Head of Research @CryptoQuant_com | Data-driven analysis of Bitcoin and digital assets.

How to get URL link on X (Twitter) App

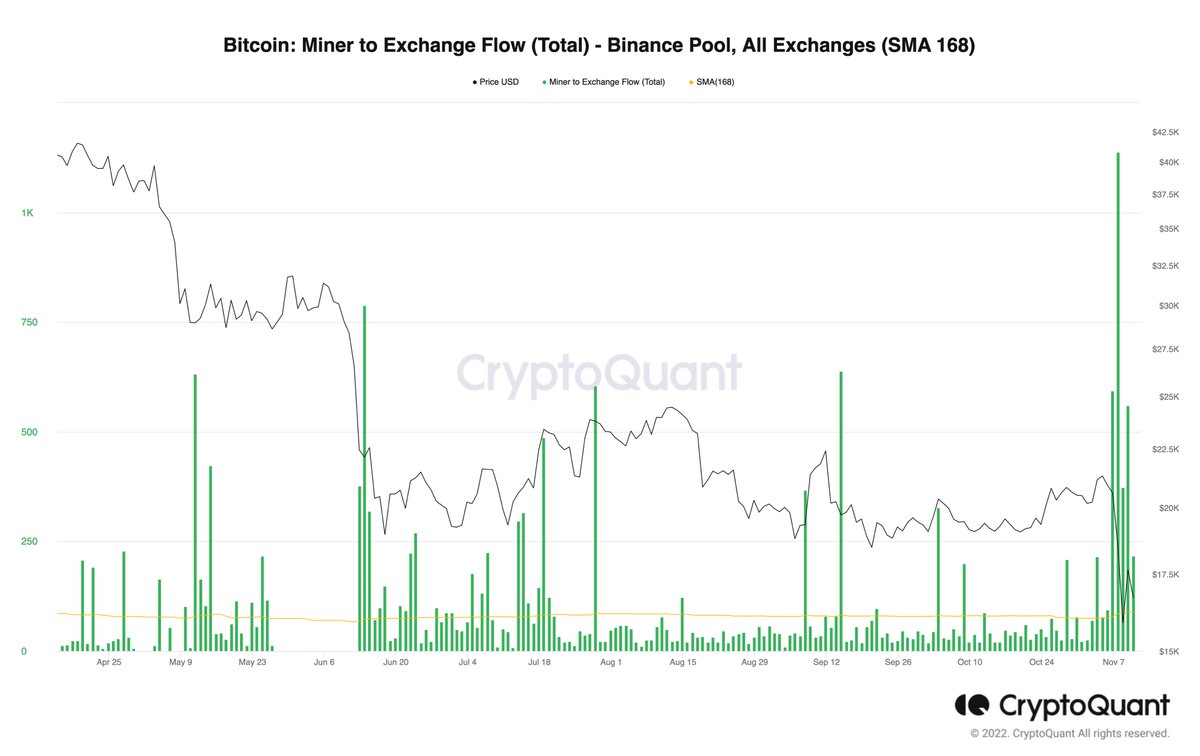

2,256 BTC out of the 2,396 BTC in the first tx went to address 1BRuc4qkCy7H1mxn4h3ekXSAQERvrGSF8, which then sent them to other 2 addresses and finally ended on Binance (chart made with breadcrumbs).

2,256 BTC out of the 2,396 BTC in the first tx went to address 1BRuc4qkCy7H1mxn4h3ekXSAQERvrGSF8, which then sent them to other 2 addresses and finally ended on Binance (chart made with breadcrumbs).

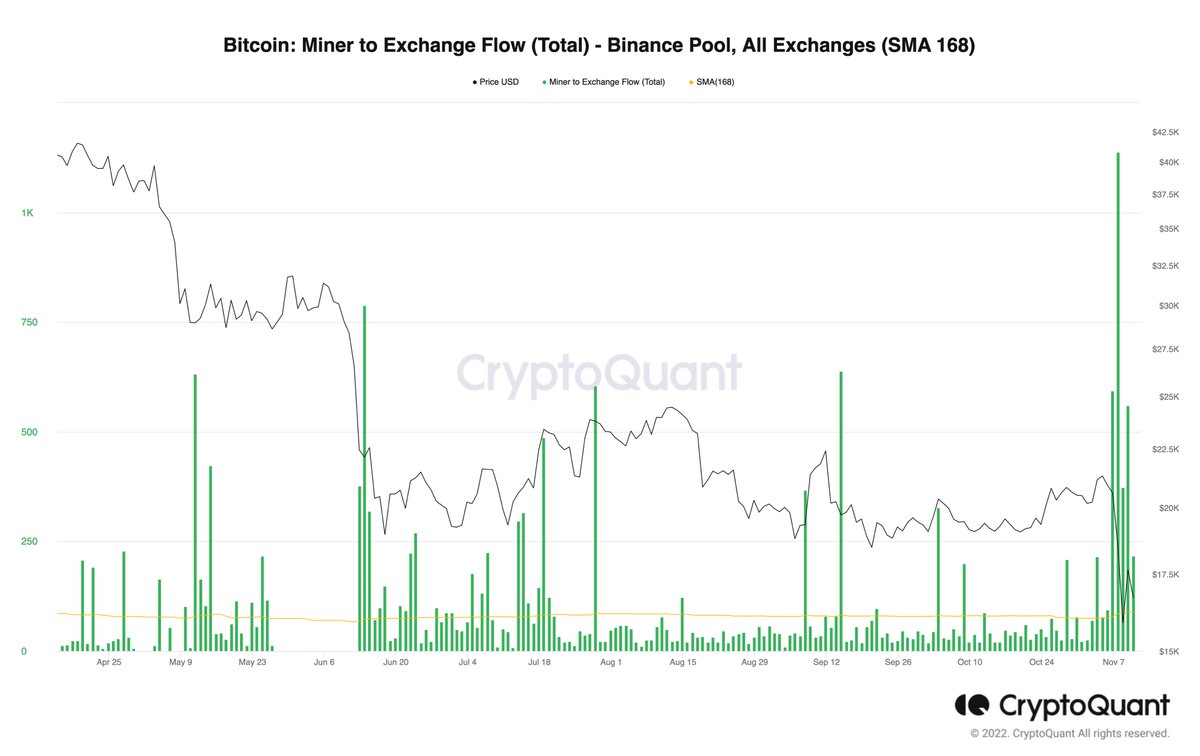

Bitcoin miners revenue is at fresh all-time lows.

Bitcoin miners revenue is at fresh all-time lows.

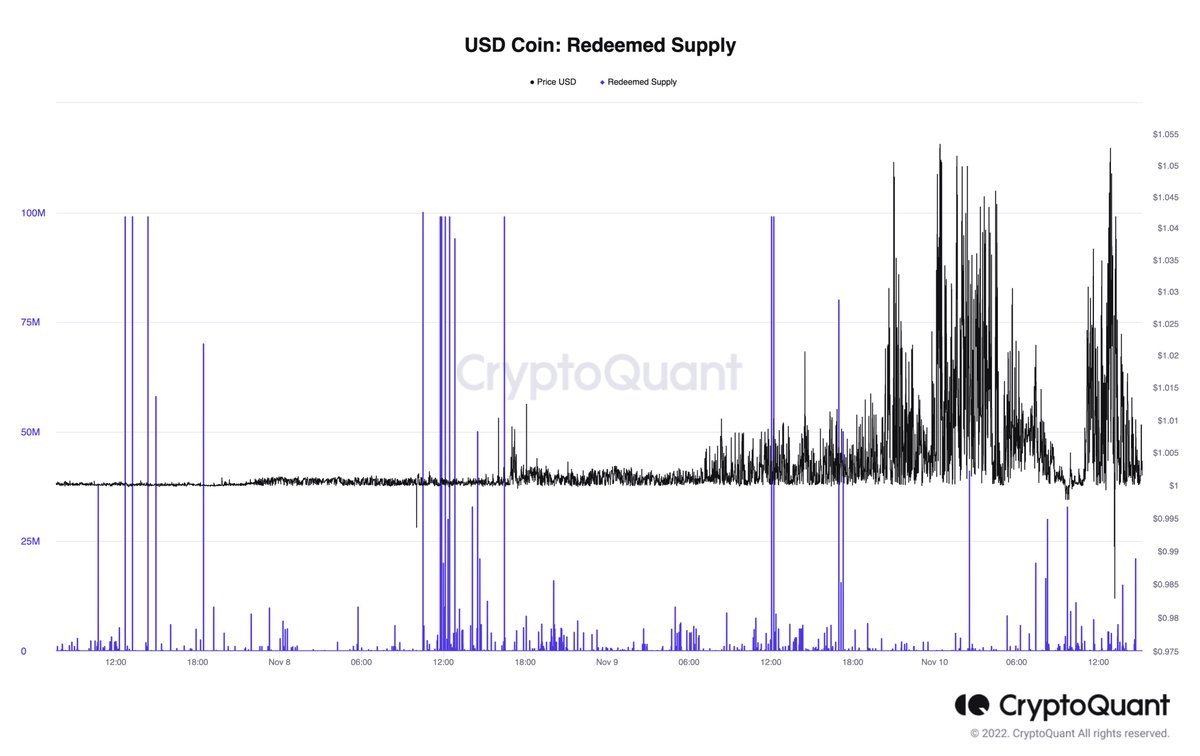

USDC's (Circle) price has also seen a lot of volatility in these few days as redemptions top $1B. Price retains peg.

USDC's (Circle) price has also seen a lot of volatility in these few days as redemptions top $1B. Price retains peg.

2/18

2/18