Web3 Writer | Tweets Focused on Helping You Achieve Financial Freedom

8 subscribers

How to get URL link on X (Twitter) App

What Are Crypto Airdrops?

What Are Crypto Airdrops?

This thread will cover how ANYONE(NO EXPERIENCE REQUIRED) can learn the tech skills needed to become a successful builder in the web3 space.

This thread will cover how ANYONE(NO EXPERIENCE REQUIRED) can learn the tech skills needed to become a successful builder in the web3 space.

Disclaimer:

Disclaimer:

Disclaimer:

Disclaimer:

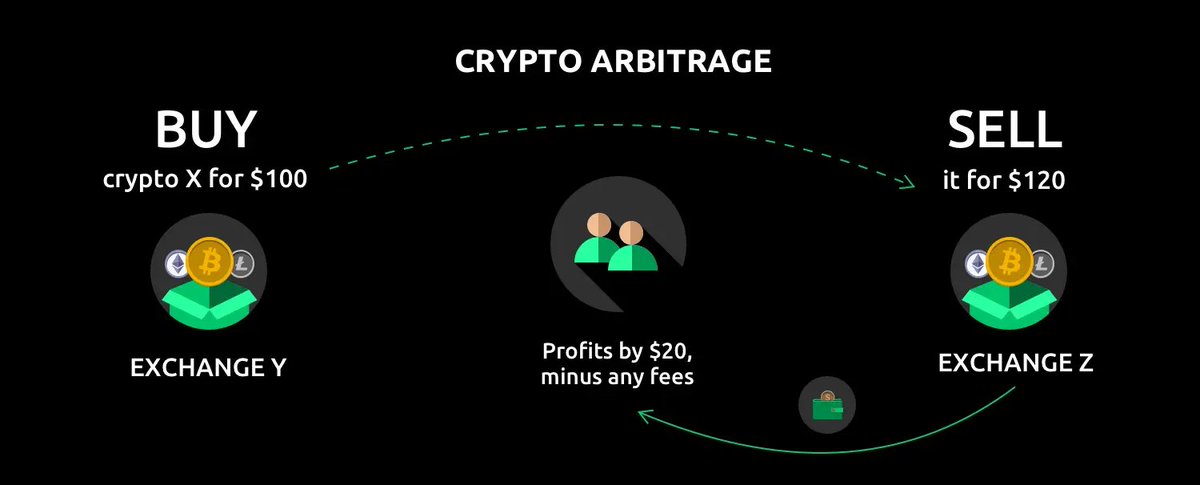

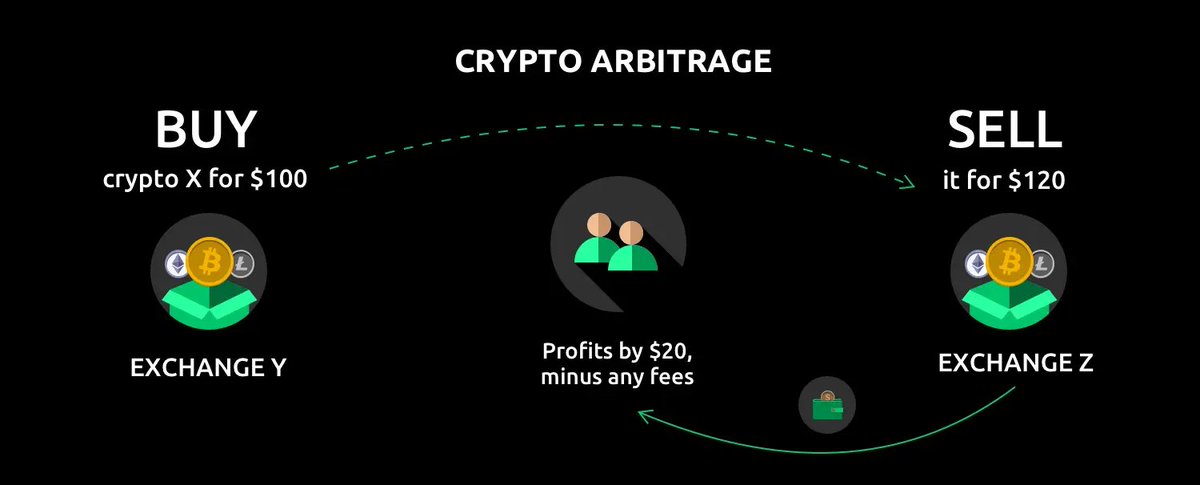

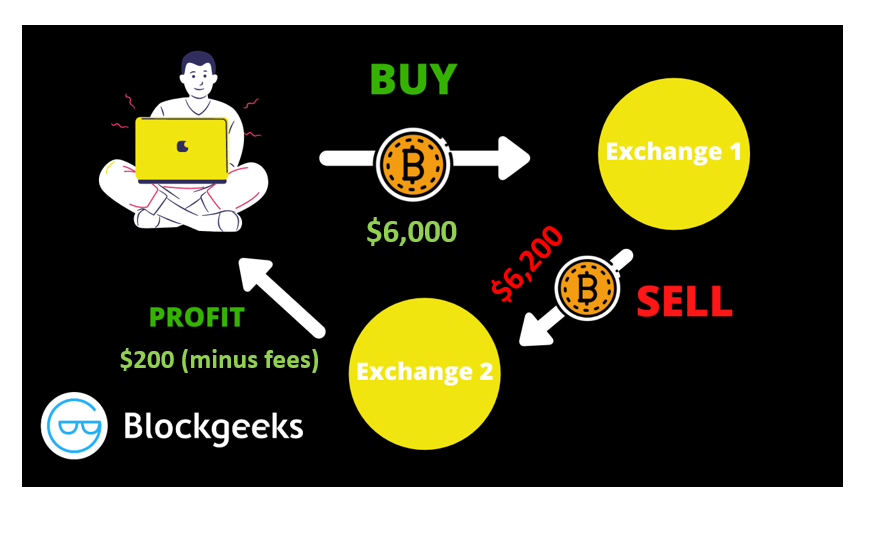

What is Arbitrage

What is Arbitrage

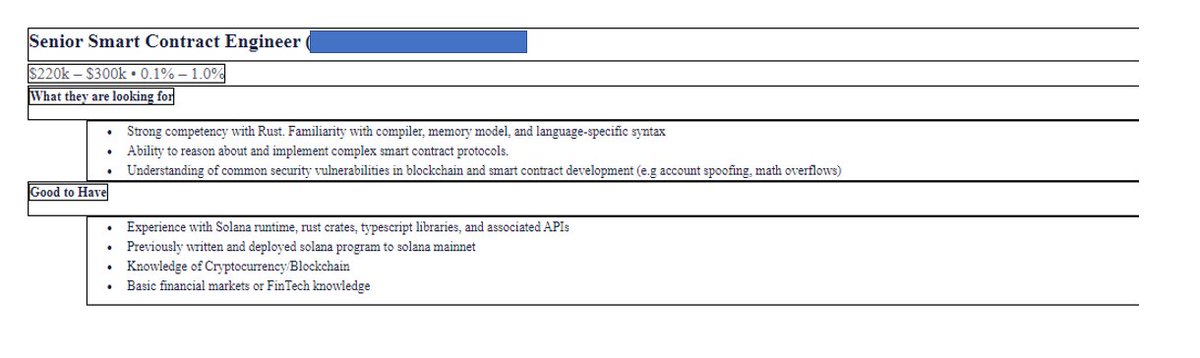

https://twitter.com/hnt_guy/status/1520770912831737858?s=20&t=m0TyF9YMkx5ubbcdWNxB2A

DISCLAIMER: NFA! DYOR!

DISCLAIMER: NFA! DYOR!

DISCLAIMER: NFA! DYOR!

DISCLAIMER: NFA! DYOR!

7) Lessons learned from 1 year of $HNT deployment

7) Lessons learned from 1 year of $HNT deployment