Investor and founder.

Fund: https://t.co/DPajNIXzz4

Charts: https://t.co/rCIakKU27z

Lowest cost trading: https://t.co/sG69DRszqJ

Posts not investment advice.

3 subscribers

How to get URL link on X (Twitter) App

WHAT HAPPENED?

WHAT HAPPENED?

How it works?

How it works?

But we are battling against a bigger force:

But we are battling against a bigger force:

1. Supply Delta + 90 Day CDD

1. Supply Delta + 90 Day CDD

Bitcoin Energy Value. Bitcoin's intrinsic value priced from the pure Joules of energy into the network only. No wacky formulas, no power laws. Energy alone maps the fair value of Bitcoin from inception. Currently at $70K, making Bitcoin fairly valued for the first time in 2 yrs.

Bitcoin Energy Value. Bitcoin's intrinsic value priced from the pure Joules of energy into the network only. No wacky formulas, no power laws. Energy alone maps the fair value of Bitcoin from inception. Currently at $70K, making Bitcoin fairly valued for the first time in 2 yrs.

2020 was the worst Bitcoin bull market in history. I believe overall performance was pinned down due to the -50% destruction of mining network by China _and_ the most aggressive Fed tightening cycle in history.

2020 was the worst Bitcoin bull market in history. I believe overall performance was pinned down due to the -50% destruction of mining network by China _and_ the most aggressive Fed tightening cycle in history.

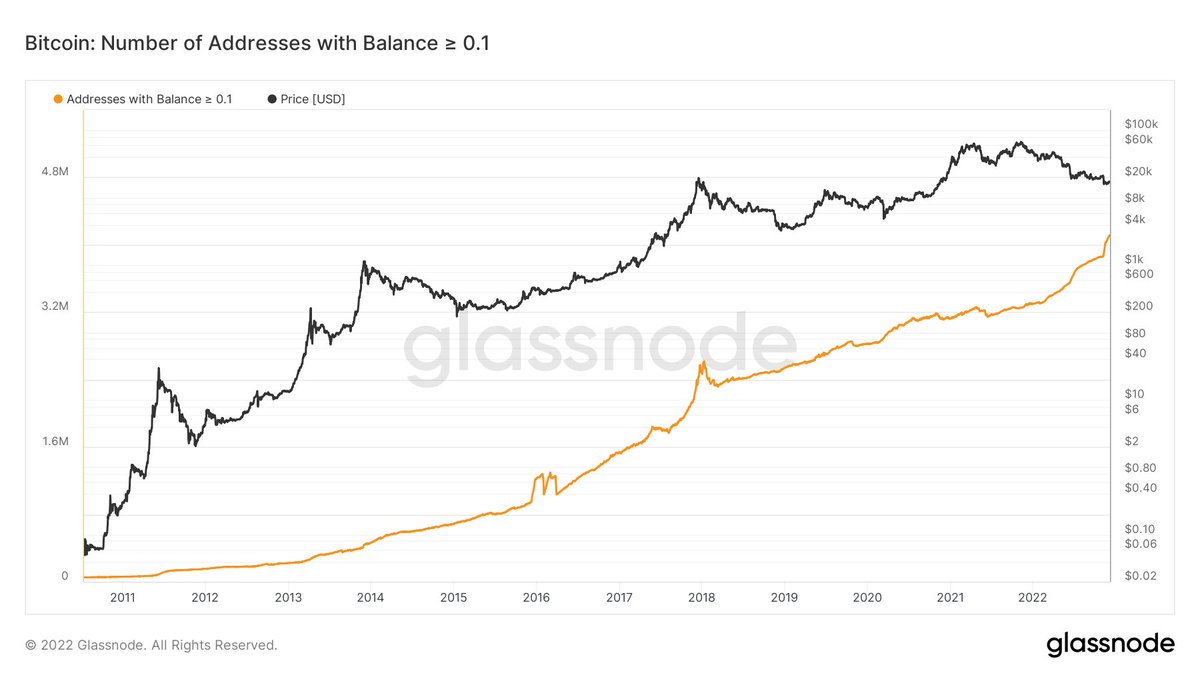

Adoption all-time-high. Despite a $10B fraud by FTX, Bitcoin adoption is screaming higher. We are witnessing one of the highest growth rates in addresses with >0.1 Bitcoin in history, seconded only by 2017. More and more people are locking away 1000s of dollars of Bitcoin.

Adoption all-time-high. Despite a $10B fraud by FTX, Bitcoin adoption is screaming higher. We are witnessing one of the highest growth rates in addresses with >0.1 Bitcoin in history, seconded only by 2017. More and more people are locking away 1000s of dollars of Bitcoin.

The indicator tracks the ratio of on-chain miner Bitcoin outflows to miner Bitcoin reserves.

The indicator tracks the ratio of on-chain miner Bitcoin outflows to miner Bitcoin reserves.

Similar in concept to a PE Ratio, except instead of stock earnings, the Bitcoin Yardstick is taking the ratio of energy work done to secure the Bitcoin network in relation to price.

Similar in concept to a PE Ratio, except instead of stock earnings, the Bitcoin Yardstick is taking the ratio of energy work done to secure the Bitcoin network in relation to price.

None of this thread is investment advice. There are always outliers to the norm. Do your own research and make an informed decision!

None of this thread is investment advice. There are always outliers to the norm. Do your own research and make an informed decision!

2/

2/

Perhaps a better comparison to today's Ukraine war is the pre-information age conflicts, such as Korea and WW2.

Perhaps a better comparison to today's Ukraine war is the pre-information age conflicts, such as Korea and WW2.

2) Note:

2) Note:

All else equal, a bullish stock market is good for #Bitcoin.

All else equal, a bullish stock market is good for #Bitcoin.

The Post-WW2 stock market rally was fueled by real economic growth. GDP was rising faster than the growth in money supply.

The Post-WW2 stock market rally was fueled by real economic growth. GDP was rising faster than the growth in money supply.