Long-term cycle,value,technical analysis; trading & investing|| Become a sub: https://t.co/Xd9ln9z7cg Website: https://t.co/Qf1d5KjZFP

How to get URL link on X (Twitter) App

2/ Together with Rio Tinto and BHP, Vale is one of the largest iron ore producers in the world. Vale and Rio Tinto had almost exactly the same production of iron ore of around 320-330 M/t in 2023. However, Vale's margins have been significantly higher than Rio Tinto's in recent years.

2/ Together with Rio Tinto and BHP, Vale is one of the largest iron ore producers in the world. Vale and Rio Tinto had almost exactly the same production of iron ore of around 320-330 M/t in 2023. However, Vale's margins have been significantly higher than Rio Tinto's in recent years.

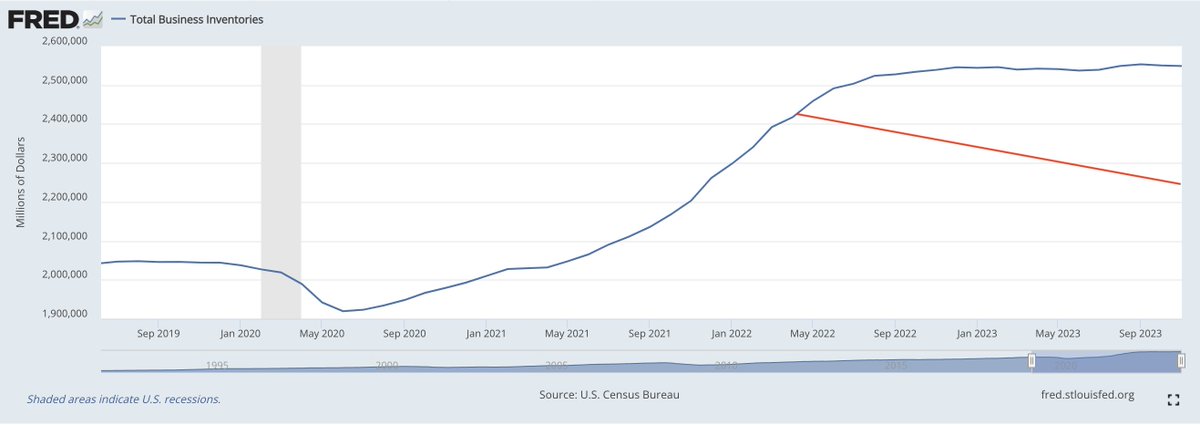

(2/2) Companies have PTSD from the 2020 supply chain problem. When the economy reheats it ends in a "buy now more than I need" mentality again. This will put pressure on prices. In real terms (goods) invetories have fallen since May 2022 (red line) and are again vulnerable to trouble.

(2/2) Companies have PTSD from the 2020 supply chain problem. When the economy reheats it ends in a "buy now more than I need" mentality again. This will put pressure on prices. In real terms (goods) invetories have fallen since May 2022 (red line) and are again vulnerable to trouble.

(2/7) Look at the near perfect correlation. Tips are the inverse of real yields, which is the current nominal yield minus inflation expectations. Silver and gold love negative real yields and hate the opposite. Real yields are on the rise right now.

(2/7) Look at the near perfect correlation. Tips are the inverse of real yields, which is the current nominal yield minus inflation expectations. Silver and gold love negative real yields and hate the opposite. Real yields are on the rise right now.