(1/n) @KhataBook 's humble journey started in 2016 in a small Electrical shop in the tiny town of Degloor, Nanded district, Maharashtra.

Vaibhav saw his father struggle keeping track of pending receivables of customers and decided to do something about it.

Vaibhav saw his father struggle keeping track of pending receivables of customers and decided to do something about it.

He learned Android from Udacity and built India's first cash management Android app, KhataBook, while helping his father run the shop.

He iterated the design till his father was comfortable with the interface and released it on playstore in October 2016.

He iterated the design till his father was comfortable with the interface and released it on playstore in October 2016.

The app had no backend, very basic front end but was built with first principles and had product market fit.

Meanwhile, at Kyte we had been thinking for sometime to account for cash transactions, as the "Bharat" coming online wasn't really doing digital transactions.

Meanwhile, at Kyte we had been thinking for sometime to account for cash transactions, as the "Bharat" coming online wasn't really doing digital transactions.

In Oct 18, I started researching the cash use case. Shoutout to my old friend RY, who ideated a lot with me during this phase.

This is when I came across KhataBook which had 60k merchants at that time. I was surprised it wasnt built by a company, but an individual, Vaibhav

This is when I came across KhataBook which had 60k merchants at that time. I was surprised it wasnt built by a company, but an individual, Vaibhav

It was pure serendipity for me to meet Vaibhav. He was about to get married, settle down and had plans to run the shop as his father was retiring. A day before he was about to take over his shop, he got my email.

He was apprehensive about sharing his number with a random guy emailing him. But after a few exchanges, he decided to meet me in Mumbai. Interestingly he had ignored a verbose email from LSVP almost a year before.

I convinced him to come onboard as a core team member and he decided to take the plunge and shifted to Mumbai. Within a month, the formidable Kyte team revamped KhataBook from scratch, added txn entry notifications and relaunched it on playstore.

We expected the product to be received well but nobody had even the ghost of an idea of what was about to happen next. The network effects of started kicking in and KhataBook went viral thanks to the starting base of 60k merchants.

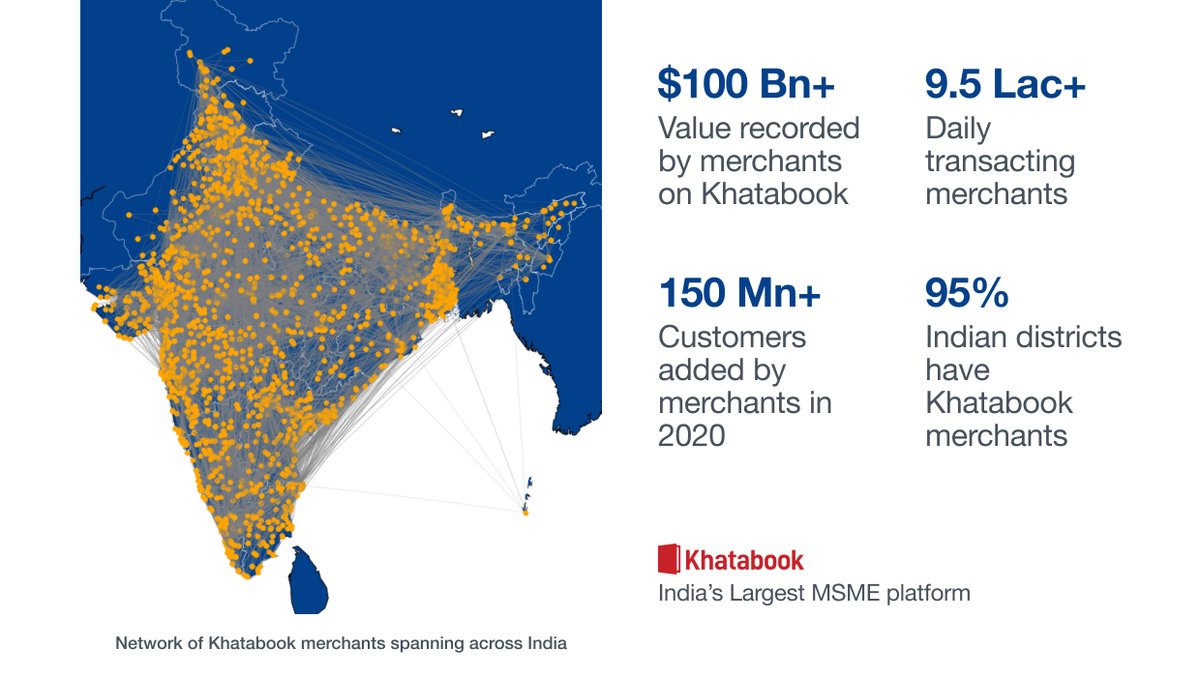

Vaibhav's vision of helping his father, has gone a lot further. KhataBook crossed 2 million actives yesterday. Shopkeepers across 3000+ Indian cities are using KhataBook along with it being widely used in Pakistan, Nepal and Bangladesh.

Txns worth 20,000+ Cr will be recorded in August in KhataBook. Who would have thought Degloor, a small town of less than 50,000 people, somewhere in India's hinterland, will be the birthplace of an app that is being used across multiple countries....

....and accounts for a significant chunk of India's retail GDP? As far as origin stories are concerned, even the good folks at marvel would probably concede that it couldn't have been penned any better.

The story of Khatabook is the story of #bharat and a precursor to the fact that the next #surge of innovations to impact millions of indians wouldn't just emanate from our gilded cities, but our hinterlands.

• • •

Missing some Tweet in this thread? You can try to

force a refresh