link on X (Twitter) App

What’s particularly interesting is that these are all mergers that a) were vetted by comp authorities & b) were approved. Hence you'd expect prices either to stay constant or to go down because of the alleged efficiencies – right?

What’s particularly interesting is that these are all mergers that a) were vetted by comp authorities & b) were approved. Hence you'd expect prices either to stay constant or to go down because of the alleged efficiencies – right?

The battle was between the Holy League (commanders were Don Juan of Austria - Spain and half brother of Philipp II, Sebastiano Venier - Venice and Marcantonio Colonna - Papal States) and the Ottomans (led by Ali Pasha who died in the battle). 2/

The battle was between the Holy League (commanders were Don Juan of Austria - Spain and half brother of Philipp II, Sebastiano Venier - Venice and Marcantonio Colonna - Papal States) and the Ottomans (led by Ali Pasha who died in the battle). 2/

1. Market share of dominant firms has not increased (Panel A: domestic sales to domestic GDP; Panel B: consolidated global sales to global GDP).

1. Market share of dominant firms has not increased (Panel A: domestic sales to domestic GDP; Panel B: consolidated global sales to global GDP).

Dubious methodologies and identification, but let’s ignore them. The core of the study is this: they have a bunch of country-sector EU data from 2010 to 2017. They estimate some TFP and see how TFP is affected by an “ex ante regulation” dummy that covers the period 2015-2017.

Dubious methodologies and identification, but let’s ignore them. The core of the study is this: they have a bunch of country-sector EU data from 2010 to 2017. They estimate some TFP and see how TFP is affected by an “ex ante regulation” dummy that covers the period 2015-2017.

You don’t drink it after noon. You don’t order it after lunch, let alone after dinner. And absolutely terrible to drink it DURING a meal (I feel bad just at the thought of it). You don’t drink it in a plastic cup. You don’t drink it on the go. You don’t drink it with a straw. 2/

You don’t drink it after noon. You don’t order it after lunch, let alone after dinner. And absolutely terrible to drink it DURING a meal (I feel bad just at the thought of it). You don’t drink it in a plastic cup. You don’t drink it on the go. You don’t drink it with a straw. 2/

With fully rational consumers (a big if), individuals who don’t care about privacy release their data. This compromises those who do care and whose information is correlated. (Cambridge Analytica scandal:data shared by 1/4m FB users but allowed to infer info about 50m users!). 2/

With fully rational consumers (a big if), individuals who don’t care about privacy release their data. This compromises those who do care and whose information is correlated. (Cambridge Analytica scandal:data shared by 1/4m FB users but allowed to infer info about 50m users!). 2/

2/ At policy level, it should be eye-opening to those that can just repeat like robots “Aghion et al. = inverted-U, hence we should do nothing".

2/ At policy level, it should be eye-opening to those that can just repeat like robots “Aghion et al. = inverted-U, hence we should do nothing".

Employs a new dataset to measure product similarity (based on computational linguistics of 10-k forms) for every pair of publicly-traded firms in US. 2/

Employs a new dataset to measure product similarity (based on computational linguistics of 10-k forms) for every pair of publicly-traded firms in US. 2/

https://twitter.com/matthewstoller/status/1149332086555402240

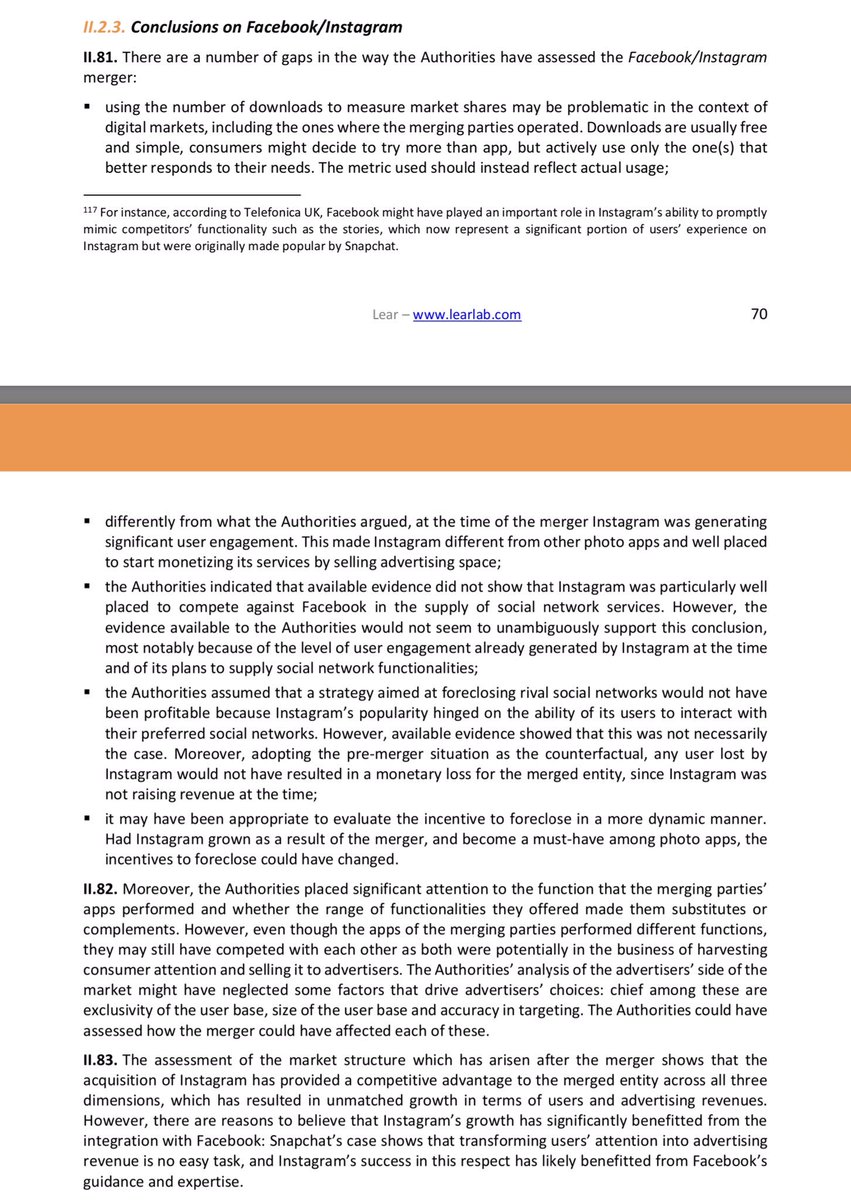

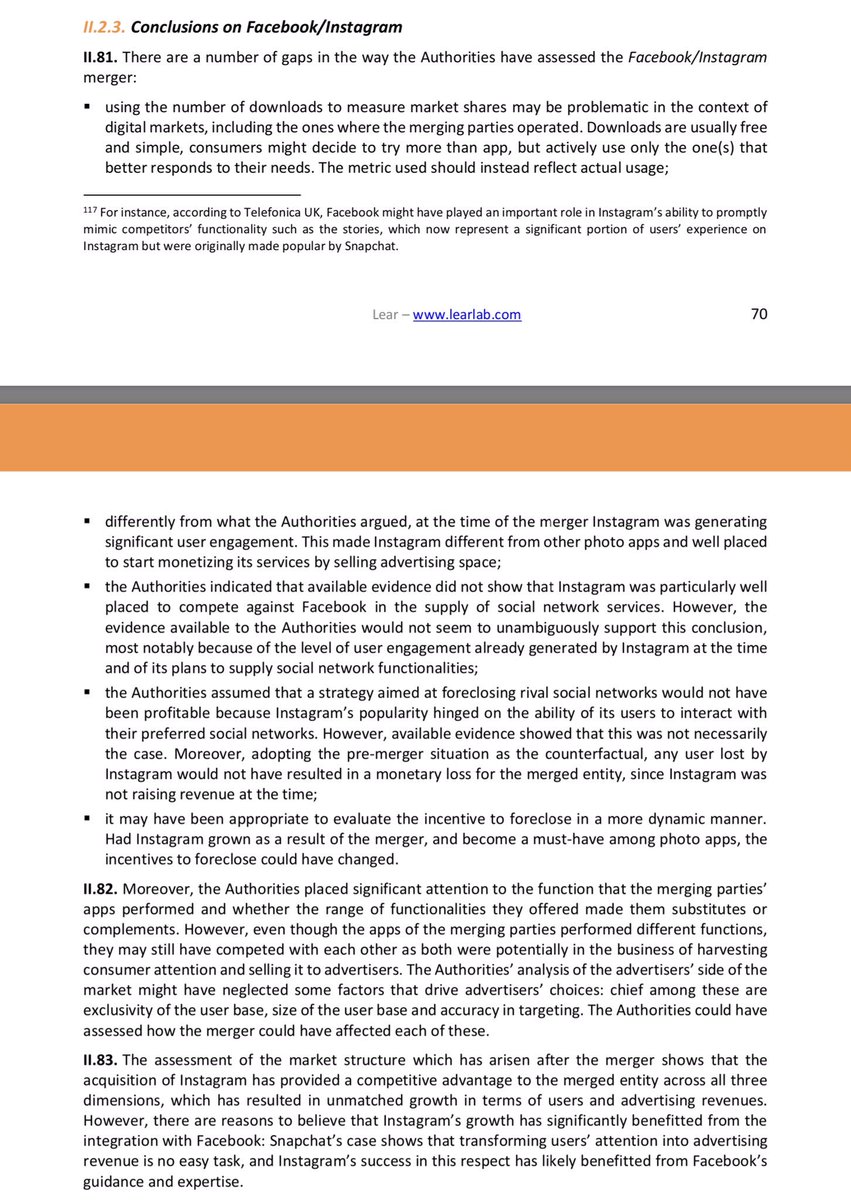

It’s too protective of the status quo when it comes to GAFAs (the G in particular). Take the example below: seriously, should we worry about IBM and ADOBE and NETFLIX in the same way as GAFAs? This is framing.

It’s too protective of the status quo when it comes to GAFAs (the G in particular). Take the example below: seriously, should we worry about IBM and ADOBE and NETFLIX in the same way as GAFAs? This is framing.

https://twitter.com/EU_Competition/status/11137592309039472641) Consumer welfare standard: Under-enforcement is the problem in the digital world. Even if consumer harm cannot be measured, platforms’ strategies to reduce competition should be forbidden in the absence of clear efficiency gains

https://twitter.com/TomValletti/status/1090325132596400128

https://twitter.com/geoffmanne/status/1090349679303450624

2. Here’s the theory :

2. Here’s the theory :

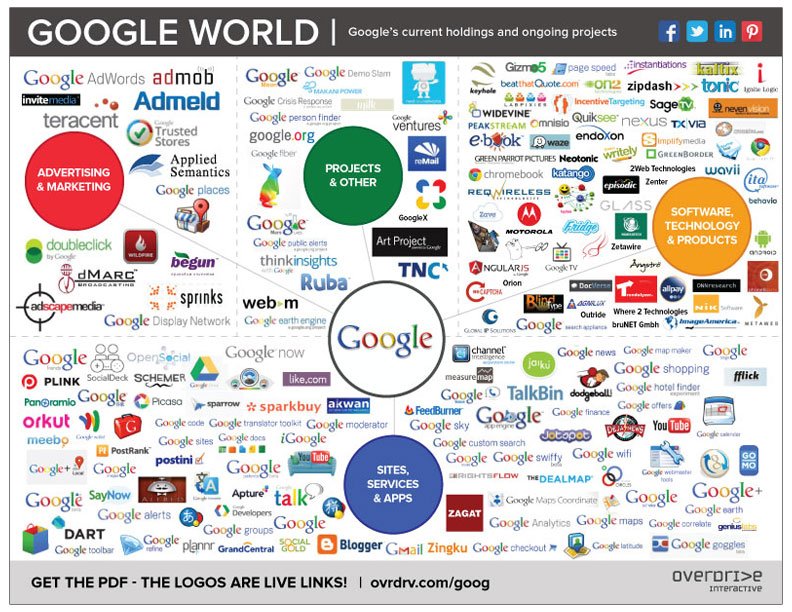

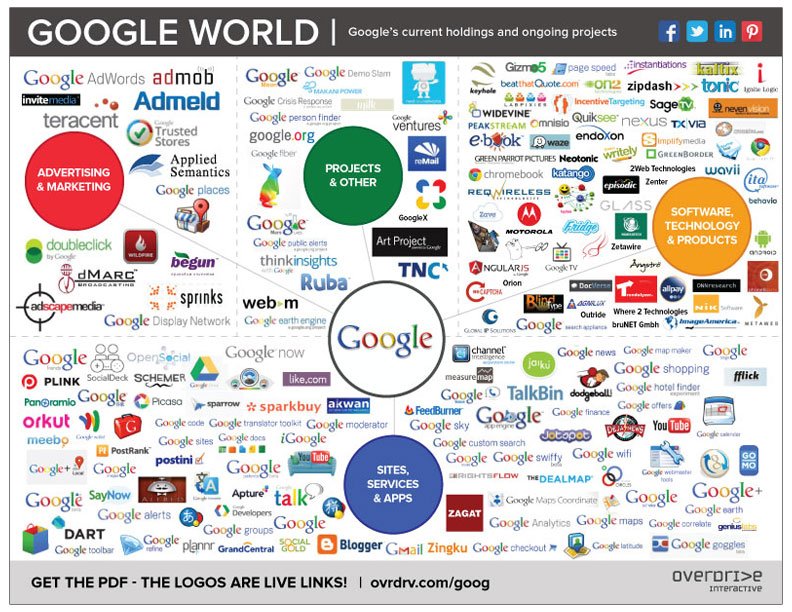

Since 2010, rate up to 1 firm every 18 days. 99% of the deals not vetted by ANY competition authority for a variety of reasons (rest approved).

Since 2010, rate up to 1 firm every 18 days. 99% of the deals not vetted by ANY competition authority for a variety of reasons (rest approved).