Thread Reader helps you read and share Twitter threads easily!

I'm @ThreadReaderApp a Twitter bot here to help you read threads more easily. To trigger me, you just have to reply to (or quote) any tweet of the thread you want to unroll and mention me with the "unroll" keyword and I'll send you a link back on Twitter 😀

— Thread Reader App (@threadreaderapp) November 25, 2017

X thread is series of posts by the same author connected with a line!

From any post in the thread, mention us with a keyword "unroll"

@threadreaderapp unroll

Follow @ThreadReaderApp to mention us easily!

Practice here first or read more on our help page!

Recent

Mar 10

Read 5 tweets

FT op-ed: “China’s growth target is a global problem…The target is not based in economics. It’s a political goal…Pursuing that aim, Beijing has been overinvesting for years, but lately it has been dumping the excess output it can’t sell at home.”

ft.com/content/cb69fb…

ft.com/content/cb69fb…

FT op-ed: “In the past, China’s export volumes rose with prices; this decade, Beijing has dropped export prices by nearly 20 per cent, producing a 40 per cent surge in volume…As a share of global GDP, no nation has ever had a larger trade surplus.”

ft.com/content/cb69fb…

ft.com/content/cb69fb…

FT op-ed: “China’s dumping offensive is deindustrialising rival exporters the world over, idling car factories in Thailand and textile plants in Indonesia. Across Asia, nations where Chinese imports are rising fastest also…have the weakest job growth.”

ft.com/content/cb69fb…

ft.com/content/cb69fb…

Mar 10

Read 6 tweets

as much as I greatly dislike generalizing, it seems like when I encounter people who have insanely blown out reactions that cause real harm to nothingburger scenarios, it's more often than not theyfabs/hefabs

that's certainly not to say all trans men or transmascs are like that by any means, not even close, but for some reason it seems when it does happen, that's who it often is

idk I think it just kind of connects back to how a lot of trans/lgbt infrastructure was built by trans women, and it feels like people just dogpile onto that for themselves and then turn around and bash trans women for it (???)

Mar 10

Read 11 tweets

🧵🧵Have Candace and Tucker just lost their minds?

No. They have not they are distributing Dugin occultism and satanism to American audiences and calling it Christianity.

In 1980, Dugin joined the Yuzhinsky Circle, a group that dabbled in Satanism, esoteric Nazism, and other forms of the occult. The circle gained a reputation for séances, mysticism, hypnotism, Ouija boards, trances, and pentagrams. Dugin adopted an alter ego named “Hans Sievers” a reference to a Nazi researcher of the paranormal.

His influences include René Guénon (a French occultist), Julius Evola (an Italian fascist occultist), and Aleister Crowley the most famous Satanist of the 20th century.

The symbol Dugin chose for his political movement is the “wheel of chaos” which comes from British occultism and looks strikingly similar to SS and neo-Nazi symbols.

Despite claiming to be a Russian Orthodox Christian, Dugin’s actual beliefs are manifestationist and occultist.

His supposed Christian allegiance is in fact adherence to esoteric ideas that he claims are the hidden truth underneath Christianity.

A Russian occultist fascist philosopher who practiced séances, adopted a Nazi alter ego, was influenced by Aleister Crowley, uses a chaos magic symbol, and believes in a cosmic war between Christianity and Judaism that man’s ideas are now being delivered, almost word for word, to the largest conservative podcast audiences in America.

They haven’t lost their minds. They’re doing exactly what Dugin’s framework calls for: using Christian civilizational language to deliver occult-fascist content to Western audiences, in order to destroy the liberal democratic order from within, break the American-Israeli alliance, and reorient the West toward the Eurasian axis.

The founders built the First Amendment to prevent foreign religious and political influence from capturing American discourse. What’s happening right now is a Russian occult-fascist framework, laundered through Catholic cultural identity and conservative media infrastructure, being delivered to the American public as though it were patriotic Christianity.

It isn’t. And once you see the overlay between Dugin’s published writings and Tucker and Candace’s recent content, you can’t unsee it.

No. They have not they are distributing Dugin occultism and satanism to American audiences and calling it Christianity.

In 1980, Dugin joined the Yuzhinsky Circle, a group that dabbled in Satanism, esoteric Nazism, and other forms of the occult. The circle gained a reputation for séances, mysticism, hypnotism, Ouija boards, trances, and pentagrams. Dugin adopted an alter ego named “Hans Sievers” a reference to a Nazi researcher of the paranormal.

His influences include René Guénon (a French occultist), Julius Evola (an Italian fascist occultist), and Aleister Crowley the most famous Satanist of the 20th century.

The symbol Dugin chose for his political movement is the “wheel of chaos” which comes from British occultism and looks strikingly similar to SS and neo-Nazi symbols.

Despite claiming to be a Russian Orthodox Christian, Dugin’s actual beliefs are manifestationist and occultist.

His supposed Christian allegiance is in fact adherence to esoteric ideas that he claims are the hidden truth underneath Christianity.

A Russian occultist fascist philosopher who practiced séances, adopted a Nazi alter ego, was influenced by Aleister Crowley, uses a chaos magic symbol, and believes in a cosmic war between Christianity and Judaism that man’s ideas are now being delivered, almost word for word, to the largest conservative podcast audiences in America.

They haven’t lost their minds. They’re doing exactly what Dugin’s framework calls for: using Christian civilizational language to deliver occult-fascist content to Western audiences, in order to destroy the liberal democratic order from within, break the American-Israeli alliance, and reorient the West toward the Eurasian axis.

The founders built the First Amendment to prevent foreign religious and political influence from capturing American discourse. What’s happening right now is a Russian occult-fascist framework, laundered through Catholic cultural identity and conservative media infrastructure, being delivered to the American public as though it were patriotic Christianity.

It isn’t. And once you see the overlay between Dugin’s published writings and Tucker and Candace’s recent content, you can’t unsee it.

What does he believe?

One: There was a lost golden age before recorded history an ancient civilization of spiritually advanced beings, sometimes called Hyperboreans, sometimes connected to the biblical giants (Nephilim). This idea comes from völkisch occultists who believed the Aryans originated in a paradise at the North Pole called Hyperborea or Arktogäa. Modern civilization destroyed the connection to this spiritual knowledge.

Two: Certain people can access hidden spiritual dimensions through esoteric practices

astral projection, trances, séances, activation of the “third eye.” Modernity suppressed this knowledge. Recovering it is part of the spiritual revolution.

Three: History is a cosmic war between two civilizations. The “Eurasian” civilization (Russia, the Orthodox world, traditional Islam) represents spiritual truth. The “Atlanticist” civilization (America, the West, liberal democracy) represents spiritual death. Russia as the “Third Rome” is the Katechon the Restrainer holding back the Antichrist. And the Antichrist is the Western liberal order.

Four: Jews are the hidden enemy. Dugin refers to a “world plot” and an “eternal enemy” behind it, directly related to the narrative of the Antichrist. This ideology sees an “occult metaphysical war” between Christianity and Judaism. In 1993, he appeared on Russian TV scaring audiences with a world plot allegedly organized by “Kike-Masons,” referencing the Protocols of the Elders of Zion. In his framework, the Jewish desire to rebuild the Third Temple in Jerusalem is the trigger for the apocalypse the final move in the cosmic war against Christian civilization.

Five: The goal is to destroy liberal democracy and replace it with a spiritual-political order based on tradition, hierarchy, and religious authority. There is no separating the political and the theological in Dugin’s Fourth Political Theory. He wants to end the separation of church and state everywhere.

How Candace and Tucker are distributing this to America:

One: There was a lost golden age before recorded history an ancient civilization of spiritually advanced beings, sometimes called Hyperboreans, sometimes connected to the biblical giants (Nephilim). This idea comes from völkisch occultists who believed the Aryans originated in a paradise at the North Pole called Hyperborea or Arktogäa. Modern civilization destroyed the connection to this spiritual knowledge.

Two: Certain people can access hidden spiritual dimensions through esoteric practices

astral projection, trances, séances, activation of the “third eye.” Modernity suppressed this knowledge. Recovering it is part of the spiritual revolution.

Three: History is a cosmic war between two civilizations. The “Eurasian” civilization (Russia, the Orthodox world, traditional Islam) represents spiritual truth. The “Atlanticist” civilization (America, the West, liberal democracy) represents spiritual death. Russia as the “Third Rome” is the Katechon the Restrainer holding back the Antichrist. And the Antichrist is the Western liberal order.

Four: Jews are the hidden enemy. Dugin refers to a “world plot” and an “eternal enemy” behind it, directly related to the narrative of the Antichrist. This ideology sees an “occult metaphysical war” between Christianity and Judaism. In 1993, he appeared on Russian TV scaring audiences with a world plot allegedly organized by “Kike-Masons,” referencing the Protocols of the Elders of Zion. In his framework, the Jewish desire to rebuild the Third Temple in Jerusalem is the trigger for the apocalypse the final move in the cosmic war against Christian civilization.

Five: The goal is to destroy liberal democracy and replace it with a spiritual-political order based on tradition, hierarchy, and religious authority. There is no separating the political and the theological in Dugin’s Fourth Political Theory. He wants to end the separation of church and state everywhere.

How Candace and Tucker are distributing this to America:

Dugin says: There’s a cosmic war between Christian and Jewish civilizations. The Third Temple is the apocalyptic Jewish project that threatens Christianity.

Tucker says: “Could this be a religious war designed to rebuild the Third Temple on the ashes of Al Aqsa?” He accused Chabad of driving the Iran war, saying “Christians have a way of dying disproportionately in these wars, which tells you something about their real motives.”

That’s not Tucker’s original thought. That’s Dugin’s Third Rome vs. Third Temple framework delivered to millions of Americans.

Tucker says: “Could this be a religious war designed to rebuild the Third Temple on the ashes of Al Aqsa?” He accused Chabad of driving the Iran war, saying “Christians have a way of dying disproportionately in these wars, which tells you something about their real motives.”

That’s not Tucker’s original thought. That’s Dugin’s Third Rome vs. Third Temple framework delivered to millions of Americans.

Mar 10

Read 13 tweets

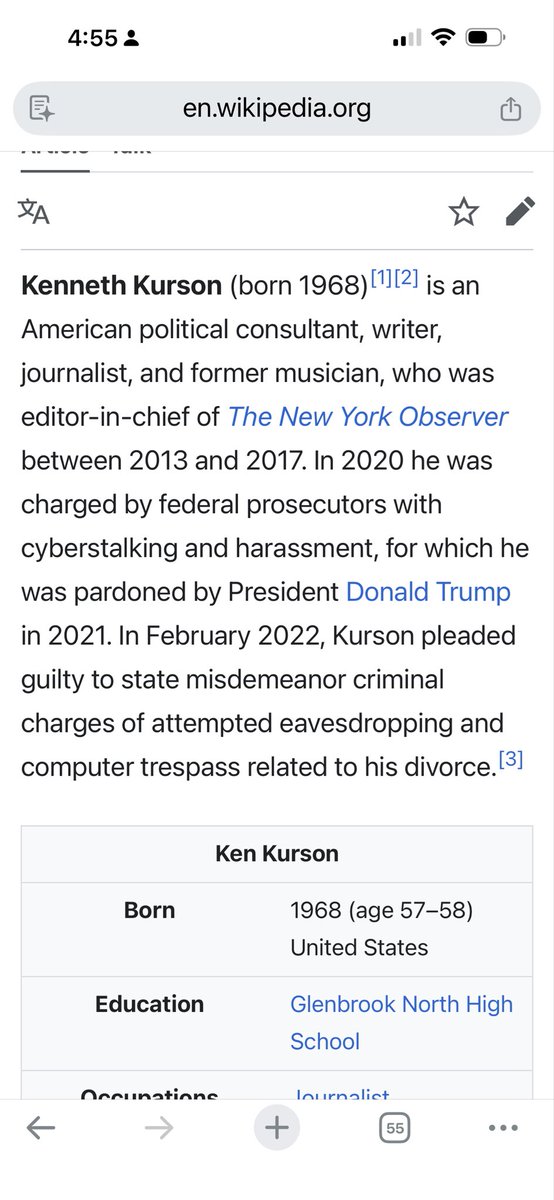

“deep ties the Kushner family has with Israel & their history of corrupt business practices & alleged violations of election laws. CHS stated that if the FBl is serious about investigating the Kushners & their relationships w/Middle East, they should look closely at Ken Kurson,”

Mar 10

Read 15 tweets

The Calvinist iconoclasts of 1566 smashed Utrecht's altars, burned its relics, and tore out its stained glass

The post-Vatican II Archdiocese demolished more churches in 30 years than the Reformation did in 200 years

They called it pastoral renewal

The lost churches of Utrecht 🧵

The post-Vatican II Archdiocese demolished more churches in 30 years than the Reformation did in 200 years

They called it pastoral renewal

The lost churches of Utrecht 🧵

Mar 10

Read 4 tweets

Next Thread:

>Fierce fighting btwn Hezbollah & the IOF invasion force. Hezb is hitting armored columns with barrages of rockets & ATGMs. Sirens ring continuously

>IRGC in response to Trump: we are the ones who will decide when the war ends. Not a single liter of oil will leave

>Fierce fighting btwn Hezbollah & the IOF invasion force. Hezb is hitting armored columns with barrages of rockets & ATGMs. Sirens ring continuously

>IRGC in response to Trump: we are the ones who will decide when the war ends. Not a single liter of oil will leave

>Reportedly footage of an IOF armored vehicle exploding while invading in the Khiam direction

>My map interpreting the current IOF ground maneuver

>One killed, eight wounded after Iranian strike on Bahrain (presumably the Millennium building strike)

>My map interpreting the current IOF ground maneuver

>One killed, eight wounded after Iranian strike on Bahrain (presumably the Millennium building strike)

>Intense footage coming out of the Khiam area in Southern Lebanon. The burning IOF armored vehicle can be seen, followed up by a barrage of rockets.

>Second video shows an impact in Kiryat Shmona

>Second video shows an impact in Kiryat Shmona

Mar 10

Read 10 tweets

Today felt more like a relief bounce than anything else.

Every major bottom I have seen had one thing in common.

We still have not seen it yet. 🧵

Every major bottom I have seen had one thing in common.

We still have not seen it yet. 🧵

A high volume flush. A real capitulation day.

Look at every bottom on this chart going back to April 2024. Each one had a massive volume spike.

Right now? Volume is quiet.

Until that spike shows up the market has not made its case for a confirmed bottom. (for me)

Look at every bottom on this chart going back to April 2024. Each one had a massive volume spike.

Right now? Volume is quiet.

Until that spike shows up the market has not made its case for a confirmed bottom. (for me)

The vix is interesting here.

It hit 35 intraday today before closing at 25.51 down 13%.

That wick could mean the vix is topping. Or it could just be recharging.

The 9 ma will be important to watch. If it holds above it worst case scenario is we get a nasty flush coming soon.

Hard to be bull/bear off one candle (in no man's land)

It hit 35 intraday today before closing at 25.51 down 13%.

That wick could mean the vix is topping. Or it could just be recharging.

The 9 ma will be important to watch. If it holds above it worst case scenario is we get a nasty flush coming soon.

Hard to be bull/bear off one candle (in no man's land)

Mar 10

Read 16 tweets

BREAKING: While a new War for Oil erupts in the Middle East

A Physics Paper just quietly dropped TODAY that will eventually make Oil, and the entire current Energy Industry, irrelevant.

Ushering in the era of Zero-Point Energy

@EagleworksSonny

Here is the breakthrough🧵

A Physics Paper just quietly dropped TODAY that will eventually make Oil, and the entire current Energy Industry, irrelevant.

Ushering in the era of Zero-Point Energy

@EagleworksSonny

Here is the breakthrough🧵

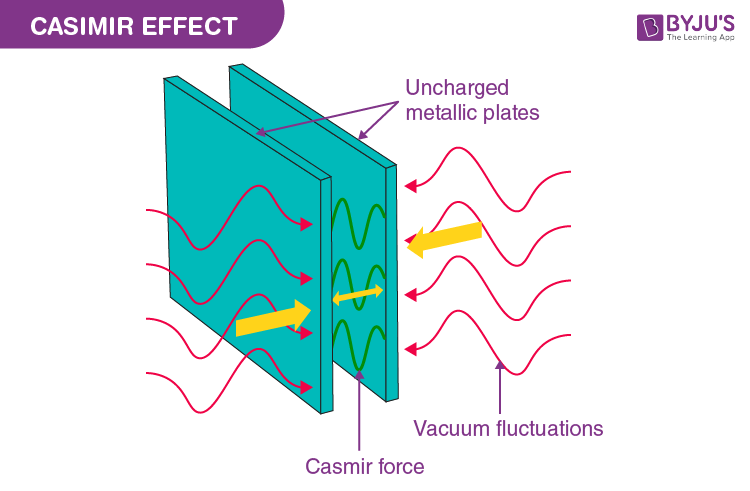

Traditionally we think of the vacuum as just that - empty

But since 1947 there has been experimental confirmation via the Casimir effect that it is not empty.

Rather, its filled electromagnetic modes whose lowest energy state is not zero

But since 1947 there has been experimental confirmation via the Casimir effect that it is not empty.

Rather, its filled electromagnetic modes whose lowest energy state is not zero

These "Zero Point" modes represent an enormous amount of energy

For each cubic meter of empty space, there is 10e80 more zero point energy than the sun releases in an entire year

Yet its always been thought to be impossible to get energy out of the vacuum, for a simple reason

For each cubic meter of empty space, there is 10e80 more zero point energy than the sun releases in an entire year

Yet its always been thought to be impossible to get energy out of the vacuum, for a simple reason

Mar 10

Read 7 tweets

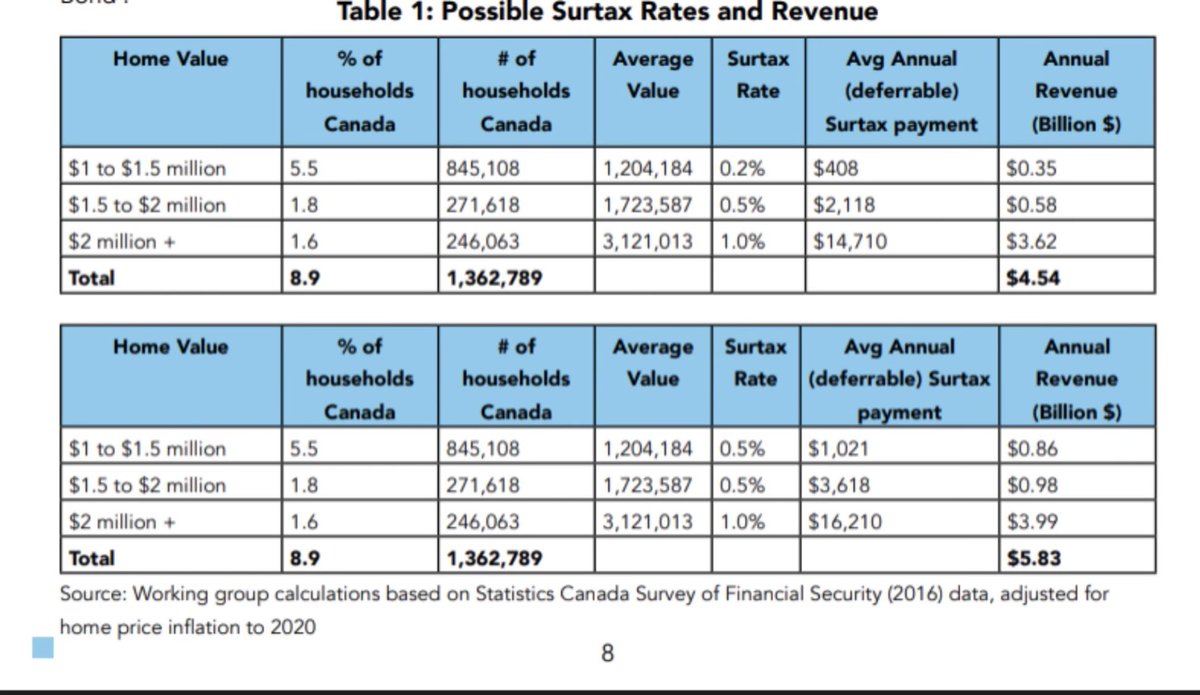

RUMOR: Liberals planning a HOME EQUITY TAX

If they win a majority there will be nothing to stop them.

The 2016 Liberal proposal may be coming back.

SENIORS who rely on their home equity for retirement will be hit HARDEST.

If they win a majority there will be nothing to stop them.

The 2016 Liberal proposal may be coming back.

SENIORS who rely on their home equity for retirement will be hit HARDEST.

The Liberal Home Equity Tax proposal would charge Canadians every year based on the value of their home.

You don’t need to sell.

You pay the tax annually on your home equity.

Example in their proposal:

Homes over $2M → ~$14,700 per year.

Your home becomes a taxable asset.

You don’t need to sell.

You pay the tax annually on your home equity.

Example in their proposal:

Homes over $2M → ~$14,700 per year.

Your home becomes a taxable asset.

If your home is worth:

🏠 $1M – $1.5M

Tax per year: $408 – $1,021

🏠 $1.5M – $2M

Tax per year: $2,118 – $3,618

🏠 $2M+ homes

Tax per year: $14,710 – $16,210

Here is the MATH

🏠 $1M – $1.5M

Tax per year: $408 – $1,021

🏠 $1.5M – $2M

Tax per year: $2,118 – $3,618

🏠 $2M+ homes

Tax per year: $14,710 – $16,210

Here is the MATH

Mar 10

Read 11 tweets

Mar 10

Read 6 tweets

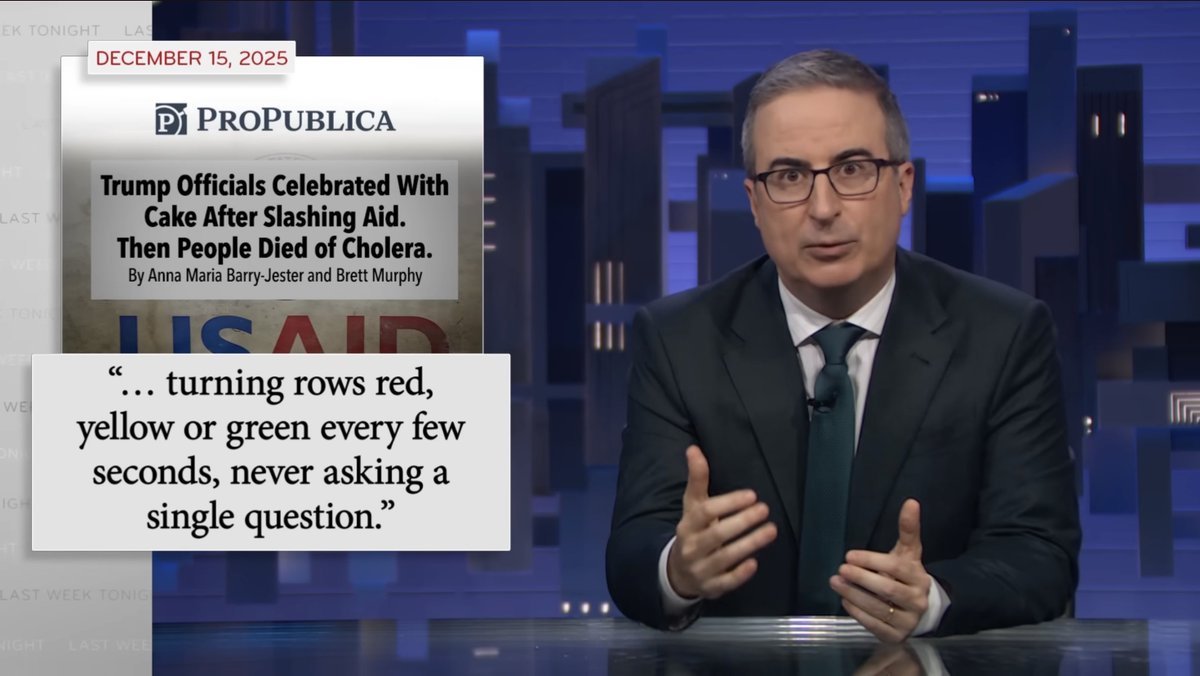

1/ On yesterday’s @lastweektonight about USAID, John Oliver cited several of our investigations.

First up was our reporting about how DOGE operatives had arbitrarily cut aid programs, in some cases by literally clicking through a spreadsheet: propub.li/4bbPEXl

First up was our reporting about how DOGE operatives had arbitrarily cut aid programs, in some cases by literally clicking through a spreadsheet: propub.li/4bbPEXl

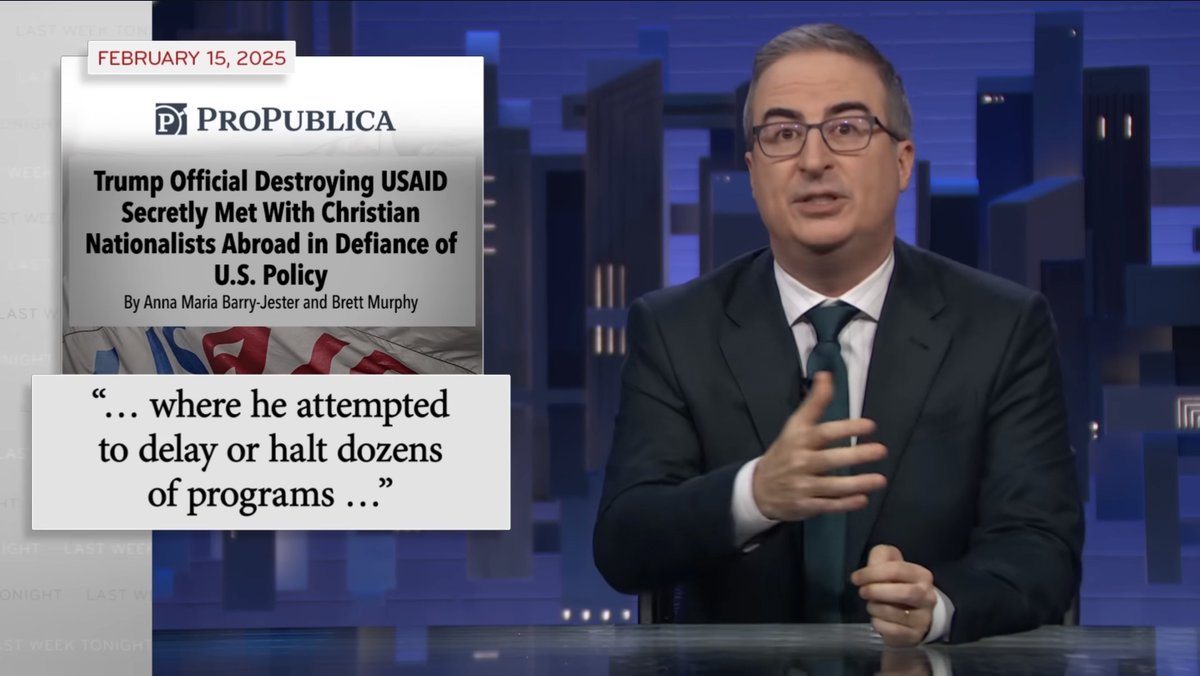

2/ Oliver later referred to our reporting about former USAID lead Peter Marocco.

Officials told us they saw Marocco’s gutting of the agency as a campaign of retribution against those who opposed his foreign policy agenda in the first Trump administration: propub.li/3N8HZBm

Officials told us they saw Marocco’s gutting of the agency as a campaign of retribution against those who opposed his foreign policy agenda in the first Trump administration: propub.li/3N8HZBm

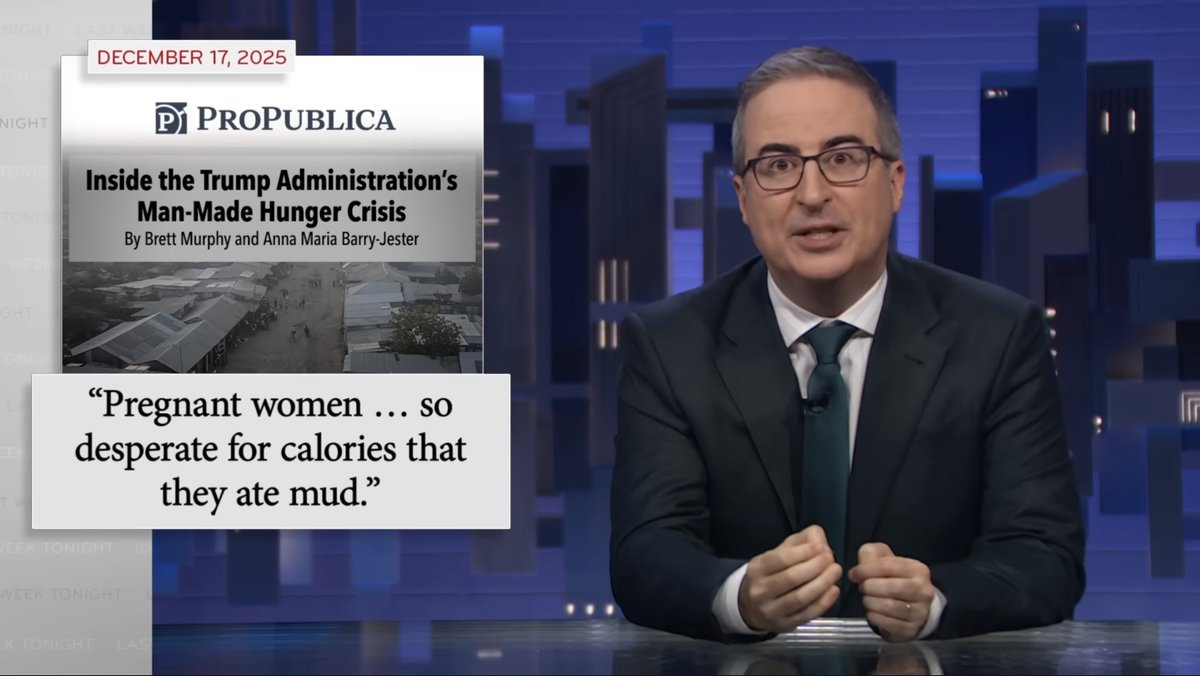

3/ Finally, Oliver brought up our reporting on how cuts to aid caused an American-made hunger crisis.

At one refugee camp, mothers had to choose which of their kids to feed & pregnant women were so desperate for calories that some resorted to eating mud: propub.li/40iWl59

At one refugee camp, mothers had to choose which of their kids to feed & pregnant women were so desperate for calories that some resorted to eating mud: propub.li/40iWl59

Mar 9

Read 10 tweets

1/ Analysis based on these facts: 15 days ago Putin faced multiple existential threats of CB default, economic collapse, & threat of command mutiny/coup.

2/ US intel assessment based on these facts likely would have raised the possibility of a rapid disintegration of

3/ Putin’s control and raised a specter of Russia’s nuclear, biological & chemical stockpiles being disbursed during the collapse much