Founder and Chief Investment Officer at Tundra Fonder. Pioneer in frontier and emerging markets. A special love for the unloved. Views are my own.

How to get URL link on X (Twitter) App

2/X

2/X

on the opposite side you have #Pakistan. To reach 10y average the market needs to rise 50%.

on the opposite side you have #Pakistan. To reach 10y average the market needs to rise 50%.

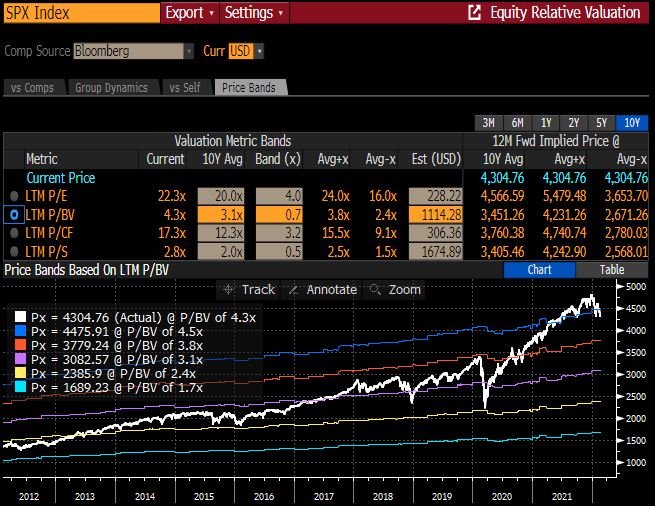

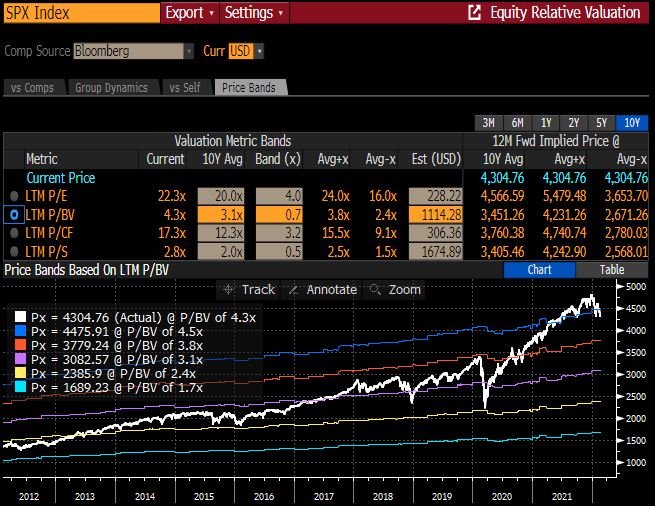

https://twitter.com/Fritz844/status/1484067533934444553Now waiting for the comments why "This time it is different" 😉

2/X - There is a structural flaw in the algorithm deciding country weights. As opposed to MSCI EM where 50% free float is required, in FM index a mere 7,5% free-float is required. Not a brilliant idea as it gives a higher weight to "zombie markets" with zero liquidity.

2/X - There is a structural flaw in the algorithm deciding country weights. As opposed to MSCI EM where 50% free float is required, in FM index a mere 7,5% free-float is required. Not a brilliant idea as it gives a higher weight to "zombie markets" with zero liquidity.