3rd cycle survivor going into the 4th with slightly more money | building @seiyantoken9000 and @symphonyAg

How to get URL link on X (Twitter) App

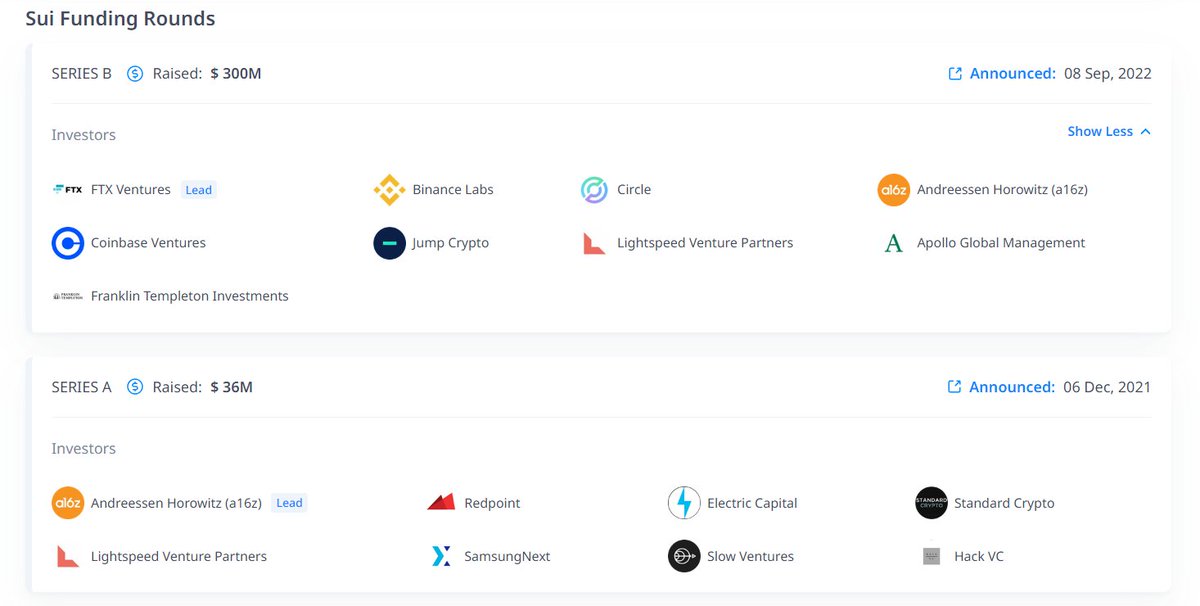

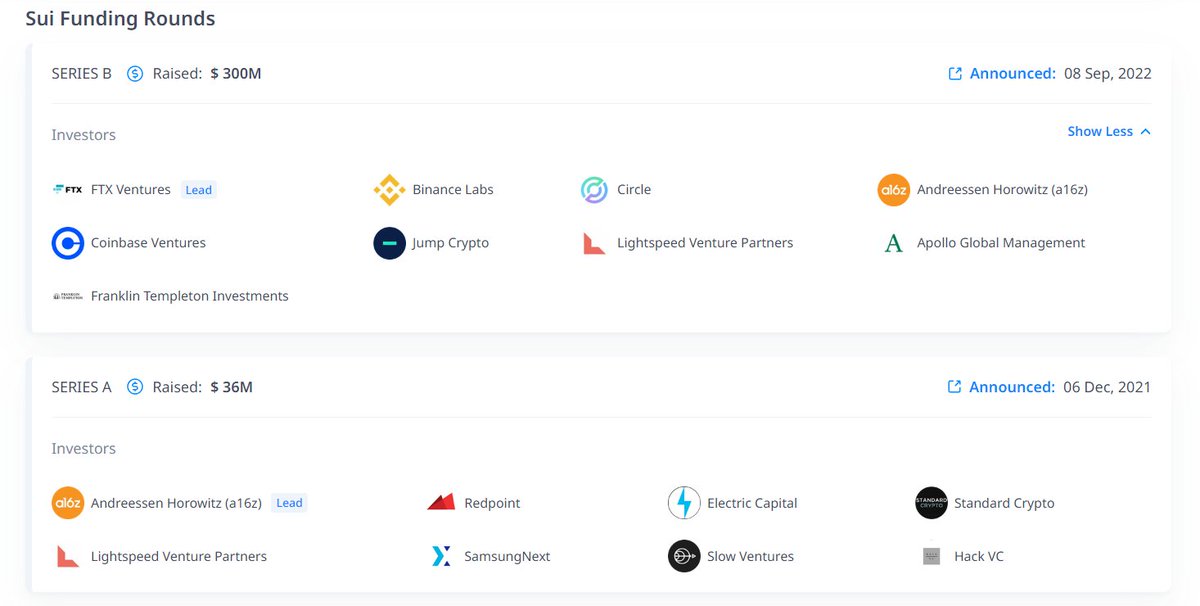

https://twitter.com/sell9000/status/1731533899384185177Like $TIA & $SEI, $SUI was quickly added to tier 1 CEX's such as CB & Binance. Makes sense; just look at all the heavy hitter VCs backing it.

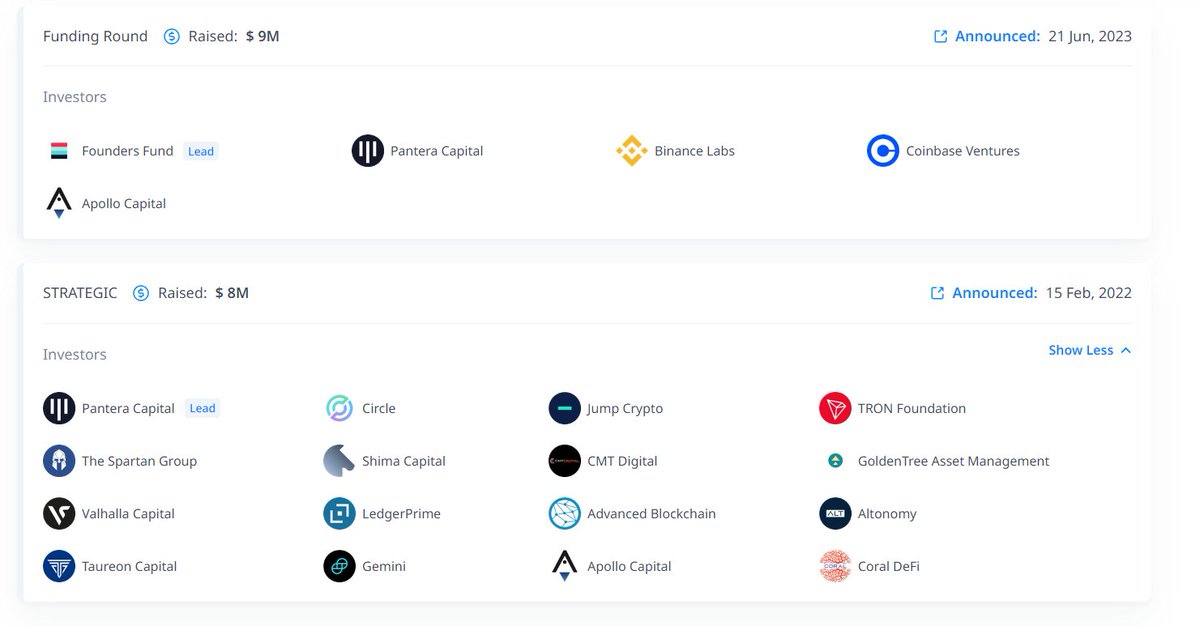

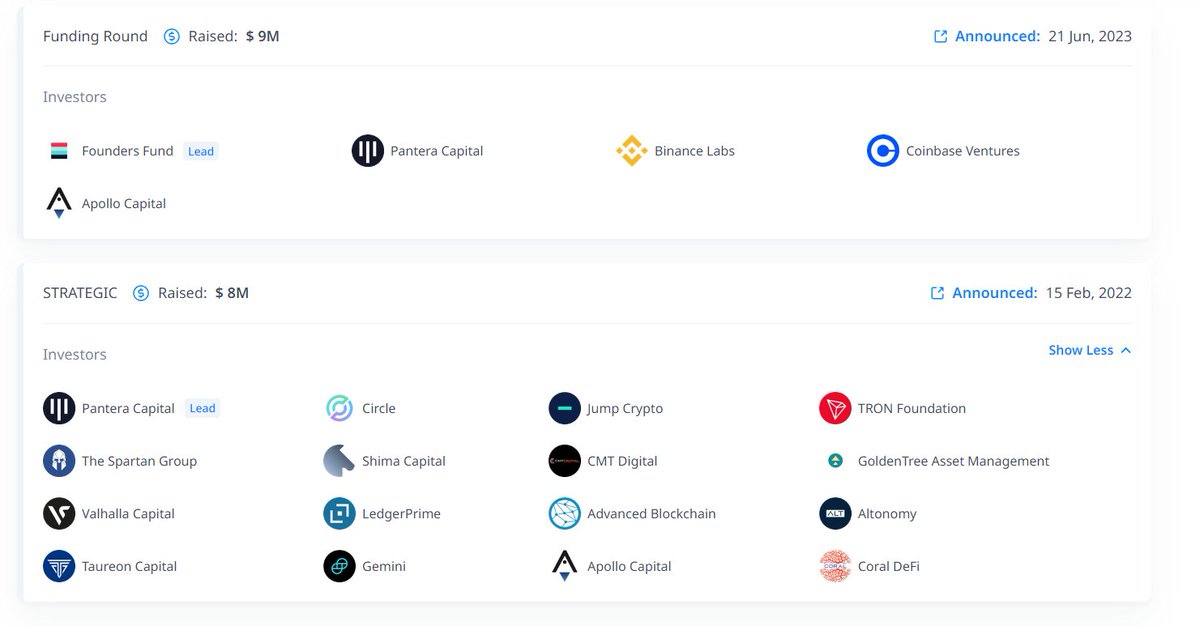

https://twitter.com/sell9000/status/1727537391651467729$MAV token launched end of June 2023 with quick listing on @Binance. Makes sense, especially with all the other heavy hitters backing the project, including @coinbase, @circle, and @jump_

First part of my DD to check out probability of deliverability was inspecting the team. Obviously I know the co-founder is ex-Robinhood. The rest are very good for networking as well. But who is actually in the trenches coding the crypto stuff? So I keep checking...

First part of my DD to check out probability of deliverability was inspecting the team. Obviously I know the co-founder is ex-Robinhood. The rest are very good for networking as well. But who is actually in the trenches coding the crypto stuff? So I keep checking...

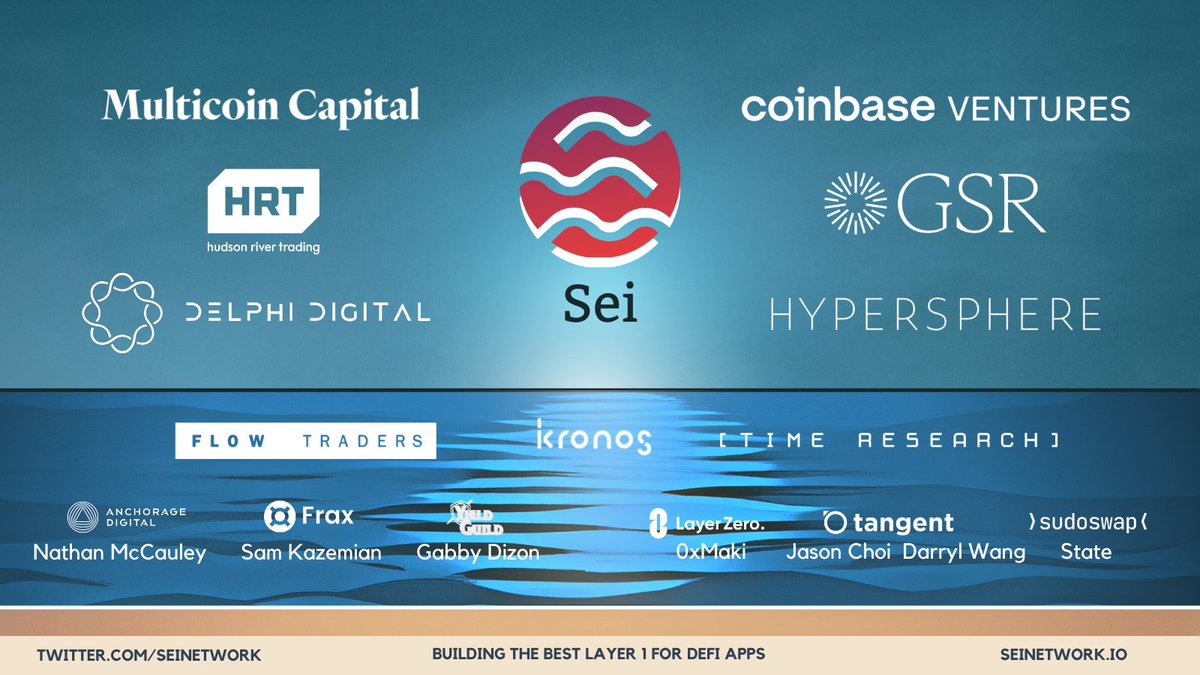

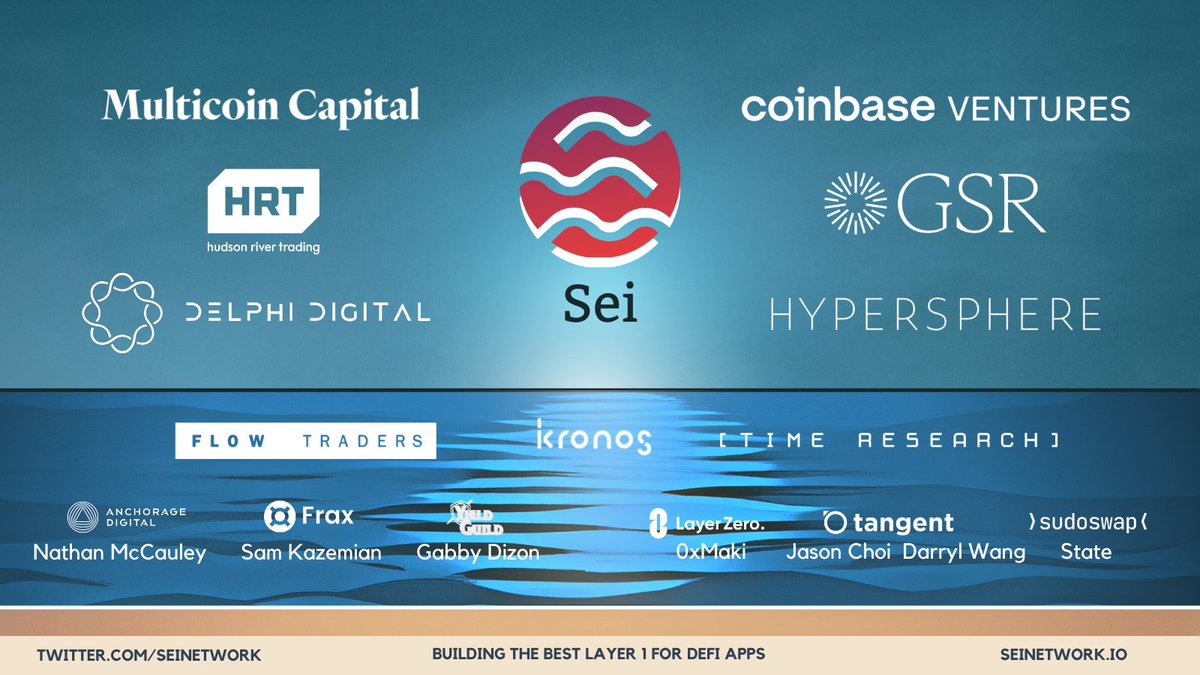

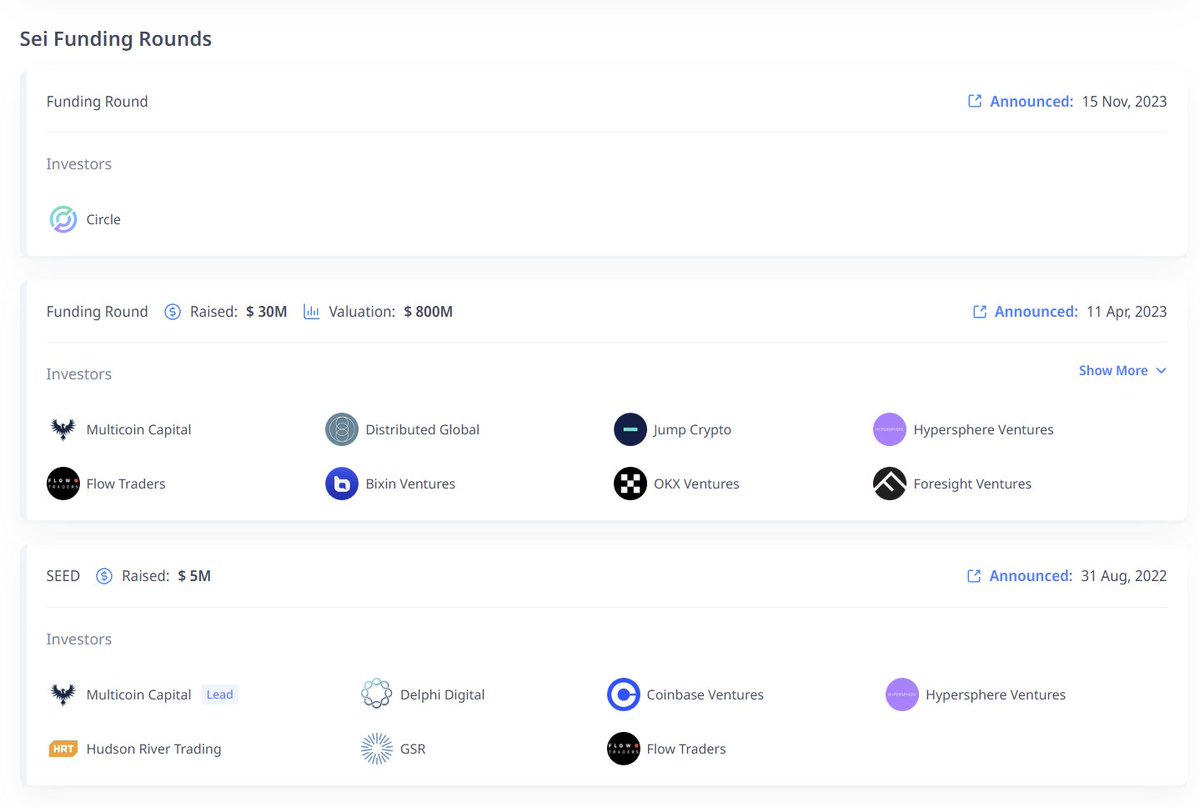

https://twitter.com/sell9000/status/1726381668804554815$SEI just launched in Aug 2023 & was quickly listed on Tier 1 CEXs including @coinbase.

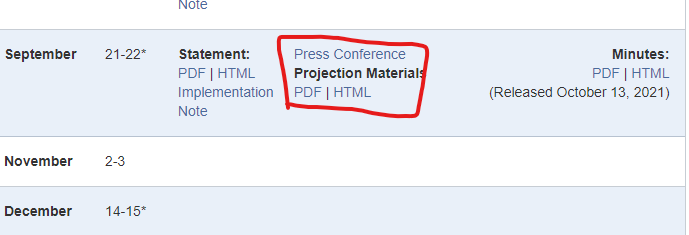

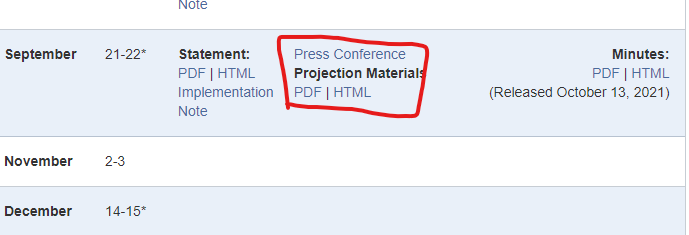

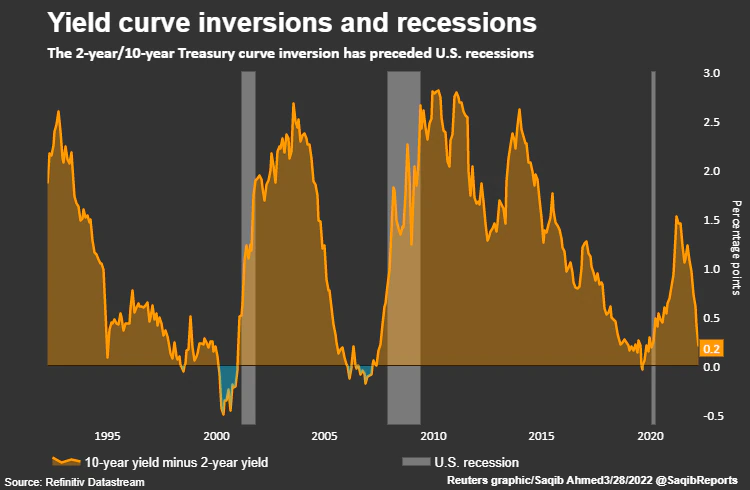

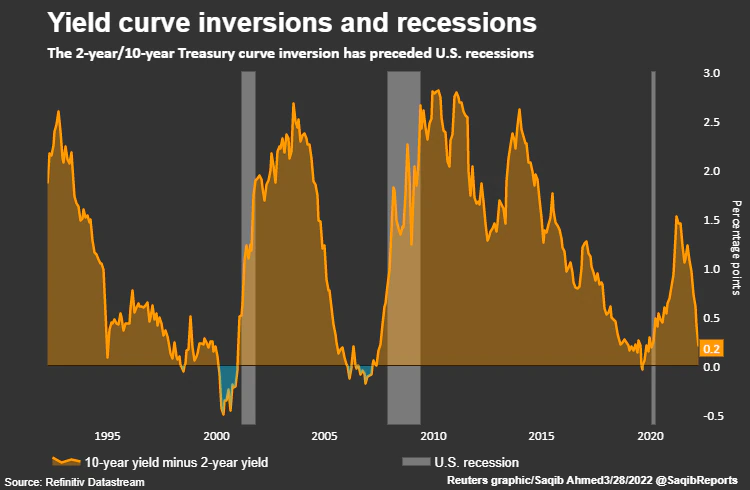

During this precursor period, we often see market rallies. For example, in the 2008-09 recession (which started in Jan '08), yield curve inverted in Aug '06 (A) after a dramatic correction, then proceeded to rally an extended run up before finally entering recession (B).

During this precursor period, we often see market rallies. For example, in the 2008-09 recession (which started in Jan '08), yield curve inverted in Aug '06 (A) after a dramatic correction, then proceeded to rally an extended run up before finally entering recession (B).