Zealous in business; fervent in spirit; serving the Lord.

2 subscribers

How to get URL link on X (Twitter) App

2. Speakers at the event include Mr Ogunjemilusi @FIRSNigeria Director Tax Policy & Exchange of Information Unit and John Ashilere, Deputy Manager Exchange of Information #DeloitteTaxCRS

2. Speakers at the event include Mr Ogunjemilusi @FIRSNigeria Director Tax Policy & Exchange of Information Unit and John Ashilere, Deputy Manager Exchange of Information #DeloitteTaxCRS

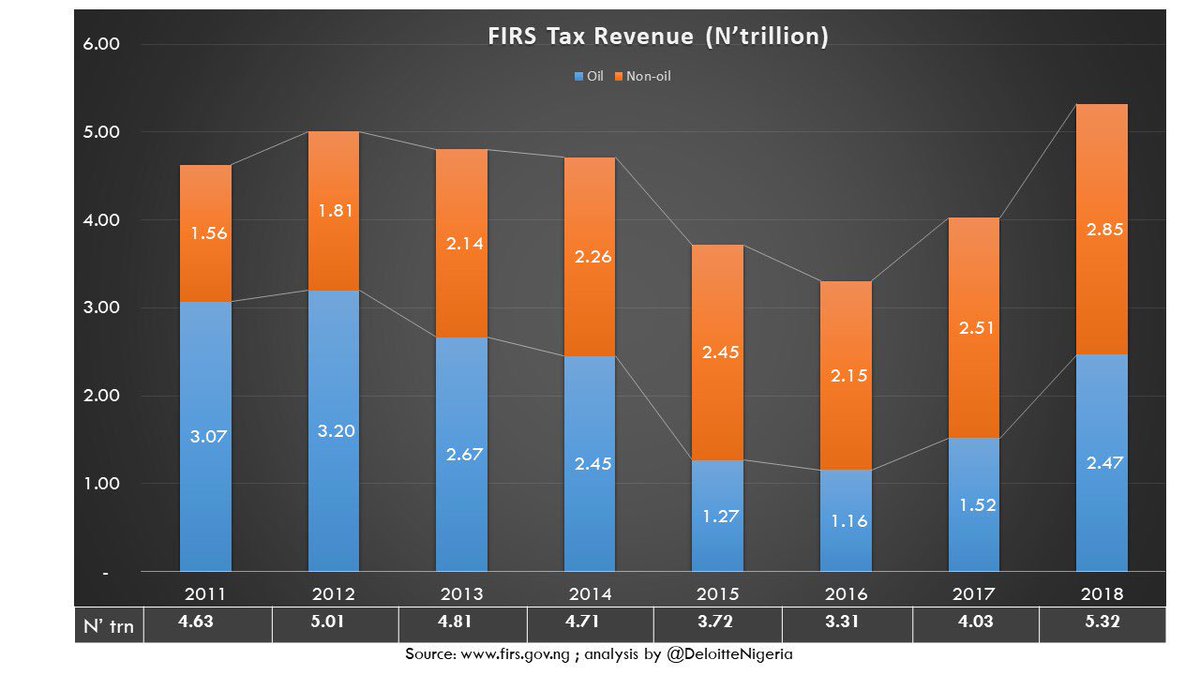

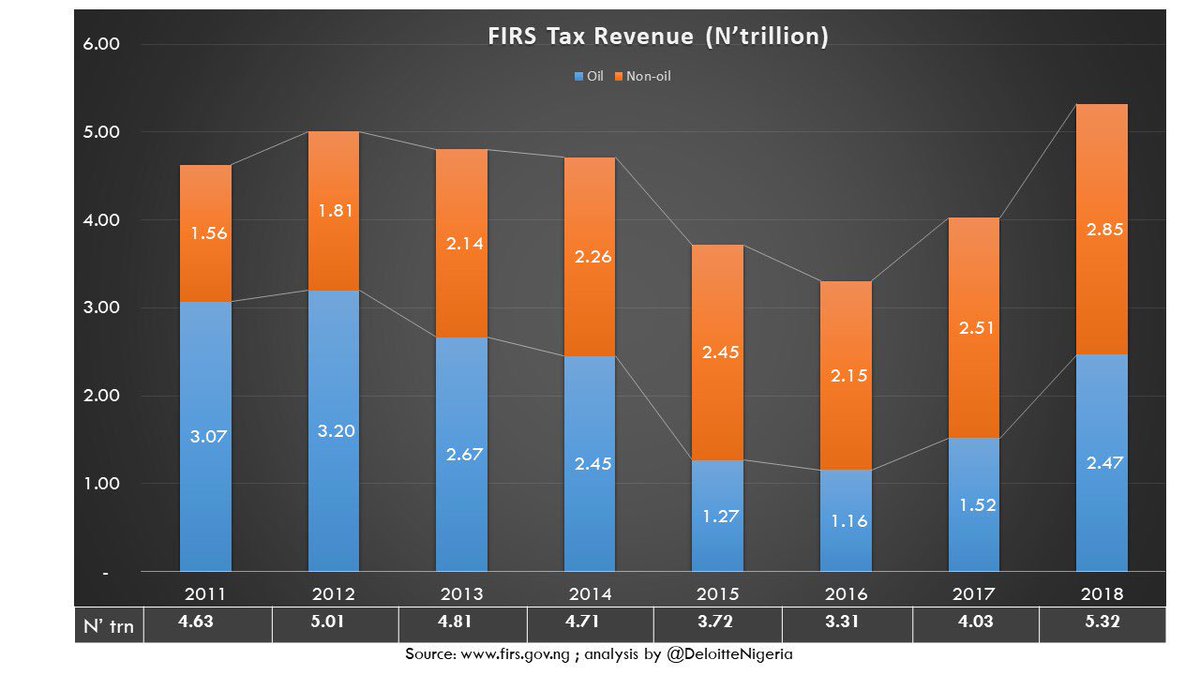

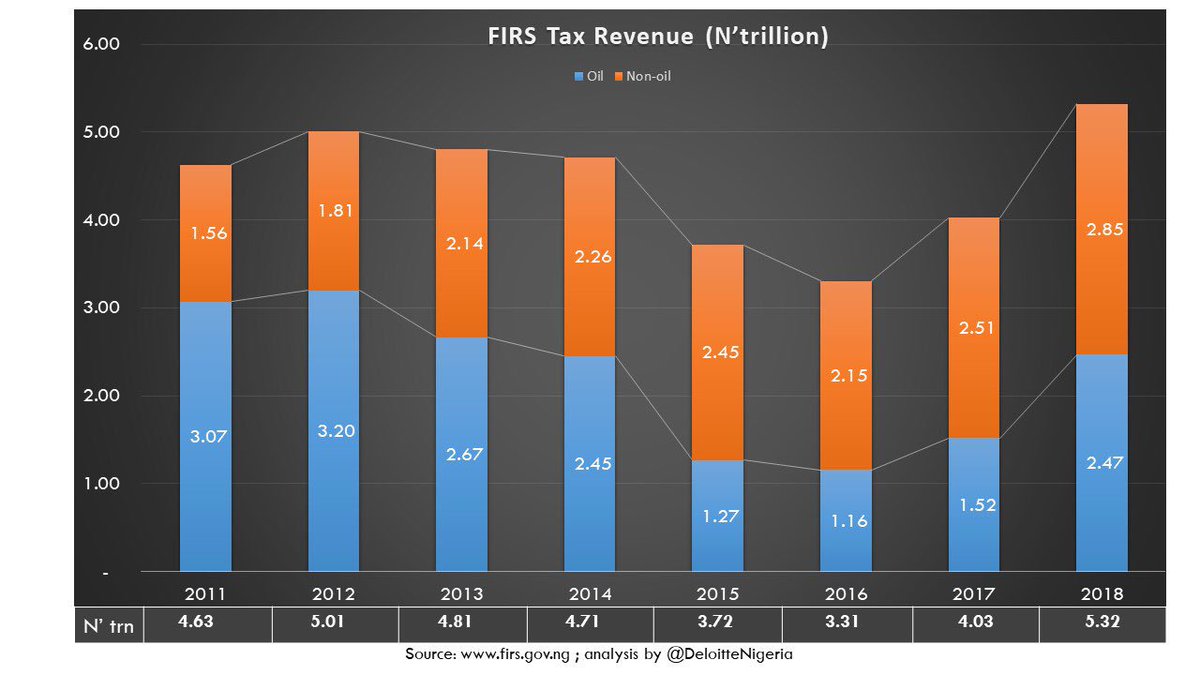

Between 2011 and 2018, the least tax revenue collection was recorded in 2016 with a total of N3.31 trillion. It was the year with the least oil tax revenue of N1.16 trillion. Check out 2011 and 2012 with oil tax revenue of N3.07 trillion and N3.2 trillion respectively. #TaxMoney

Between 2011 and 2018, the least tax revenue collection was recorded in 2016 with a total of N3.31 trillion. It was the year with the least oil tax revenue of N1.16 trillion. Check out 2011 and 2012 with oil tax revenue of N3.07 trillion and N3.2 trillion respectively. #TaxMoney

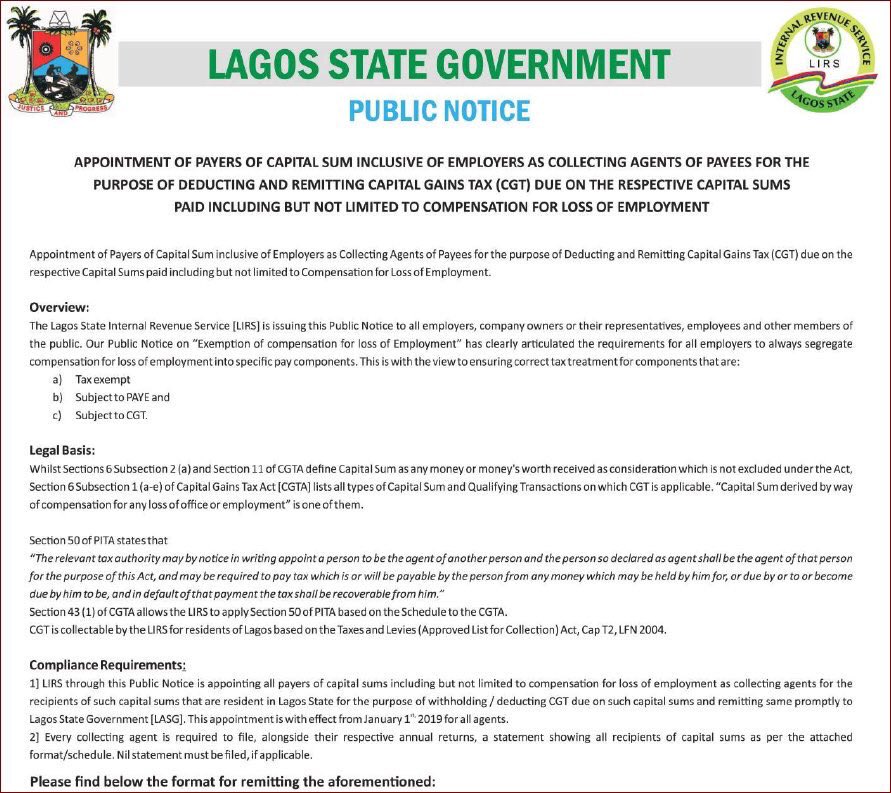

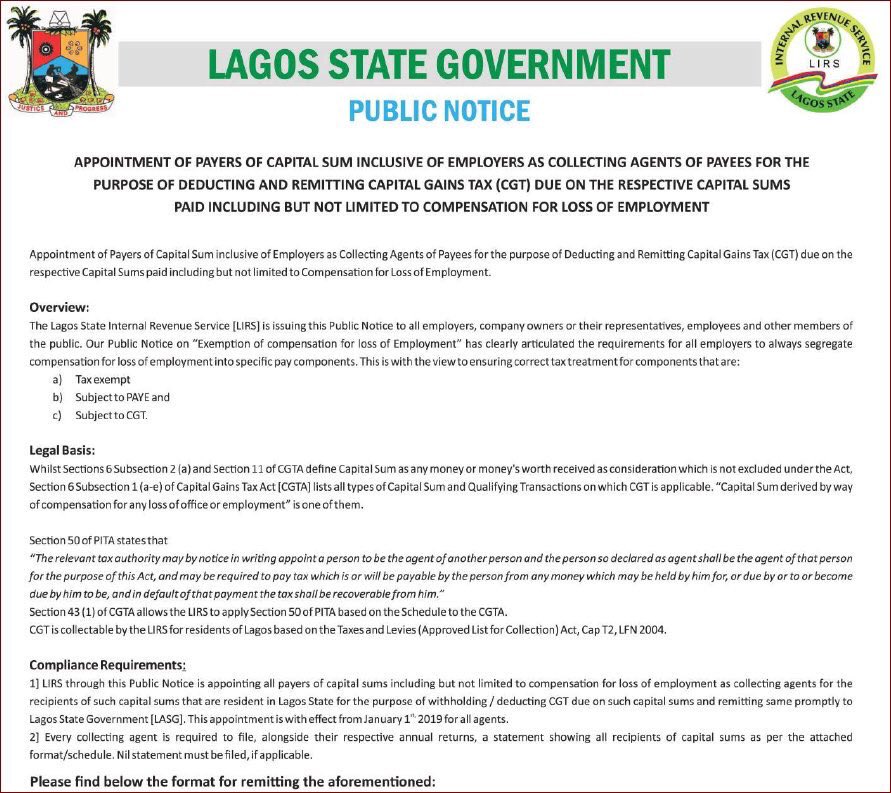

2. Whilst @LIRSGovNG agrees that compensation for loss of employment are free of personal income tax, it seek ways to proactively collect capital gains tax as may be prescribed by Capital Gains Tax Act, by holding employers responsible. #TaxingNigeria #SeveranceBenefit

2. Whilst @LIRSGovNG agrees that compensation for loss of employment are free of personal income tax, it seek ways to proactively collect capital gains tax as may be prescribed by Capital Gains Tax Act, by holding employers responsible. #TaxingNigeria #SeveranceBenefit

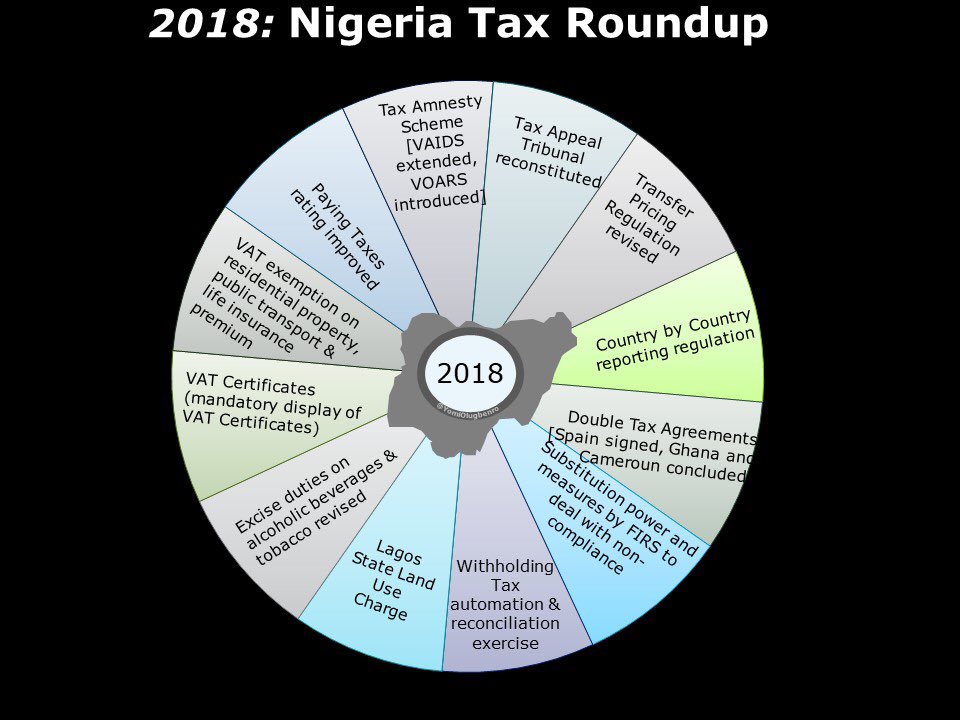

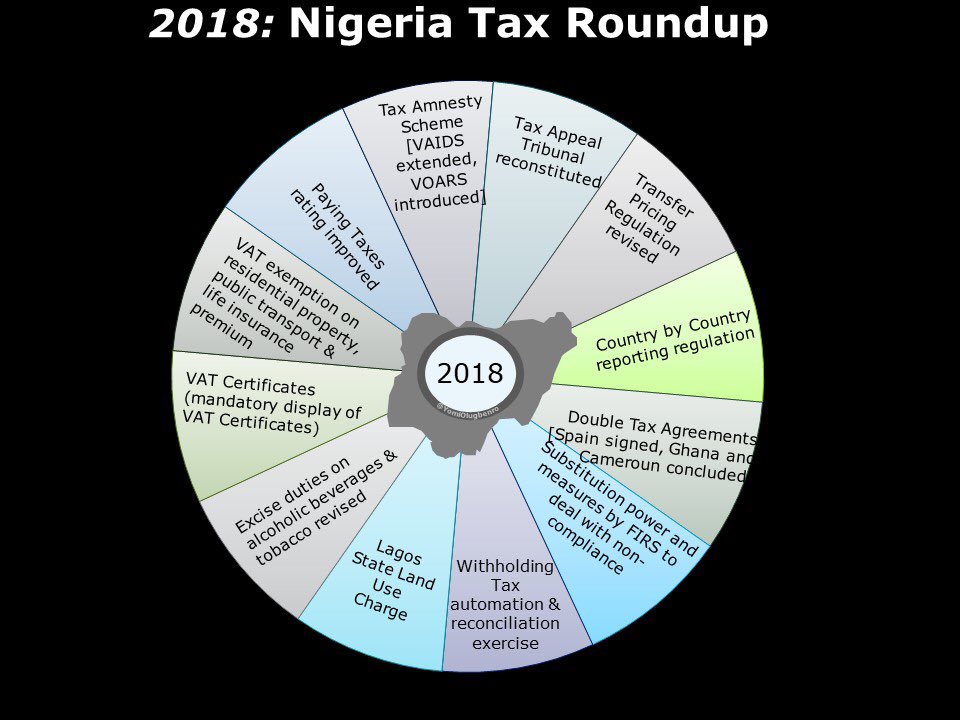

2. Tax Appeal Tribunals were reconstituted in July 2018, with one each in the 6 geopolitical zones, Lagos and Abuja, totalling 8. The Tribunals will help to accelerate the resolution of pending and new tax cases. More details here blog.deloitte.com.ng/federal-govern… #TaxRecap2018

2. Tax Appeal Tribunals were reconstituted in July 2018, with one each in the 6 geopolitical zones, Lagos and Abuja, totalling 8. The Tribunals will help to accelerate the resolution of pending and new tax cases. More details here blog.deloitte.com.ng/federal-govern… #TaxRecap2018