How to get URL link on X (Twitter) App

Fundamentally despite a pickup in oil at year start, Nigeria swung into a CA deficit of over $1bn. Although some is shifting parts but our services deficit has surged again as the $ illusion is back and we are seeing ourselves as Americans again.

Fundamentally despite a pickup in oil at year start, Nigeria swung into a CA deficit of over $1bn. Although some is shifting parts but our services deficit has surged again as the $ illusion is back and we are seeing ourselves as Americans again.

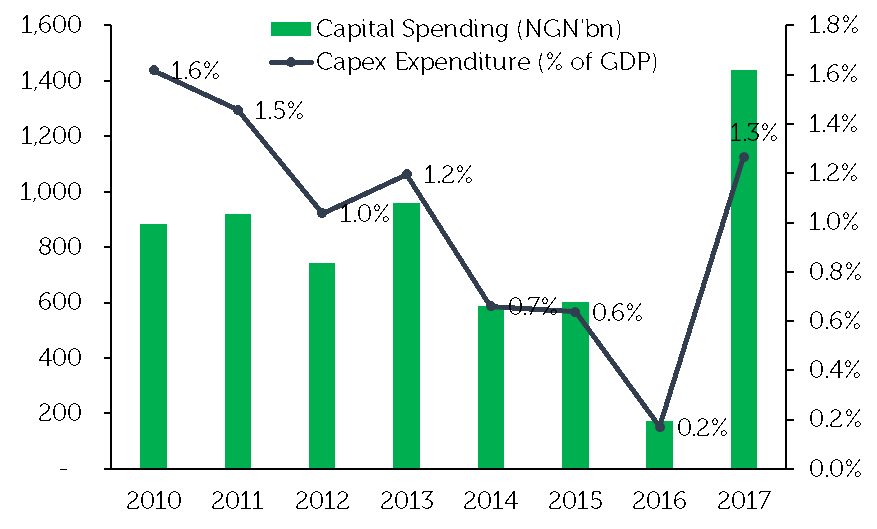

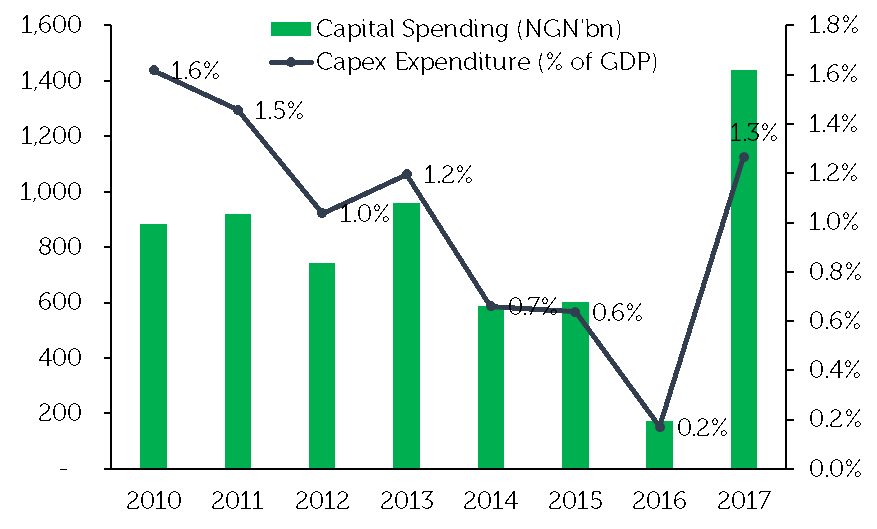

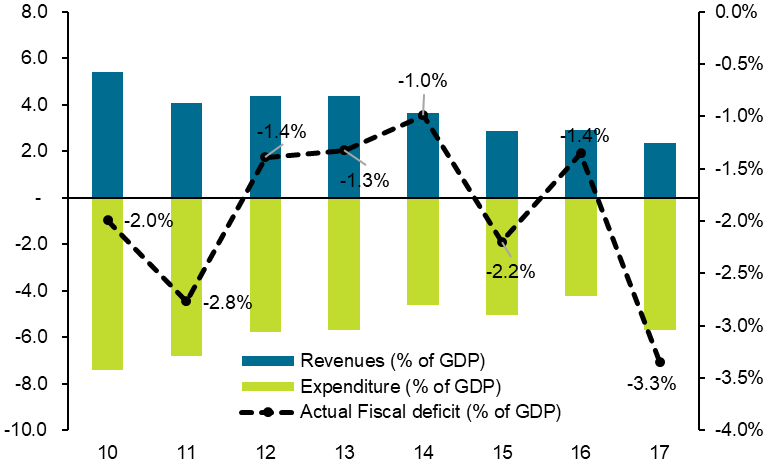

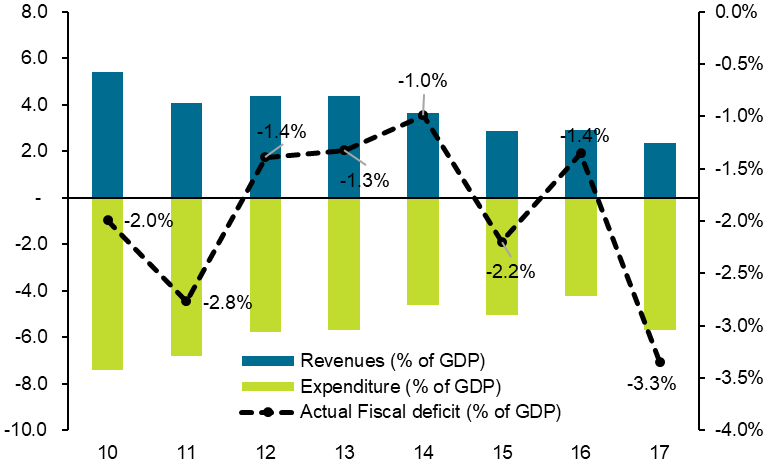

I admire BRF and he is clearly in campaign mode but NO the FG cannot fund infrastructure in Nigeria. Last year's 1.3% came after pushing debt/GDP by 200bps to 16% at a high cost. nearly 70% debt service to revenue. The FG balance sheet simply cannot take us from 1-5% of GDP

I admire BRF and he is clearly in campaign mode but NO the FG cannot fund infrastructure in Nigeria. Last year's 1.3% came after pushing debt/GDP by 200bps to 16% at a high cost. nearly 70% debt service to revenue. The FG balance sheet simply cannot take us from 1-5% of GDP

But interestingly, capex spending came in a record NGN1.44tr (1.3% of GDP and around 66% of target) with overall budget execution at 87% suggesting some credibility in implementation despite the costs driven by higher drawdowns by Works, Power and Housing

But interestingly, capex spending came in a record NGN1.44tr (1.3% of GDP and around 66% of target) with overall budget execution at 87% suggesting some credibility in implementation despite the costs driven by higher drawdowns by Works, Power and Housing