I am revisiting the topic of Public Issue of Non-Convertible Debentures (NCDs) covered a couple of days back. Only this time, I am focusing on Subordinated (Tier II) NCDs that are slipped in (sometimes slyly) along with senior secured NCDs of NBFCs. Thread (1/9)

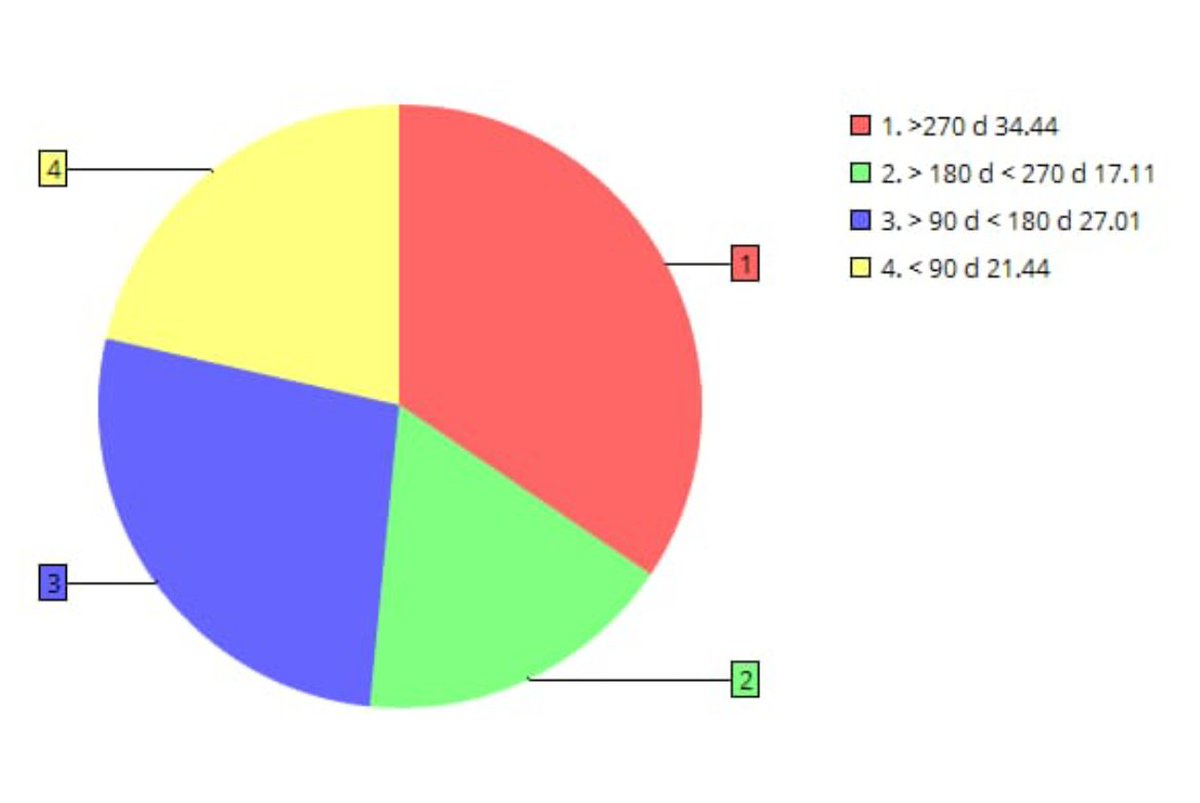

Refer to the picture, below (the pic is representative only). A subordinated NCD (circled in red) appears as one of the many maturity options. A naive investor may think that it is similar to other NCDs on offer, just that it has a longer maturity. (2/9)

What many investors are unaware of is the fact that subordinated NCDs are paid after senior NCD holders in-case the company goes into liquidation i.e. subscribers to option I to VIII NCDs, in the pic above, would be paid before payments are made to option IX to XI NCDs. (3/9)

Let us take the example of DHFL and ILFS to further elucidate the point made above. Investors of subordinated NCDs in these NBFCs facing liquidity crisis would receive lesser amount of money on debt settlement as compared to Investors of senior NCDs. (4/9)

Subordinated debt is treated akin to equity capital in the calculation of capital for NBFCs and hence these debt instruments are considered to be riskier than regular senior debt/ NCDs. (5/9)

Further, the subordinated NCDs, by regulations, are unsecured in nature and hence compared to secured NCDs, these are riskier. (6/9)

The subordinated NCDs also cannot have covenants. This effectively means that senior lenders could exit a position triggering a covenant when the financial profile of the company deteriorates but subordinated NCD holders will have to necessarily hold the NCDs till maturity. (7/9)

Furthermore, the additional coupon for taking higher risk in case of subordinated NCDs, in Indian markets, is only about 0.25% to 0.50%. In western economies subordinated NCDs usually carry a risk spread of approx. 2% - 5% over senior NCDs. Higher risk =/= high returns. (8/9)

My take - The investors of subordinated NCDs are usually not aware of the additional risks that they carry. A 'DHFL or ILFS' like event can completely wipe-off their investments in no time. Hence, investors should carefully choose their options in public issue of NCDs. (9/9)

@kayezad @ActusDei @_soniashenoy @andymukherjee70 @invest_mutual @BMTheEquityDesk @dmuthuk @rohitchauhan @contrarianEPS @shyamsek @chokhani_manish @pvsubramanyam @BalakrishnanR @Sanjay__Bakshi @TamalBandyo @CafeEconomics @menakadoshi @latha_venkatesh @AmolPlanRupee

@deepakshenoy @dugalira @Iamsamirarora @SunilBSinghania @mrinagarwal @IamMisterBond @NagpalManoj @SalariedTaxpay1 @YashwantSinha @ayushmitt

#Subordinateddebt #MutualFundsSahiHai #DHFL #ILFS #mutualfunds #bondmarket #CreditRiskFund #Publicissue #NBFC #Debt #Debentures #NCDs #Bonds #Subdebt #TierII

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh