Head of Macroeconomic Research, Pictet Wealth Management @PictetGroup.

ECB Watcher. All opinions mine.

6 subscribers

How to get URL link on X (Twitter) App

The ECB's Bank Lending Survey was conducted between 22 March and 6 April, taking into account recent events.

The ECB's Bank Lending Survey was conducted between 22 March and 6 April, taking into account recent events.

In real terms, M1 growth is now down 10% YoY, consistent with a collapse in economic growth. 😱

In real terms, M1 growth is now down 10% YoY, consistent with a collapse in economic growth. 😱

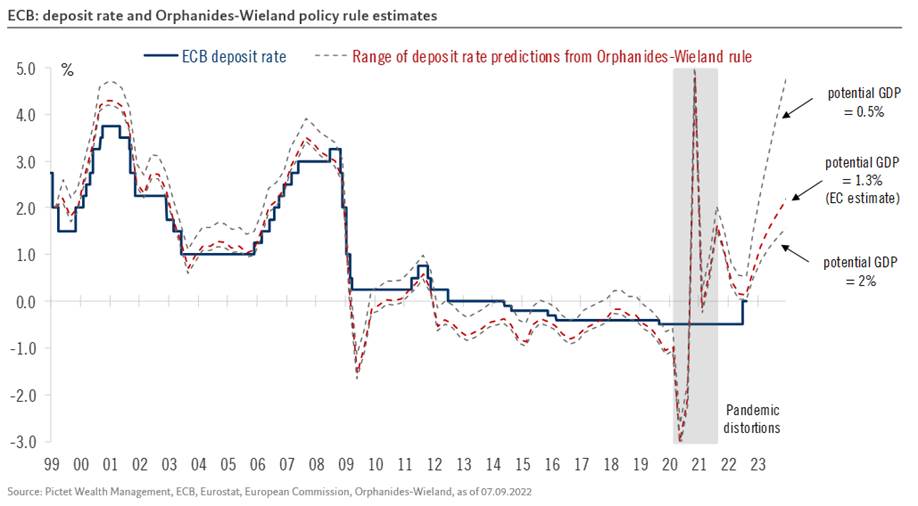

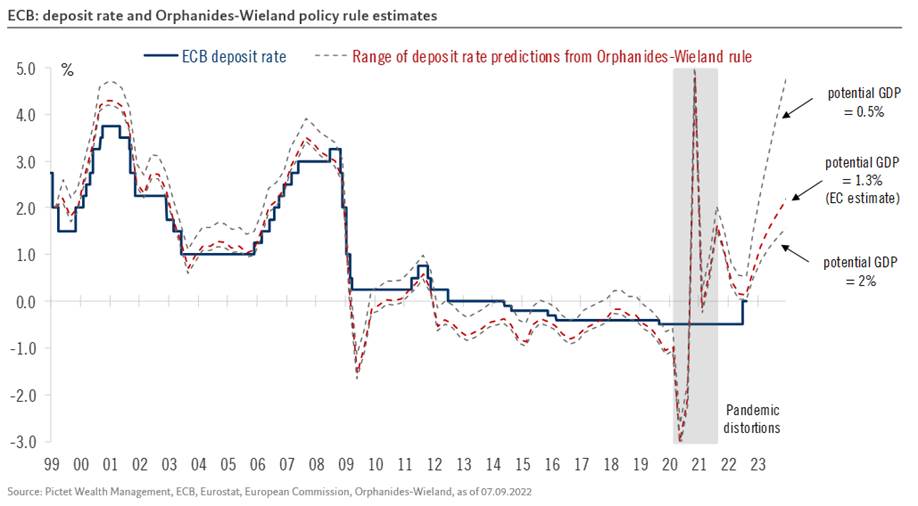

The hawkish reality check came in December, when the ECB committed to raising rates "significantly at a steady pace to reach levels that are sufficiently restrictive". The sentence should be adjusted as the ECB gets closer to peak rates.

The hawkish reality check came in December, when the ECB committed to raising rates "significantly at a steady pace to reach levels that are sufficiently restrictive". The sentence should be adjusted as the ECB gets closer to peak rates.

https://twitter.com/PictetGroup/status/1600407264354934784

Here's the @NBB_BNB_FR press release confirming the profit warning issued in September.

Here's the @NBB_BNB_FR press release confirming the profit warning issued in September.https://twitter.com/ecb/status/1594621911178350593A 50bp rate hike looks very likely at the 15 December meeting: "one platform for considering a very large hike, such as 75 basis points, is no longer there". Crucially, the hawks seem to be on the same line unless November inflation surprises massively to the upside.

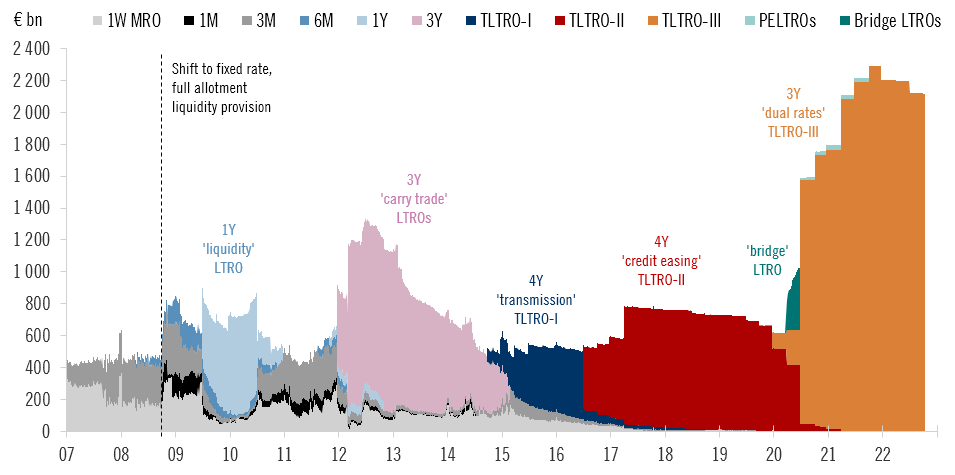

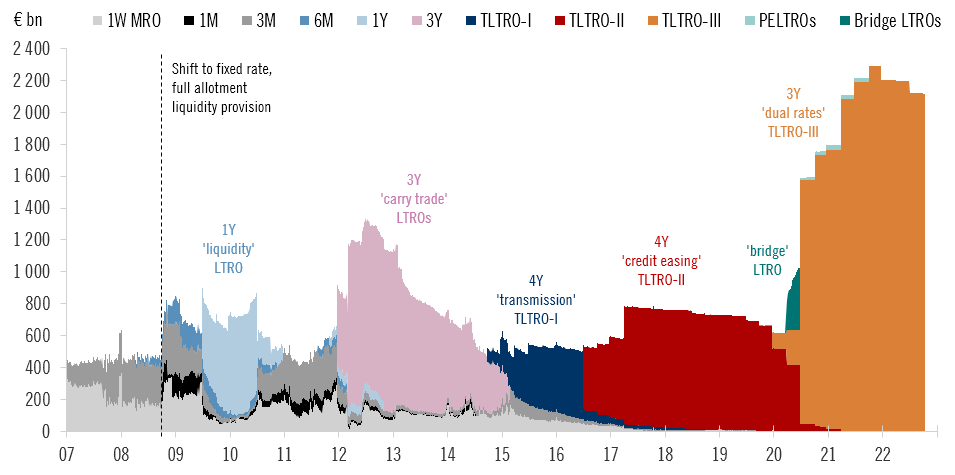

We once dubbed TLTROs The Last Tools Really Operational. TLTROs have played a crucial role in the transmission of monetary policy to the real economy, including during the pandemic, providing stable medium-term funding to banks under the conditions to maintain lending to SMEs.

We once dubbed TLTROs The Last Tools Really Operational. TLTROs have played a crucial role in the transmission of monetary policy to the real economy, including during the pandemic, providing stable medium-term funding to banks under the conditions to maintain lending to SMEs.

The SNB's record losses make it highly unlikely that the central bank will redistribute anything to the federal government and cantons.

The SNB's record losses make it highly unlikely that the central bank will redistribute anything to the federal government and cantons.

Euro area core HICP inflation rose to 4.79% in September as underlying price pressures kept broadening. Core goods inflation was up 50bp to 5.6%, but is likely to ease soon. Services inflation up by 50bp to 4.3%, which is more of a concern.

Euro area core HICP inflation rose to 4.79% in September as underlying price pressures kept broadening. Core goods inflation was up 50bp to 5.6%, but is likely to ease soon. Services inflation up by 50bp to 4.3%, which is more of a concern.

https://twitter.com/fwred/status/1567851982613872642This is because after a special period, TLTRO rates are calculated as the average deposit rate *over the life of the operation*, i.e. below the current deposit rate. Banks will now move all their excess reserves to the ECB's deposit facility to get +0.75% and lock in the spread.

ECB: "This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to the ECB’s 2% medium-term target."

ECB: "This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to the ECB’s 2% medium-term target."

We expect the ECB to hike rates by 75bp. It’s all about preserving credibility at all cost, because a failure to act would lead to more pain in the future, as per @Isabel_Schnabel's Jackson Hole speech.

We expect the ECB to hike rates by 75bp. It’s all about preserving credibility at all cost, because a failure to act would lead to more pain in the future, as per @Isabel_Schnabel's Jackson Hole speech. https://twitter.com/PictetGroup/status/1567424702632677376?t=goey33w7zxPYvslNn19VTA&s=19

https://twitter.com/ecb/status/1537045009962254336Yes, this is what they should have said last week. Better one week late than never. Details will matter a lot, but now I can't see how they could not deliver by the next meeting.

https://twitter.com/ecb/status/1536761008743645184"What is important in this environment is that investors have a clear understanding that monetary policy can and should respond to a disorderly repricing of risk premia that impairs the transmission of monetary policy and poses a threat to price stability." @Isabel_Schnabel

https://twitter.com/MAmdorsky/status/1535127285229133824Interestingly, the FT article notes that "the risk of yield curve inversion could put pressure on the ECB to start shrinking its balance sheet even before the end of this year." Talking about the APP, this is a risk we've been flagging (QT).