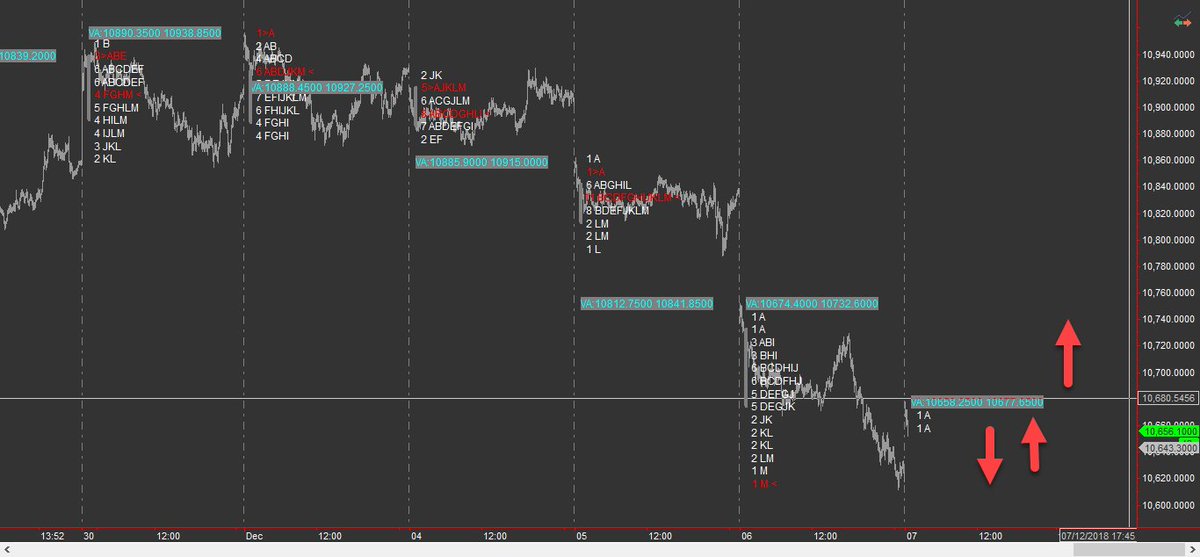

Few points to ponder on Longer TF

- Rising Trendline since 2008 currently placed roughly around 9000 (Long TF)

- Rising Trendline since Dec. 2016 from 6825 have been breached on monthly basis and currently placed above 11300. so close above it is needed

1/n

- breached 7 MEMA and tested 20 MEMA ( also middle BB)

What happend once 20 MEMA was breached ??

Only 3 instances of corrections

- Since 2003 in 2008 (Crash)

- 2011-12-13 (Minor)

- 2015 (deep)

* MEMA = Monthly EMA

2/n

- Since 2003 only once 54 MEMA have been breached that was in 2008 crash

- in 2011 & 2016 took support at 54 MEMA and reversed

- currently 54 MEMA is placed at 9765

3/n

Bollinger band (BB)

- only thrice it have breached Middle BB

- 2008

- 2011-12-13

-2016

- Since 2016 have tested Middle BB 3 times once currently

- currently middle BB is placed at 10940

4/n

- Since 2003 only thrice have it touched lower BB

- 2008 , 2011 & 2016

- currently lower BB is placed at 10062

5/n

RSI (11) placed at 51.73

- since 2014 there is bearish divergence

- after hitting high in jan 2018 there is continuous bearish divergence

- have breched low of 51.87 made in oct 2018

6/n

- currently nearing to 51.46 made in dec 2016 marked as support line

- broken triangle as clearly visible

7/n

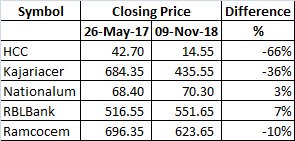

leaving TA behind for a while some data crunching

updated data courtesy

@ankitkall

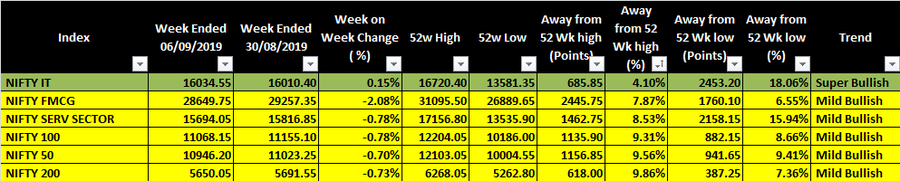

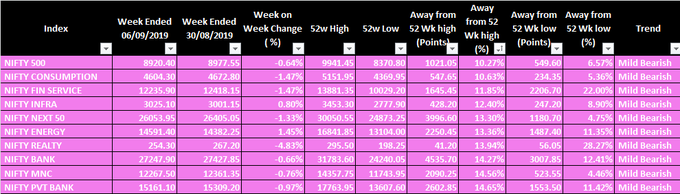

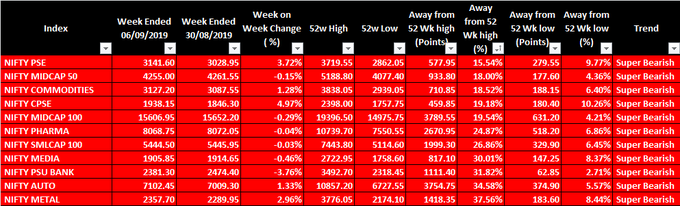

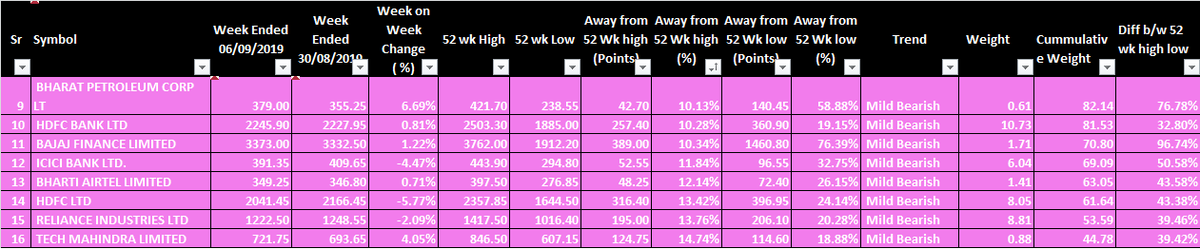

lets look at how different sectors are placed based on there difference from 52 week high

9/n

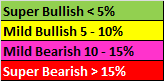

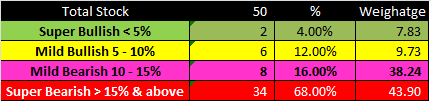

leaving TA behind for a while some data crunching on nifty 50 stocks

updated data courtesy

@ankitkall

lets look at how different stocks are placed based on there difference from 52 week high

10 / n

last tweet took 35 mins + 3 abuses... to write as data needed to be correct for better presentation !!

11/n

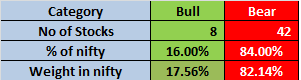

leaving TA behind for a while some data crunching on nifty 50 stocks and how bullish and bearish stocks are placed as a team

updated data courtesy

@ankitkall

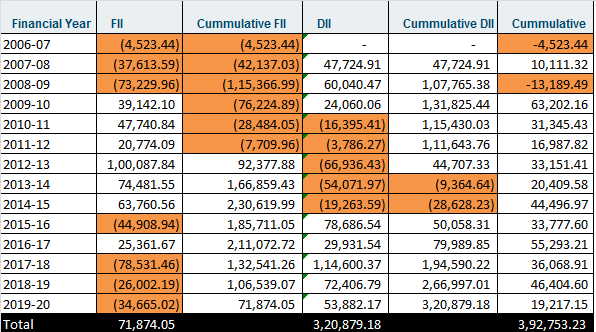

Looking at institutional data

- FII from peak cumulative buying of 2.30 Lk crore in 2014-15 there buying have dried up and is at 0.72 Lk crore currently

- Is this FII leaving India ??

- DII ( retail money ?? ) have entered market post 2015-16

13/n

- if 7k is taken as base and 12k as top ( for time being) and taking an average nifty cost comes to 9500 odd

- currently nifty at 11k

- hardly return of 16% cumulatively for 4.5 years ( FD is 7%)

14/n

Enough data suggests that this period of under performance can be attributed to one thing

- few stocks used to maintain Ms. Nifty so people still hanging on " HOPE " that broader market will catch up

- dumb money is still chasing rather then sitting out !!

15/end