How to get URL link on X (Twitter) App

https://twitter.com/KyleSamani/status/11511520768288808962/ If the prior distributed consensus rendition was focused on better understanding security, this one by the Multicoin team focuses on better understanding scalability. @RyanTheGentry does a fantastic job breaking this down for us - thankfully, we have him to learn from!

https://twitter.com/danzuller/status/114548708478384128558/ First, we can often surprise ourselves with what we can accomplish if we set our minds to something. Prior to transitioning into #crypto full-time, I had virtually no technical understanding of technology, computer science, or distributed systems (I was a PE/VC guy).

https://twitter.com/danzuller/status/114503334753150976023/ Some people have asked about hybrid PoW/PoS - I'm going to hold off on that for this Part Two to stay on course, but will touch on this in an appendix after Part Three.

https://twitter.com/danzuller/status/1126669184711184384?s=20

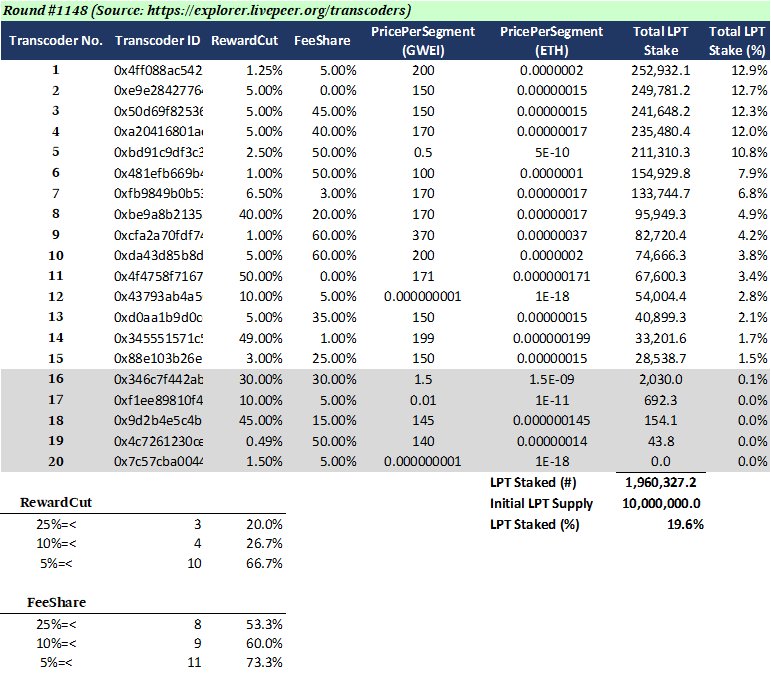

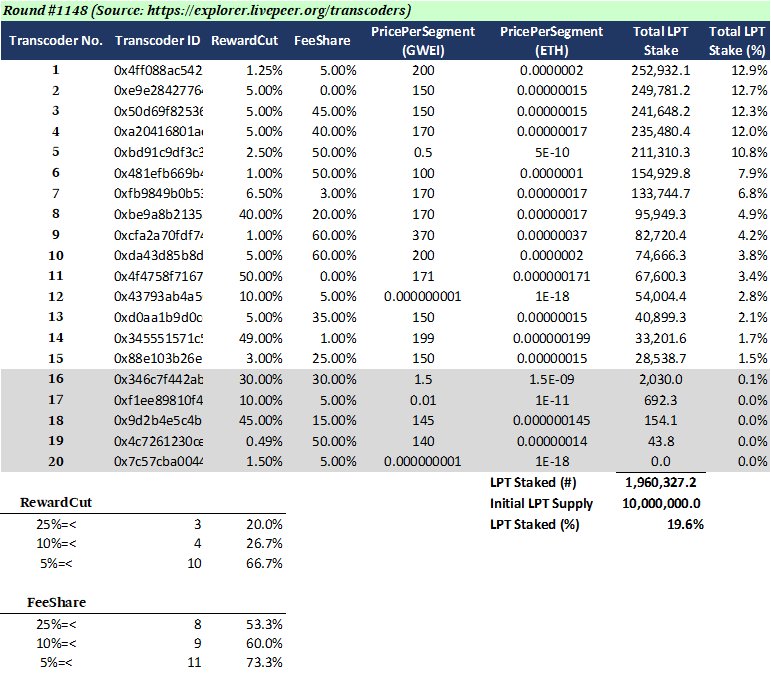

2/ Interesting takeaway from the above: the transcoder market appears very choppy (to delegators).

2/ Interesting takeaway from the above: the transcoder market appears very choppy (to delegators).