How to get URL link on X (Twitter) App

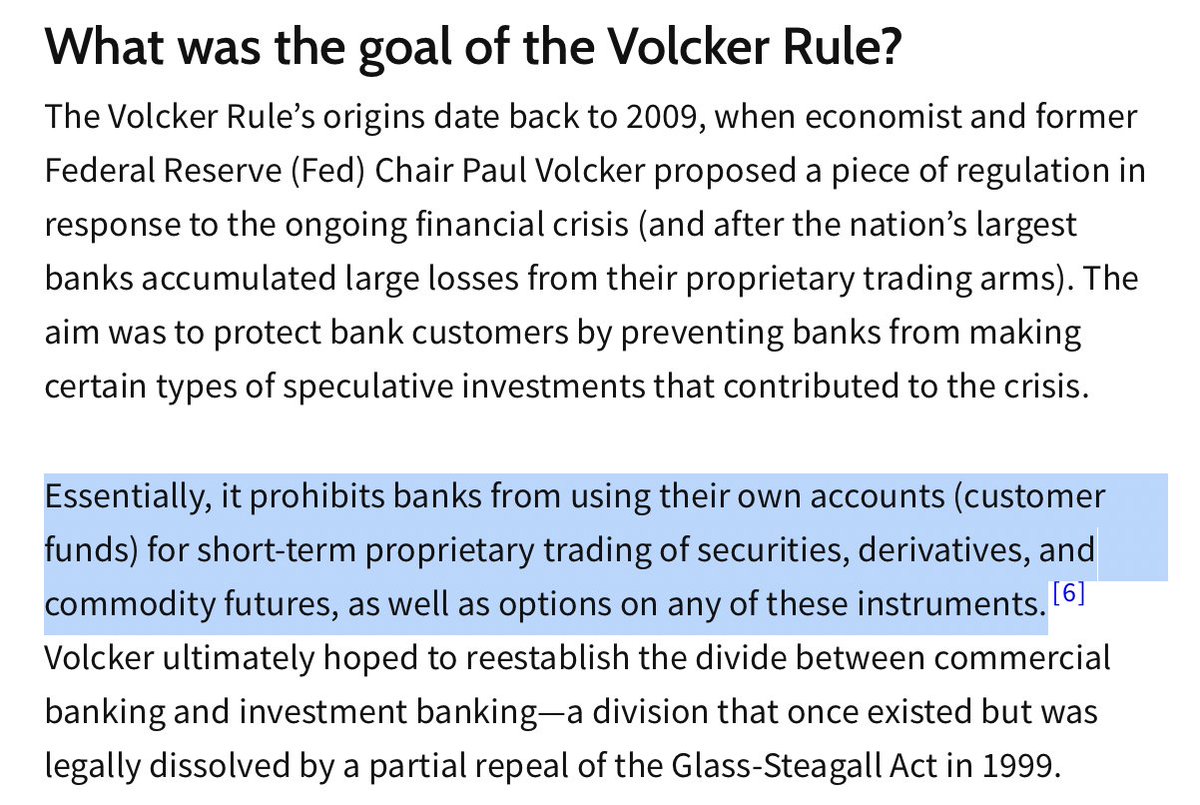

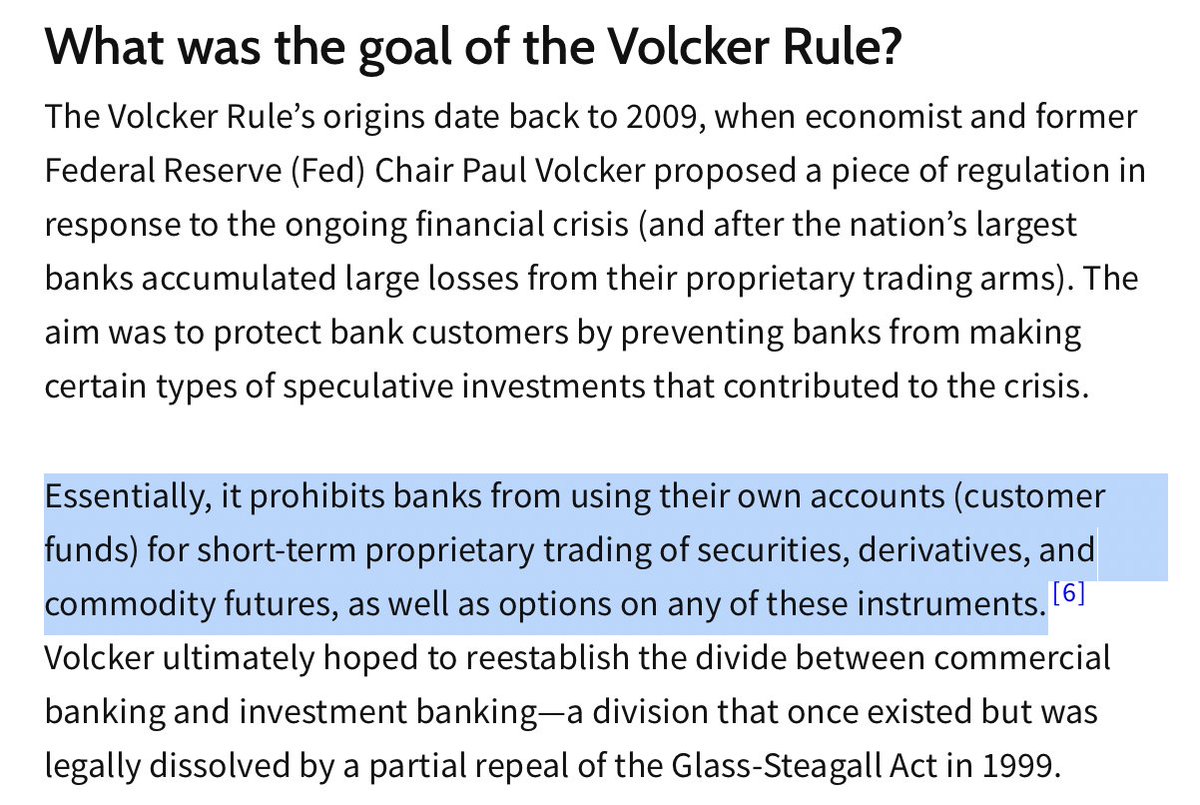

https://twitter.com/articlagoon/status/1589437707302105089?s=20&t=eY8w7ZxHQGXhxQrqPFuyFgPost-financial crisis, TradFi had the Volcker rule imposed on banks to prevent them from using customer funds to trade. Why? Because as Voyager, Celsius, FTX showed, a bank run or a drop in asset means insolvency

https://twitter.com/articlagoon/status/1589437707302105089

https://twitter.com/articlagoon/status/1590023804180660229Since I already touched on the language of the announcement above, I won't go into details again.

https://twitter.com/SBF_FTX/status/1590012124864348160@SBF_FTX tweet from above implies that it’s being fully acquired. Notice the first and last investors wording