MBA | Class of ‘17.

TG channel: https://t.co/vjjrr7WsoQ

Hyperliquid trading fee discount:

https://t.co/QC33ccQcVL

How to get URL link on X (Twitter) App

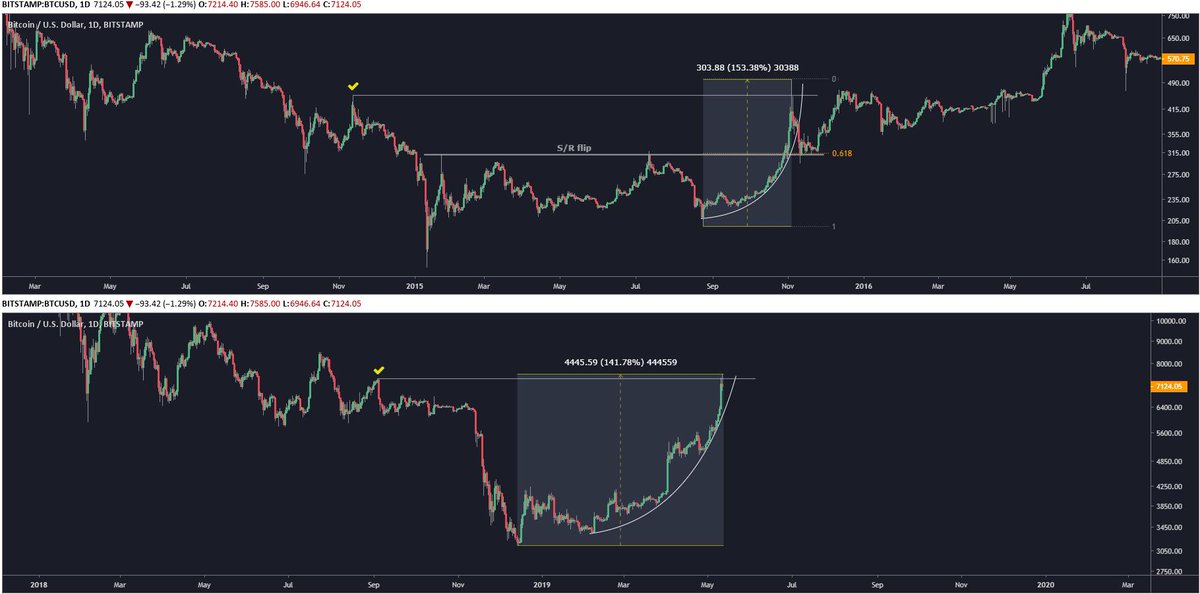

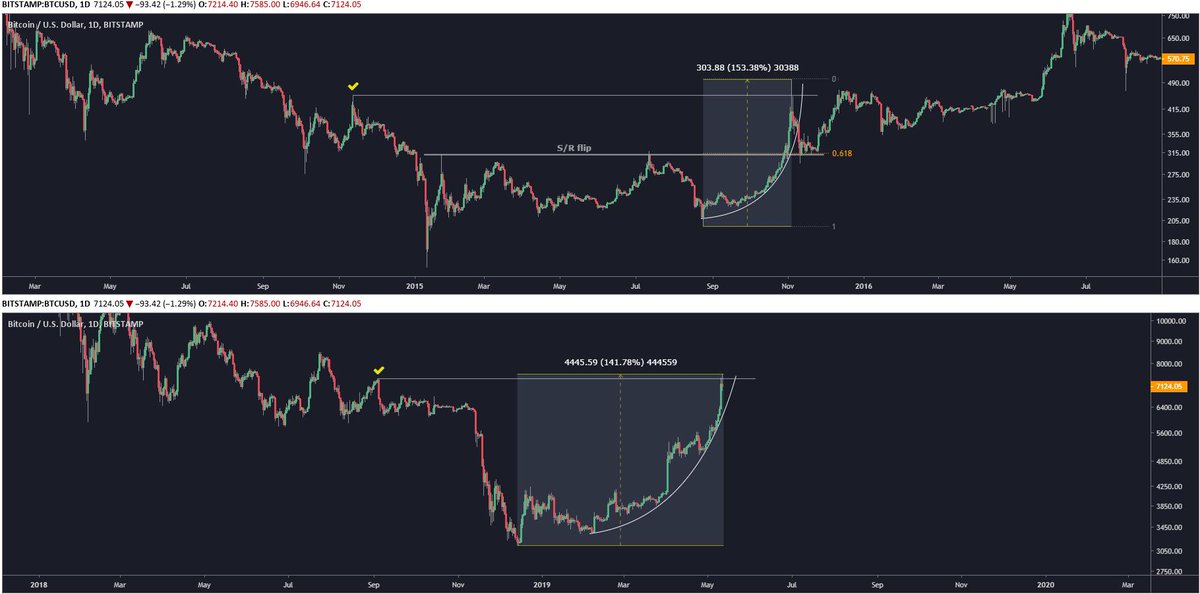

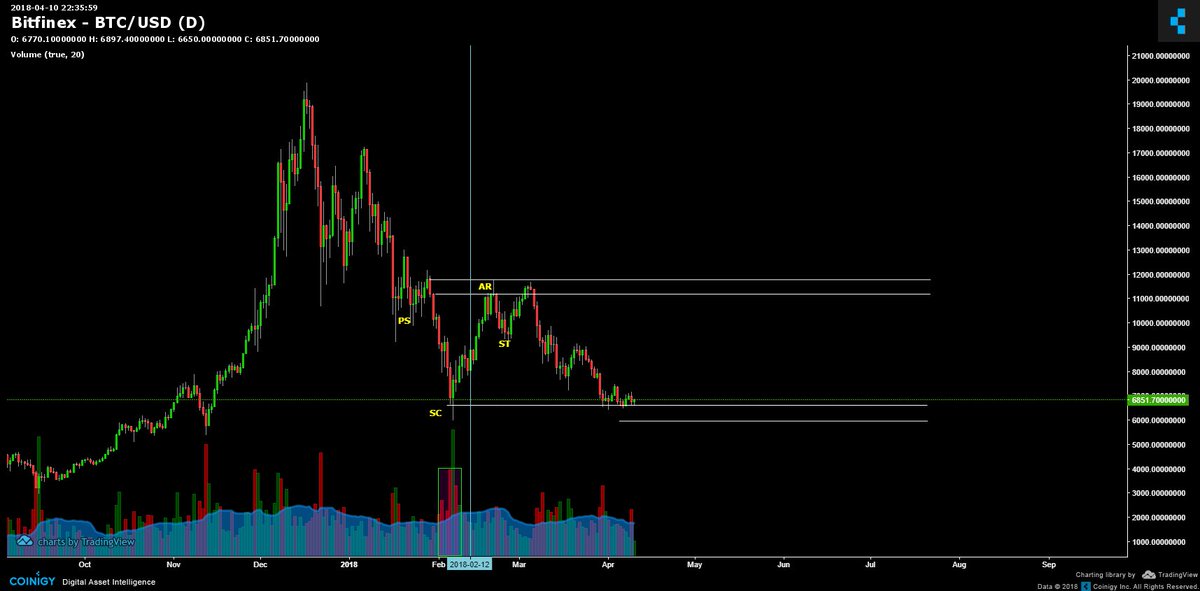

Bull market corrections can be brutal & disorienting. Although they are healthy for the overall state of the market, they tend to test your conviction.

Bull market corrections can be brutal & disorienting. Although they are healthy for the overall state of the market, they tend to test your conviction.