#Thread

Been reading a bunch of Annual Reports last few days. Creating this thread to capture and share interesting tidbits from the ones I am reading this season. Will be updated on an ongoing basis next few weeks.

1/n

Been reading a bunch of Annual Reports last few days. Creating this thread to capture and share interesting tidbits from the ones I am reading this season. Will be updated on an ongoing basis next few weeks.

1/n

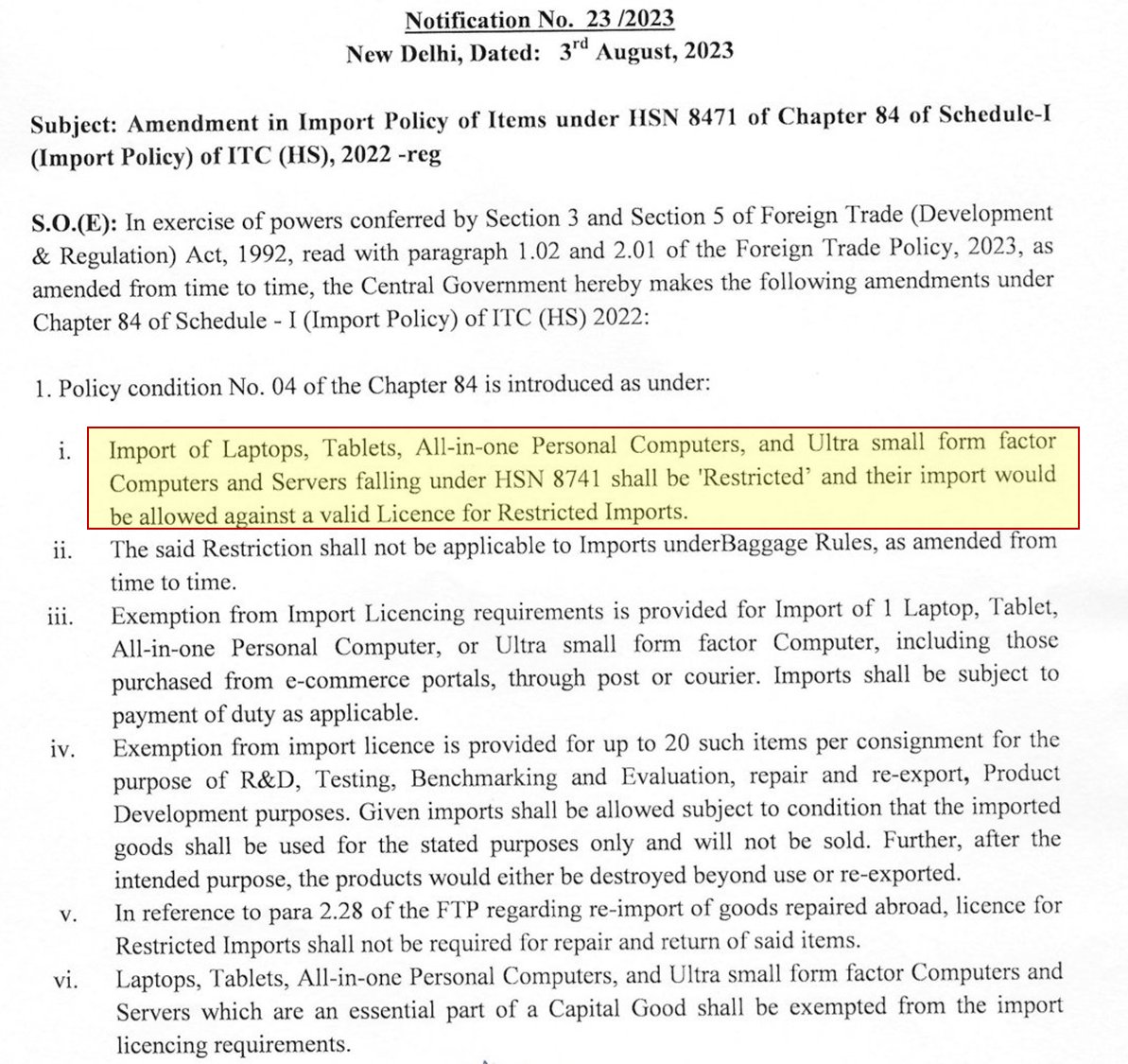

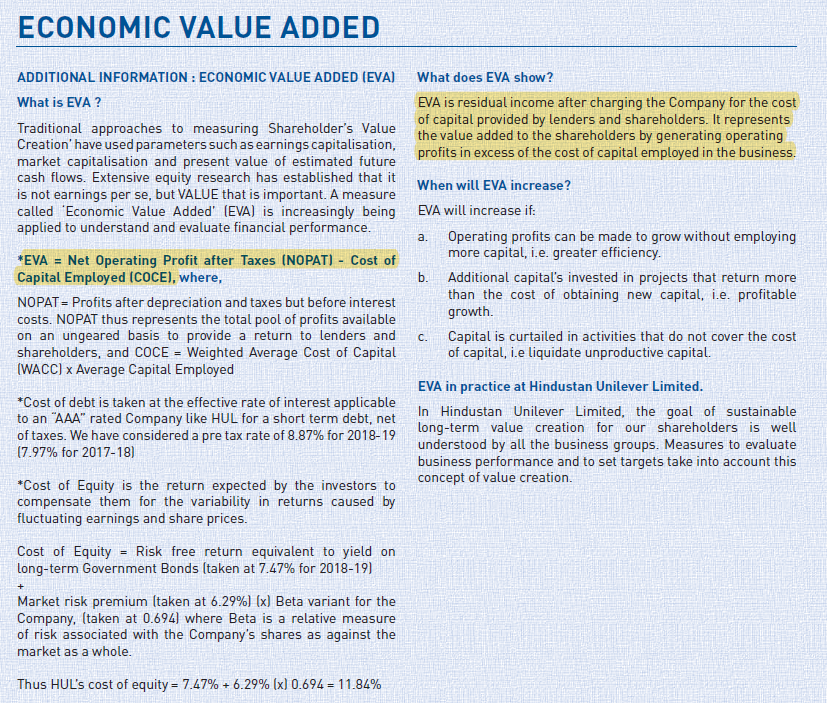

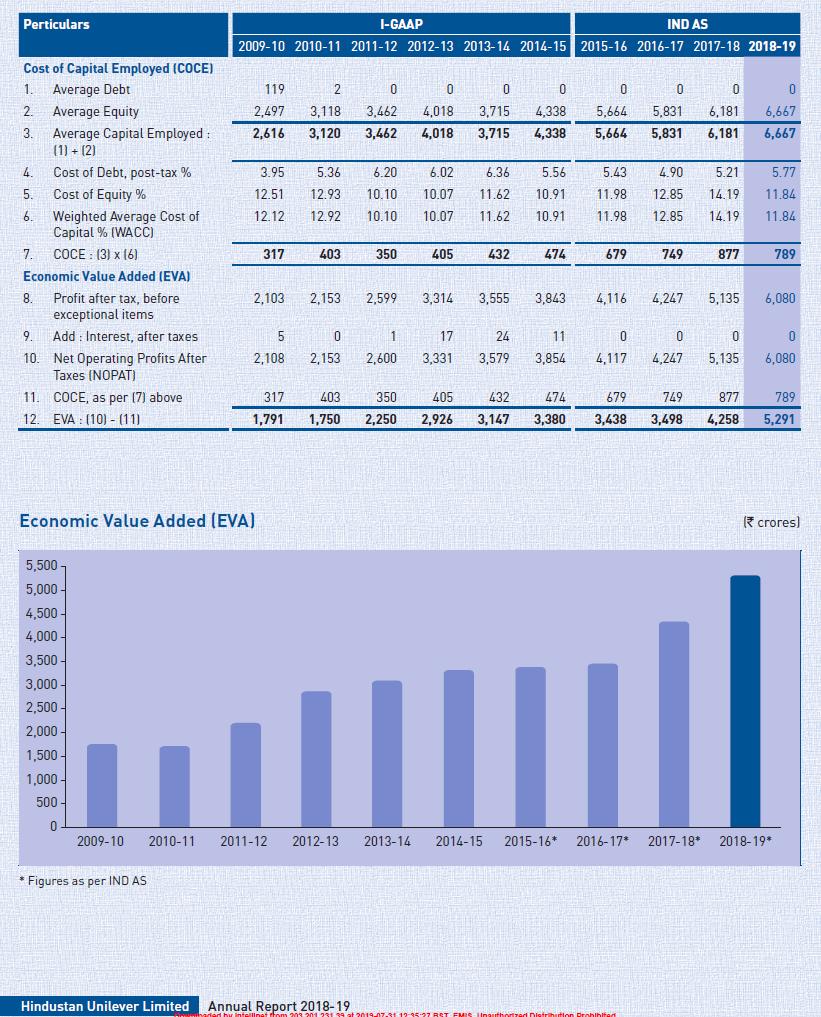

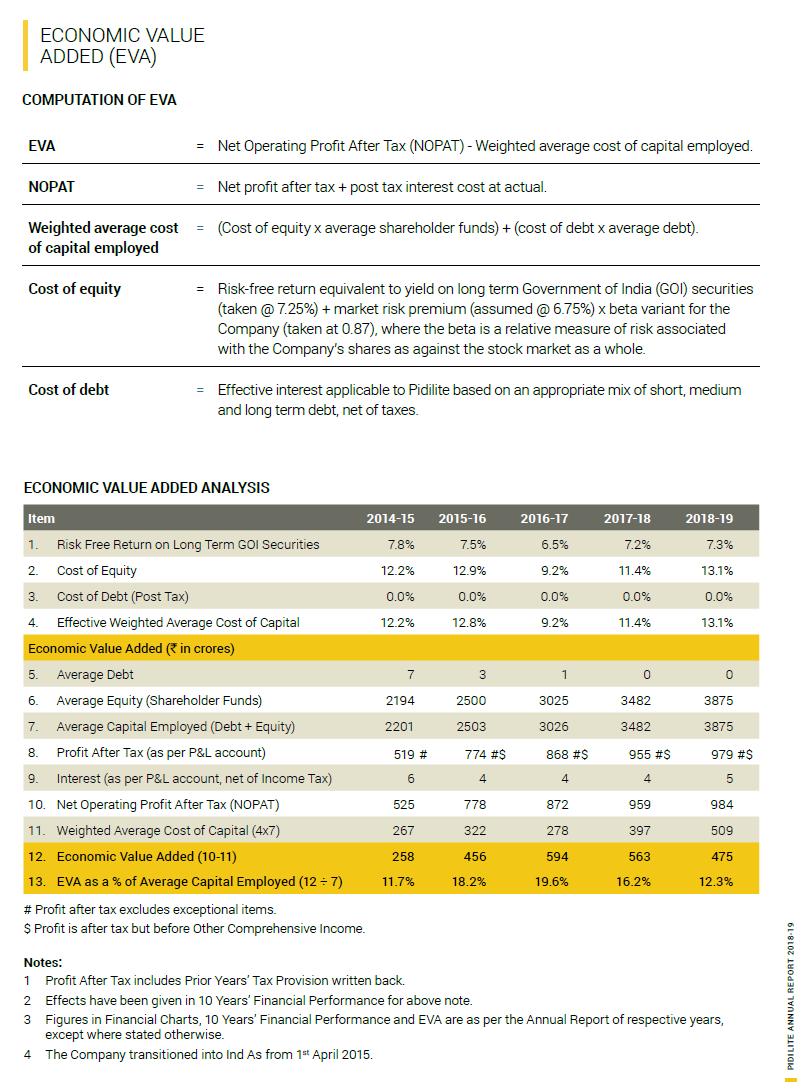

2. Few bluechips have reported their #EconomicValueAdded (EVA), a good measure of shareholder value creation. HUL AR does a great job of explaining details. EVA as % avg capital employed over a period of time can be a good leading indicator. Pidilite also shares EVA details

3. Chairman's letter+MD&A section of top 2/3 key players provide great overview of economy and sector dynamics.

Few suggested section reads are HUL, Kotak, PEL, Sterlite Tech, Everest Ind+Visaka, Godrej Prop, OCCL, Hikal, Aavas, RBL, L&T Infotech, Zydus Wellness.

Suggest more!

Few suggested section reads are HUL, Kotak, PEL, Sterlite Tech, Everest Ind+Visaka, Godrej Prop, OCCL, Hikal, Aavas, RBL, L&T Infotech, Zydus Wellness.

Suggest more!

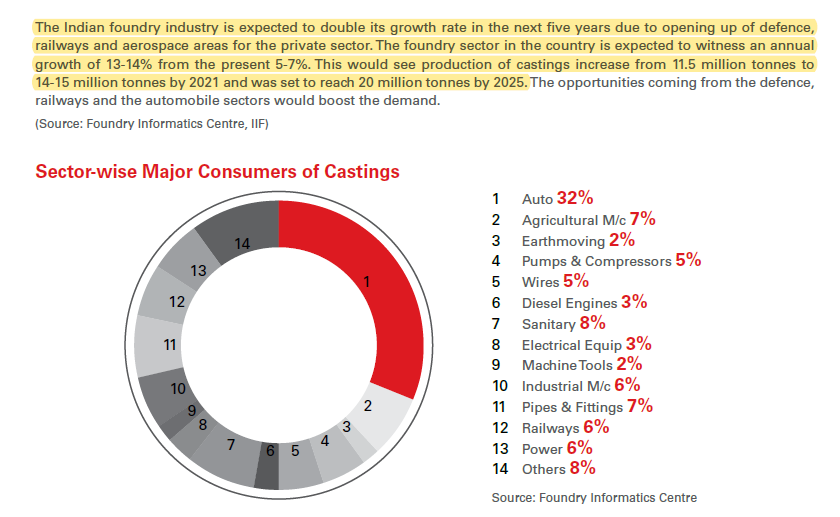

4. #AlisonCastalloy AR makes for a great read, both for the interesting developments and technology progress at the company as well as evolving industry landscape. Says growth rate in Indian foundry industry will double over next 5 years. PS: Also says FY20 will be challenging.

5. #Logistics is very interesting with a time frame 3-5 years. GST, e-way bill, National Logistics Policy, relaxed FDI and Infra status has boosted outlook. Recommended ARs- Mahindra Logistics (must read), VRL, Shreyas Shipping are good reads. 3rd PL+coastal are big opportunities

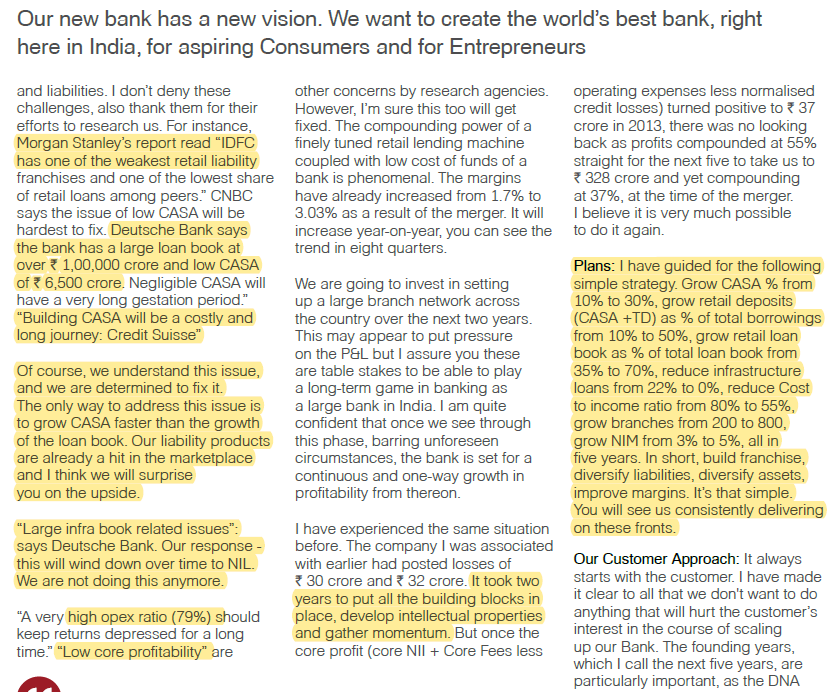

6. #IDFCFirstBank: CEO Vaidi's letter "A new beginning" has some bold statements around turnaround & an aggressive roadmap.

>In investment phase, implementing Capital First's profitable retail model

>Expects high profit growth in next few years

PS: Read with a pinch of skepticism

>In investment phase, implementing Capital First's profitable retail model

>Expects high profit growth in next few years

PS: Read with a pinch of skepticism

7. Some interesting small cap ARs:

a. Rajratan Global wires (leading tyre bead wire mfr) - 2x capacity; near term headwinds.

b. Kirloskar Pneumatic- multiple triggers

c. Saksoft- Digital transaformation. Phase 2.0

d. Kriti Nutrients - Commodity to brand

Not reco, only study!

a. Rajratan Global wires (leading tyre bead wire mfr) - 2x capacity; near term headwinds.

b. Kirloskar Pneumatic- multiple triggers

c. Saksoft- Digital transaformation. Phase 2.0

d. Kriti Nutrients - Commodity to brand

Not reco, only study!

• • •

Missing some Tweet in this thread? You can try to

force a refresh