@business editor for US interest rates. Monitoring Treasuries, futures, TIPS since 1997. estanton@bloomberg.net. Opinions mine & @compostmaven’s.

3 subscribers

How to get URL link on X (Twitter) App

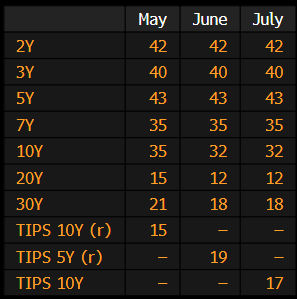

https://twitter.com/BChappatta/status/1453416647184863235As noted, today's 5-year auction drew 1.157%, a yield about 2.5bp lower than the WI yield at the 1pm bidding deadline, a historically big miss and a sign that demand exceeded dealer expectations.