I simplify economics for a DeFi audience and examine crypto from an econ angle. Economist. PhD.

2 subscribers

How to get URL link on X (Twitter) App

Don’t get me wrong, high levels of inflation isn’t good.

Don’t get me wrong, high levels of inflation isn’t good.

Recessions can accompany aggressive interest rate tightening.

Recessions can accompany aggressive interest rate tightening.

In this thread you’ll learn about:

In this thread you’ll learn about:

In this thread we'll cover:

In this thread we'll cover:

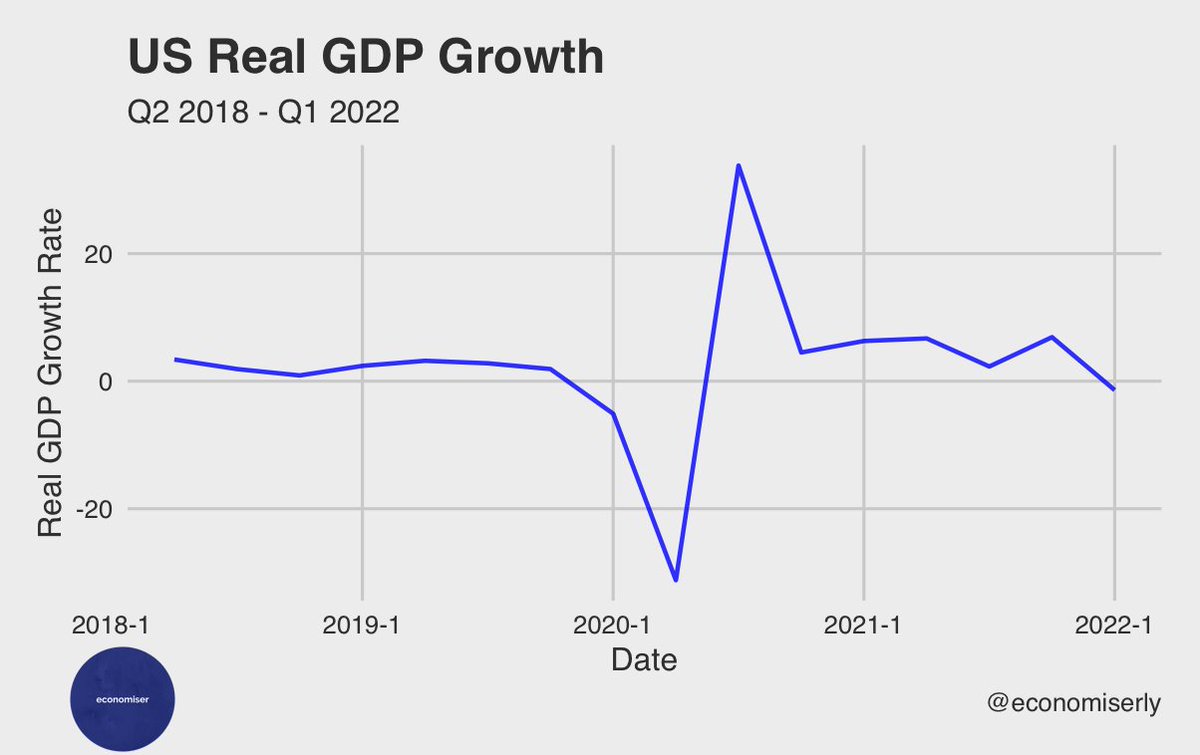

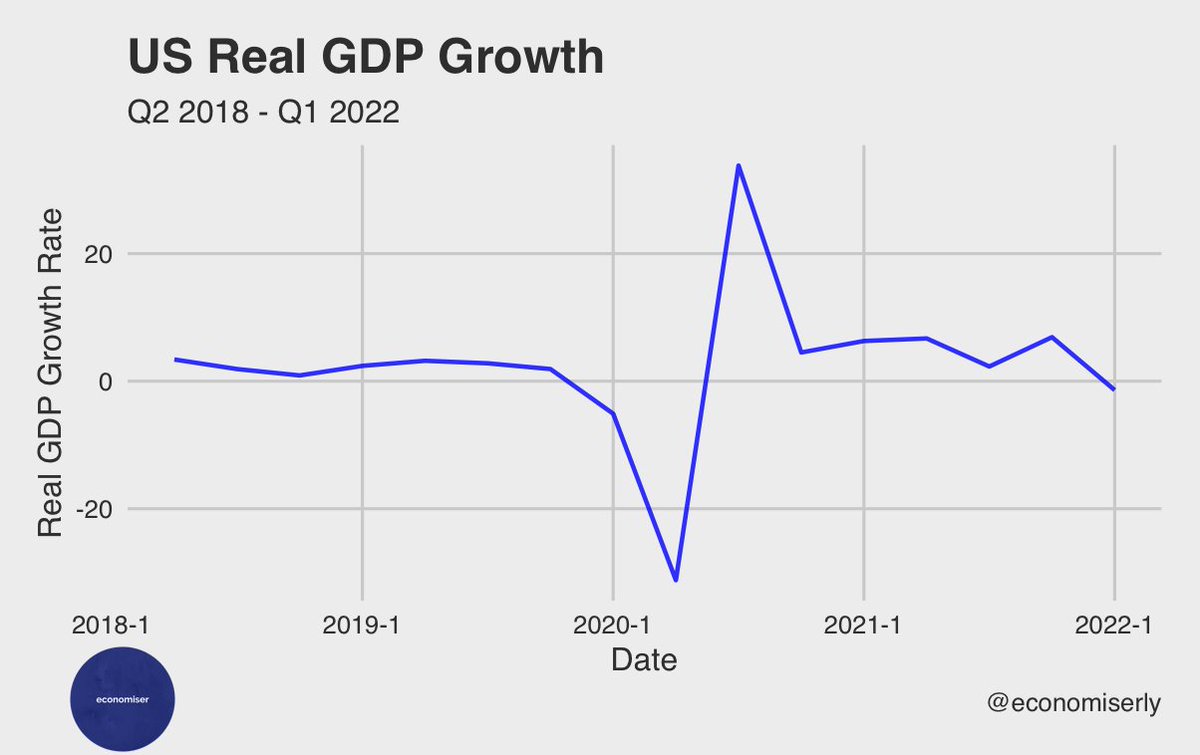

The economy was expected to slow down (due to higher interest rates), but it was NOT expected to go into negative economic growth.

The economy was expected to slow down (due to higher interest rates), but it was NOT expected to go into negative economic growth.

The global economic environment in 2022 is looking troubling.

The global economic environment in 2022 is looking troubling.

2/ This is the FOURTH and FINAL part of my series on StrongBlock, DaaS & PIPs.

2/ This is the FOURTH and FINAL part of my series on StrongBlock, DaaS & PIPs.https://twitter.com/economiserly/status/1512397402673713154?s=21&t=7p5DP6Or_dCVZ5OXqYbBkg

https://twitter.com/economiserly/status/1513848932912320513?s=21&t=7p5DP6Or_dCVZ5OXqYbBkg

https://twitter.com/economiserly/status/1514943436008402946?s=21&t=7p5DP6Or_dCVZ5OXqYbBkg

https://twitter.com/economiserly/status/1514943436008402946?s=21&t=j8Eb1TYP4jIq5fa9ky9KUA

2/ This is the THIRD PART of a multi-part series on Strong & DaaS protocols.

2/ This is the THIRD PART of a multi-part series on Strong & DaaS protocols.https://twitter.com/economiserly/status/1512397402673713154?s=21

https://twitter.com/economiserly/status/1513848932912320513?s=21

2/ This is the SECOND part of a multi-part series.

2/ This is the SECOND part of a multi-part series.https://twitter.com/economiserly/status/1512397402673713154?s=21

@Strongblock_io 2/ This will be the first part of a multi-part series.

@Strongblock_io 2/ This will be the first part of a multi-part series.

@WANDinvestments 2/ Wand has some of the most original tokenomics I’ve seen.

@WANDinvestments 2/ Wand has some of the most original tokenomics I’ve seen.

1/ The name “Ponzi Scheme” comes from Charles Ponzi, an Italian immigrant to the US.

1/ The name “Ponzi Scheme” comes from Charles Ponzi, an Italian immigrant to the US.