Healthcare services, tech & policy nerd. Alum: @theNAMedicine, @StanfordEng, @SAISHopkins, @CMCnews, @BCG and various health services & tech cos. Views my own.

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/medicarepayment/status/1371539868397015042MedPAC's headline chart is a reminder that MA is so attractive and profitable (in part) because CMS pays private plans more for each member than it would cost to cover the same person under traditional Medicare.

https://twitter.com/medicarepayment/status/1371539868397015042For starters, MedPAC reminds us just how popular and successful Medicare is, in the eyes of its own beneficiaries.

Cano might be the clearest example I've seen of a large risk-bearing provider focused on a specific demographic group: elderly Hispanic patients.

Cano might be the clearest example I've seen of a large risk-bearing provider focused on a specific demographic group: elderly Hispanic patients.

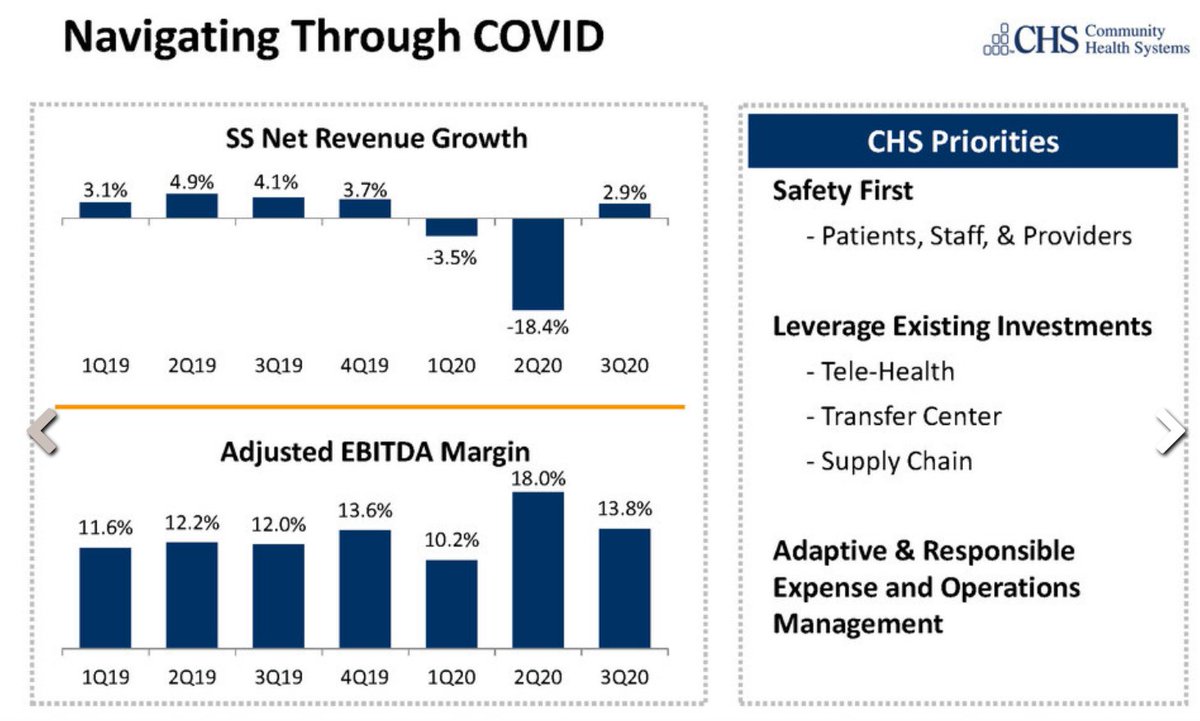

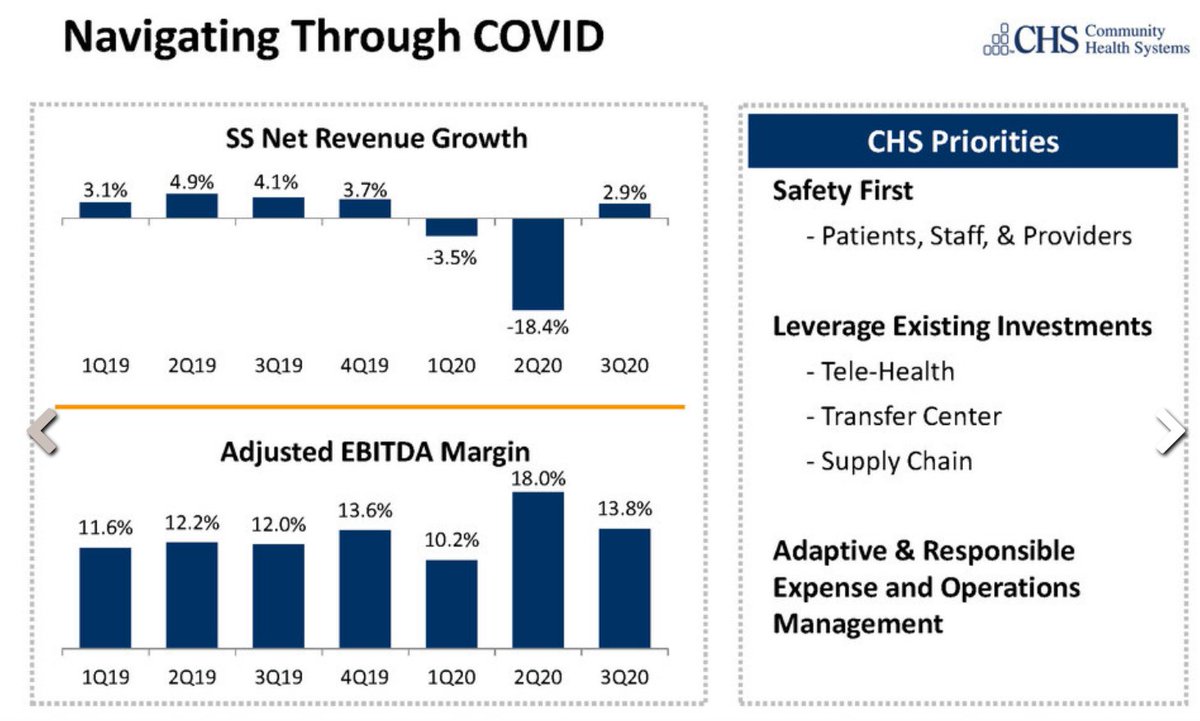

https://twitter.com/rachelcohrs/status/1356263583873720320We have, for example, Community Health Systems, which operates 89 hospitals in 16 states, many of them in smaller towns / metro areas.

To clarify, KP says it has 9.3M members in California, of whom 75-80% are prob over 16, given CA's population structure.

To clarify, KP says it has 9.3M members in California, of whom 75-80% are prob over 16, given CA's population structure.

https://twitter.com/chamath/status/1313461164890677249Caveat to all this is the startling lack of meat in the investor presentation. It is >100 pages, but most look something like this 👇, and cite only "internal company analysis."

https://twitter.com/Rock_Health/status/1233549602047057923Prior digital health IPOs have seen firms pitching employers on savings through lower utilization, either via chronic disease mgmt (@Livongo) or convenient services that might reduce ER visits (@Teladoc, perhaps @OneMedical).

https://twitter.com/chrissyfarr/status/1221949163434233857As full disclosure, this is partly speculative. I was at the company in the 2013 - 2015 time frame, and did not work on the pharma/life sciences business at any point.

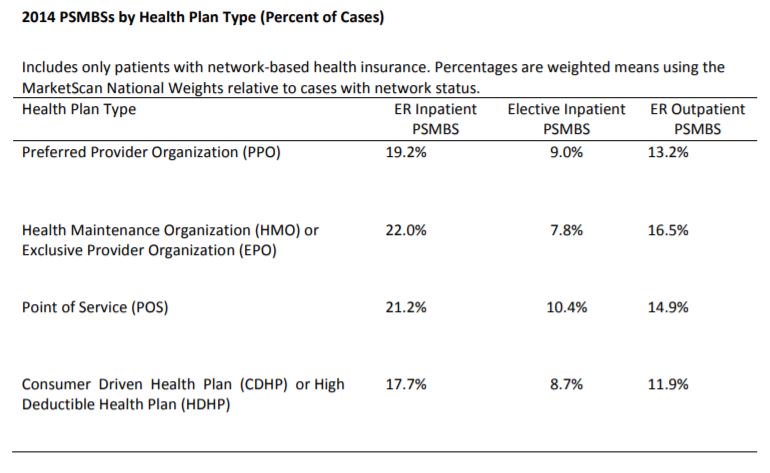

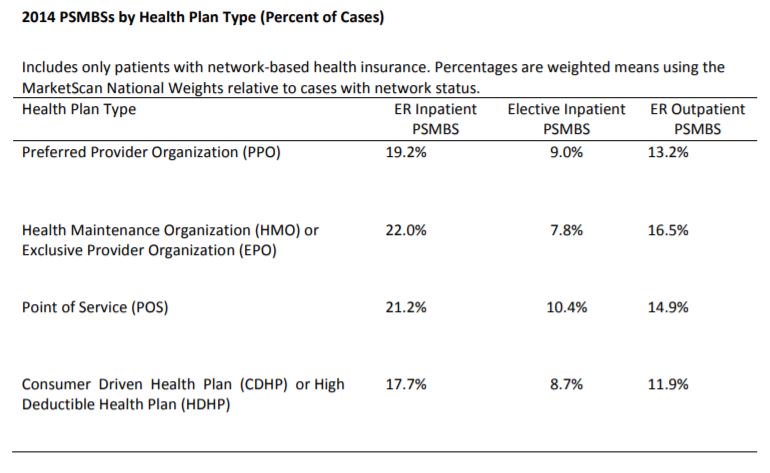

https://twitter.com/katieryan/status/1167498844277370880First, multiple studies have found little difference in the incidence of surprise billing across plan types.

https://twitter.com/ddiamond/status/1163094978450591744Start with a reality check on hospital closures. In recent years, we've seen 15-25 hospitals close each year (18 in 2017, 15 in 2018), and 5 - 15 new hospitals open each year.