How to get URL link on X (Twitter) App

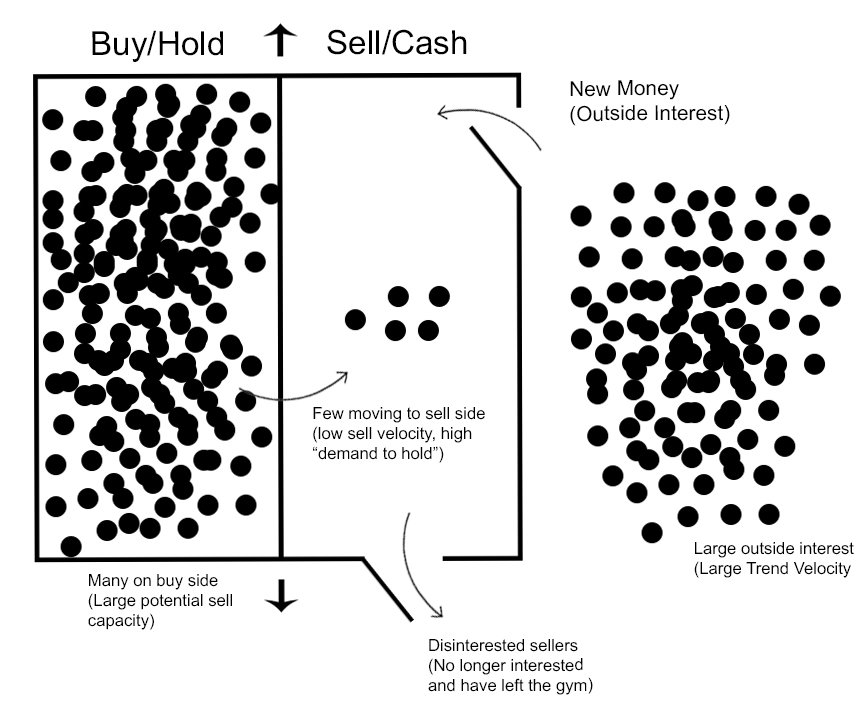

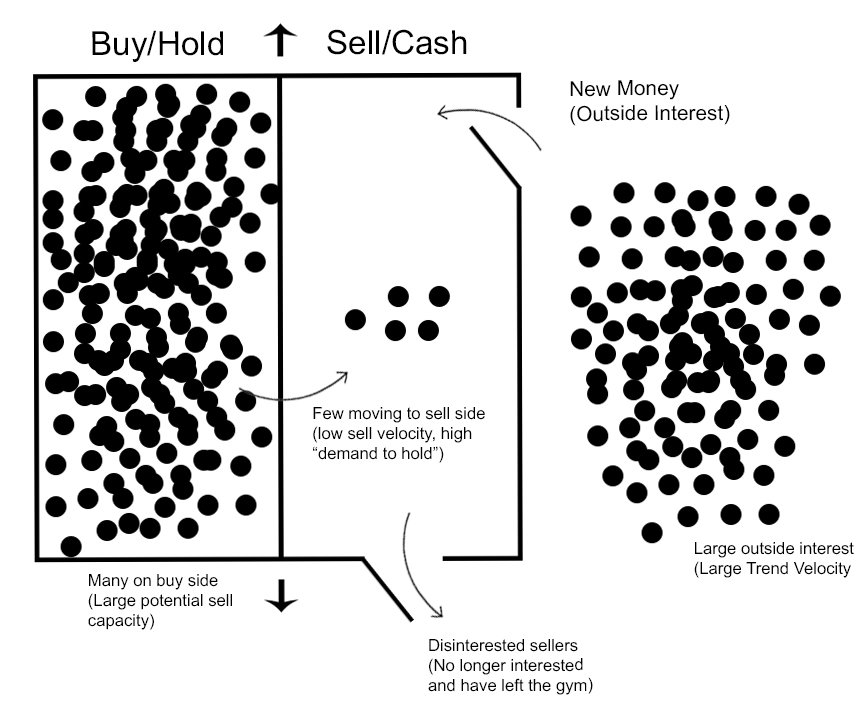

2/ People enter the gym first by being in cash (entering through the door and sitting on the sell/cash side). When they move to the buy side, price increases. When those on the buy/hold side move to the sell side, price decreases.

2/ People enter the gym first by being in cash (entering through the door and sitting on the sell/cash side). When they move to the buy side, price increases. When those on the buy/hold side move to the sell side, price decreases.