Trading Q&A by @zerodhaonline is a community Q&A forum for all things related to trading and stock markets.

How to get URL link on X (Twitter) App

Nifty 50 market breadth for the day;

Nifty 50 market breadth for the day;

Nifty 50 market breadth for the day;

Nifty 50 market breadth for the day;

Nifty Realty was the best-performing sector, rising more than 2%, followed by Nifty Media and Metal, gaining more than 1.3% each. While Nifty Energy and PSU Bank indexes were the biggest losers, falling more than 1%.

Nifty Realty was the best-performing sector, rising more than 2%, followed by Nifty Media and Metal, gaining more than 1.3% each. While Nifty Energy and PSU Bank indexes were the biggest losers, falling more than 1%.

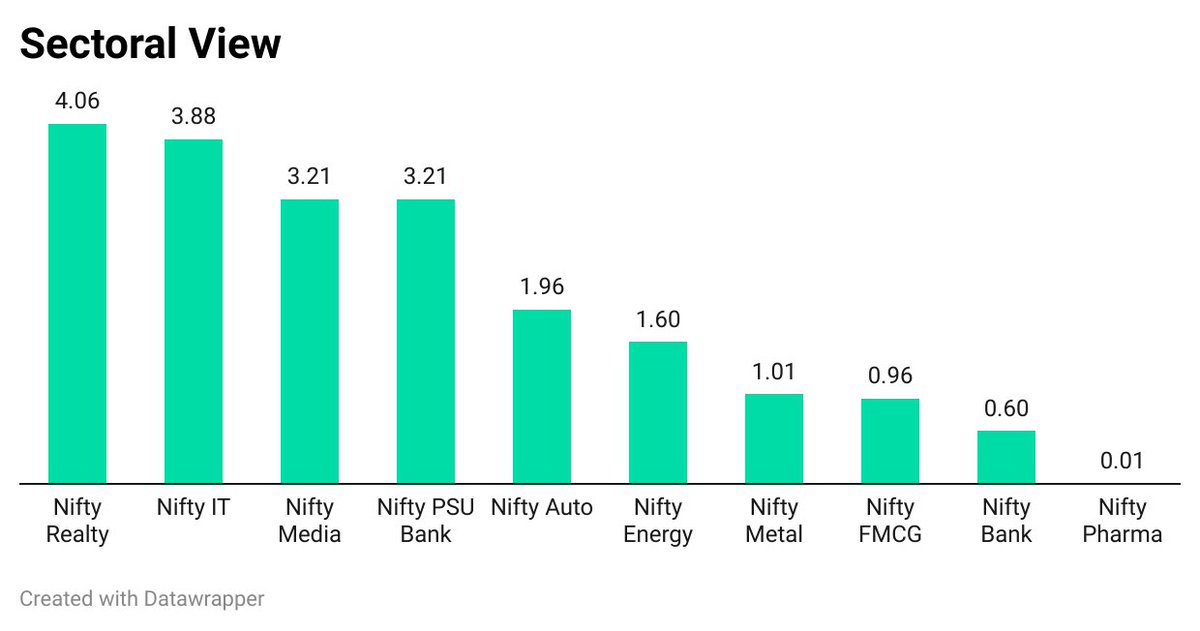

All sectoral indices ended the day in green. With Nifty Realty topping the tables, up by over 4%. Followed by Nifty IT, Media and PSU Bank indexes, each surging over 3%.

All sectoral indices ended the day in green. With Nifty Realty topping the tables, up by over 4%. Followed by Nifty IT, Media and PSU Bank indexes, each surging over 3%.

All sectors managed to close on a positive note. Nifty Realty index leading the gains, up by over 3.14%.

All sectors managed to close on a positive note. Nifty Realty index leading the gains, up by over 3.14%.