How to get URL link on X (Twitter) App

https://twitter.com/jitenkparmar/status/1890719817562309077

These businesses suddenly went into turmoil even though it was business-as-usual for their peers.

These businesses suddenly went into turmoil even though it was business-as-usual for their peers.

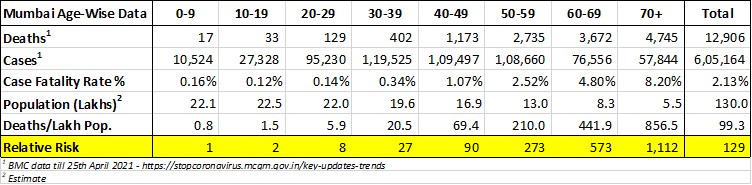

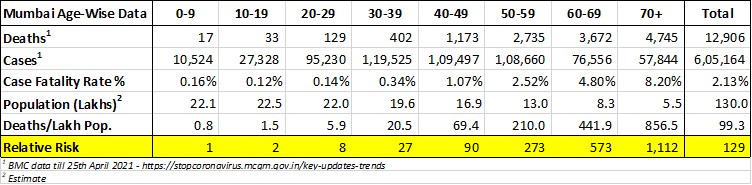

But CFR % does not clearly represent the difference in mortality risk.

But CFR % does not clearly represent the difference in mortality risk.

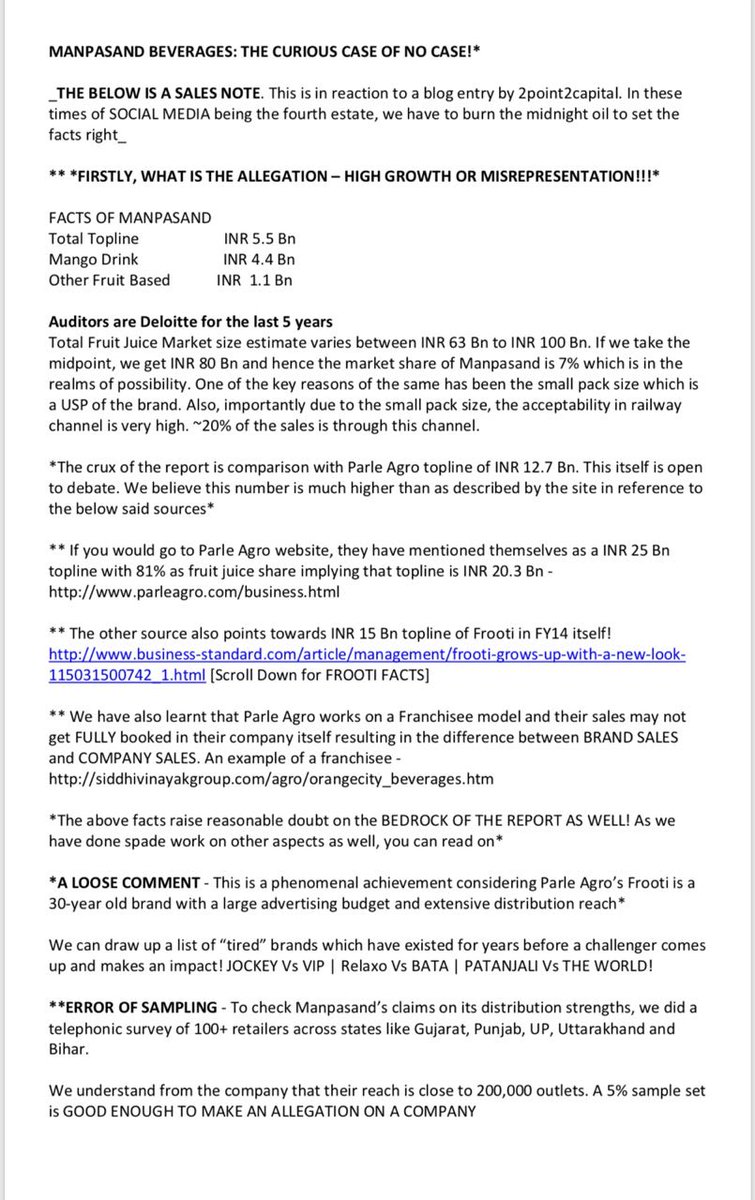

https://twitter.com/iancassel/status/971772613881139200In the public domain, so many issues have been raised by a number of analysts without any real counter. At least that merited a tempering of the high praise that has been lavished if not a deeper analysis of the issues raised. Hopefully, this is just an error in judgement ...

https://twitter.com/amitmantri/status/971324821069025282While FY13-17 growth numbers themselves make little sense, the situation worsens further when FY12 data is also included in the analysis.

Why does it have 5 months+ of receivables? Why are 1300 crs of receivables non-current i.e. outstanding for more than a year?

External Tweet loading...

If nothing shows, it may have been deleted

by @Moneylifers view original on Twitter