I'm just thinking out loud here.

-

Charting: https://t.co/E5e2plZFD7

-

https://t.co/W5i6e88Dj6

-

My Hungarian YouTube channel 👇

How to get URL link on X (Twitter) App

https://twitter.com/vojtek_milan/status/15236739603065364482)

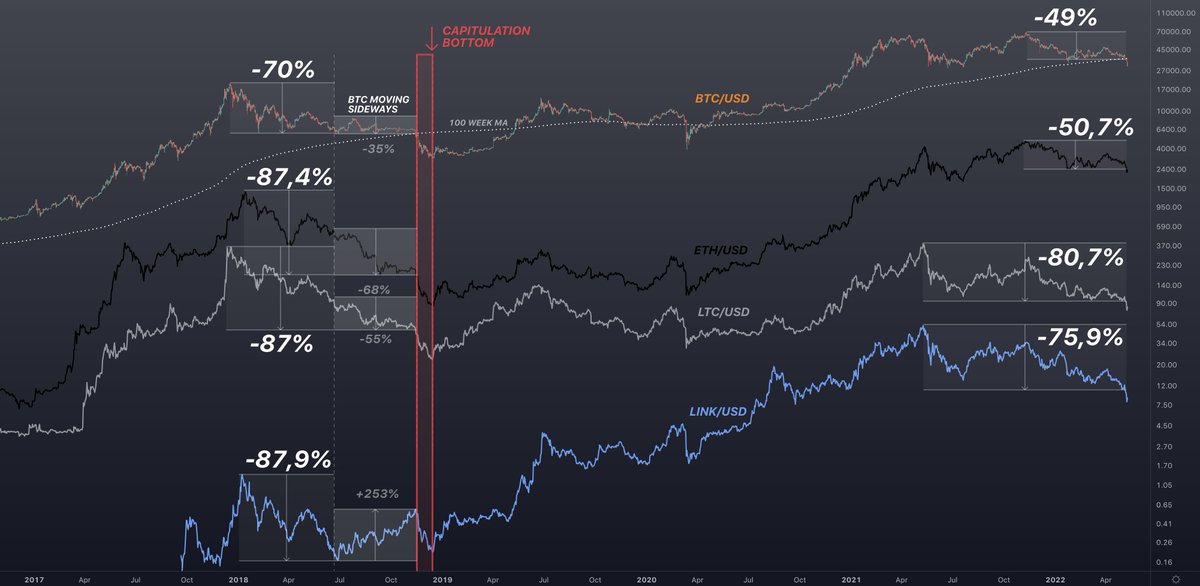

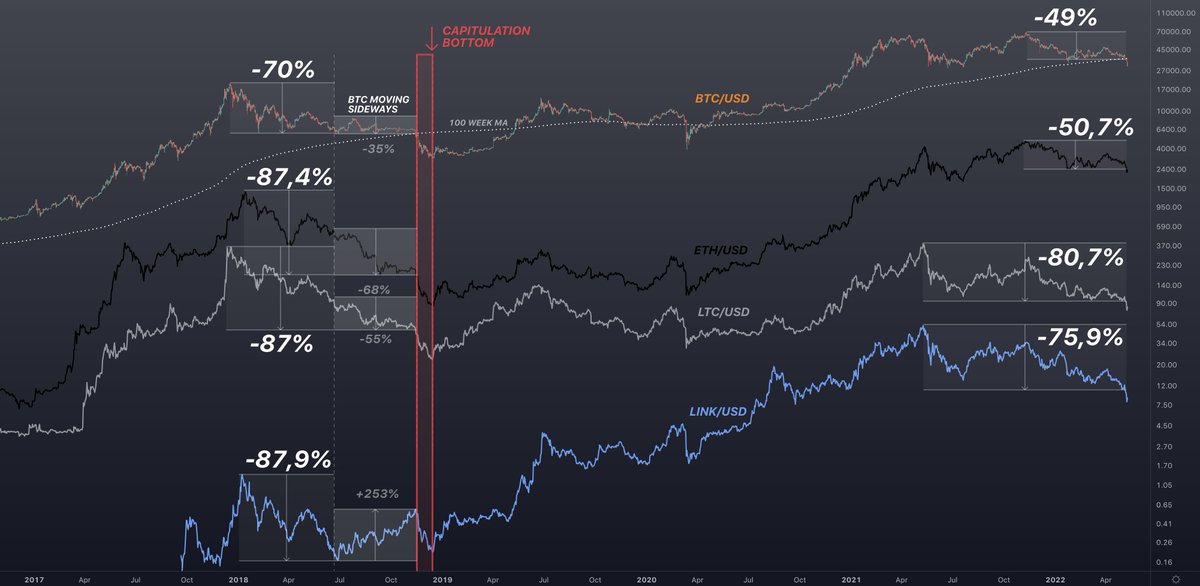

Oh and always do your math. I have seen serious problems lately regarding calculating %.

Oh and always do your math. I have seen serious problems lately regarding calculating %.

https://twitter.com/vojtek_milan/status/1523673960306536448

*First of all, it's pretty hard to determine the "cycle top".

*First of all, it's pretty hard to determine the "cycle top".

https://twitter.com/vojtek_milan/status/1450807601558601731

...trying to believe that we are going to witness the same rally from these levels again. Market not always gives a 2nd chance.

...trying to believe that we are going to witness the same rally from these levels again. Market not always gives a 2nd chance.