1/ stuff i'm thinking about right now (hence quiet and mostly off social) - a brain dump with links

2/ web3 infra business models very analogous to web2, hence business metrics end up converging over time

limited examples of scalable token-driven models that work, most successful co's are web2 / centralized models

tomtunguz.com/spot-the-diffe…

limited examples of scalable token-driven models that work, most successful co's are web2 / centralized models

tomtunguz.com/spot-the-diffe…

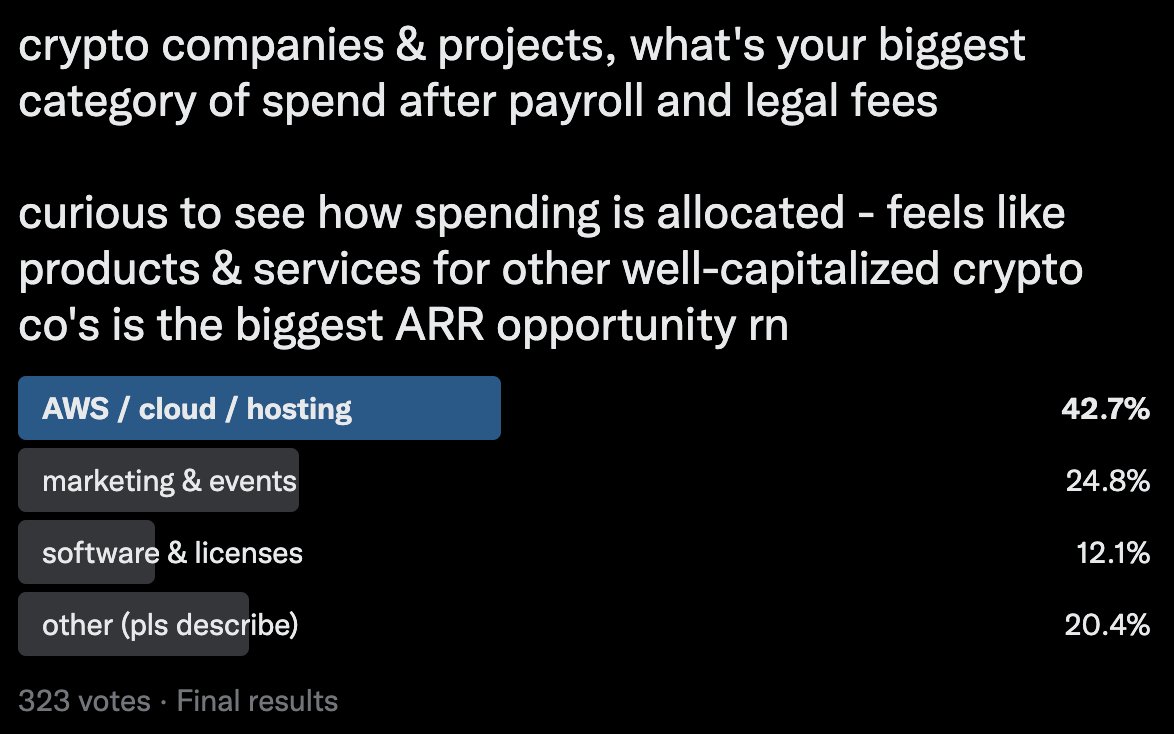

3/ most profitable businesses in crypto, outside of interchange, is selling services to venture funded crypto co's

hosting and web3 infra will be a huge category, but custom SaaS growing rapidly esp in cybersecurity, compliance, and legal tech

hosting and web3 infra will be a huge category, but custom SaaS growing rapidly esp in cybersecurity, compliance, and legal tech

4/ AWS dominates startup spend by giving credible early stage co's $150k in credits and building strong "lock in"

whoever spends their way to this strategy in crypto infra will dominate. microsoft and IBM tried in 2017, google is about to unleash their multi-product strat.

whoever spends their way to this strategy in crypto infra will dominate. microsoft and IBM tried in 2017, google is about to unleash their multi-product strat.

5/ lending pools were helpful for liquidity aggregation but don't make sense LT

in current environment, P2P lending platforms that enable aggregation of customized loans into loan portfolios built using custom risk parameters will dominate. customization > aggregation.

in current environment, P2P lending platforms that enable aggregation of customized loans into loan portfolios built using custom risk parameters will dominate. customization > aggregation.

6/ crypto products need better bundling. constructing your own crypto ops and backend stack is brutal + cost heavy rn. unsure if it will be M&A or channel partnerships, but too much is unbundled from a price perspective and cognitive overload perspective.

7/ very few companies have invested in building effective sales and marketing teams that have technical competence - seeing high churn and poor NPS from companies who enjoyed free media during the bull market but now have to acquire and retain users and customers

8/ NFT projects will launch their own marketplaces, their own front-end products and platforms, and if they can, their own chains. once u run out of stuff to sell or your audience runs out of cash, u need cash flow

@KyleSamani has a good post on this - multicoin.capital/es/2022/06/22/…

@KyleSamani has a good post on this - multicoin.capital/es/2022/06/22/…

9/ as a follow on, NFT market microstructure is still being formed but will be an even bigger category than DeFi as the universe of assets represented as NFTs grows. liquidity aggregation will be key to winning.

my thoughts on this

meltem.mirror.xyz/Qc2jR5ggGznGrU…

my thoughts on this

meltem.mirror.xyz/Qc2jR5ggGznGrU…

10/ bitcoin is (still) exciting despite the narrative cycle on CT and in MSM. vocal minority of bitcoin MLM ppl (podcasters and paid content shills) aren't relevant. builders are focused on global gig economy, payments via LN, new privacy tools, etc. slow and steady progress.

11/ DAOs (in current form) are really not useful for solving the social and economic coordination problems they're trying to solve

more DAO tooling doesn't change this. it's a behavioral economics / tsxn cost problem re: Coase's theorem.

should be used sparingly imho

more DAO tooling doesn't change this. it's a behavioral economics / tsxn cost problem re: Coase's theorem.

should be used sparingly imho

12/ all reliable, secure compute will require energy. energy is a universal constant for all comms and compute.

solving for energy sources + more efficient hardware just as important as inventing new consensus mechanisms. physics ftw.

huge opportunity if u r patient

solving for energy sources + more efficient hardware just as important as inventing new consensus mechanisms. physics ftw.

huge opportunity if u r patient

13/ after 8 years of crypto VC in equity + tokens, tokens still the fastest path to liquidity by dragging future EV into present moment, but rife w moral hazard and difficult to monetize w/o bigger whales to buy ur bags

next 3 - 5 years need material exits on overpriced equity

next 3 - 5 years need material exits on overpriced equity

14/ critical inflection point for industry as a whole on censorship resistance + decentralization

washington DC is busy. compromise is being negotiated behind closed doors. not a criticism, just a reality. this makes bitcoin more important imho cuz fewer "big" players to attack.

washington DC is busy. compromise is being negotiated behind closed doors. not a criticism, just a reality. this makes bitcoin more important imho cuz fewer "big" players to attack.

15/ still early for the blockspace / secure financial compute as an asset narrative, but digital commodities markets are coming. enron was super early. a few co's tried in 2013 w/ cloud compute futures. will be a big narrative cycle in 2023 +

16/ twitter bots are absolutely unbearable. the level of spam / crypto junk email is insane. i don't want your newsletter or podcast or NFT gated DAO.

crypto still one of the most exciting and high growth categories imho, just more landmines + dumb money now. DMs open!

crypto still one of the most exciting and high growth categories imho, just more landmines + dumb money now. DMs open!

• • •

Missing some Tweet in this thread? You can try to

force a refresh