How to get URL link on X (Twitter) App

1/n

1/n

(1/N) - Advances Q3 FY'23

(1/N) - Advances Q3 FY'23

High Interest and Inflation sucks liquidity out of the market.

High Interest and Inflation sucks liquidity out of the market.

(1/N) - Reigniting value creation:

(1/N) - Reigniting value creation:

(1/n) - Stock is in hot industry. While I am a believer in thematic investing. I prefer pick and shovel strategy. Not doubt EV is a hot theme. But rather than buying EV Car makers, I'll rather go for component makers

(1/n) - Stock is in hot industry. While I am a believer in thematic investing. I prefer pick and shovel strategy. Not doubt EV is a hot theme. But rather than buying EV Car makers, I'll rather go for component makers

#1. Price Action - This stock is making lower high and lower lows and will be in bearish territory till the time the diagonal trend line is broken

#1. Price Action - This stock is making lower high and lower lows and will be in bearish territory till the time the diagonal trend line is broken

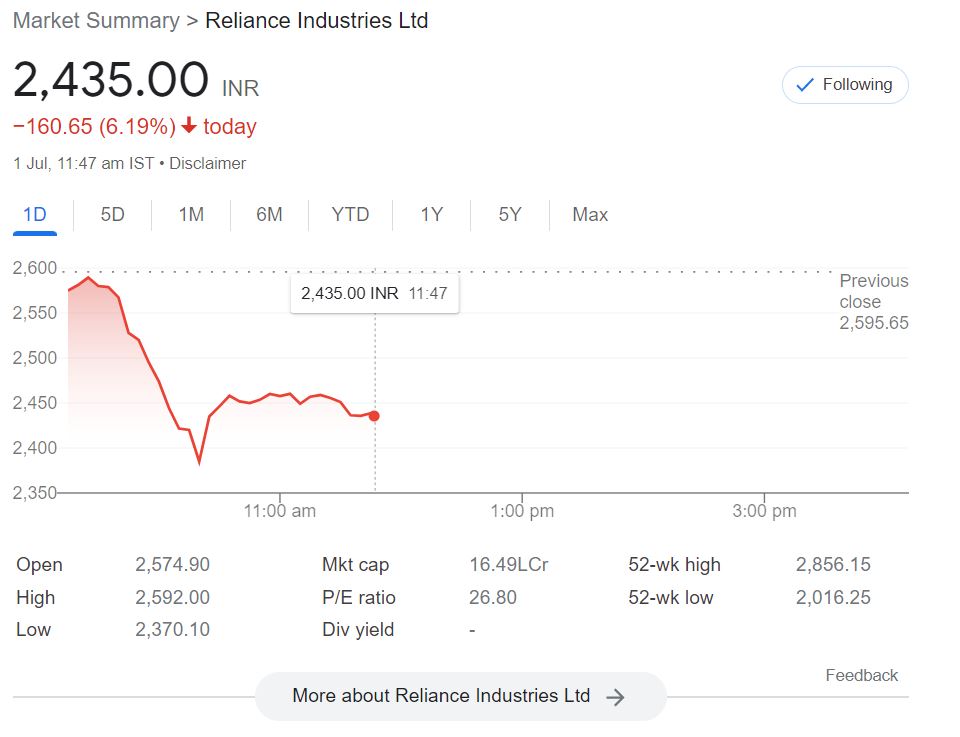

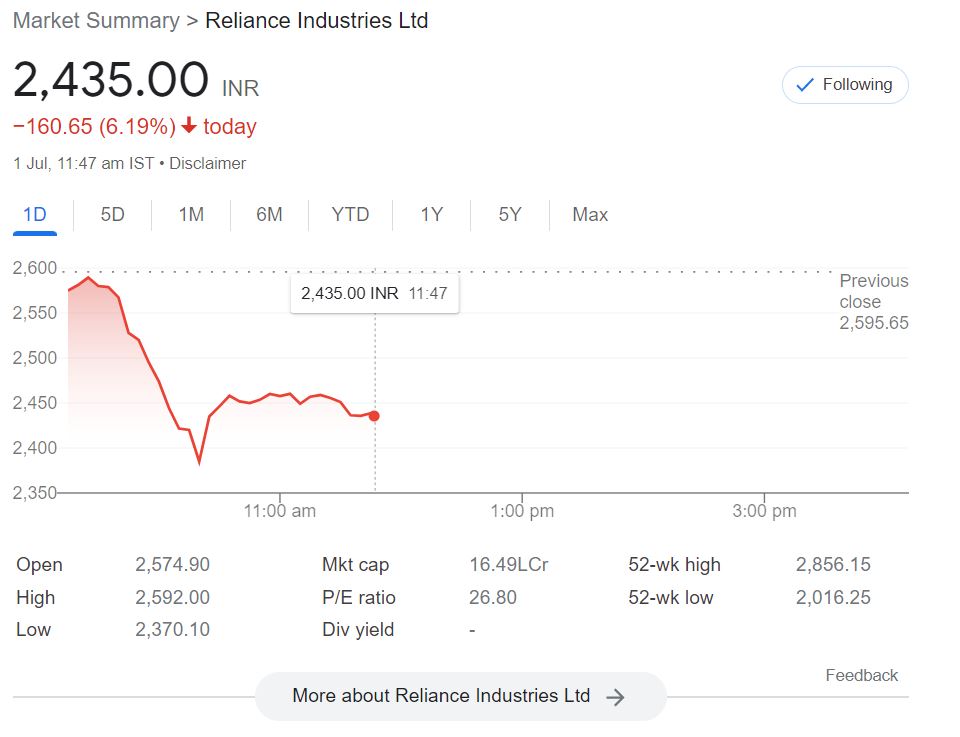

(1/n) Govt today announced an increase in taxes on the export of petrol, diesel, and aviation turbine fuel (ATF).

(1/n) Govt today announced an increase in taxes on the export of petrol, diesel, and aviation turbine fuel (ATF).