1/ @CathieDWood wrote a thoughtful letter on why should stay public. Here's a quick walkthrough of a valuation of its #EV business, even though the #autonomous opportunity could dwarf its pure hardware business, which @TashaARK explains.

https://twitter.com/CathieDWood/status/1032407528213229568

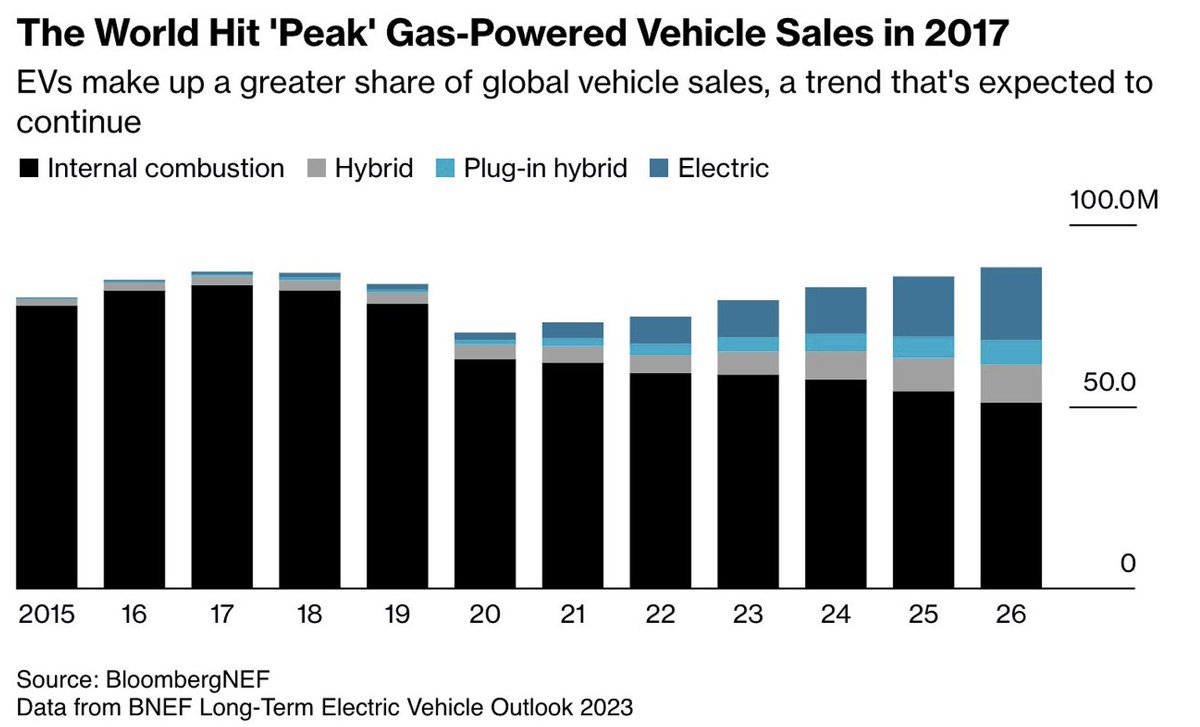

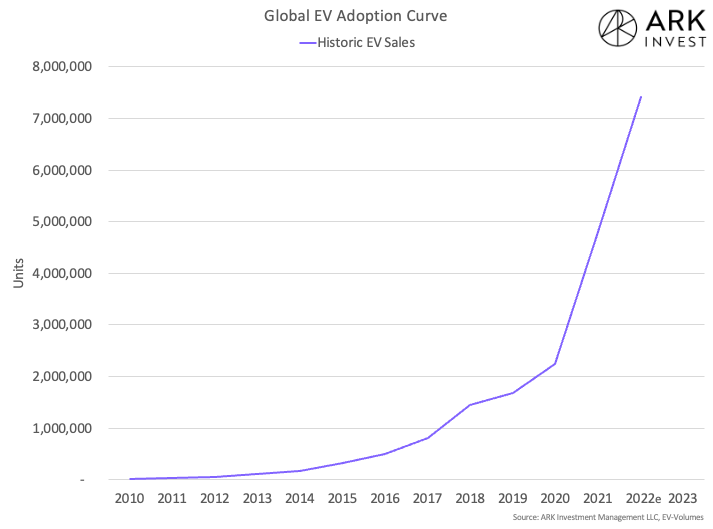

2/ ARK's research: by early 2020s there should be 17M EVs sold globally.

Why? Due to battery cost declines EVs will be cheaper than gas car, easy choice for the end consumer.

Here's a paper I wrote explaining more details research.ark-invest.com/electric-vehic…

Why? Due to battery cost declines EVs will be cheaper than gas car, easy choice for the end consumer.

Here's a paper I wrote explaining more details research.ark-invest.com/electric-vehic…

3/ Tesla may be on track to have ~17% of unit market share of EVs globally in 2018, (higher revenue share):

Tesla 220k EVs in 2018, global forecast calls for 1.9M plug in vehicles, 70% of which should be BEV. 1.9M * .7 = 1.3M ev-volumes.com/country/total-…

220k/1.3M = ~17%

Tesla 220k EVs in 2018, global forecast calls for 1.9M plug in vehicles, 70% of which should be BEV. 1.9M * .7 = 1.3M ev-volumes.com/country/total-…

220k/1.3M = ~17%

4/ Now let's assume that over the next 5 years Tesla loses 7% market share to competitors. That gives them a 10% market share in 2023 or 1.7M EVs.

At an ASP of $50k, 2023 revenue = $85B

At an ASP of $50k, 2023 revenue = $85B

5/ Take your choice of teardown electrek.co/2018/07/16/tes… or look at the white paper above on declining battery costs and we put gross margin at 30%.

$85B * .3 = $25.5B

$85B * .3 = $25.5B

6/ Let's put SG&A comparable to BMW's at 10% of revenue

$85B * .1 = $8.5B

R&D to sales also at 10% = $8.5B

$25.5B - 8.5B - 8.5B = $8.5B in operating income

$85B * .1 = $8.5B

R&D to sales also at 10% = $8.5B

$25.5B - 8.5B - 8.5B = $8.5B in operating income

7/ BMW's EBITDA margin is 16.5%, but say Tesla's is only 12%

$85B * .12 = $10.2B in EBITDA

$85B * .12 = $10.2B in EBITDA

8/ The average auto and truck EV/EBITDA is 10.62 pages.stern.nyu.edu/~adamodar/New_…

$10.2B * 10.62 = $108.3B enterprise value

Assume level of debt you'd like, Tesla is suggesting $3.3B sec.gov/Archives/edgar…

Market cap would be $105B

Tesla's market cap today is ~$55B

$10.2B * 10.62 = $108.3B enterprise value

Assume level of debt you'd like, Tesla is suggesting $3.3B sec.gov/Archives/edgar…

Market cap would be $105B

Tesla's market cap today is ~$55B

• • •

Missing some Tweet in this thread? You can try to

force a refresh