The Binance Research team had a closer look at Arbitrum. Here's what we found 👇🧵

1/ Arbitrum is an L2 solution designed to boost the speed and scalability of Ethereum smart contracts while adding additional privacy features. Arbitrum further allows developers to run unmodified EVM contracts and transactions without compromising on layer 1 security

2/ Around a month ago, Arbitrum updated its platform to “Nitro,” - introducing changes to the platform that bring along long-term improvements.

3/ With the introduction of Nitro, transactions are now handled in two stages. In the first stage, Nitro puts transactions into a sequence in which they will be processed. It then publishes the sequence and applies a deterministic state transition function to each transaction.

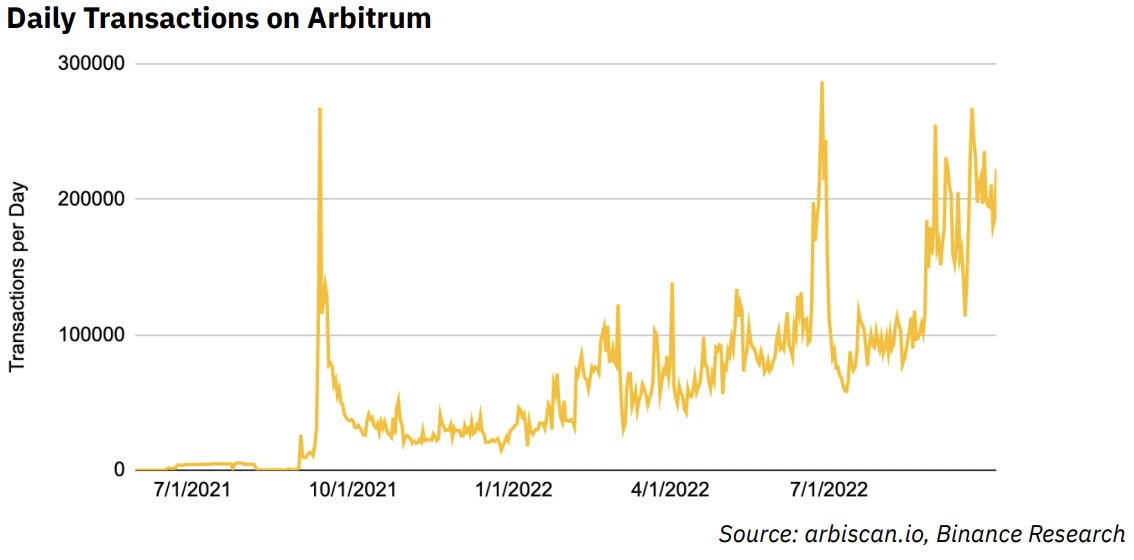

4/ Just looking at transactions on Arbitrum, we can observe a positive trend since the beginning of the year. We saw the Arbitrum Odyssey as a key event, driving further adoption, but expect that long-term growth will need to come from further integration of centralized exchanges

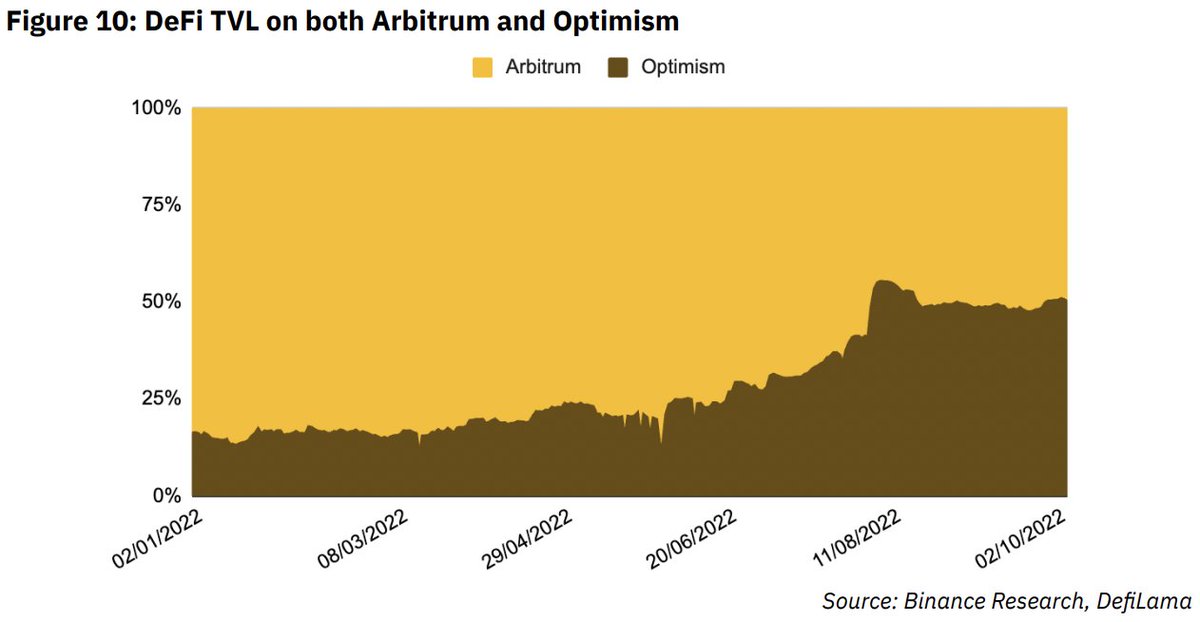

5/ While DeFi TVL has been initially bigger on Arbitrum, TVL is now almost equally split between Arbitrum and Optimism. As such, despite recent developments to Arbitrum, we have not seen substantial market share gains. However Arbitrum has more TVL when considering token balances

6/ Not only did OpenSea announce its support for Arbitrum and its NFT ecosystem, but the combination of new infrastructure, incoming users with new NFTs from Odyssey, and a token launch created a perfect storm for the continued growth of Arbitrum.

7/ We can conclude that while being in constant competition with Optimism and other scaling solutions, Arbitrum’s ecosystem has still been on a consistent rise throughout the year.

8/ While centralization is still a key risk factor that we want to point out - Arbitrum is not alone in this, as most L2s are, in one way or another, still mainly exposed to some form of centralization risk.

9/ If you want to learn more about #Layer2 scaling and #Arbitrum and become a true expert, remember to check out our report!

research.binance.com/en/analysis/la…

research.binance.com/en/analysis/la…

• • •

Missing some Tweet in this thread? You can try to

force a refresh