How to get URL link on X (Twitter) App

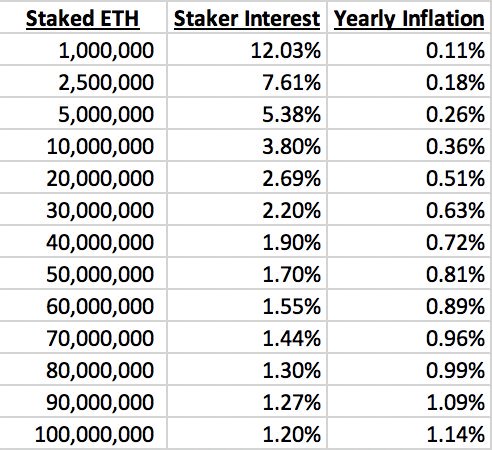

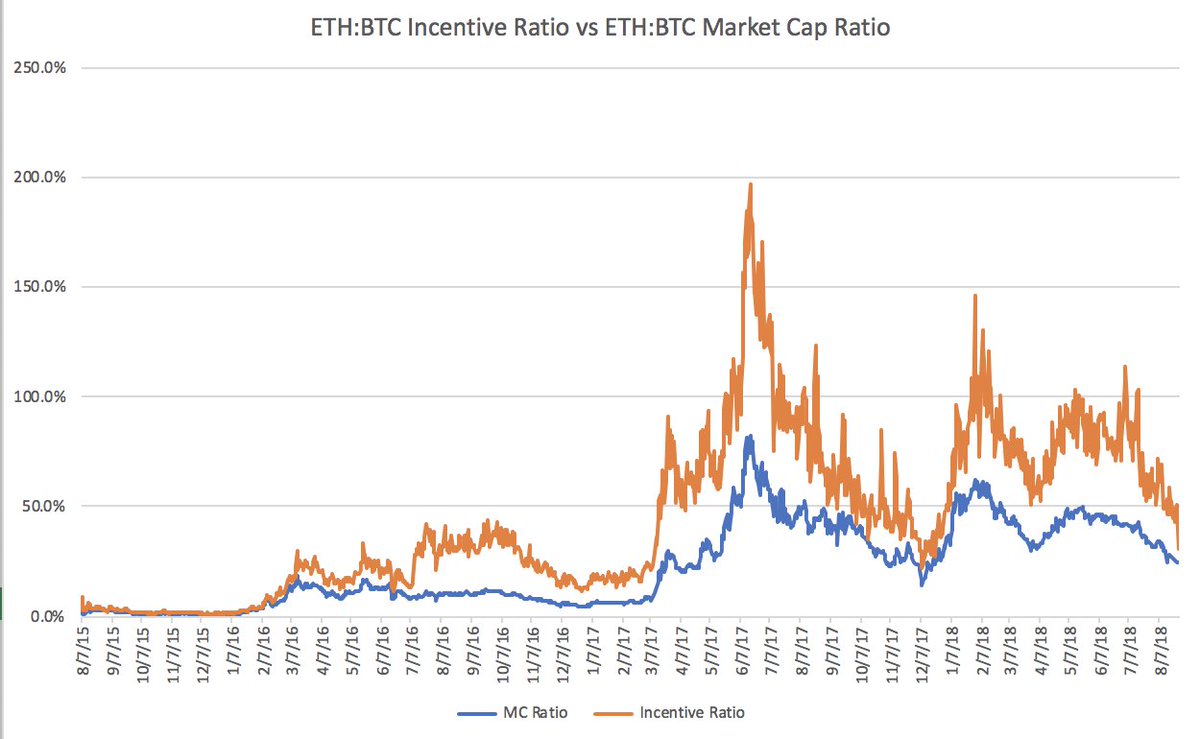

https://twitter.com/econoar/status/10229422398513111042/ First let's revisit my post. I theorize that since network participants are paying for network security, you can create a baseline against another chain to analyze if you are overpaying or underpaying versus said chain. For my Ethereum comparison I take Bitcoin.