Chief EM Strategist, @SEBGroup. Prev @handelsbanken, @GoldmanSachs, @SITEStockholm, @IIES_Sthlm. Personal account, views are my own.

2 subscribers

How to get URL link on X (Twitter) App

First of all, and to a critical point: I think it would a big mistake to buy into the Turkish governments' allegations that the Gulenists mentioned in the articles are in any way terrorists. They are legitimate political refugees and their human rights deserve safeguarding.

First of all, and to a critical point: I think it would a big mistake to buy into the Turkish governments' allegations that the Gulenists mentioned in the articles are in any way terrorists. They are legitimate political refugees and their human rights deserve safeguarding.

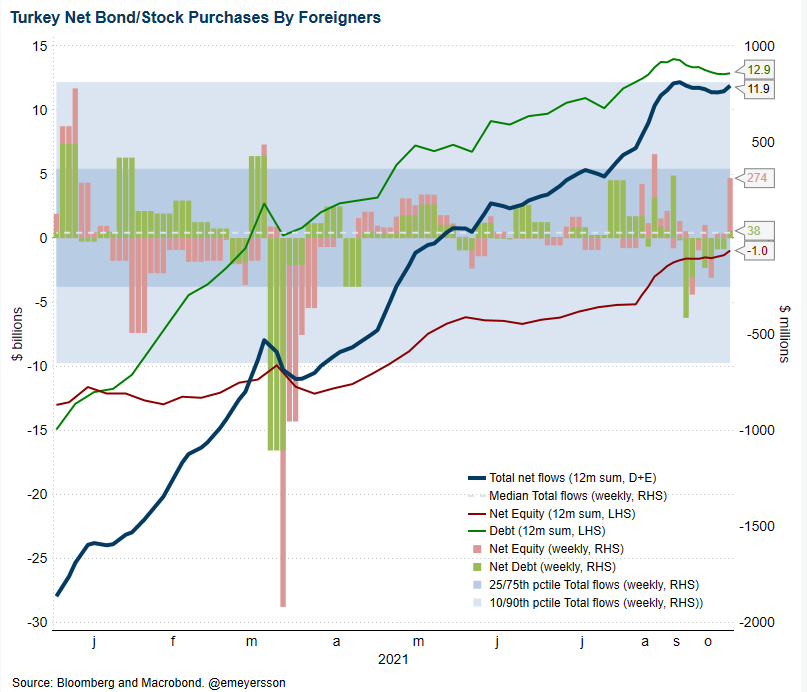

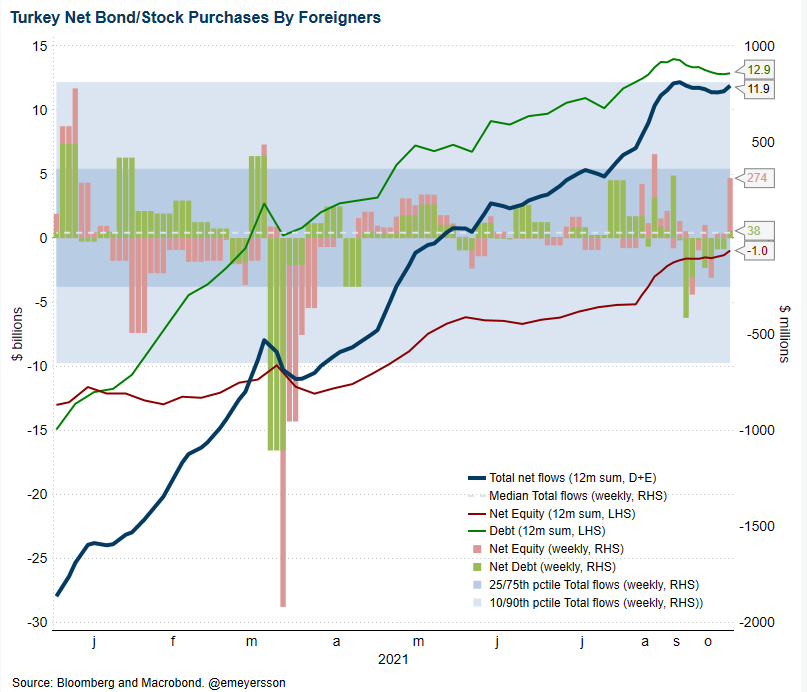

https://twitter.com/ali_hakan_kara/status/1460168783511924736Yes, there was a recent increase in foreign equity inflows, but that's one data point so far

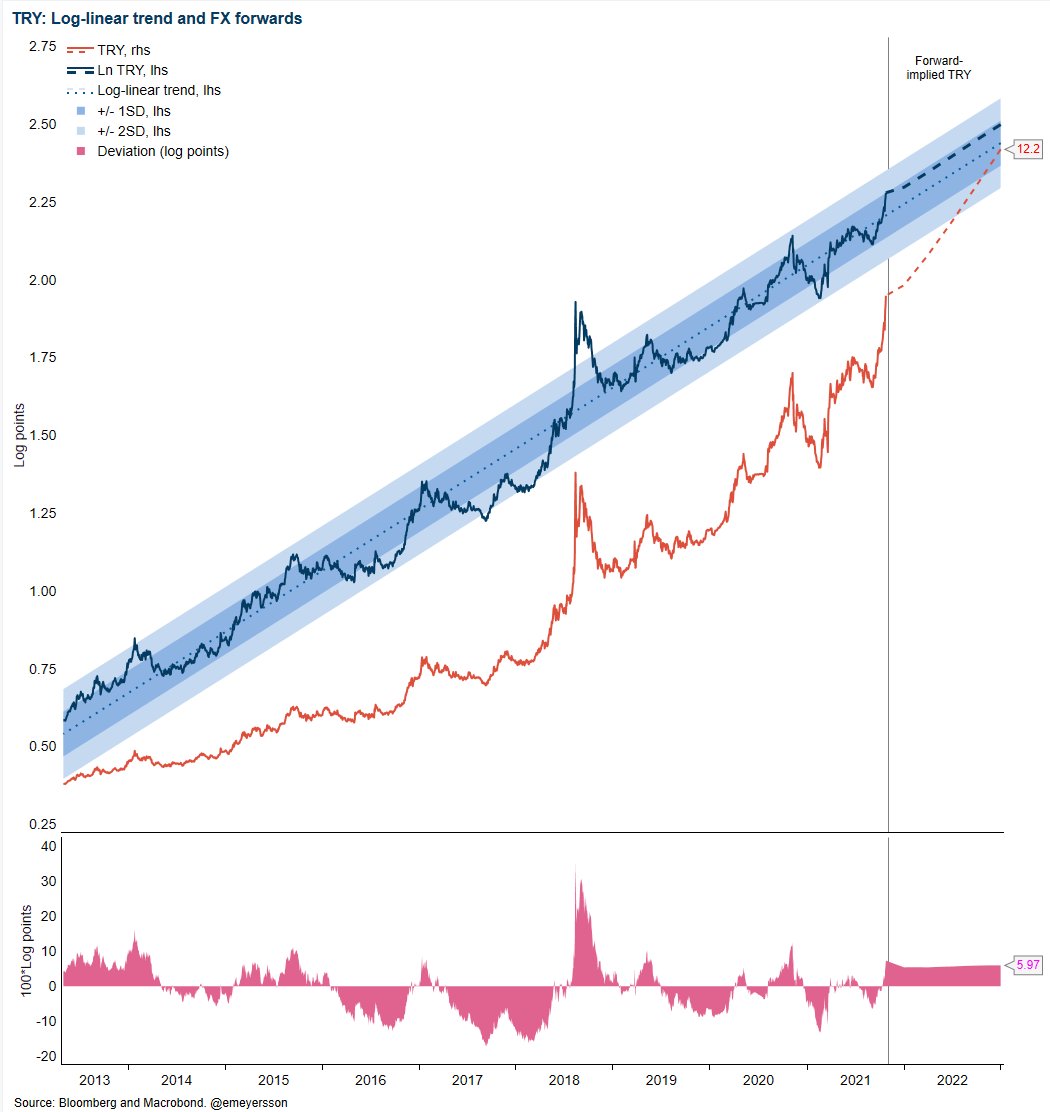

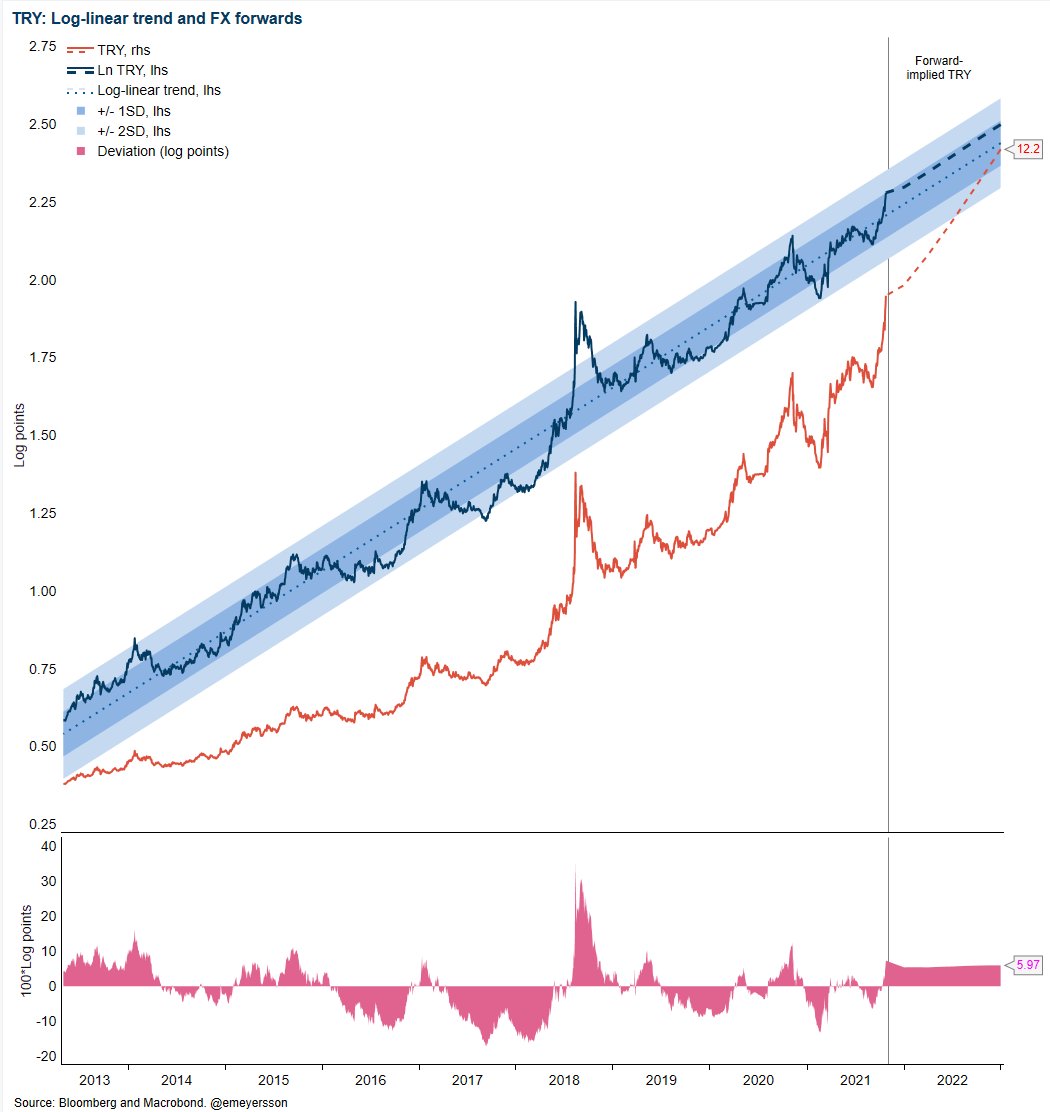

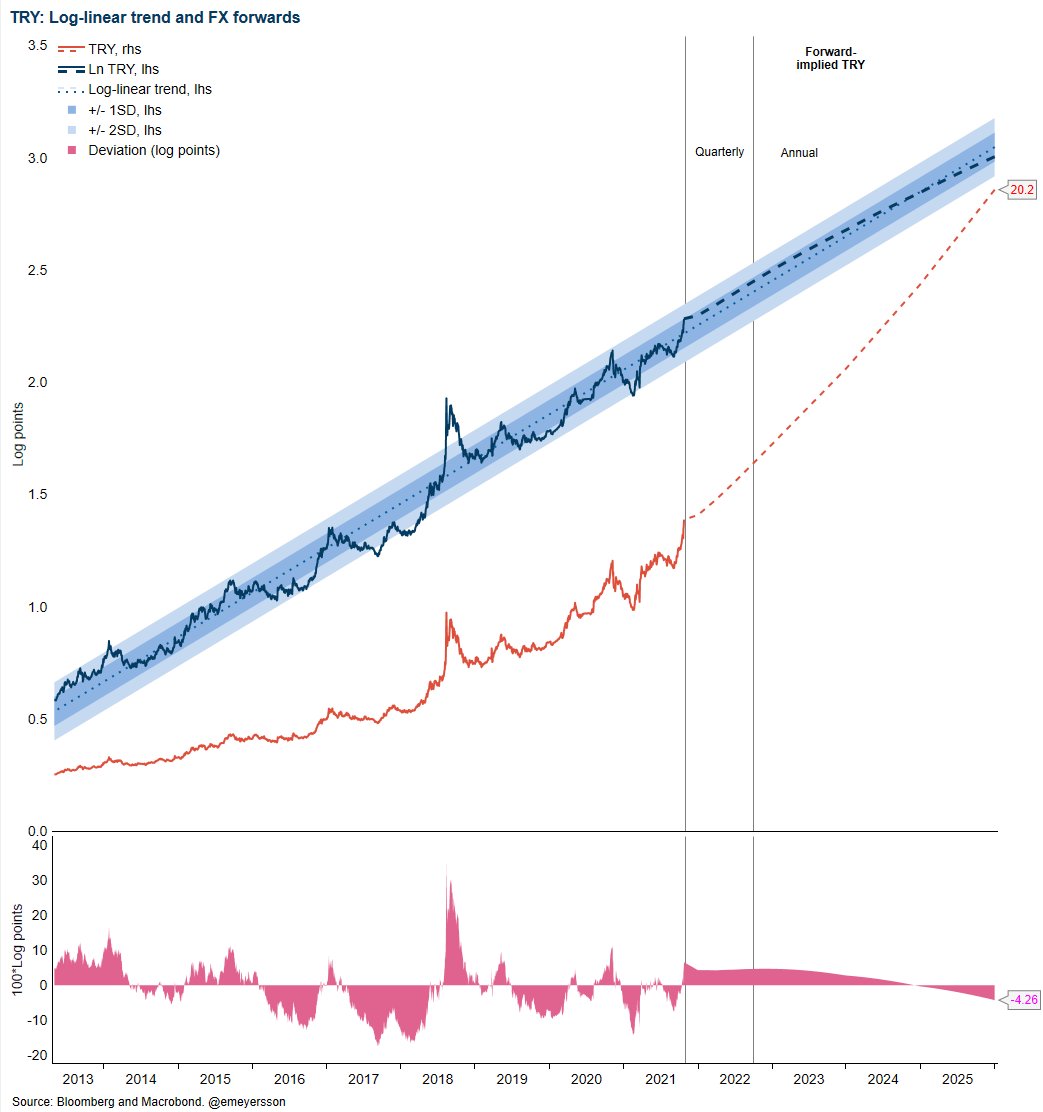

Longer term, post-2023, FX forwards have a somewhat flatter rate of depreciation (assuming perhaps that RTE is not in charge then). Still, TRY at 20 in 2025 looks rough.

Longer term, post-2023, FX forwards have a somewhat flatter rate of depreciation (assuming perhaps that RTE is not in charge then). Still, TRY at 20 in 2025 looks rough.

https://twitter.com/middleeasteye/status/1419707292073746443Saied’s ”only motive for repeatedly thwarting the nomination of positions for the Constitutional Court - even though four are chosen by the presidency, four by parliament and four by the judiciary - is to stop a body that can rule his moves unconstitutional from existing.”

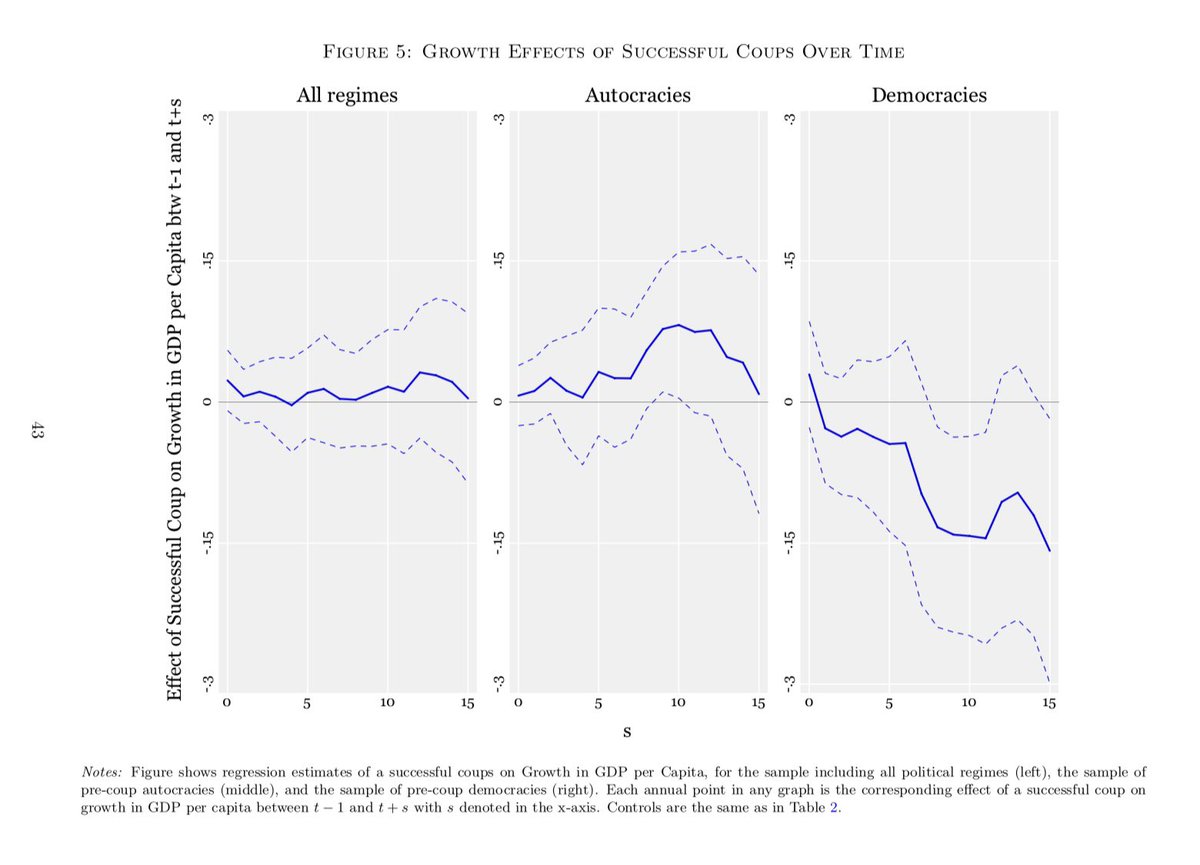

https://twitter.com/glcarlstrom/status/1419536963087052801Less technical version here freepolicybriefs.org/2015/05/25/cou…

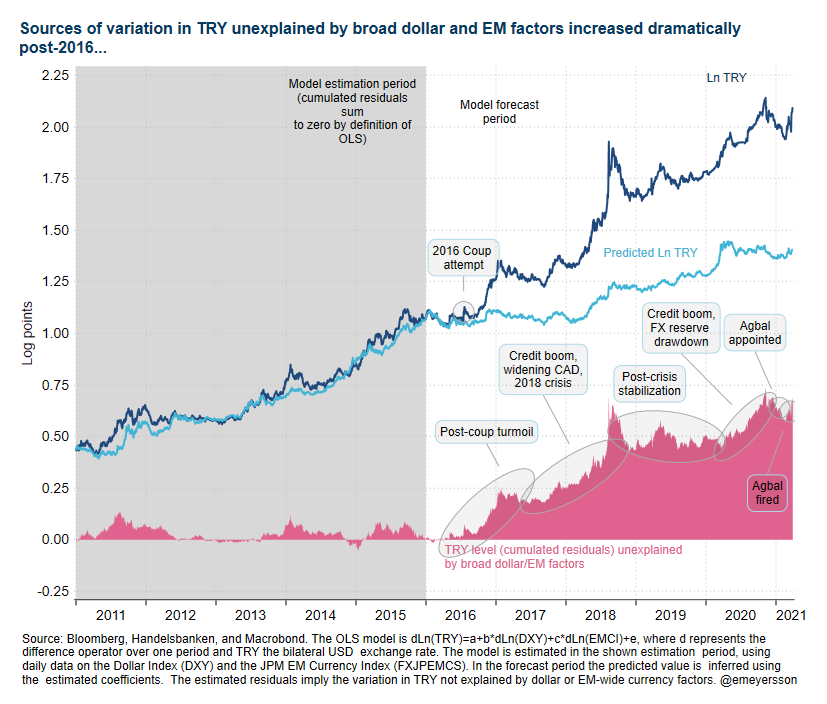

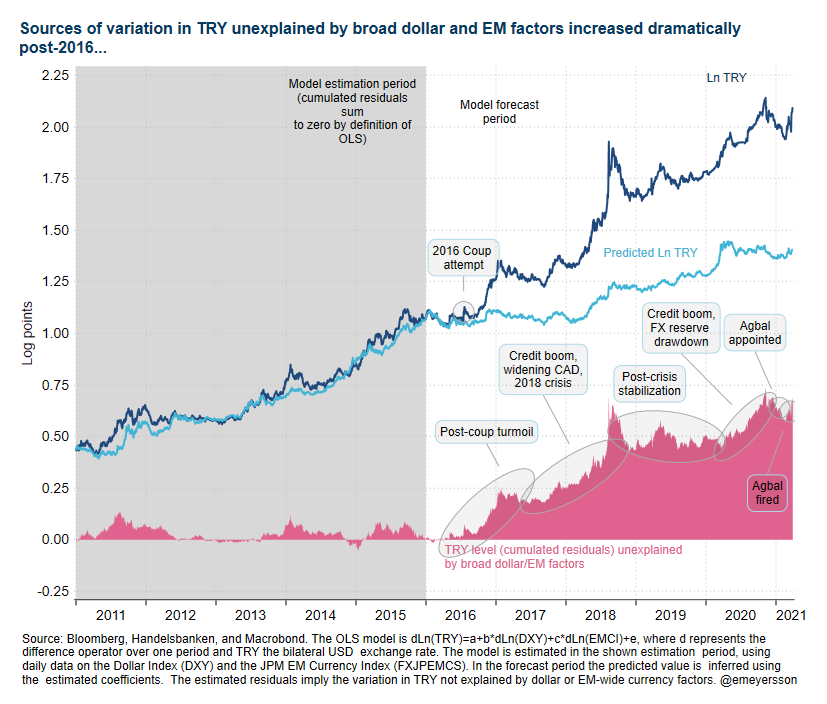

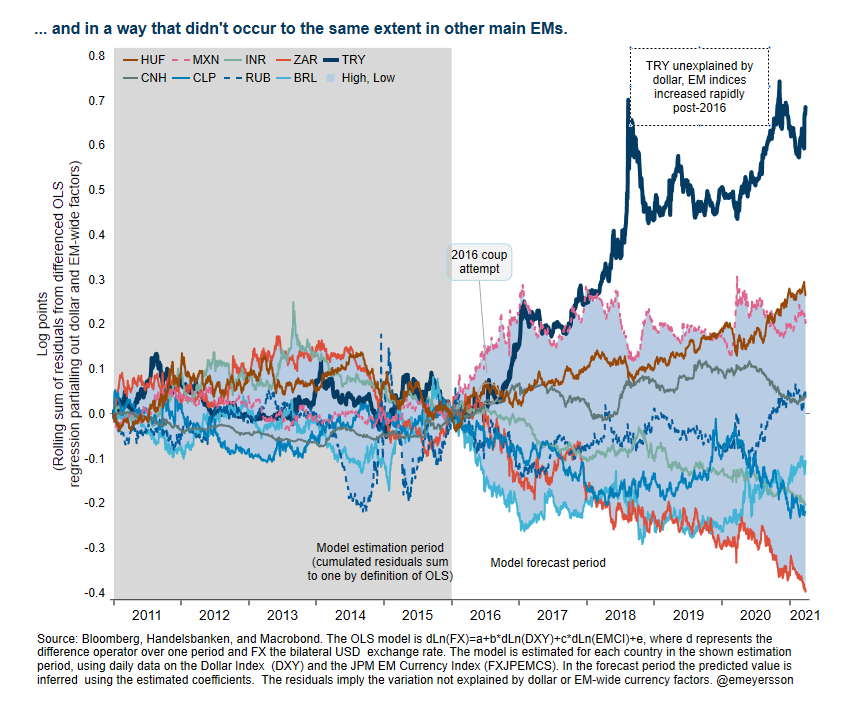

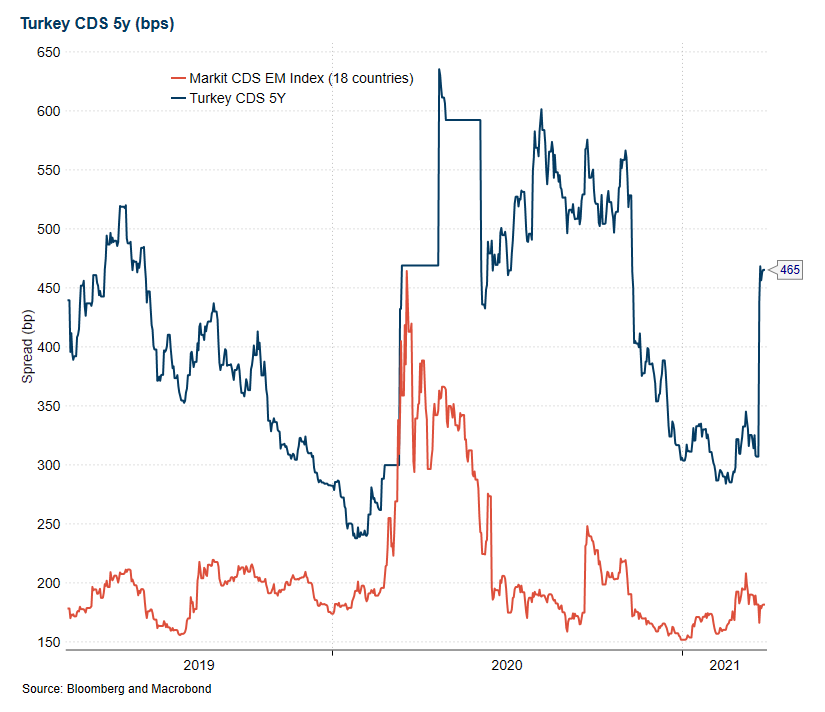

If its recent crisis isn't to a large extent about homemade problems, how come the sovereign spreads spike for Turkey but not for EM indices overall?

If its recent crisis isn't to a large extent about homemade problems, how come the sovereign spreads spike for Turkey but not for EM indices overall?

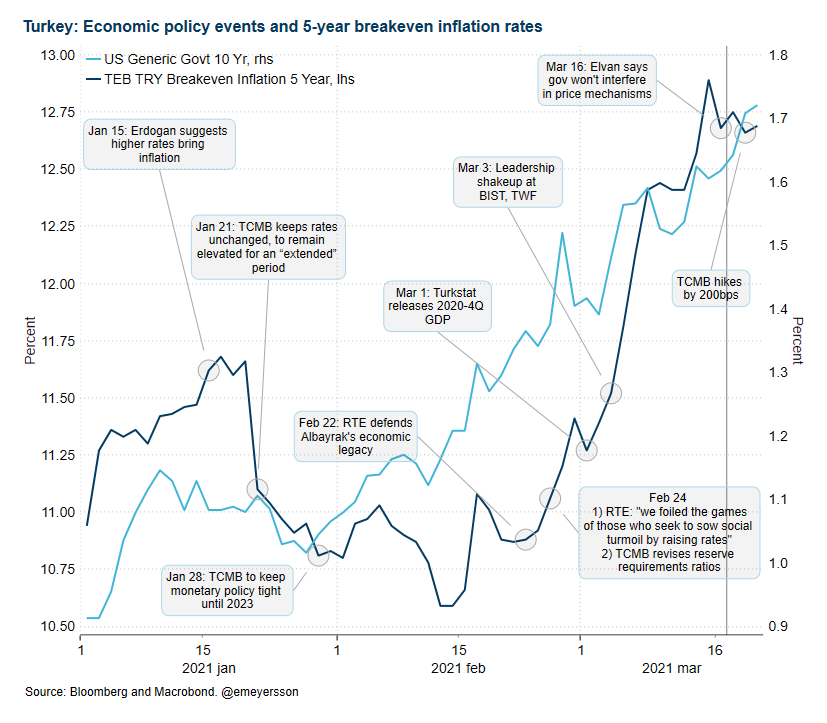

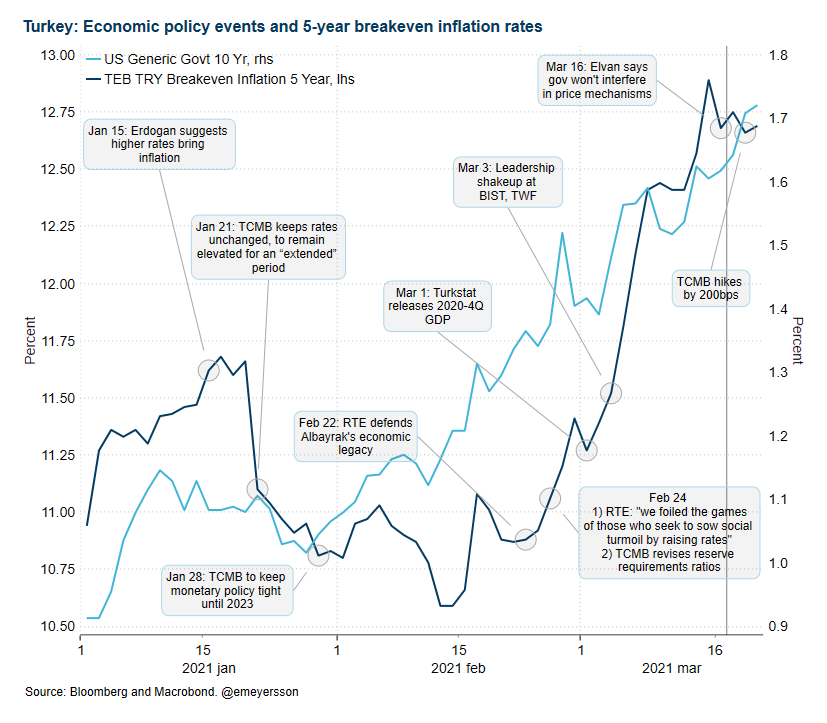

https://twitter.com/RobinBrooksIIF/status/1376166178767392777For one, markets were already losing hope that TCMB would successfully bring inflation down as shown by breakevens. The timing of the rise is only weakly correlated with US yields but fairly strongly so with RTE speaking publicly against the aim of the fmr economic policy team.

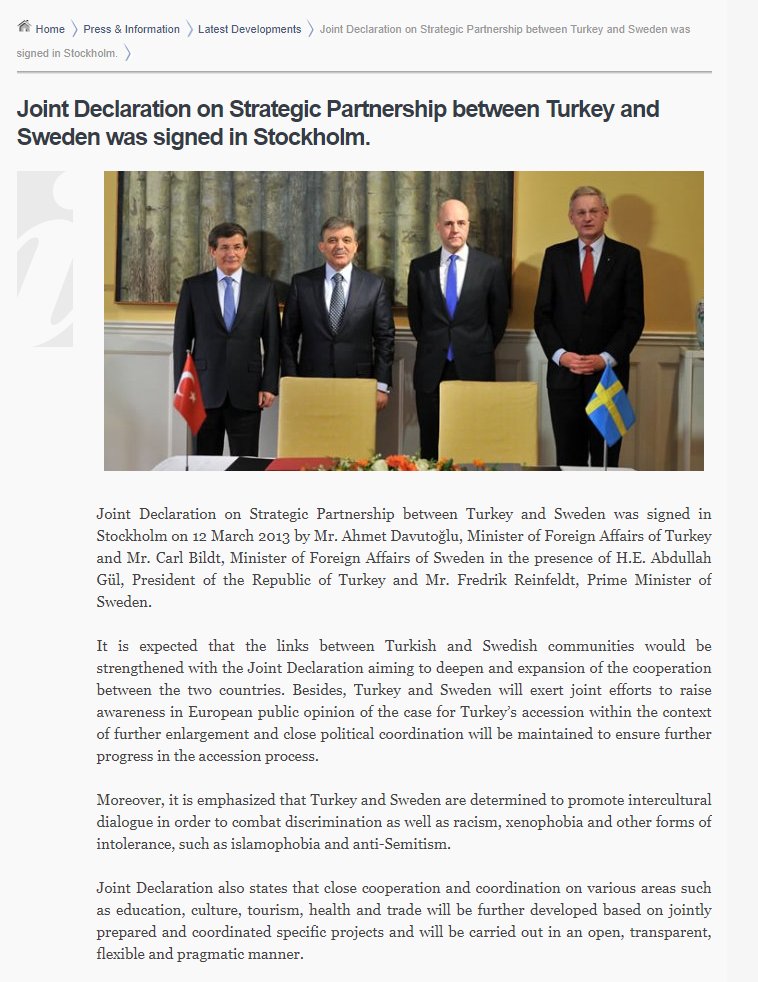

https://twitter.com/emeyersson/status/1372883251732287490The good news here is that the communication from @AnnLinde and @SweMFA is much stronger than during a certain predecessor web.archive.org/web/2014040616…

https://twitter.com/emeyersson/status/1331205186593886211

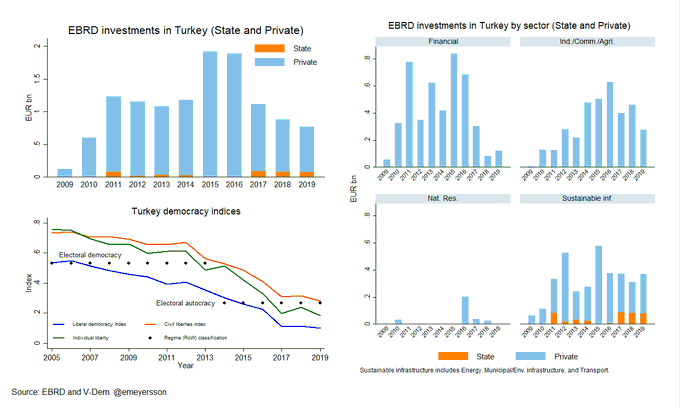

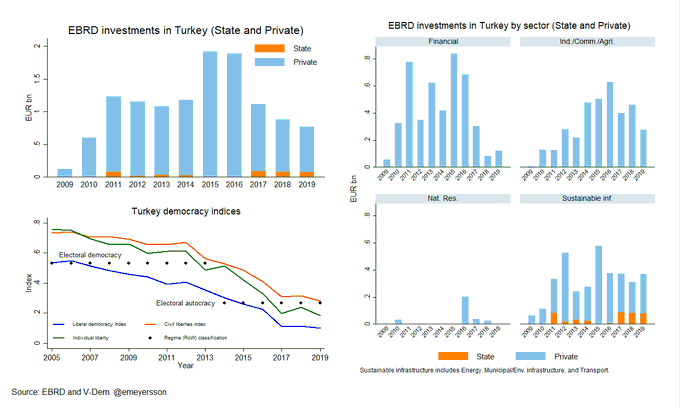

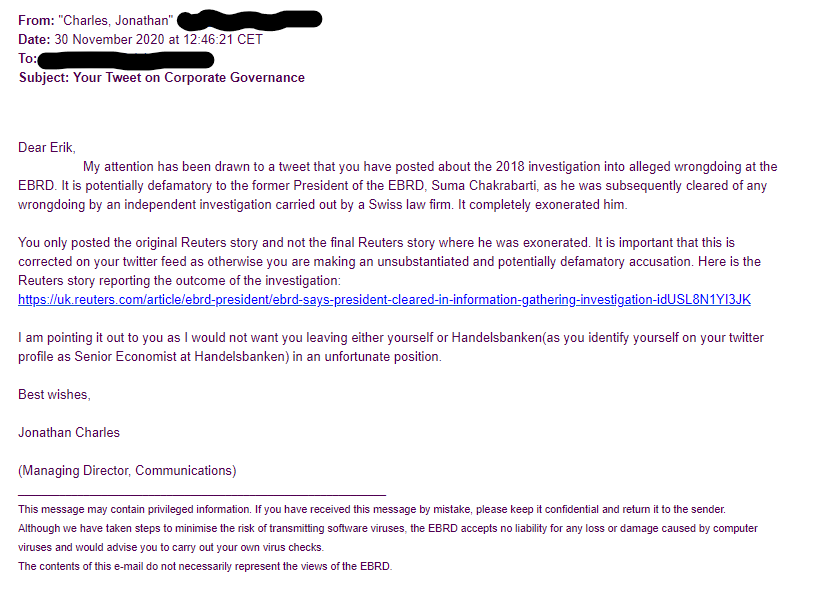

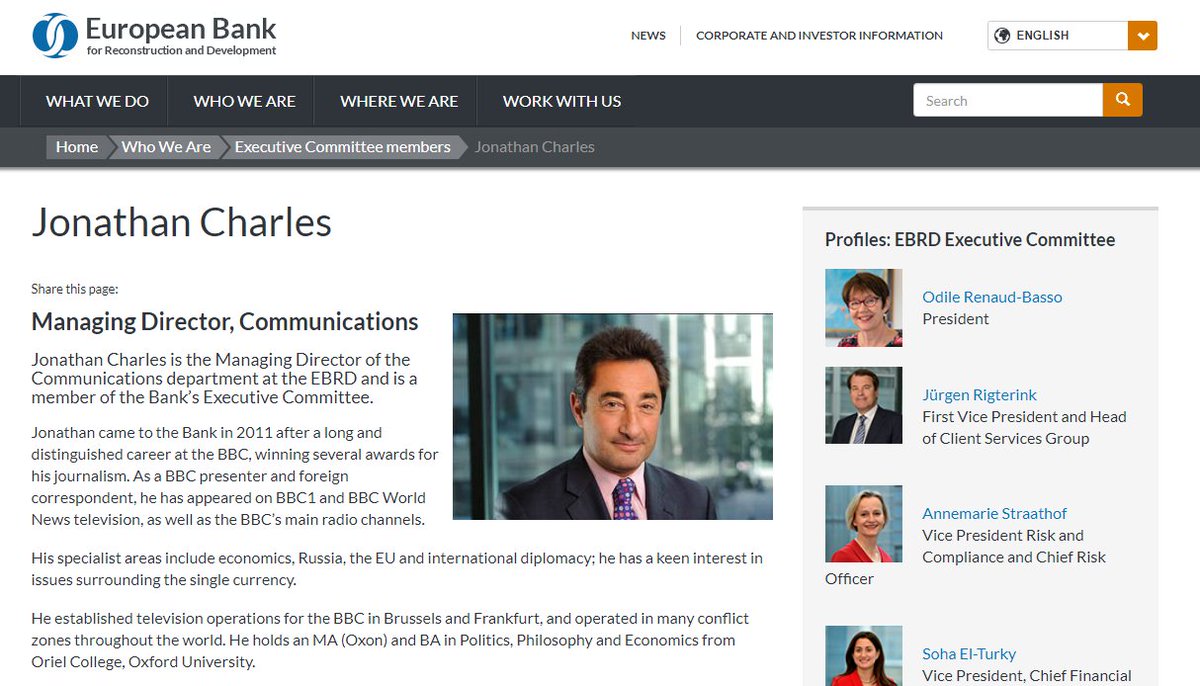

The EBRD has repeatedly made its clear its sidestepping of democratic preconditions for investment in the country, not only in statements by the President to the press but also in its official reports. aa.com.tr/en/economy/ebr…

The EBRD has repeatedly made its clear its sidestepping of democratic preconditions for investment in the country, not only in statements by the President to the press but also in its official reports. aa.com.tr/en/economy/ebr… https://twitter.com/emeyersson/status/1327364063291207687?s=20

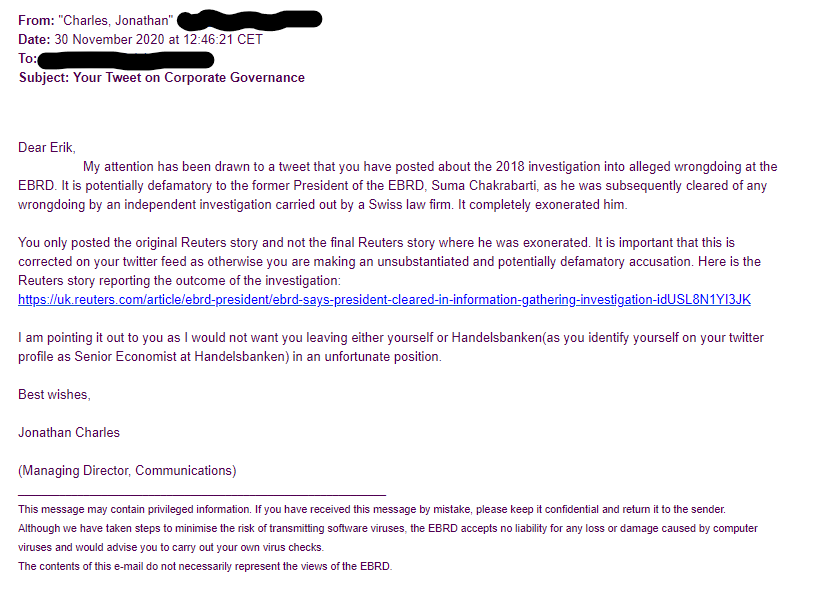

https://twitter.com/emeyersson/status/1333051281158647809

Well I guess message received on what this was really about and who this was really from. A personal adviser to the Kazakh and Uzbek presidents has blocked me.

Well I guess message received on what this was really about and who this was really from. A personal adviser to the Kazakh and Uzbek presidents has blocked me.