I share design, growth & innovation stories for better, wealthier, and more creative people.

How to get URL link on X (Twitter) App

https://twitter.com/jack/status/14219553813251399741/

https://twitter.com/studios/status/1402986591065235464

2. Fintech SPACs transactions in H1

2. Fintech SPACs transactions in H1

The technology analyst shares her perspectives on the tech industry and analyzing a company:

The technology analyst shares her perspectives on the tech industry and analyzing a company:

Why healthcare is ripe to be disrupted?

Why healthcare is ripe to be disrupted?

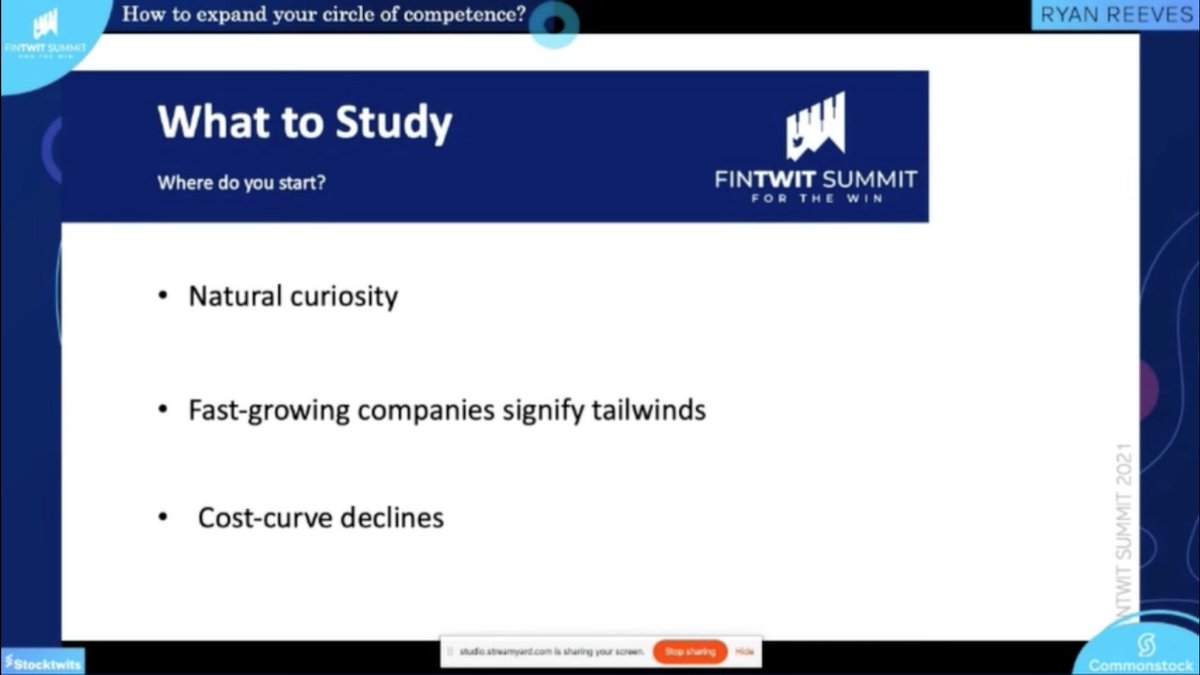

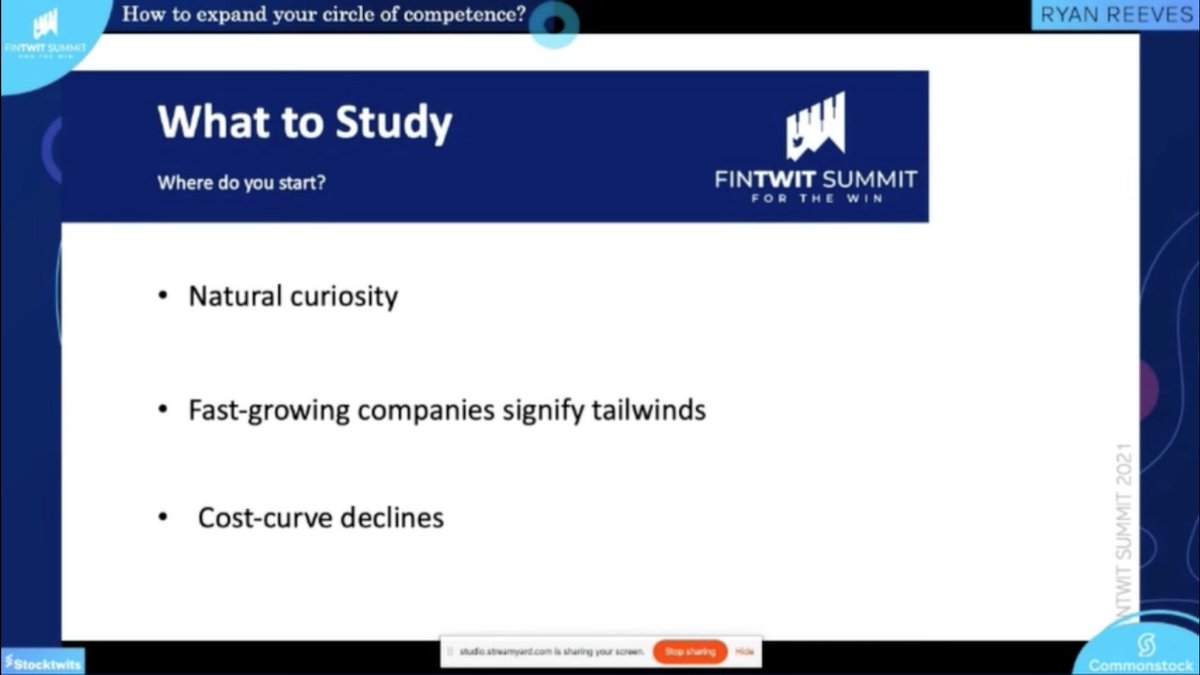

Muji shares the 3 areas of the focus of his in-depth research:

Muji shares the 3 areas of the focus of his in-depth research:

1/ @morganhousel

1/ @morganhousel https://twitter.com/studios/status/1373267241349881856

Kris structures portfolio management in 3 categories:

Kris structures portfolio management in 3 categories:

Regardless of the disadvantages, you can focus on the other side of the coin 🪙:

Regardless of the disadvantages, you can focus on the other side of the coin 🪙:

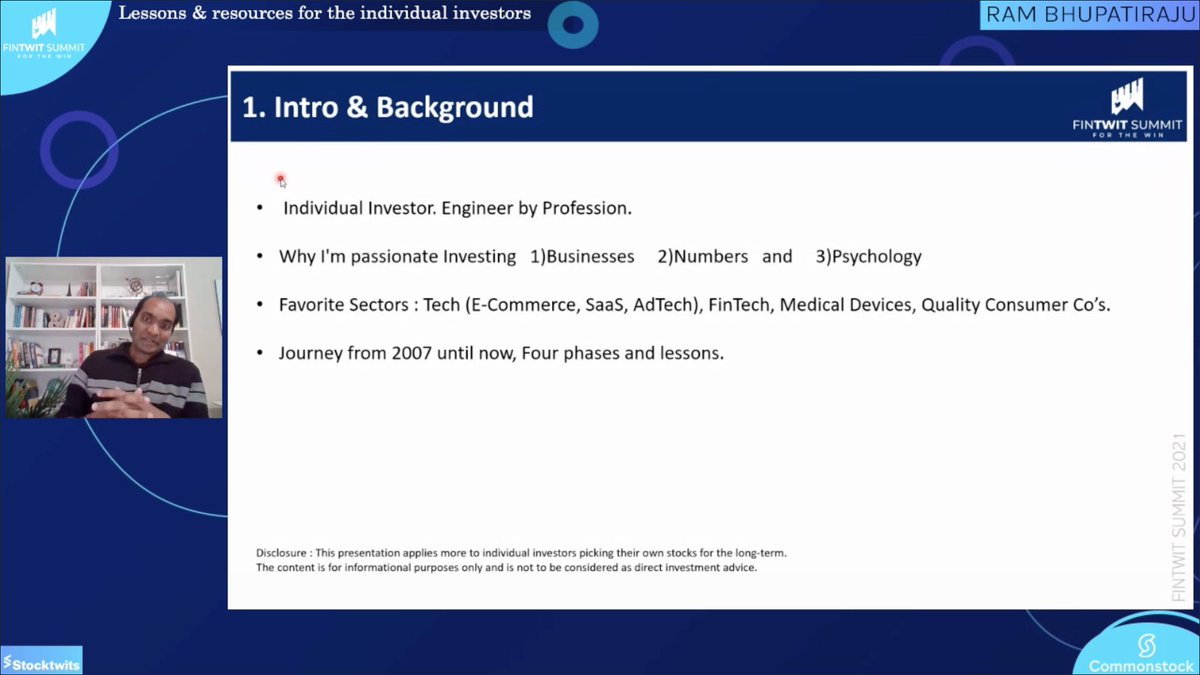

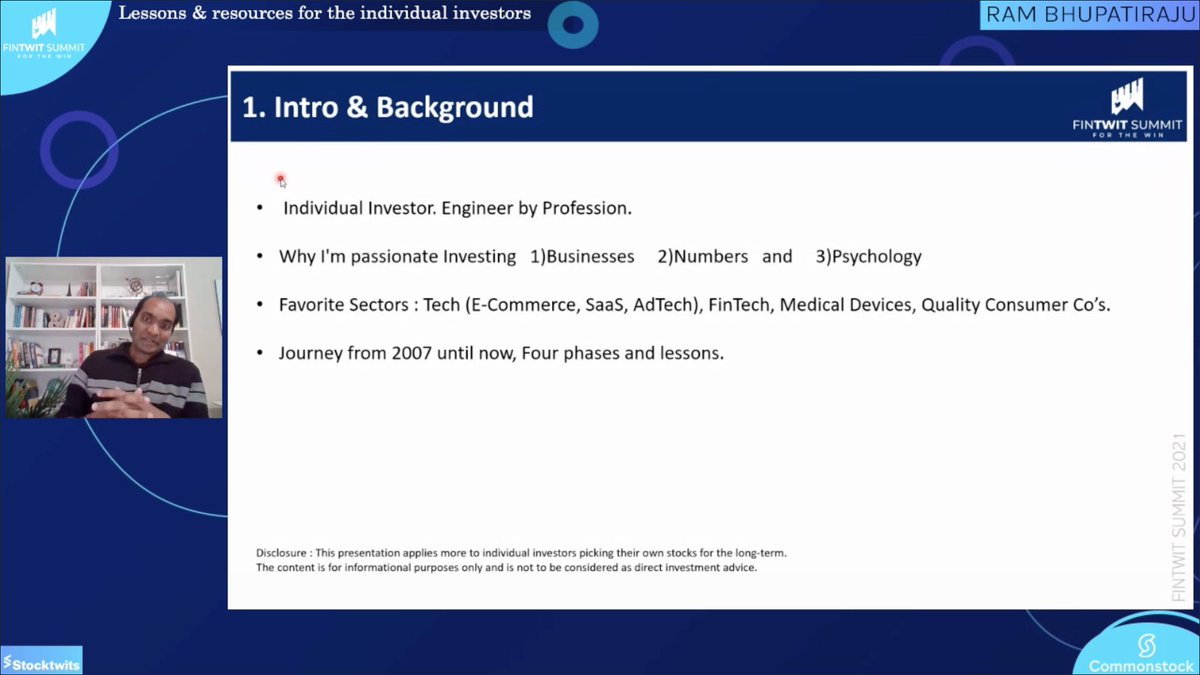

Here are the principles that Ram follows:

Here are the principles that Ram follows:

You need to have a way to track the different elements that are essential to the company:

You need to have a way to track the different elements that are essential to the company:

If you had invested $1000 in $AAPL in 2008, today you would have worth >$20477.

If you had invested $1000 in $AAPL in 2008, today you would have worth >$20477.

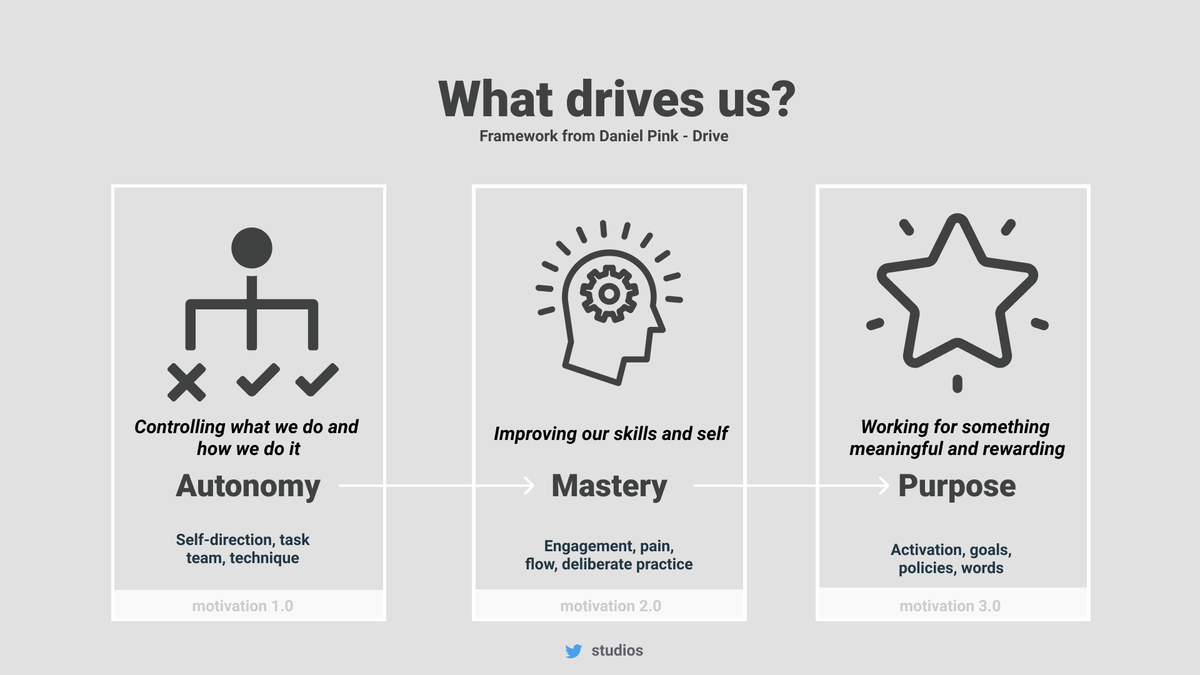

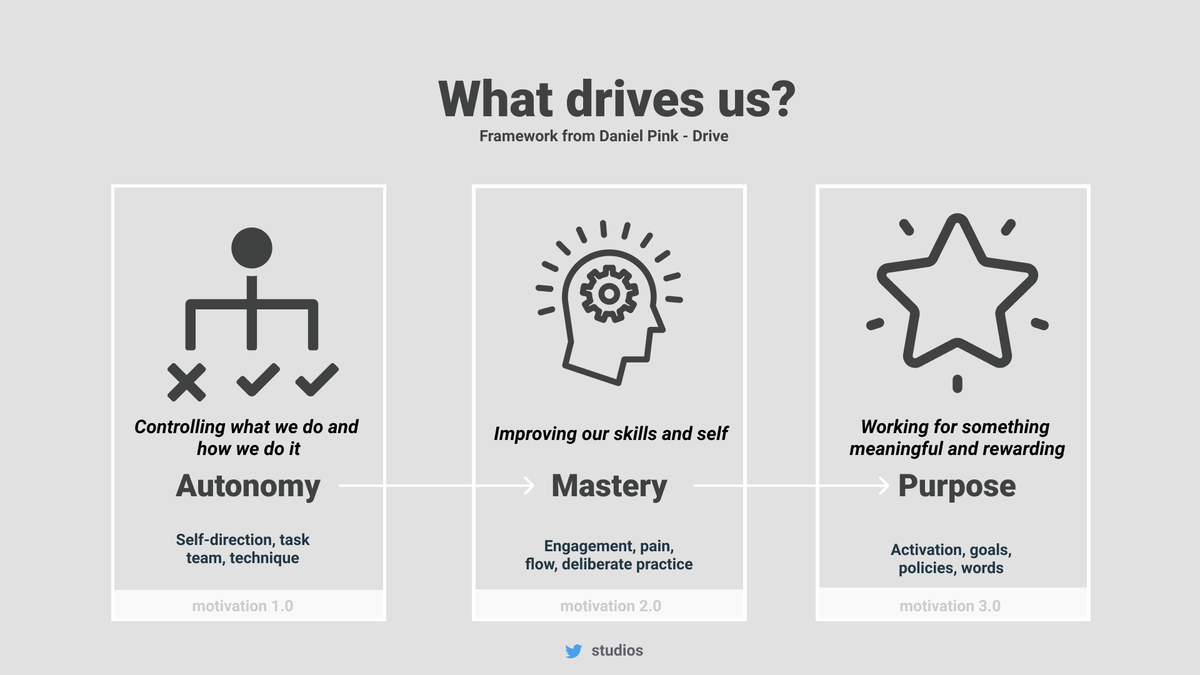

1/ Autonomy -Being in control and able to guide both what we do and how we do it.

1/ Autonomy -Being in control and able to guide both what we do and how we do it.

1/ @adblockplus stops ads, improves browser speed, and protects you online.

1/ @adblockplus stops ads, improves browser speed, and protects you online.