Attorney, Gamer, Wanderer. Not your lawyer (probably). “Oppression makes a wise man mad.”

How to get URL link on X (Twitter) App

https://twitter.com/tier10k/status/1640369444064034817First thing I'll note is that these are all allegations

https://twitter.com/tier10k/status/1638652840137703426I'll be frank though, this is probably the suit we want to see litigated if a large CEX is going to litigate something. We knew the day was coming, let's hope @iampaulgrewal and @brian_armstrong are up to the task.

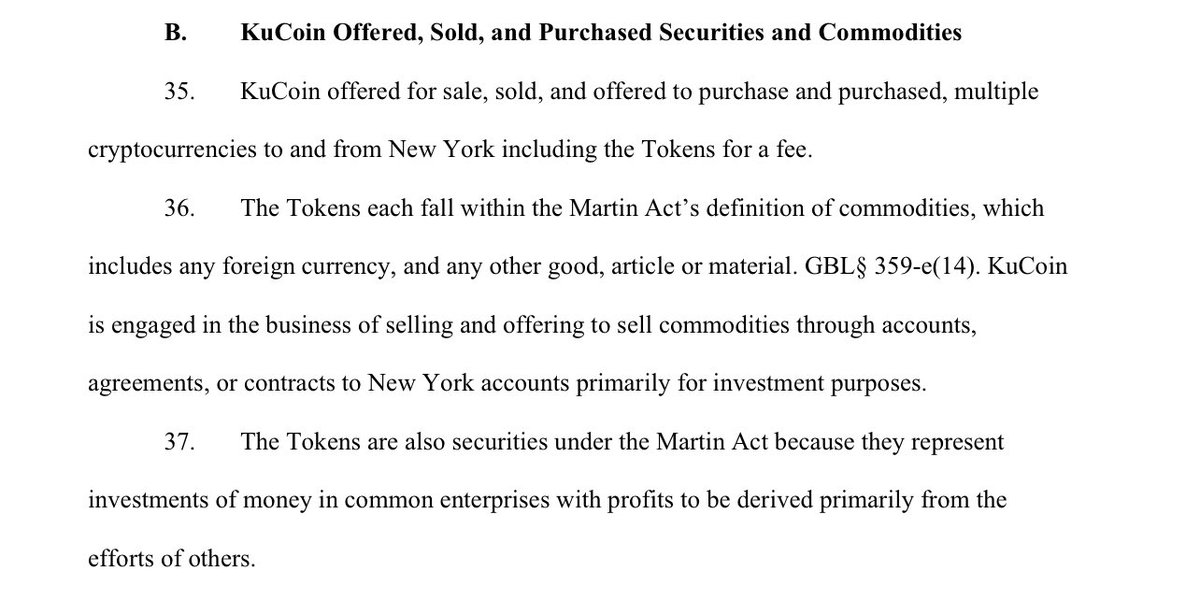

https://twitter.com/collins_belton/status/1633935215633526784This is very bizarre considering the NY financial regulators not only have approved each of those exchanges but have had ample time to disclose any concerns about ETH status over the past five+ years with the POS shift happening.

https://twitter.com/tier10k/status/1633928643474001920That said, it’s unlikely KuCoin responds to this and I suspect NYAG wanted to put this argument out there to try to get it into a default judgment. Thats not as strong as something argued in court, but it ain’t nothing.

https://twitter.com/CoinDesk/status/1626341910104137731

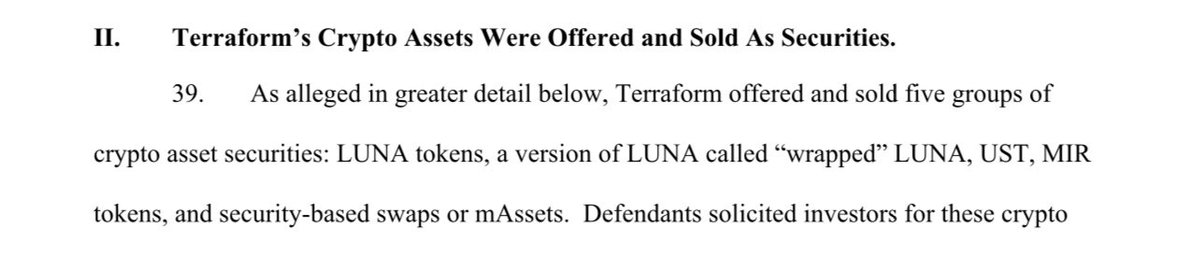

Getting into the weeds now but this may have very far reaching implications for many projects. Despite Do’s obvious fraud and deep involvement that might distinguish some of the Luna eco, much of the behavior alleged to create the securities law issues are endemic in the industry

Getting into the weeds now but this may have very far reaching implications for many projects. Despite Do’s obvious fraud and deep involvement that might distinguish some of the Luna eco, much of the behavior alleged to create the securities law issues are endemic in the industry

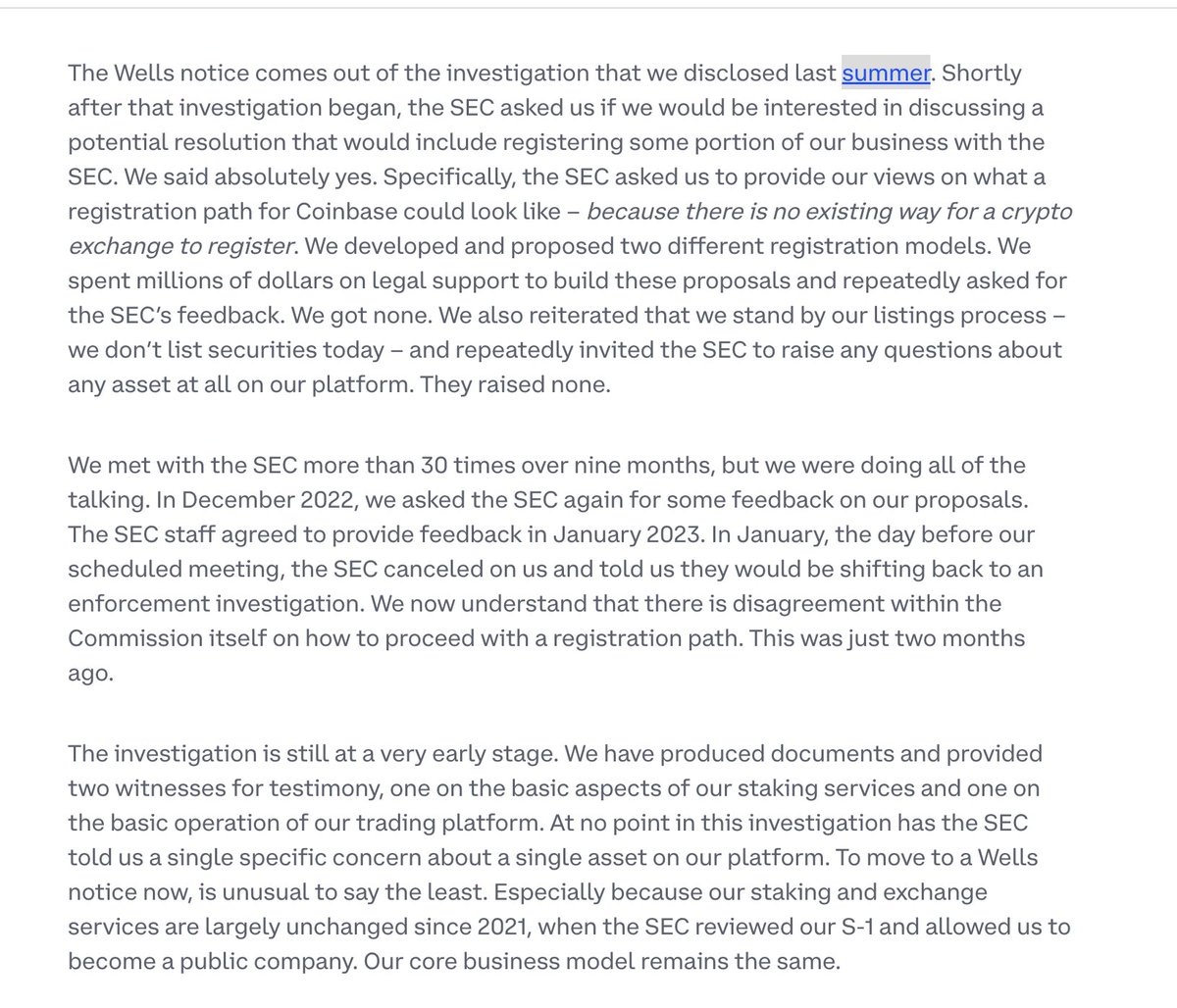

https://twitter.com/coinbase/status/1536682940347785216I think it’s genuinely hard to overstate the level of mismanagement here. With so many other crypto failures recently, you can see how those entities get into those situations or can’t anticipate their future properly; this business has no excuse.

https://twitter.com/lex_node/status/1481664100207927303As I referenced when I shifted my focus to pro bono and other matters, at this pt there are times where it feels almost negligent to counsel some of the things we must by virtue of today’s legal realities. It sometimes feels like telling a co to box opponents blind and bound.

https://twitter.com/donnaredel/status/14792165626494074881. AFAIK, this is the 1st time community pools have been specifically called out. I’m kind of surprised it took them this long.

https://twitter.com/Mudit__Gupta/status/1444654017066385412One challenge with @SECGov’s uneven application of Howey so far is that devs and counsel often are left struggling to determine what level of ongoing contribution the team can contribute before running the risk of being seen as providing “essential managerial efforts.”

https://twitter.com/collins_belton/status/1414660537707732992This isn't speculation either; I'm personally aware of some large gaming companies that have been poking around for 2-3 years now, but they never seem to have a cohesive strategy and have been in exploratory mode with a bunch of experiments w/ Web3 startups for years.