#SundayCharts #Uranium - US apocalypse edition.

Just a couple words of commentary before the charts. Friday's move against the entire US U sector was incredibly reactionary and opportunistic. As we have discussed in the past couple weeks the bigger US stocks were rolling over...

Just a couple words of commentary before the charts. Friday's move against the entire US U sector was incredibly reactionary and opportunistic. As we have discussed in the past couple weeks the bigger US stocks were rolling over...

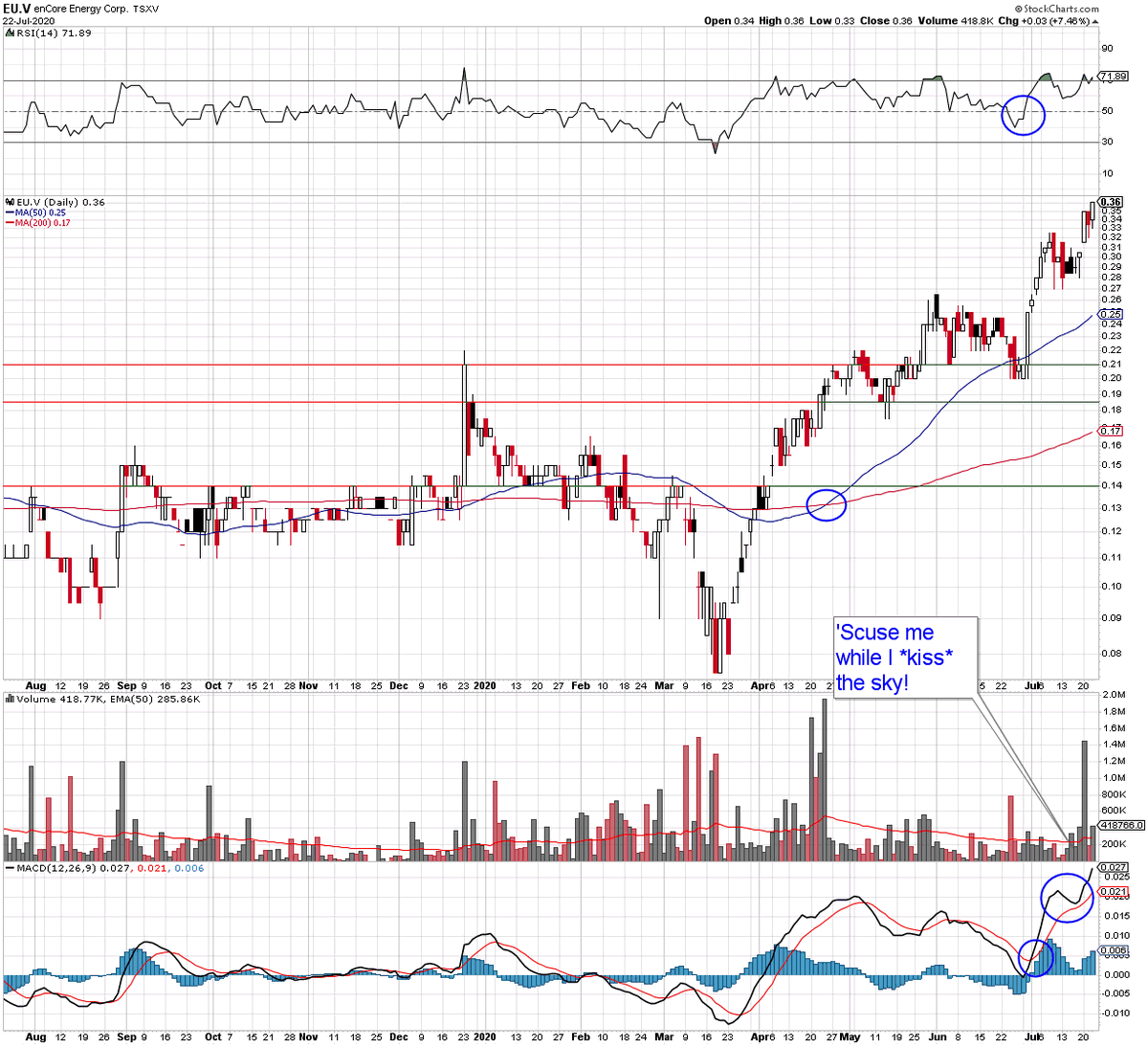

...from an oscillator perspective and were technically vulnerable. had broken down from its price trend. had just failed a test of resistance. None of this could have predicted Friday IMO but it did hint that down was the next move.

On top of that, this was always going to be a "sell the news" event in my eyes. This was discussed previously and others were of the same opinion. Coming into Friday there were very few people that would be buying at the levels of the previous few closes.

Now we mix in a overnight rumor that was missing key information and the stage was set. If I was of a shorting mind set this would have been a great setup. Nobody interested in buying, some situational holders that didn't care much about the overall thesis, bad news backdrop.

Once the first level of stops was smashed algos come in and reinforce the trade. Most people were just staring at their screens. Pretty fascinating really. It is good to keep in mind that this is the volatility potential for the sector in both directions. Upside is more fun

Personally speaking, I am reasonably well diversified and my positions are right sized. I thought this before hand but know it now. My accounts actually had a small gain on Friday which surprised me. Even before knowing this I watched the action with detachment.

I am more speculative than many here but diversification is the key. My big regret is that I am pretty much all in right now. I wish I could have been a buyer of a few names on Friday afternoon. The technicals will be fascinating to watch in the days and weeks to come. 👍👍👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh