Chartered Financial Analyst. Cycling. Eastern spirituality. Drumming. Veganism. Indian classical music. All-in on 3-stock portfolio: $TSLA #1, $AMD #2 $NTLA #3

3 subscribers

How to get URL link on X (Twitter) App

My overall investment analysis framework can be summarized in these 7 steps.

My overall investment analysis framework can be summarized in these 7 steps.

This strategy of buying the avg max drawdown in my favored stocks has allowed me to avoid much larger losses on bad bets (i.e. $Z, $BYND, $NVTA) + increase returns on good bets (i.e. $TSLA, $SQ, $ABBV, $SHAK).

This strategy of buying the avg max drawdown in my favored stocks has allowed me to avoid much larger losses on bad bets (i.e. $Z, $BYND, $NVTA) + increase returns on good bets (i.e. $TSLA, $SQ, $ABBV, $SHAK).

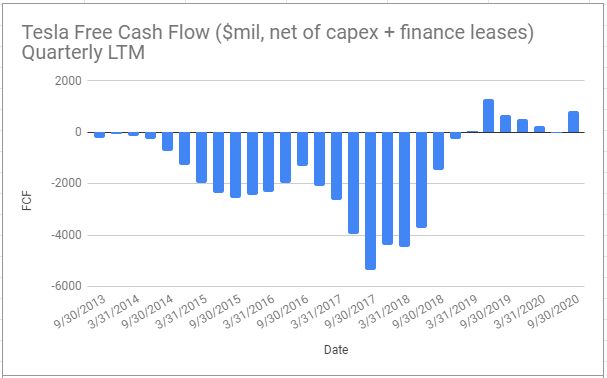

Why cash flow margins will continue to rise despite ASPs falling:

Why cash flow margins will continue to rise despite ASPs falling:

If Tesla is kicking off 23% cash ROIC on 700k unit deliveries (TTM) across two factories, despite operating at only 70% capacity, and if Berlin and Austin factories are anywhere near as cost efficient as Shanghai, I think it's likely for Tesla's cash ROIC to reach 40% in < 4yrs.

If Tesla is kicking off 23% cash ROIC on 700k unit deliveries (TTM) across two factories, despite operating at only 70% capacity, and if Berlin and Austin factories are anywhere near as cost efficient as Shanghai, I think it's likely for Tesla's cash ROIC to reach 40% in < 4yrs.

Here's the full table with data and footnotes.

Here's the full table with data and footnotes.

Gross Profit:

Gross Profit: