I made this account to talk about my random thoughts about crypto currencies. I am also a software engineer.

How to get URL link on X (Twitter) App

https://twitter.com/MelissaLeeCNBC/status/11585233861900738582/ The reason is simple. If this was something that served the interests of the people then they wouldn’t need to try so hard to convince people of it. “Well if four former Federal Reserve chairs say it then it must be true!”.

https://twitter.com/cryptocraig123/status/11428488957074391042/ In my opinion we are in a re-accumulation area that began after we were rejected at the 0.618 fibonacci retracement at $13.8k. I have seen a lot of calls for $8k or lower. I just don’t see it happening. The market is not supposed to be that easy.

https://twitter.com/novogratz/status/1152544675888357376

https://twitter.com/isaacandsuch/status/11159798163547340802. Sound money that cannot be debased by wealthy elites, bankers, oligarchs, and politicians or printed out of nothing to serve their interests is perhaps the greatest invention of our time.

https://twitter.com/WhalePanda/status/1059736840171855873If you look back at December, Bitcoin’s difficulty was actually about 1/4 of what it is now according to blockchain.com/charts/difficu…. Also the price was 3x as much. Since the block reward has not changed we can calculate the estimated energy usage last year to mine one dollar’s worth

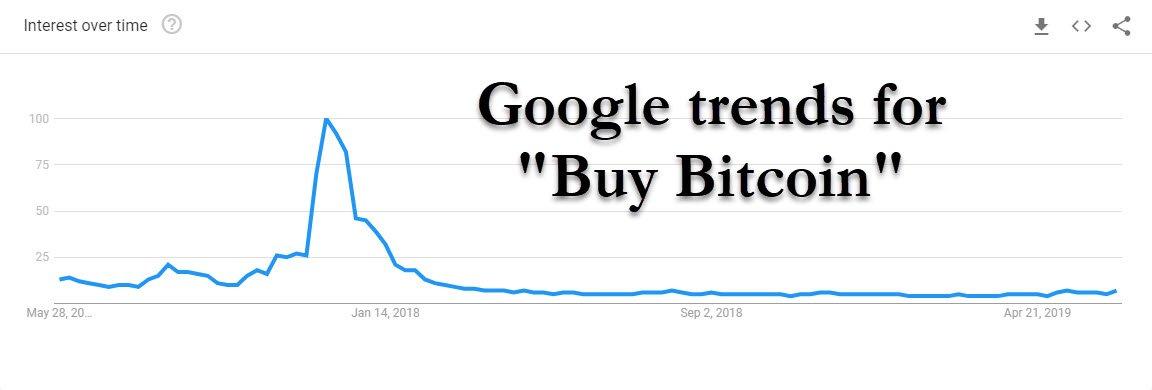

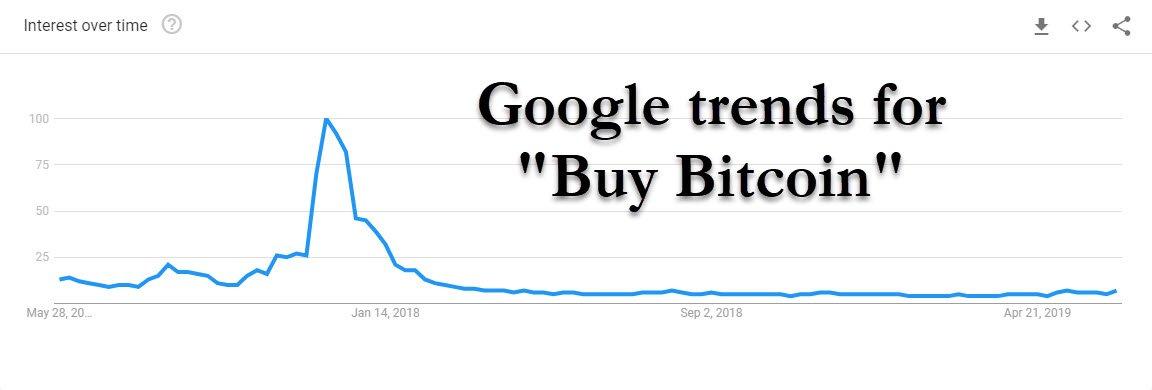

2. I believe that big players are trying to drive the public out and make them lose all faith in Bitcoin so they can accumulate a large percent of the supply and keep it suppressed for years to come. So far this strategy seems to be working.

2. I believe that big players are trying to drive the public out and make them lose all faith in Bitcoin so they can accumulate a large percent of the supply and keep it suppressed for years to come. So far this strategy seems to be working.