How to get URL link on X (Twitter) App

https://twitter.com/AnandableAnand/status/1472863972537737218?s=20(this is my approach anyway..)

https://twitter.com/muskk/status/1462088598124068868?s=20

https://twitter.com/muskk/status/1462086837938184193?s=20Trade entry point: Two scenarios. One safe and one aggressive. See pic below (pasting pic to reduce length of this thread).

https://twitter.com/muskk/status/1457215816894582785?s=20

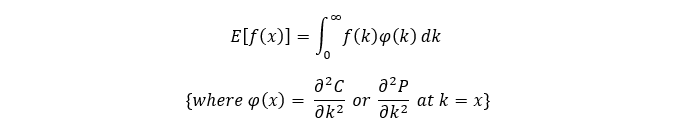

https://twitter.com/muskk/status/1456574274982928390?s=20realized index returns distribution. To put it simply, selling deep OTM puts has been observed to be a profitable strategy and the authors try to confirm the existence of such risk premium by coming up with a "skew swap" strategy.

and so on (T=1 can be weekly also but I reckon weekly distributions won't look that smooth based on what I observed of option price/IV behavior).

and so on (T=1 can be weekly also but I reckon weekly distributions won't look that smooth based on what I observed of option price/IV behavior).

https://twitter.com/raghavanand648/status/1447786852027494402?s=20

So the idea is that the basis (monthly minus weekly fut) of 60 odd will go up to say 90-95 and the way to trade in this case is long monthly future and "short weekly call plus long weekly put" at a strike that is close to synthetic future (check call - put + strike for any

So the idea is that the basis (monthly minus weekly fut) of 60 odd will go up to say 90-95 and the way to trade in this case is long monthly future and "short weekly call plus long weekly put" at a strike that is close to synthetic future (check call - put + strike for anyhttps://twitter.com/muskk/status/1443131179675312134?s=20, there will be much more downward price pressure on calls, in case of a flattish market open tomorrow (I'll come to this later), than there will be on puts. Why? Call/Put premiums follow Bnf Fut (obviously due to parity) and given they're affected by expected realized moves

..(better close to expiry than say a friday), when big down move is accompanied by IV increase/spike which is most often the case anyway, best to do is to enter a call ratio spread and keep adding if the down move continues. Once the down move ends and there is a recovery..

..(better close to expiry than say a friday), when big down move is accompanied by IV increase/spike which is most often the case anyway, best to do is to enter a call ratio spread and keep adding if the down move continues. Once the down move ends and there is a recovery..