How to get URL link on X (Twitter) App

https://twitter.com/jamers2012/status/16336867568169861122/10 If digitization of securities is going to work, then —

2/24 wholesale prices and sells it to the end user, acting as a middleman between the retail purchaser and the utility distribution company (“UDC”) that owns the wires that allow for energy transmission to the customer site. Under its agreement

2/24 wholesale prices and sells it to the end user, acting as a middleman between the retail purchaser and the utility distribution company (“UDC”) that owns the wires that allow for energy transmission to the customer site. Under its agreement

2/33 Mining personnel, Luna Squares was an attractive hosting opportunity because Celsius Mining viewed Luna Squares as charging reasonable hosting rates and being competent at quickly and economically building out infrastructure for mining,

2/33 Mining personnel, Luna Squares was an attractive hosting opportunity because Celsius Mining viewed Luna Squares as charging reasonable hosting rates and being competent at quickly and economically building out infrastructure for mining,

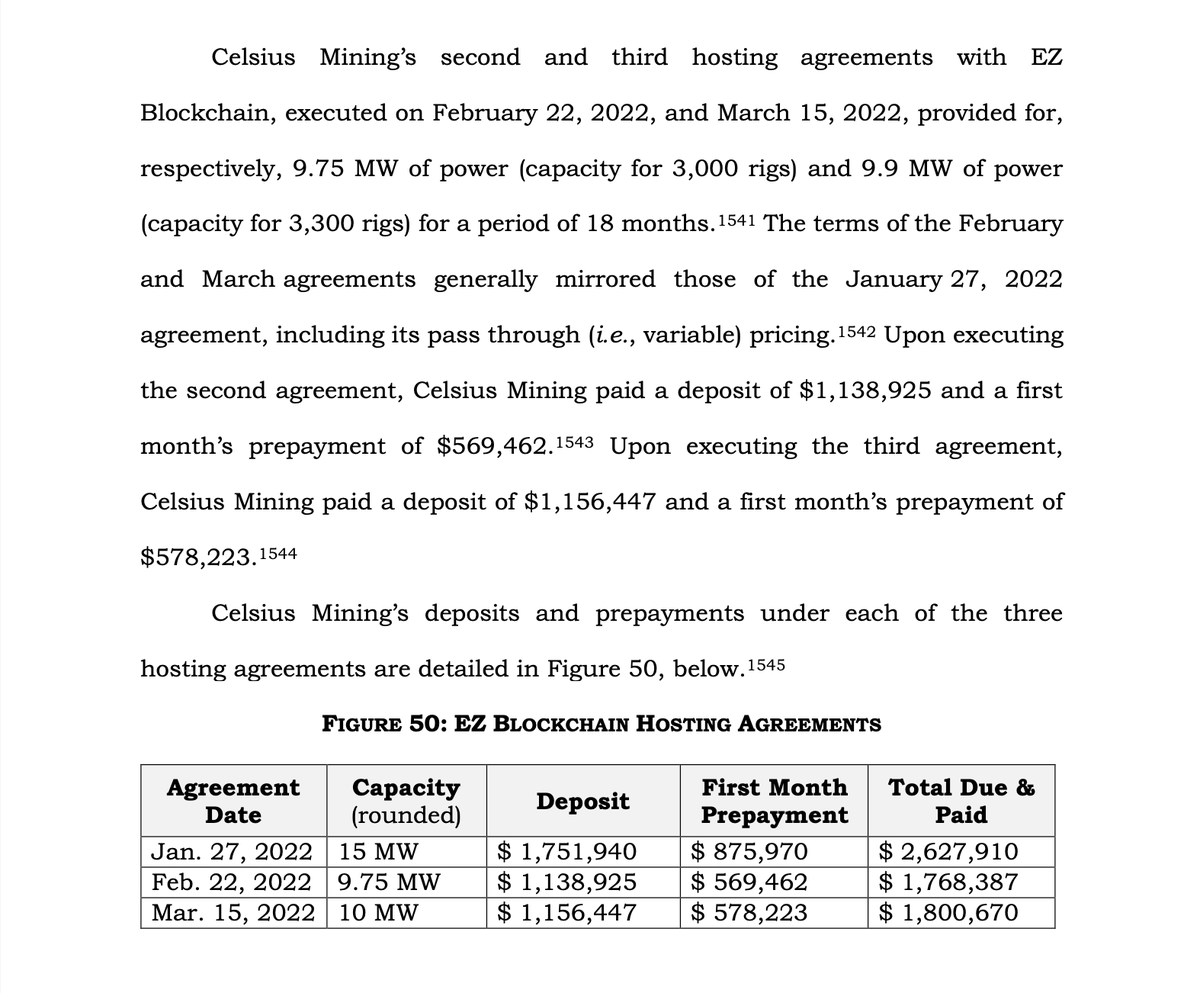

2/22 approximately 35 MW of power— capacity for an estimated 10,785 rigs—over a term of 18 months at a variable rate. Celsius Mining turned to EZ Blockchain because, according to Celsius Mining, its business model involves identifying small

2/22 approximately 35 MW of power— capacity for an estimated 10,785 rigs—over a term of 18 months at a variable rate. Celsius Mining turned to EZ Blockchain because, according to Celsius Mining, its business model involves identifying small

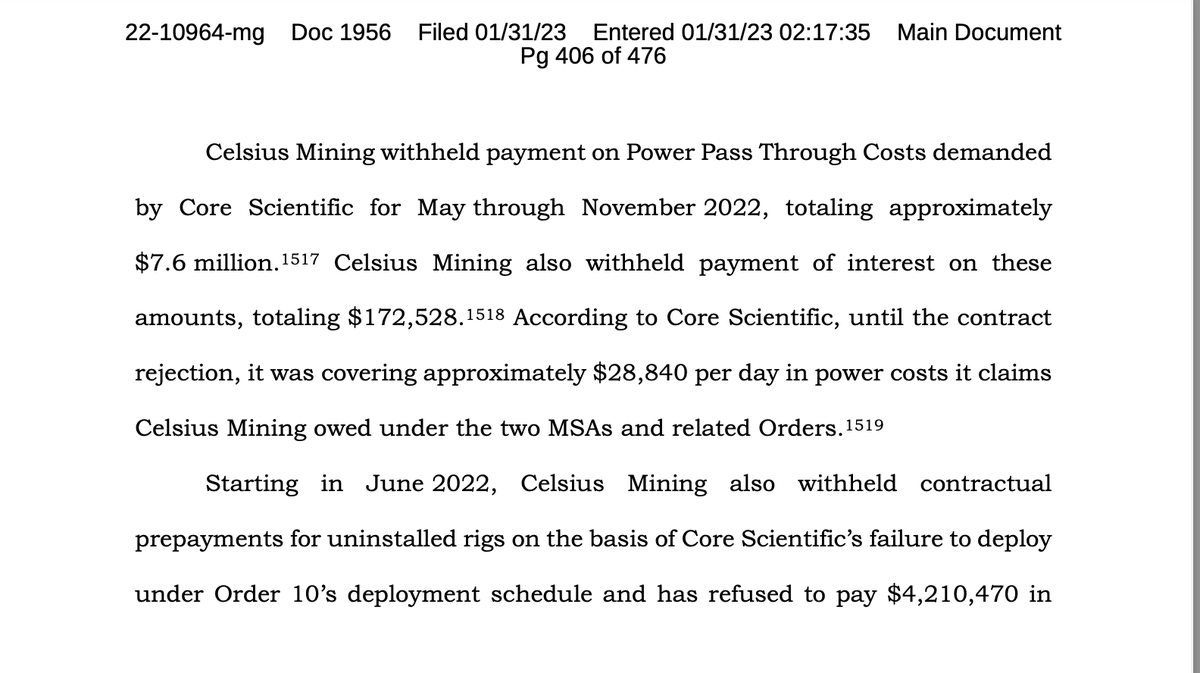

2/18 provided all promised hosting capacity under Orders 1-4, 6-7, 9 and 1-A but failed to timely complete deployment under Order 10, missing contracted deployment deadlines in the spring of 2022 and failing to deploy any Celsius Mining rigs after May 2022.

2/18 provided all promised hosting capacity under Orders 1-4, 6-7, 9 and 1-A but failed to timely complete deployment under Order 10, missing contracted deployment deadlines in the spring of 2022 and failing to deploy any Celsius Mining rigs after May 2022.

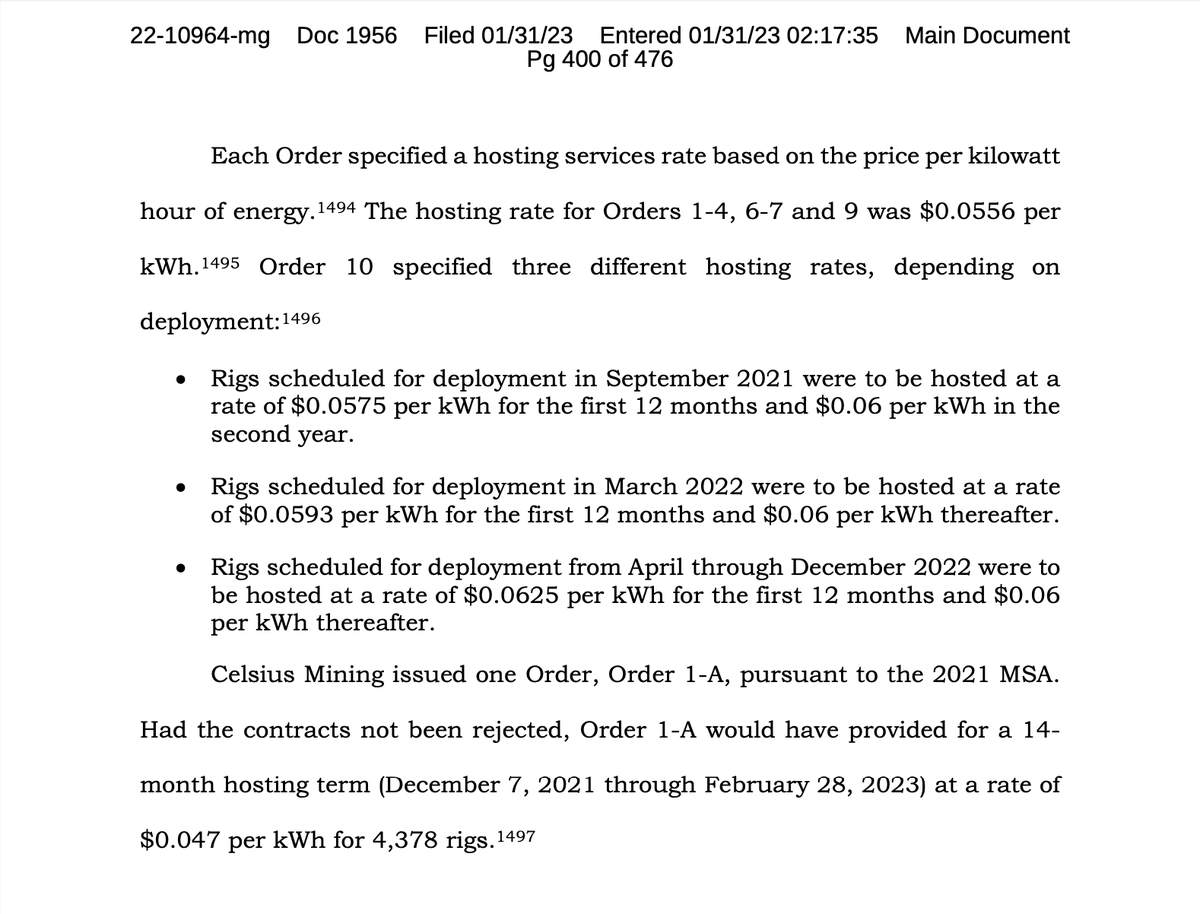

2/27 allegedly interpreted as fixed—hosting rate of approximately $0.056 per kWh of energy. Celsius Mining elected to purchase rigs through Core Scientific, in addition to procuring hosting services, believing it would benefit from wholesale

2/27 allegedly interpreted as fixed—hosting rate of approximately $0.056 per kWh of energy. Celsius Mining elected to purchase rigs through Core Scientific, in addition to procuring hosting services, believing it would benefit from wholesale

2/5 all of its utility and hosting costs—and in some instances disputes those charges. Figure 47 below details Celsius Mining’s outstanding utility and hosting charges. Celsius Mining has made prepayments to its hosts in the form of contractually stipulated

2/5 all of its utility and hosting costs—and in some instances disputes those charges. Figure 47 below details Celsius Mining’s outstanding utility and hosting charges. Celsius Mining has made prepayments to its hosts in the form of contractually stipulated

2/17 saw mining as a means of generating significant returns. But as reflected in the discussion above at Part One, Section XI.D.1, mining returns have decreased significantly since Celsius Mining began its operations, and, in 2022, Celsius Mining’s financial

2/17 saw mining as a means of generating significant returns. But as reflected in the discussion above at Part One, Section XI.D.1, mining returns have decreased significantly since Celsius Mining began its operations, and, in 2022, Celsius Mining’s financial

2/10 third-party to piggy-back off of that third party’s existing hosting agreements with Core Scientific, Inc., the entity that—through January 4, 2023—was Celsius Mining’s primary third-party mining host. Between December 2020 and February 2022,

2/10 third-party to piggy-back off of that third party’s existing hosting agreements with Core Scientific, Inc., the entity that—through January 4, 2023—was Celsius Mining’s primary third-party mining host. Between December 2020 and February 2022,

2/25 (“BTC”) transactions. A block is a collection of data that contains a timestamp and other information about recent transactions. Bitcoin miners assemble blocks of transactions in exchange for which they receive a “reward” in BTC. The following example

2/25 (“BTC”) transactions. A block is a collection of data that contains a timestamp and other information about recent transactions. Bitcoin miners assemble blocks of transactions in exchange for which they receive a “reward” in BTC. The following example

2/4 Mining, the entity under whichCelsius conducts its Bitcoin mining operations, is generally current on its utility bills (both those billed directly and those billed indirectly through third-party Bitcoin mining hosts) with two exceptions.

2/4 Mining, the entity under whichCelsius conducts its Bitcoin mining operations, is generally current on its utility bills (both those billed directly and those billed indirectly through third-party Bitcoin mining hosts) with two exceptions.

2/13 in one place all of Celsius’s crypto assets. The Coin Stats worksheet on the Freeze Report summarizes Celsius’s crypto assets and liabilities on a coin-by-coin basis. At all times, a significant portion of Celsius’s crypto assets was deployed and

2/13 in one place all of Celsius’s crypto assets. The Coin Stats worksheet on the Freeze Report summarizes Celsius’s crypto assets and liabilities on a coin-by-coin basis. At all times, a significant portion of Celsius’s crypto assets was deployed and

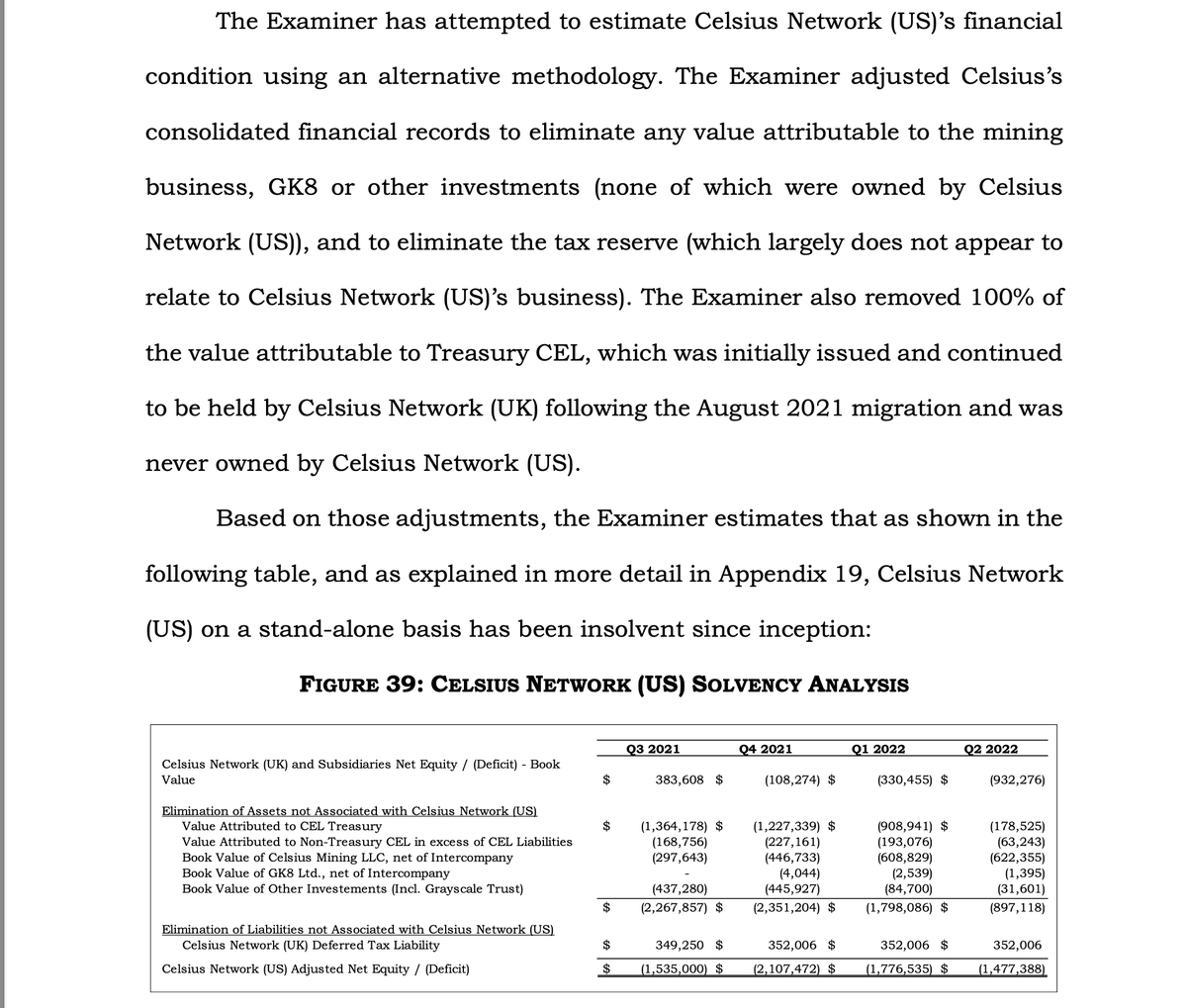

2/6 stand-alone financial records of Celsius Network (US) to evaluate whether she could reach a conclusion about its financial condition. As a result of the financial record issues identified above, the Examiner determined that at this stage the

2/6 stand-alone financial records of Celsius Network (US) to evaluate whether she could reach a conclusion about its financial condition. As a result of the financial record issues identified above, the Examiner determined that at this stage the

2/14 customer assets that were deployed with third parties at the time of the migration. Rather than unwinding those deployments or substituting Celsius Network (US) as the counterparty, the deployed crypto assets remained with Celsius Network (UK).

2/14 customer assets that were deployed with third parties at the time of the migration. Rather than unwinding those deployments or substituting Celsius Network (US) as the counterparty, the deployed crypto assets remained with Celsius Network (UK).

2/17 recognized at the Celsius Network (UK) level, which was the top-tier operating company and the direct or indirect owner of all other Celsius businesses and investments. As a result, Celsius Network (UK) directly or indirectly owned all of the equity in

2/17 recognized at the Celsius Network (UK) level, which was the top-tier operating company and the direct or indirect owner of all other Celsius businesses and investments. As a result, Celsius Network (UK) directly or indirectly owned all of the equity in

2/9 never meaningfully deployed CEL to earn yield or liquidated Celsius’s CEL holdings. Internal Celsius documents often referred to CEL as an “undeployed asset.” Mr. Perman explained that Celsius could not deploy CEL to earn yield because of “wrong way risk. The counterparty

2/9 never meaningfully deployed CEL to earn yield or liquidated Celsius’s CEL holdings. Internal Celsius documents often referred to CEL as an “undeployed asset.” Mr. Perman explained that Celsius could not deploy CEL to earn yield because of “wrong way risk. The counterparty

2/16 As Mr. Sunada-Wong observed: “One of the huge structural problems we have is that we have a hole in our balance sheet, and that isn’t going to change unless the mining company gets a valuation.” Originally called Celsius Core LLC, Celsius Mining was

2/16 As Mr. Sunada-Wong observed: “One of the huge structural problems we have is that we have a hole in our balance sheet, and that isn’t going to change unless the mining company gets a valuation.” Originally called Celsius Core LLC, Celsius Mining was

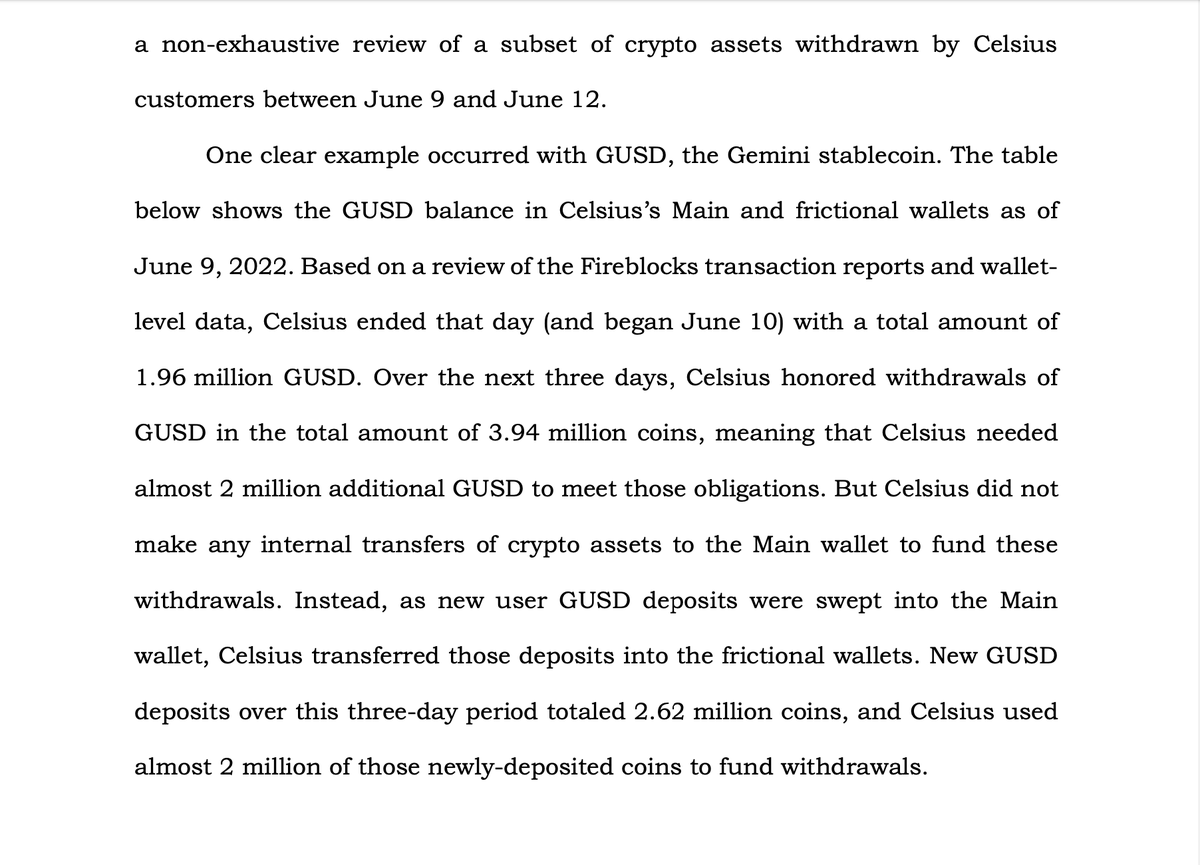

2/22 customer deposits to fund customer withdrawal requests. As previously explained in the Interim Report, Celsius processed customer withdrawals through what it referred to as the “frictional wallets,” or what Mr. Tappen described as “the company’s ATM.”

2/22 customer deposits to fund customer withdrawal requests. As previously explained in the Interim Report, Celsius processed customer withdrawals through what it referred to as the “frictional wallets,” or what Mr. Tappen described as “the company’s ATM.”