1/ Electricity is the new oil. China just killed the future of the internal combustion engine. And climate action (energy transition) is neither scary nor costly to the economy, but will pay for itself over twenty years. That's why I've written Oil Fall. gum.co/OilFall

2/ Years ago I coined a phrase "It's going to take alot of oil, to get off oil." The idea: to fight fossil fuel path dependency and build new energy infrastructure would mean a massive, ongoing hit to global GDP. I loved these words and thought them clever. Now, they're wrong.

3/ In one of the earlier papers to estimate the cost of a clean energy transition, @Sustainable2050 et al (2012) suggested 2% of global annual GDP would be required, and then this investment would convert into gains as time went by. This was a good opening salvo to the question.

4/ But now, 7 years later, we no longer live in that world. Indeed, the cost-crash for energy transition has been so revolutionary on a global level, that simple price incentives now taking place at the consumer level are effectively turning what had been costs to gains.

5/ We should be talking not about the cost of climate action to the global economy, but rather, the incredibly high cost of staying on the fossil fuel system, where at least half of all the energy the world pays for is lost to the atmosphere. With oil, the losses are even higher.

6/ The Oil Fall series (Part I) begins in California where the first indications began to appear in 2017 that sales of internal combustion engine vehicles would peak, then permanently lose all market share growth to EV. That's now happened. When California warns, listen.

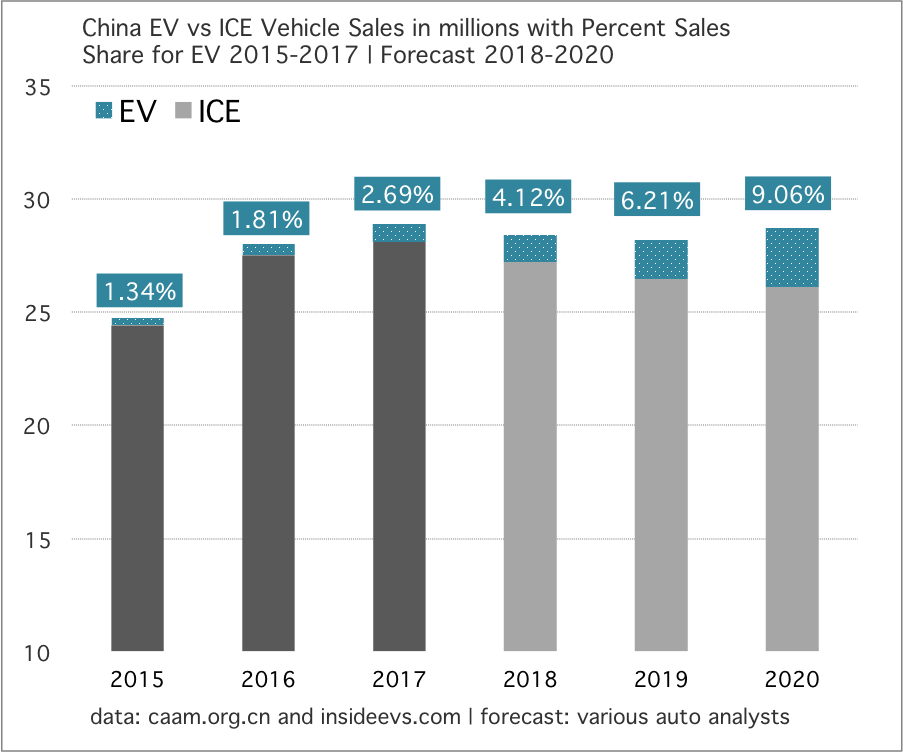

7/ Part II of the Oil Fall series moved on to the China question: if we know once ICE vehicle sales growth peaks it will never claw back share from EV, how close are we to this inflection in China? Originally I thought this could happen as early as 2020. Well, 2020 came early.

8/ I'm confident the global community has not fully absorbed what just happened in China. But the oil market spotted the change immediately. The 2018 oil crash is nearly entirely about a revision to future oil growth. That's why Part II of Oil Fall was titled "China Sudden Stop."

9/ The internal combustion engine has protected the global oil franchise for nearly a century now. Take away that protection, and oil, long accustomed to world dependency, will be imperiled. Now comes the EV drivetrain, superior in every way. And consumers want those advantages.

10/ Here's how China's vehicle market was shaping up coming into mid-year 2018. It had joined the global slowdown in total vehicle sales, but, only mildly. EV growth very strong. But ICE still growing. And most wondered if EV sales could really hit 1 million.

11/ But in the 2H of 2018 China's total vehicle market broke down pretty hard. For the first year in decades, sales went into outright decline. That opened up risk that EV sales would get hurt too. But no. EV now on pace to sell 1.2 million in 2018. *ICE growth is over in China.*

12/ A primary focus of the Oil Fall series has been to hunt for Peak ICE growth. I'm not alone. The good folks at @BloombergNEF have been on the case as well. Many thanks to them. Now, the world is waking up to peak ICE too.

https://twitter.com/colinmckerrache/status/1080392107981000709

13/ The Oil Fall series has been followed all year globally by urban planners, investment managers, and folks in the energy industry. I was particularly happy to learn @AIALosAngeles has Oil Fall on their reading list. LA is dear to me, and the series. gum.co/OilFall

14/ There's a reason LA appears as a through-line in the Oil Fall series: ponder deeply how you would transform Los Angeles, moving it away from fossil fuels, and you will have unlocked solutions for most of the world. Post-war car centered cities, and all that, you see.

15/ Here's why it's over for ICE in California (led by Los Angeles, of course) as EV take control of the market. In 2018, EV took at least 175K of a falling market, of 1.992 million vehicles. ICE sales fell for a second year in a row. And EV (EV+PHEV) now at 8.7% of sales.

16/ But the worst news of all for the oil industry here, in the EU, and China, is that wind and solar electricity is cheap, and it takes 70% less energy to move an EV a mile down the road. Those are devastating facts for a product known as oil, that has long been protected.

17/ The Oil Fall series quantifies how easy it will be--indeed, already is trivially easy--to build new wind and solar to meet marginal demand growth from emerging fleets of EV, even a *fast* emerging fleet of EV. People's intuitions lead them astray on this area. So, an example.

18/ In 2018, the US sold 360,000 new EV (pure, 100% EV and also PHEV). To be very overly generous, that represents about 1.45 TWh of new electricity demand. But hells bells, the amount of *new* wind and solar created in 2018 alone will be at least 60 TWh. Gasoline is in trouble.

19/ As you can see, the US could have put 3.6 million new EV on the road last year, not just 360K, and they all would have been easily covered by generation from new wind and solar. China is running the same formula. The heart of the matter is the extreme efficiency of EV.

20/ So here we all are, incorrectly wondering *how to pay* for energy transition (climate action) when now, given extraordinary tech gains, can pay for itself. Sure, if you try to accomplish this in one year...but transitions play out and distribute their costs over decades.

21/ Gasoline is the portal through which the next big inflection point arrives in energy transition. The world consumes about 400 billion gallons of gasoline per day. EV roughly speaking only need 30% of that energy (equivalent) to get the same job done. China will lead the way.

22/ How do large physical systems change? Not overnight. First growth slows. Then growth goes flat. And then the decline. The reason you can't intuit how much trouble oil and fossil fuels face is because you see easily see the dependency on them, but less so the transition.

23/ Accordingly, the war for oil's future has nothing to do with the 100 mbpd of daily consumption but the 1-2 mbpd of annual growth the industry needs. Same for ICE vs EV: the marginal change *IS* the big change you are looking for.

24/ In Part III of the Oil Fall series, Waste Crash, I spend a great deal of time addressing energy storage, and the common mistake much analysis makes assuming that 100% of system demand will need to be covered by fixed site storage. But again, the same error: about the margin.

25/ In the same way the market is starting to solve the problem already of intermittent wind and solar generation, energy storage will itself be a market maker of prices. To boot: theories about fixed-site storage at maximal levels will eventually be reigned in.

26/ Closing thoughts. The world has to spend about 6% of the energy it produces on the energy required to just extract that energy. With fossil fuels, extraction is forever. Wind and solar are upfront-cost machines--but the year-over-year "extraction" is just wind and sun.

27/ Meanwhile, the global economy historically has spent somewhere between 6% of GDP and 10% of GDP (higher at times) on energy. Energy costs will never go to zero. But an electrification of the economy, in which marginal growth comes from wind and solar, represents a large...

28/ ..ongoing harvesting operation in which thermodynamic gains (yes, in dollars too) will be picked up by the economy. Not over just one year, but again over a couple of decades. So if you are thinking you have to "raise taxes to pay for it," you have not properly understood it.

29/ One of the biggest mistakes the climate community can make at the current juncture is to misconceive the problem as requiring policy edicts, rather than policy incentives. The latter recognizes the wind is already at the back of transition. The former is stuck in year 2010.

30/ Thanks so much to all the readers so far that have given me feedback on the Oil Fall series. This thread today has leaned in a very thematic direction but there is much data inside of the Oil Fall series. I hope you read it and respond. All best, G gum.co/OilFall

Coda and typo to the Oil Fall mega-thread: In tweet #21, I inadvertently wrote the world consumes 400 billion gallons per day, but of course it's per *year*. Worry not: that data point is featured strongly, and correctly, in the Oil Fall series,

• • •

Missing some Tweet in this thread? You can try to

force a refresh