How to get URL link on X (Twitter) App

1. @rage_trade Made the decision to shut down their under-performing GLP vaults to "focus" on their perps product.

1. @rage_trade Made the decision to shut down their under-performing GLP vaults to "focus" on their perps product.

Rule #1: Try NOT do seeds/angel investments.

Rule #1: Try NOT do seeds/angel investments.

1) @GCRClassic was the first big CT account to note : Volume traded > market cap is suggestive of a potential top as this is often indicative of high turn over in the circulating supply.

1) @GCRClassic was the first big CT account to note : Volume traded > market cap is suggestive of a potential top as this is often indicative of high turn over in the circulating supply.

I used @DeBankDeFi Time Machine to look at the @binance hot wallet, 0x28c6c06298d514db089934071355e5743bf21d60 on 3/12/23...the day before @cz_binance announced his $1b liquidity purchase.

I used @DeBankDeFi Time Machine to look at the @binance hot wallet, 0x28c6c06298d514db089934071355e5743bf21d60 on 3/12/23...the day before @cz_binance announced his $1b liquidity purchase.

Reported 1st by @michael_bodley, @amazon will be launching a NFT marketplace on/around April 24th.

Reported 1st by @michael_bodley, @amazon will be launching a NFT marketplace on/around April 24th.

The most easily accessible source of fee revenue is @tokenterminal. This is unfortunate because they tend to have institutional subscriptions & funds+researchers who ACTUALLY believe their data wo questioning it. 🎗️Remember: easy != accurate

The most easily accessible source of fee revenue is @tokenterminal. This is unfortunate because they tend to have institutional subscriptions & funds+researchers who ACTUALLY believe their data wo questioning it. 🎗️Remember: easy != accurate

Synapse is about to launch SynChain. Recent price action and "soon" comments in the $SYN discord lead me to believe it will likely be announced in or around Eth Denver this Feb.

Synapse is about to launch SynChain. Recent price action and "soon" comments in the $SYN discord lead me to believe it will likely be announced in or around Eth Denver this Feb.

https://twitter.com/TechFlowPost/status/1600035573804040194?s=20&t=nl-MSSXIKsAy-Z3GonNCvA

Previously I had noted that Amber Group was suspiciously TWAPing large amounts of $stETH from @CurveFinance's LP.

Previously I had noted that Amber Group was suspiciously TWAPing large amounts of $stETH from @CurveFinance's LP. https://twitter.com/crypto_condom/status/1593236120120479746?s=20&t=JYPKZdmLjSicrgR2n7ivoQ

There are 2⃣ collateral positions that reside on Sushi’s Bentobox infrastructure which place user funds at risk.

There are 2⃣ collateral positions that reside on Sushi’s Bentobox infrastructure which place user funds at risk.

Find a SAFE lending protocol which uses the @chainlink price feed for $cbETH & has CHEAP $ETH lending.

Find a SAFE lending protocol which uses the @chainlink price feed for $cbETH & has CHEAP $ETH lending.

1. Celebrities including:

1. Celebrities including:

Recently, the @TheTieIO did a really phenomenal overview of @0xPolygon ecosystem growth in their latest State of Crypto update here:

Recently, the @TheTieIO did a really phenomenal overview of @0xPolygon ecosystem growth in their latest State of Crypto update here: https://twitter.com/thetieio/status/1573037182733926402?s=46&t=9-L49WKQdkYE9_Zc08NmlQ

First, go to defillama.com/yields

First, go to defillama.com/yields

https://twitter.com/apywizard/status/1565777258756935686

Rumor 1: $GMX can fail bc of a competitor attack

Rumor 1: $GMX can fail bc of a competitor attack

Currently, @kwenta_io volume to date is $1.9B. If all volume has been toxic, it has been consistently rekting stakers in the debt pool.

Currently, @kwenta_io volume to date is $1.9B. If all volume has been toxic, it has been consistently rekting stakers in the debt pool.

Assets under management (AUM) are at an ATH.

Assets under management (AUM) are at an ATH.

Its important to recognize the supply of $GMX is very low. There is a total circulation of:

Its important to recognize the supply of $GMX is very low. There is a total circulation of:

Derivative exchanges like @GMX_IO & $GNS benefit token holders because trading profit thrives in volatility.

Derivative exchanges like @GMX_IO & $GNS benefit token holders because trading profit thrives in volatility.

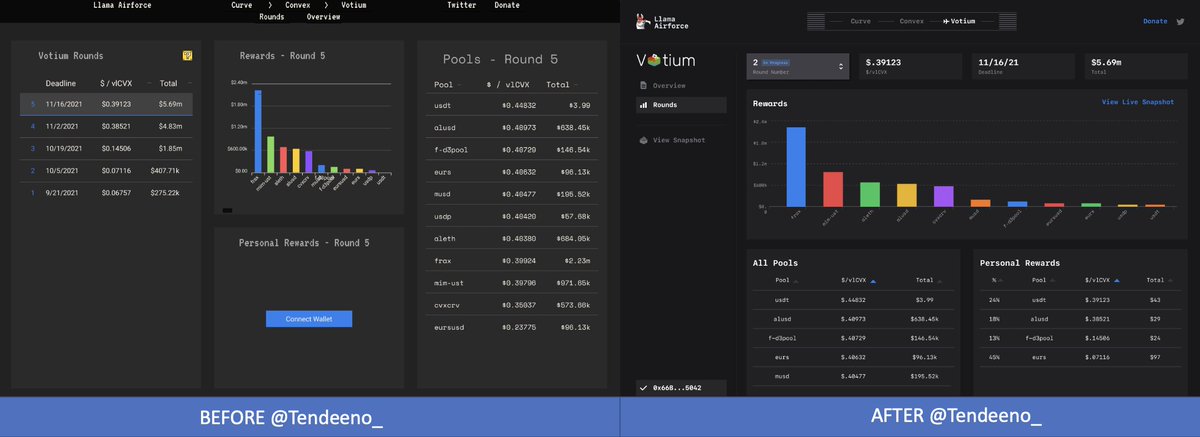

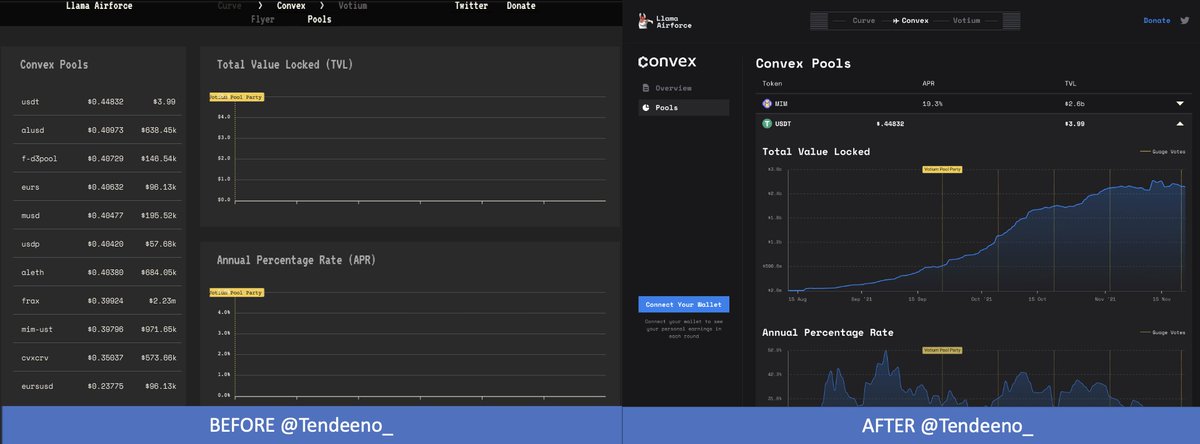

If you are a @CurveFinance or @ConvexFinance maxi like myself, you may recognize @Tendeeno_'s work from Llama.Airforce. His UI for @0xAlunara + Benny arguably helped ignite the Curve Wars by providing a beautiful front end to demonstrate historic APR & bribe revenue.

If you are a @CurveFinance or @ConvexFinance maxi like myself, you may recognize @Tendeeno_'s work from Llama.Airforce. His UI for @0xAlunara + Benny arguably helped ignite the Curve Wars by providing a beautiful front end to demonstrate historic APR & bribe revenue.

In 2021, a waifu infested 💩 $OHM fork called @UmamiFinance launched to great acclaim on #Arbitrum.

In 2021, a waifu infested 💩 $OHM fork called @UmamiFinance launched to great acclaim on #Arbitrum.

The SPAC is a $150m vehicle called "Metaverse Acquisitions Corp" announced on @Twitter here:

The SPAC is a $150m vehicle called "Metaverse Acquisitions Corp" announced on @Twitter here:https://twitter.com/tradedvc/status/1529103969141895168?s=21&t=RKbFZbqXSV-mEVHzoNsItw