Hedge Fund Manager Blockchain Opportunity Fund

CEO Blockware Solutions

CEO Blockware Mining

Subscribe to our Research: https://t.co/4sDChjpEp3

CANSLIM

How to get URL link on X (Twitter) App

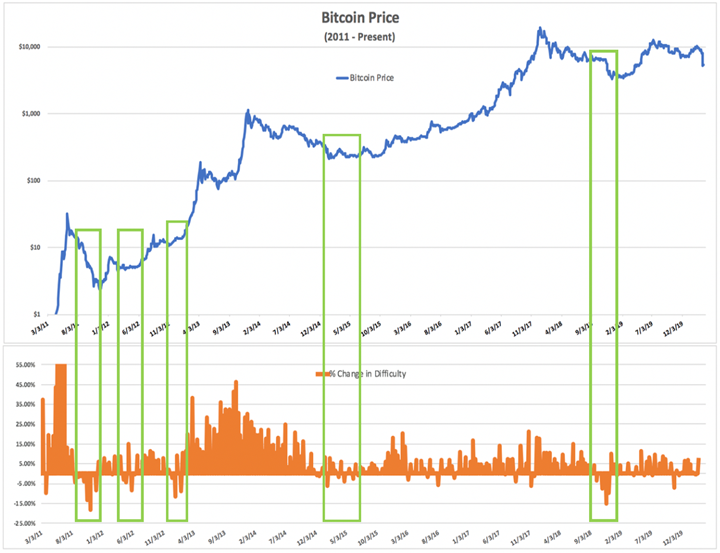

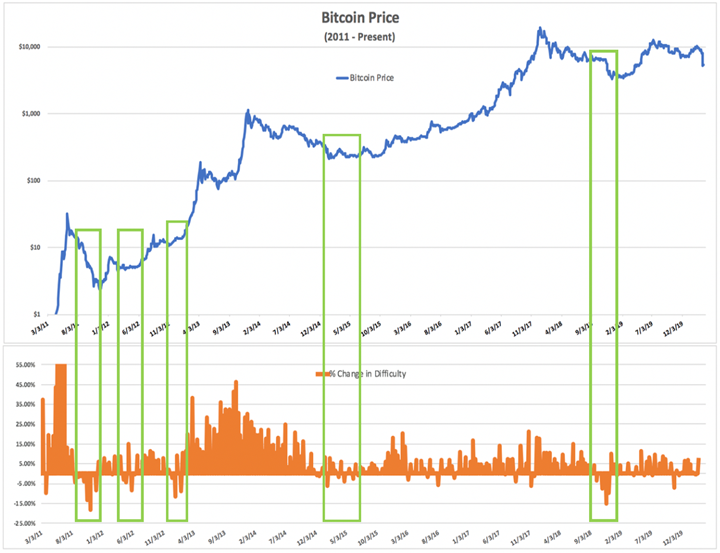

2) Many havnt noticed yet but 30%+ of the mining network has shut off Post Halving. New BTC is getting allocated to more efficient miners who can hold - a far more fertile environment for BTC to rally when solely analyzing the Supply Side.

2) Many havnt noticed yet but 30%+ of the mining network has shut off Post Halving. New BTC is getting allocated to more efficient miners who can hold - a far more fertile environment for BTC to rally when solely analyzing the Supply Side.

2)

2)

2) A majority of assets perform well in a Bull Market – you can blindly throw darts at a board and be successful. Bear Markets reveal inefficiencies and pockets ripe for disruption. The beauty of Nasty Bear Markets is that the junk never comes back.

2) A majority of assets perform well in a Bull Market – you can blindly throw darts at a board and be successful. Bear Markets reveal inefficiencies and pockets ripe for disruption. The beauty of Nasty Bear Markets is that the junk never comes back.

2) Today we witnessed one of the largest Difficulty reductions in Bitcoin history. In the past, extreme difficulty reductions signal favorable probabilities for long-term capital deployment.

2) Today we witnessed one of the largest Difficulty reductions in Bitcoin history. In the past, extreme difficulty reductions signal favorable probabilities for long-term capital deployment.

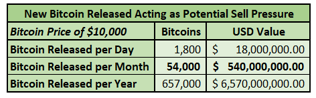

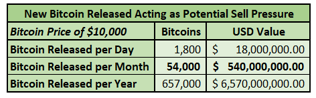

2) Everyone in the Bitcoin space should deeply understand this information as it thoroughly explains the Bitcoin Mining Network and how Miners create constant sell pressure on the price of Bitcoin. Bitcoin Miners are the backbone of the network as they are the security layer and

2) Everyone in the Bitcoin space should deeply understand this information as it thoroughly explains the Bitcoin Mining Network and how Miners create constant sell pressure on the price of Bitcoin. Bitcoin Miners are the backbone of the network as they are the security layer and

2) These institutions and large holders have long investment time horizons, which is why we refer to them as strong hands. When the strong hands accumulate enough Bitcoin and soak up the weaker hands’ selling, the market will be positioned for significant price advancements

2) These institutions and large holders have long investment time horizons, which is why we refer to them as strong hands. When the strong hands accumulate enough Bitcoin and soak up the weaker hands’ selling, the market will be positioned for significant price advancements

believe Bitcoin will be utilized as a payment system, the market disagrees.

believe Bitcoin will be utilized as a payment system, the market disagrees.