Why do NFT prices drop after reveal EVERY TIME & how can you take advantage? 🧵👇🏽 🧶👇🏽

What is Expected Value (EV)?

In statistics & probability analysis, the EV is calculated by multiplying each of the (benefits/utility/returns,etc. of) possible outcomes by the likelihood that each outcome will occur —> and then summing all of those values.

In statistics & probability analysis, the EV is calculated by multiplying each of the (benefits/utility/returns,etc. of) possible outcomes by the likelihood that each outcome will occur —> and then summing all of those values.

So what does this mean for NFTs?

For simplicity purposes, imagine there was a random mint for a collection of 5 NFTs. Two commons, one above average, one rare, & one ultra rare.

Now assume that the current “fair-values” of each *respectively* are 1ETH, 1ETH, 2ETH, 4ETH, 7ETH.

For simplicity purposes, imagine there was a random mint for a collection of 5 NFTs. Two commons, one above average, one rare, & one ultra rare.

Now assume that the current “fair-values” of each *respectively* are 1ETH, 1ETH, 2ETH, 4ETH, 7ETH.

In this scenario, during PRE-REVEAL, u don’t know which one u will mint. But u have the following odds:

40% or 2/5 chance at minting a ‘common’

20% or 1/5 chance at minting an ‘above average’

20% or 1/5 chance at minting a ‘rare’

20% or 1/5 chance at minting an ‘ultra rare’

40% or 2/5 chance at minting a ‘common’

20% or 1/5 chance at minting an ‘above average’

20% or 1/5 chance at minting a ‘rare’

20% or 1/5 chance at minting an ‘ultra rare’

The Expected Value (EV) of ONE random mint would then be the following:

40%*1ETH + 20%*2ETH + 20%*4ETH + 20%*7ETH = 3ETH

Simply put, this means (if your odds are truly random), 3ETH is a fair price to pay for 1 Mint of this particular NFT set

Why would you want to do that? 👇🏽

40%*1ETH + 20%*2ETH + 20%*4ETH + 20%*7ETH = 3ETH

Simply put, this means (if your odds are truly random), 3ETH is a fair price to pay for 1 Mint of this particular NFT set

Why would you want to do that? 👇🏽

Because u have the chances to mint the rare or ultra rare and get something worth 4ETH or 7ETH.

Alternatively, ur luck can also go against u (I.e. u mint a common), but it offsets ur upside odds so it’s just the risk u choose to take.

Now this is where things get interesting👇🏽

Alternatively, ur luck can also go against u (I.e. u mint a common), but it offsets ur upside odds so it’s just the risk u choose to take.

Now this is where things get interesting👇🏽

“Risk aversion" is the tendency of people to choose outcomes with low uncertainty over high uncertainty (I.e. prefer certainty over uncertainty), even if the EV of the uncertain outcome is equal to or even higher than the value of the more certain outcome

“Risk inclined" is opposite — the tendency of people to choose outcomes with higher uncertainty over lower uncertainty (I.e. prefer uncertainty over certainty), even if the EV of the certain outcome is equal to or even higher than the value of the more uncertain outcome

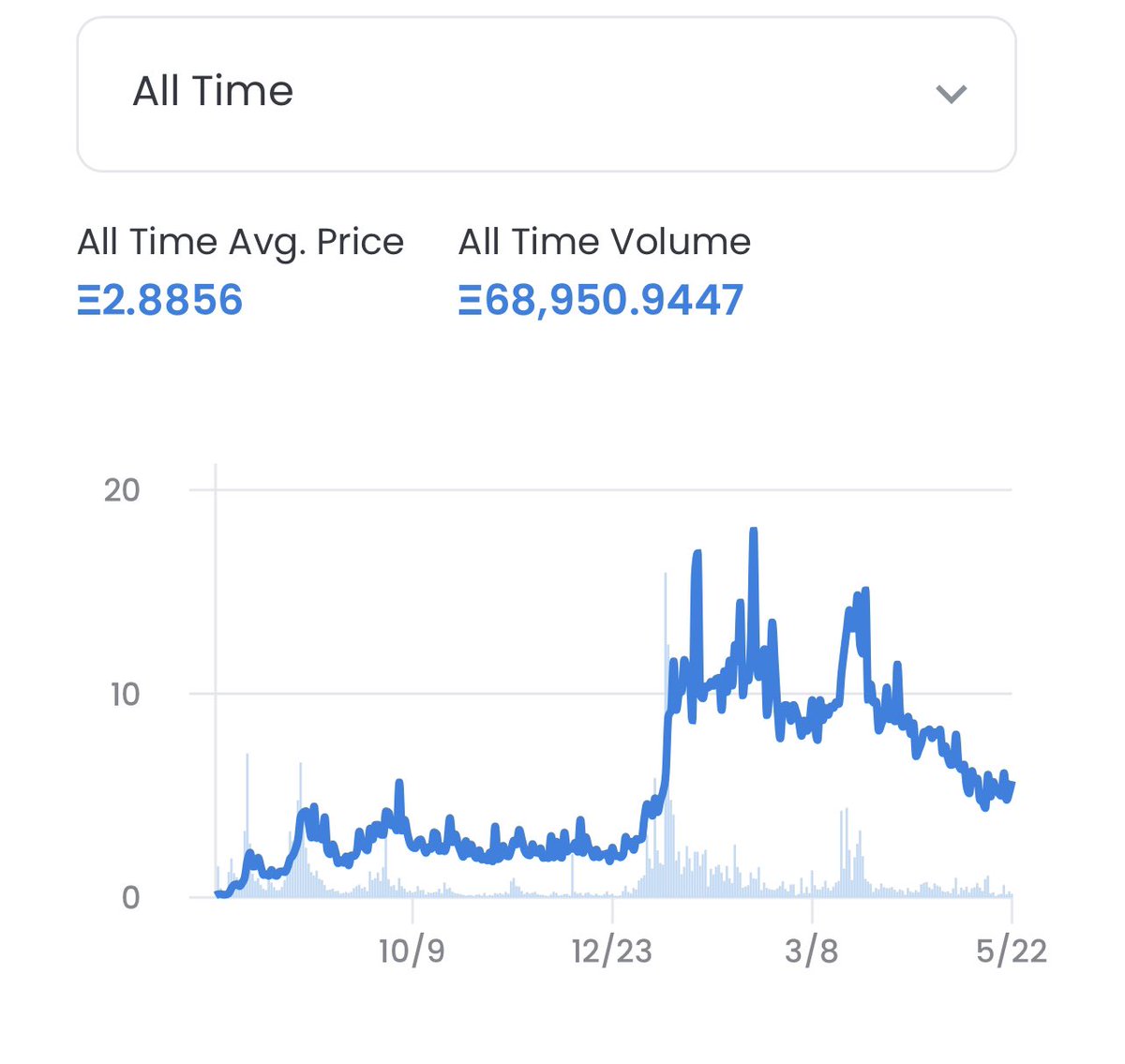

Remember: THE AVERAGE NFT TRADER IS A GAMBLING DEGEN — meaning they are more likely to be “RISK INCLINED”

Back to our example: this means they are willing to even OVER-PAY for that example mint by 0.5E or 1E above fair-value to make the pre-reveal market value = 3.5E or 4E 🤦🏽♂️

Back to our example: this means they are willing to even OVER-PAY for that example mint by 0.5E or 1E above fair-value to make the pre-reveal market value = 3.5E or 4E 🤦🏽♂️

So let’s assume now people are willing to pay 3.5E, which is the floor of the pre-reveal, because all tokens are valued the same (due to fair odds)

Once the reveal happens… two minters would’ve gotten the ‘common’ and assume now one minter lists one at Floor for 1E (fair value)

Once the reveal happens… two minters would’ve gotten the ‘common’ and assume now one minter lists one at Floor for 1E (fair value)

Now instead of 5 pre-mint items being somewhat identically priced at 3.5E each… u have a much broader range of listings, with the floors for commons being really low (I.e. closer to 1E as expected)

Great, thx for the math lesson Riddles 🤓, but where’s my Alpha here?👇🏽👇🏽

Great, thx for the math lesson Riddles 🤓, but where’s my Alpha here?👇🏽👇🏽

I’m glad you asked.

The Alpha here is u arbitraging the fact that ppl are degens & are willing to pay OVER fair value for a less than fair probability that they mint rares.

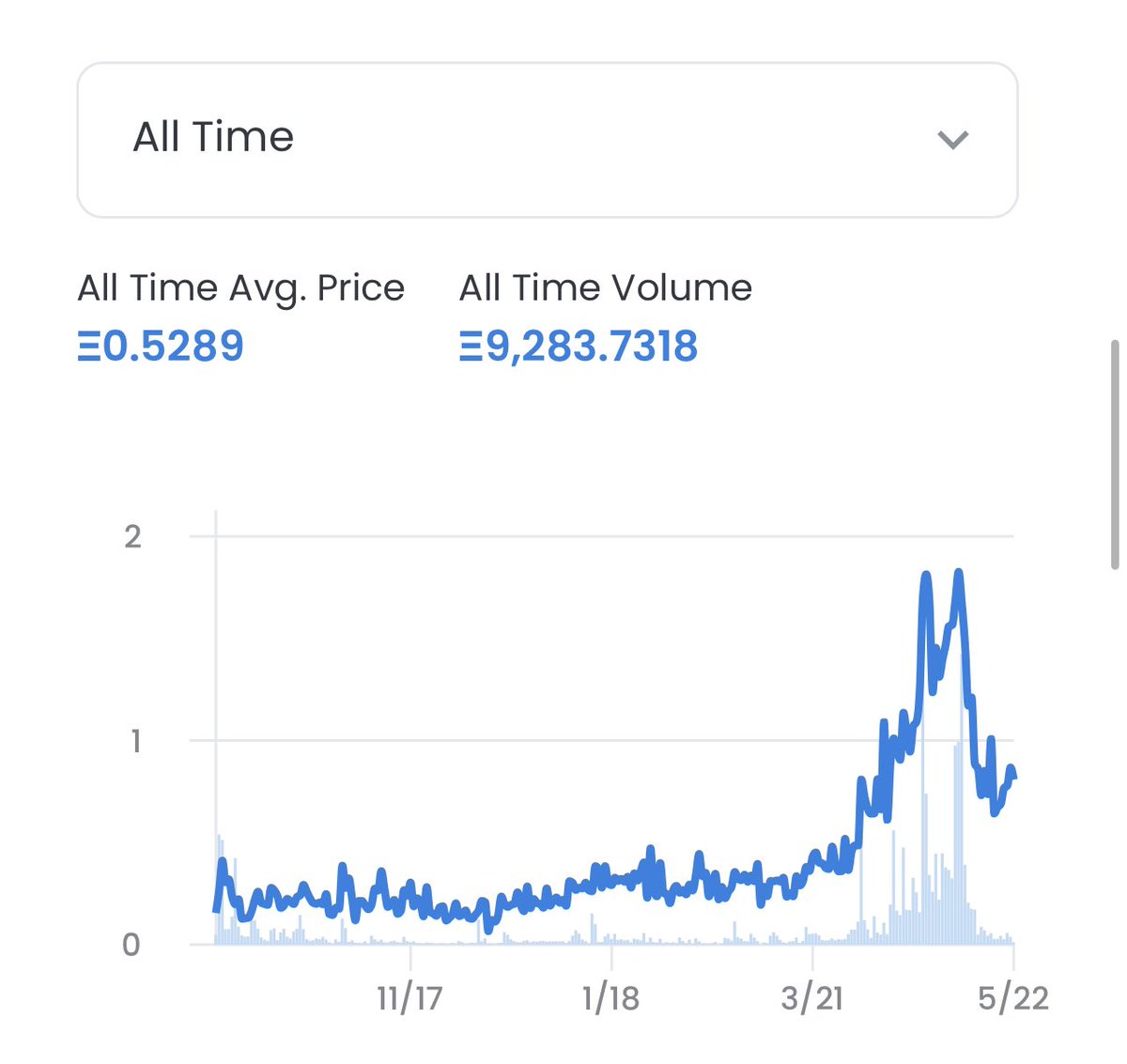

This means, in theory, u should sell just before reveal EVERY TIME

The Alpha here is u arbitraging the fact that ppl are degens & are willing to pay OVER fair value for a less than fair probability that they mint rares.

This means, in theory, u should sell just before reveal EVERY TIME

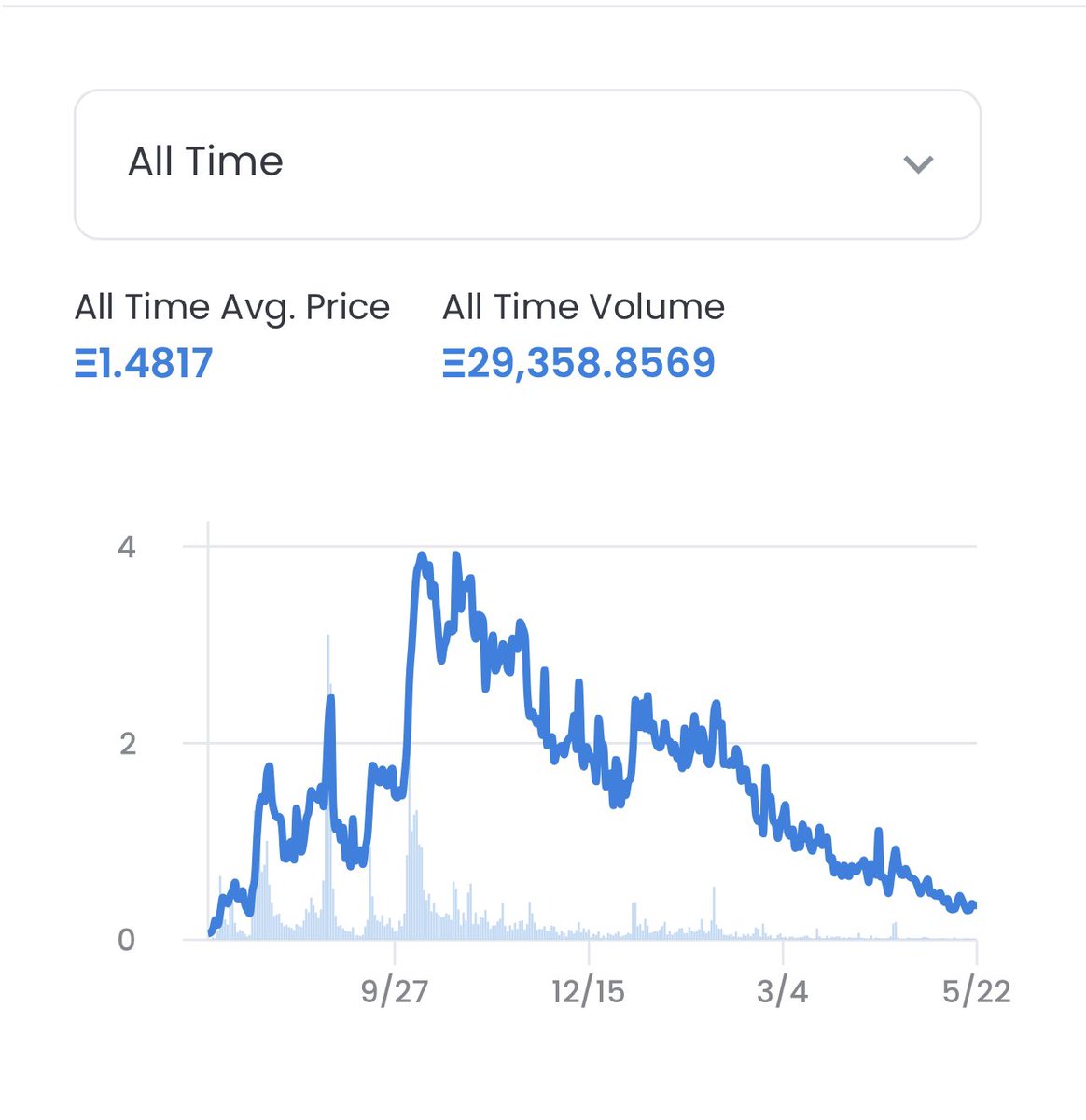

Real NFT example: @OthersideMeta common land was ~3ETH to mint. Yet the pre-reveal floor was roughly 8ETH…

now let’s assume a KODA / rares BLENDED fair value is 33ETH… & the odds of those were ~ 1 in 10…

This means ppl should have valued floor at 3 + (30 / 10) = 6 ETH

👇🏽👇🏽

now let’s assume a KODA / rares BLENDED fair value is 33ETH… & the odds of those were ~ 1 in 10…

This means ppl should have valued floor at 3 + (30 / 10) = 6 ETH

👇🏽👇🏽

* If you don’t get that last part, I think you need to be doing more art & discord moderation than trading tbh… I’m kidding… but seriously, go back & finish grade 9 math *

So as you can see, there was a 2ETH arbitrage opportunity here (I.e. 8ETH - 6ETH)

So as you can see, there was a 2ETH arbitrage opportunity here (I.e. 8ETH - 6ETH)

Law of Large Numbers: as the number of identically distributed, randomly generated variables increases, their sample mean (average) approaches their theoretical mean.

In other words, this is the reason the house always wins, because over time, the “theoretical mean” prevails 🧠

In other words, this is the reason the house always wins, because over time, the “theoretical mean” prevails 🧠

If you trade systematically, you should look to exploit these types of psychological biases / logical fallacies that the noobs have in this space.

This space won’t stay amateur for long, take advantage while you can. Don’t be the noob.

This space won’t stay amateur for long, take advantage while you can. Don’t be the noob.

If you enjoyed this 🧵, the nicest gesture in twitter is an RT. RT'ing the first post (shared below for your convenience) would help tremendously in getting it infront of more ppl like you. Always appreciate our frenship ♥️

https://twitter.com/ethernaz/status/1528962113263239169

Check out all my threads 🧵 here ⤵️

https://twitter.com/ethernaz/status/1517397816515215360

ADDITIONAL POINT:

Selling before reveal, & buying back in after reveal at floor would be the optimal strategy (if u genuinely want the project)

Anytime u are buying floor, try to pay slightly/marginally above floor for a better NFT

Use tools like @raritytools, @trait_sniper

Selling before reveal, & buying back in after reveal at floor would be the optimal strategy (if u genuinely want the project)

Anytime u are buying floor, try to pay slightly/marginally above floor for a better NFT

Use tools like @raritytools, @trait_sniper

Many have been asking about “how to determine fair value” — no one has the answers, but this is a decent start for a framework ⤵️

https://twitter.com/ethernaz/status/1517397950808399872

• • •

Missing some Tweet in this thread? You can try to

force a refresh