Government, on August 13, issued a 'Scheme to provide a one-time partial credit guarantee to PSBs for purchase of pooled assets of financially sound NBFCs'. This scheme is a step in right direction towards solving the liquidity crunch that NBFCs are faced with. Thread (1/12)

It may be recalled that the Finance Minister, in her budget speech, had made an announcement to this effect. Thid scheme attempts to address temporary asset liability mismatches of NBFCs/HFCs so that they don't have to resort to distress sale owing to paucity of liquidity. 2/12

The major features of this scheme are:

A) It is a one time guarantee provided by GoI, for a period of 24 months.

B) The schemes is only applicable to PSU banks for first loss of up to 10%

C) Guarantee can be invoked if the credit rating of the pool goes to 'D' (default). 3/12

A) It is a one time guarantee provided by GoI, for a period of 24 months.

B) The schemes is only applicable to PSU banks for first loss of up to 10%

C) Guarantee can be invoked if the credit rating of the pool goes to 'D' (default). 3/12

D) The scheme would be valid for a period of six months, or till such date by which Rs 1 lakh crore assets get purchased by banks.

E) Assets originated up to March 31, 2019 will only be eligible under this scheme. 4/12

E) Assets originated up to March 31, 2019 will only be eligible under this scheme. 4/12

F) The pool of assets should be rated and should have a minimum rating of 'AA'.

G) NBFCs/HFCs can sell up to a maximum of 20% of their standard assets subject to a cap of Rs 5,000 crore at fair value. 5/12

G) NBFCs/HFCs can sell up to a maximum of 20% of their standard assets subject to a cap of Rs 5,000 crore at fair value. 5/12

H) The minimum capital adequacy should be 15% for NBFCs and 12% for HFCs and net NPA should not be more than 6% as on March 31, 2019.

I) They should have made a net profit in at least one of the last two preceding financial years. 6/12

I) They should have made a net profit in at least one of the last two preceding financial years. 6/12

J) For availing the window, NBFCs/HFCs will pay a fee equivalent to 0.25% of the fair value of assets, to GoI.

K) Microfinance Institutions and Core Investment Companies have been excluded from the benefits of this scheme. 7/12

K) Microfinance Institutions and Core Investment Companies have been excluded from the benefits of this scheme. 7/12

My take on the impact of this scheme:

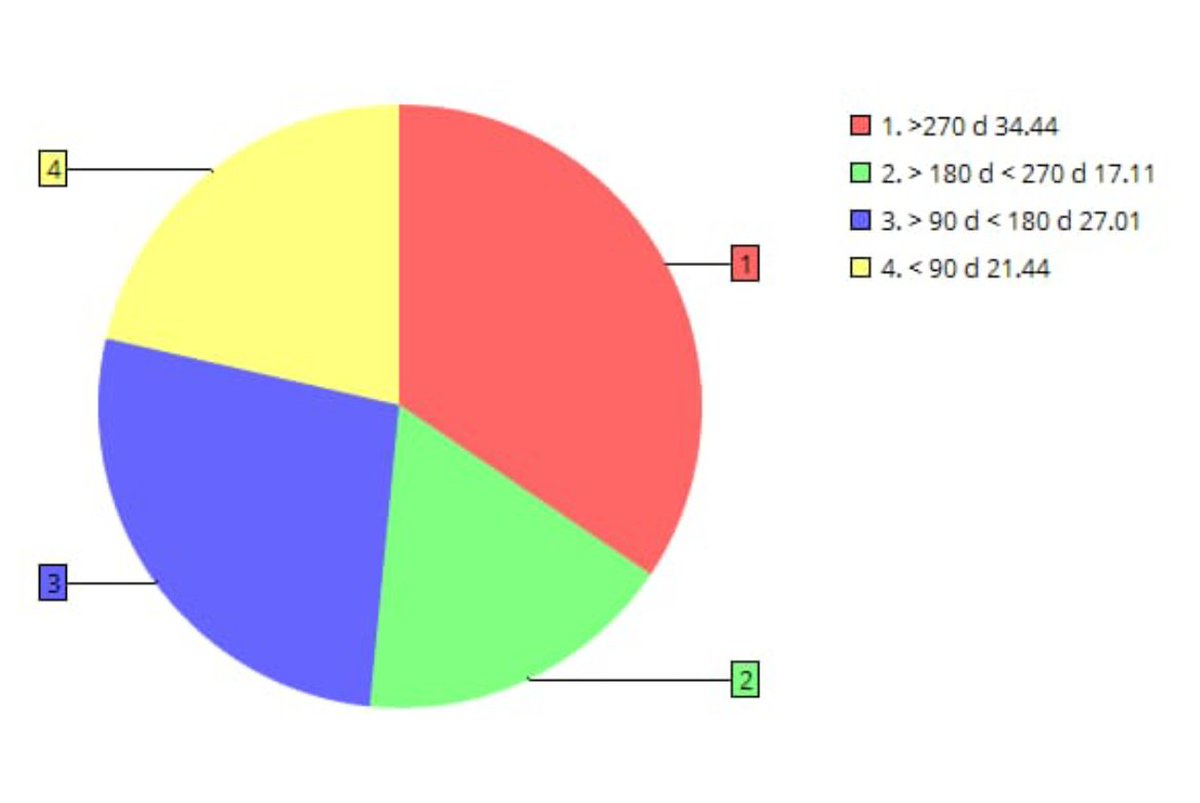

A) NBFCs that offer loans with a tenure of 2-3 years will benefit the most i.e. NBFCs offering 2-wheeler loans, Commercial/ car loans, SME loans, equipment loans, personal loans etc. , will reap maximum benefit out if the scheme. 8/12

A) NBFCs that offer loans with a tenure of 2-3 years will benefit the most i.e. NBFCs offering 2-wheeler loans, Commercial/ car loans, SME loans, equipment loans, personal loans etc. , will reap maximum benefit out if the scheme. 8/12

B) Housing finance companies can take limited benefit out of the scheme as most housing loans would not fit the tenure criteria (residual maturity of less than 2 years). Loans againt property, however could fit the bill. 9/12

C) Wholesale NBFCs may not take much benefits out of the scheme as the scheme requires a 'homogeneous pool of obligors' and 'assets with no bullet repayment of both principal and interest'. 10/12

D) The biggest beneficiaries would be - Bajaj Finance, Cholamandalam, Sundaram, Shriram Transport, Shriram City Union, Magma, SREI and the likes.

E) HDFC, Piramal, PNB Housing, Edelweiss etc will get limited benefits. 11/12

E) HDFC, Piramal, PNB Housing, Edelweiss etc will get limited benefits. 11/12

Overall, it is a very good scheme for the cash thirsty NBFC/ HFC sector. It will ease of the liquidity problems considerably. Govt should be credited for a very good piece of legislation. 12/12

@kayezad @ActusDei @_soniashenoy @andymukherjee70 @invest_mutual @BMTheEquityDesk @dmuthuk @rohitchauhan @contrarianEPS @shyamsek @chokhani_manish @pvsubramanyam @BalakrishnanR @Sanjay__Bakshi @TamalBandyo @CafeEconomics @menakadoshi @latha_venkatesh @AmolPlanRupee

@deepakshenoy @dugalira @Iamsamirarora @SunilBSinghania @mrinagarwal @IamMisterBond @NagpalManoj @SalariedTaxpay1 @YashwantSinha @ayushmitt

#NBFC #hfc #SHRIRAM #Edelwiess #partialcreditguarantee #bondmarket #budget #financeminister #liquidity #liquiditycrisis #Magma

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh