Can someone put a comparison of price on adding date and today..

Have an interesting story to tell over the weekend

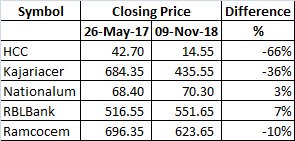

Only 5 stocks

Have an interesting story to tell over the weekend

Only 5 stocks

https://twitter.com/KNSvasan/status/866611333436915712

Data courtesy @KNSvasan @im_naresh @anand_luhar @amitgoenka2k

Will try to put a small note on Inclusion of stock in fno segment

Reason effect and outcome this is purely based on my experience over last one and a half decade 1/n

Will try to put a small note on Inclusion of stock in fno segment

Reason effect and outcome this is purely based on my experience over last one and a half decade 1/n

What is primary motive of an investor whether it's promoter or operator or insider ...

Sole motive is to make profits at cost of anything and forget the word "ethics"

Beg borrow steal

Same is big players including promoters insider operator 2/n

Sole motive is to make profits at cost of anything and forget the word "ethics"

Beg borrow steal

Same is big players including promoters insider operator 2/n

Once a co starts growing in size and promoter / op or both combine together sees a much beautiful picture of making easy money via market operation rather then doing business ethically

(Don't expect ethics from indians promoters least 75% will take any means for easy money) 3/n

(Don't expect ethics from indians promoters least 75% will take any means for easy money) 3/n

Inclusion in FNO have certain criteria where last 6 months data needs to be managed as per set guidelines by nse

nseindia.com/products/conte…

nseindia.com/content/circul…

4/n

nseindia.com/products/conte…

nseindia.com/content/circul…

4/n

Now comes tricky part

Can't put in words but in our country everything can be managed if you have resources so inclusion in fno is not a big deal for shabby co and promoters

(I don't here want to say all are shabby)

5/n

Can't put in words but in our country everything can be managed if you have resources so inclusion in fno is not a big deal for shabby co and promoters

(I don't here want to say all are shabby)

5/n

So b4 a stock is included in fno in benami a.c.'s via help of operators and market makers

(There are many market makers who provide intraday liquidity to a stock solely for purpose getting eye balls attracted for as low as 5k per cr)

6/n

(There are many market makers who provide intraday liquidity to a stock solely for purpose getting eye balls attracted for as low as 5k per cr)

6/n

In typical doe theory treat this as accumulation as well as advancing phase where informed investors in hand with the main investors knows what's the game is going to be like...

Returns of a certain level r assured and since they (op + investors) have been working together 7/n

Returns of a certain level r assured and since they (op + investors) have been working together 7/n

Both parties have a high level of confidence in each other (even they make losses sometimes but its part of business) so the investor is hardly bothered with very short term views

Main controller is operator who have a tab on everything including promoter + investor

8/n

Main controller is operator who have a tab on everything including promoter + investor

8/n

The whole model is based on p&l sharing basis off course later to settled in cash or any other convenient mode

The last sucker is genuine retail fooled by research report funda media and everything possible

9/n

The last sucker is genuine retail fooled by research report funda media and everything possible

9/n

So now let's get to modus-operandi

Without promoter being involved no manipulation is possible but they will never come in front rather they will have someone to work for them

Once deal is struck op is front runner who have set of investors and his idea is very clear 10/n

Without promoter being involved no manipulation is possible but they will never come in front rather they will have someone to work for them

Once deal is struck op is front runner who have set of investors and his idea is very clear 10/n

Idea is pump n dump

Be4 inclusion stocks are pumped up so as to meet criteria

Two things are met by doing this

1. Price advanced without too much public participation

2. With rise on volumes and prices dono inclusion criteria are met

11/n

Be4 inclusion stocks are pumped up so as to meet criteria

Two things are met by doing this

1. Price advanced without too much public participation

2. With rise on volumes and prices dono inclusion criteria are met

11/n

Now comes regulatory in picture

Dnt need to explain it.. under the table over a coffee (🍻🍺) or any other benefit (in any form} everything gets done ...

Once it's know stock going to include in fno which is privy info to op prices are jacked up

12/n

Dnt need to explain it.. under the table over a coffee (🍻🍺) or any other benefit (in any form} everything gets done ...

Once it's know stock going to include in fno which is privy info to op prices are jacked up

12/n

Time frame

Generally such operations are at start of a bull market explosion phase and culminate towards end of a bull market as the biggest part is offloading (discussed later)

13/n

Generally such operations are at start of a bull market explosion phase and culminate towards end of a bull market as the biggest part is offloading (discussed later)

13/n

Once stocks gets in fno it attracts many more mkt particpants from across trading section giving an easy exit to op had bought at uch lower levels

It gives an easy exit as it's public driving prices and op even if does little pump up public will jump in to see high prices 14/n

It gives an easy exit as it's public driving prices and op even if does little pump up public will jump in to see high prices 14/n

Now every investor (who invested at initial stage ) will look for an easy exit and even op needs funds as it comes with a cost (incl margin funding from 12 - 18% pa) + inherent risk which op carries on

15/n

15/n

Now exit part

Jack up price in cash markets will attract participants taking position in fno n operator reverse side i.e. shorting underlying simultaneously taking position in option via shorting calls long puts

(if u know full game u will do every possible thing 2 make $)

16/n

Jack up price in cash markets will attract participants taking position in fno n operator reverse side i.e. shorting underlying simultaneously taking position in option via shorting calls long puts

(if u know full game u will do every possible thing 2 make $)

16/n

The pumping and dumpings carries on till market is conducive for such operations I.e. retail participation is there

Now at same time wen pumping is going on op is also exiting holding in cash markets

So for his fno short position he have the underlying so he is hedged

17/n

Now at same time wen pumping is going on op is also exiting holding in cash markets

So for his fno short position he have the underlying so he is hedged

17/n

For eg 1 lk share is total float in mkt and op have 90k

He will jack up price in cash mkt and simultaneously short in future so he is fully hedged

Simultaneously as price rise he will keep exiting slowly in cash as well as fno there by reducing position in market

18/n

He will jack up price in cash mkt and simultaneously short in future so he is fully hedged

Simultaneously as price rise he will keep exiting slowly in cash as well as fno there by reducing position in market

18/n

Certain times some investor may have some liquidity issues at these time we see panic selling in stocks and op needs 2 replace mr x with mr y coz it haves a cascading effect I.e. op investor + genuine investor both looking for an exit door there by mounting pressure on op

19/n

19/n

Once the desired results are met underlying is set free and really no one is bothered about it including promoter as it's already carrying the title of being a SIN STOCK

Go and check data from last 2 decades u will find hundreds of such stocks

20/n

Go and check data from last 2 decades u will find hundreds of such stocks

20/n

In no way I mean to say all are pump n dump stock

But all these small midcap which gets added in fno should be watched very keenly rather then getting stuck and crying

N/n

... The End ...

If missed anything will add to it

But all these small midcap which gets added in fno should be watched very keenly rather then getting stuck and crying

N/n

... The End ...

If missed anything will add to it

• • •

Missing some Tweet in this thread? You can try to

force a refresh