How to get URL link on X (Twitter) App

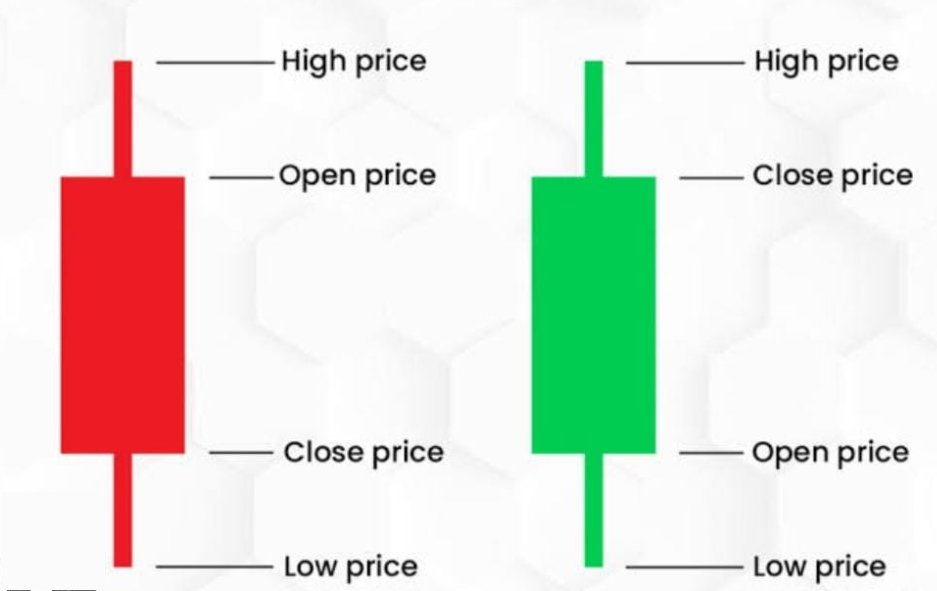

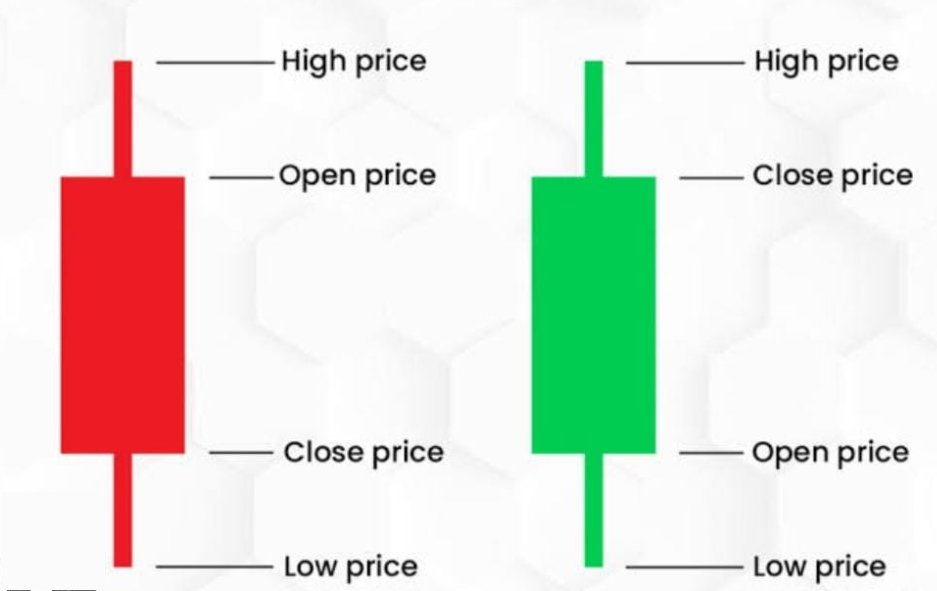

Trade the Gap : We analyzed the outcome of going long on gap-up days and closing the position at the end of the day to see how the market would perform.

Trade the Gap : We analyzed the outcome of going long on gap-up days and closing the position at the end of the day to see how the market would perform.

2/ By scrutinizing historical data from Banknifty, we aim to reveal the truth behind the trend. Can we rely on trends to guide our trading strategies, or is there more complexity at play? 📈📉

2/ By scrutinizing historical data from Banknifty, we aim to reveal the truth behind the trend. Can we rely on trends to guide our trading strategies, or is there more complexity at play? 📈📉

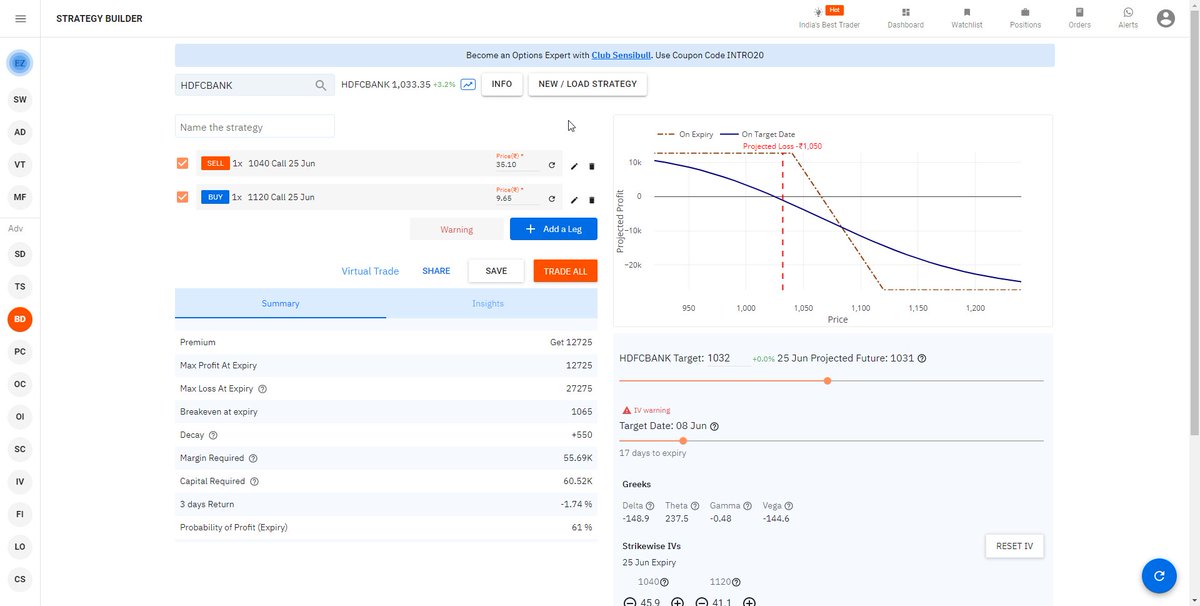

What a move and Days like this makes me believe that you should hedge your position. Hedge trade helped to control a big loss. Added another Bearish Call Spread in Tata Motors (Last one :-) ) .

What a move and Days like this makes me believe that you should hedge your position. Hedge trade helped to control a big loss. Added another Bearish Call Spread in Tata Motors (Last one :-) ) .

Zeel :

Zeel :